After the close of Post-Market Trading on July 23, Eastern Time, $Alphabet-A (GOOGL.US)$ Alphabet-A will release its second-quarter Earnings Reports.

According to Analysts’ expectations, Alphabet is projected to achieve revenue of $93.943 billion in the second quarter, representing a year-over-year growth of 10.86%. The estimated EPS is $2.18, indicating a year-over-year increase of 15.24%. The operating margin is expected to rise to 34%.

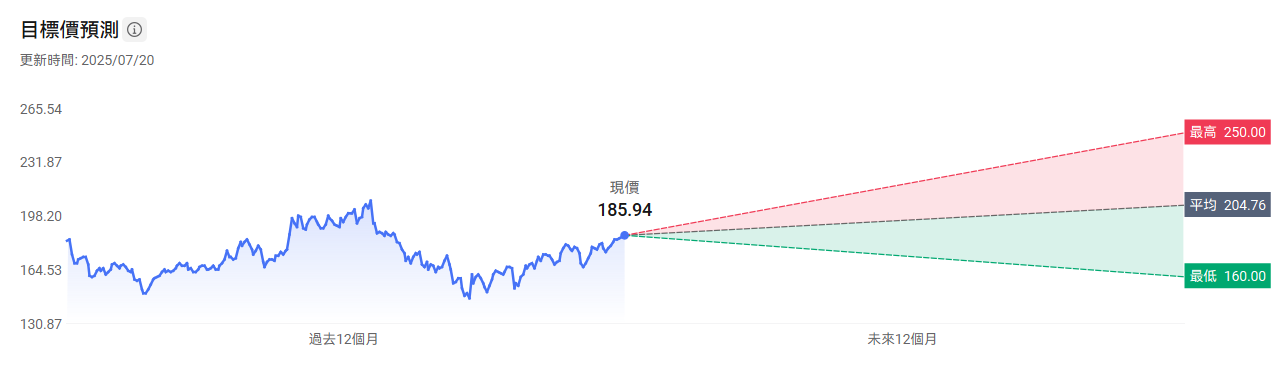

This year, Alphabet’s valuation has been suppressed by the narrative of AI Search Engines eroding its market share. Currently, Alphabet’s stock price is down more than 2%, and it has the lowest PE among the FAANG stocks, at just 18.7 times.

Given that Alphabet’s stock has not yet turned positive this year, the market is placing greater importance on this Earnings Report. Could this be a turning point?

Given that Alphabet’s stock has not yet turned positive this year, the market is placing greater importance on this Earnings Report. Could this be a turning point?

For this Earnings Report, the market’s focus will be on Alphabet’s advertising revenue, the incremental benefits Gemini brings to the search business, and the AI capital expenditures that investors are most interested in.

How has Alphabet’s advertising business been impacted by AI?

How has Alphabet’s advertising business been impacted by AI?

Analysts believe that Google’s advertising business will maintain robust growth in the second quarter, primarily benefiting from the further expansion and increased accuracy of the AI overviews feature. This feature currently reaches 1.5 billion users per month and has proven to effectively increase ad conversion rates by 26%, particularly in verticals such as finance and retail.

Citi expects Google’s second-quarter advertising revenue to be around $700 billion, representing a year-over-year increase of 9-10%.

By business segment:

Google Search: Revenue is expected to be $52.7 billion, up about 9% year-over-year. BofA believes that advertisers’ spending has accelerated since April, and strong search volumes indicate that the integration of Gemini and the search engine is helping to generate revenue.

YouTube Advertising: Revenue is expected to be $9.5 billion, up about 10% year-over-year, mainly driven by the increasing contribution of Shorts ad revenue.

Google Network (advertising on third-party websites): Revenue is expected to be around $7.3 billion, remaining essentially flat year-over-year.

Notably, the progress of the U.S. Department of Justice’s lawsuit requiring Google to divest its ad technology division may bring uncertainty. However, Google’s management has stated that they will appeal vigorously, and it is expected that this will not have a material impact on the business in the short term.

In other words, the market’s concern that AI search engines will impact Google’s advertising revenue is unlikely to materialize in the near term.

Can Cloud Business Drive High Growth?

Wall Street generally expects Google’s Cloud Business to report second-quarter revenue of $13.1 billion, representing a 26% year-over-year increase.

Analysts believe the primary growth drivers are the integration of the Gemini large model with Workspace, which has enhanced enterprise customer stickiness, and the mass production of the in-house Cypress chip, which has significantly improved AI computing efficiency and cost structure. It is expected to replace 30% of third-party CPU/GPU procurement, saving $5 billion in costs while enhancing AI computing power efficiency.

In addition, the A4X virtual machine and Vera Rubin GPU service launched in collaboration with NVIDIA will further enhance Google’s competitiveness in the high-performance computing market.

Citi expects capital expenditures for the quarter to be $189 billion, a 43% year-over-year increase. Google’s capital expenditure guidance for 2025 is $750 billion. At the Earnings Conference, attention should be paid to any changes in Google’s AI capital expenditures. If there is an upward revision, it would indicate increased confidence in AI and good progress in the business.

What Do Wall Street Analysts Think?

Currently, out of 55 analysts on Wall Street, 43 maintain a “Buy” or “Strong Buy” rating. Among them, BofA, KeyBanc, Jefferies, and Needham have set target prices for Alphabet-A at $210-215, indicating an approximately 15% upside from the closing price last Friday.

Wedbush Analyst Scott Devitt stated:

Google’s valuation is attractive, and as investors continue to weigh the risks and potential regulatory headwinds associated with generative AI on its search business, strong advertising results could serve as a catalyst for the stock price. Despite increased competition and uncertainty for Google Search and YouTube, he believes that the second-quarter expectations are achievable, with even greater growth opportunities expected in the second half of the year.

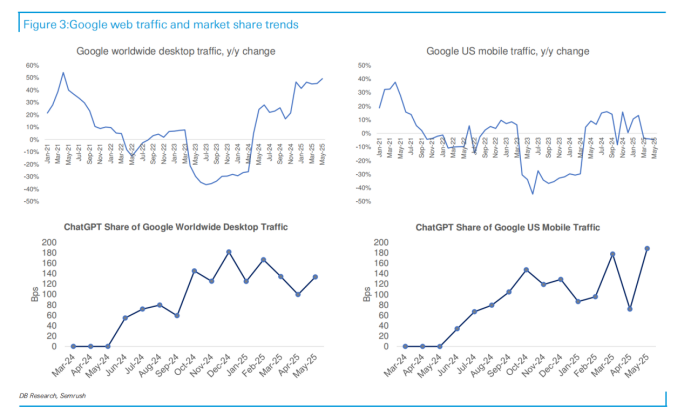

According to a Deutsche Bank report: Data shows that Google’s search engine market share improved in the second quarter compared to the first quarter.

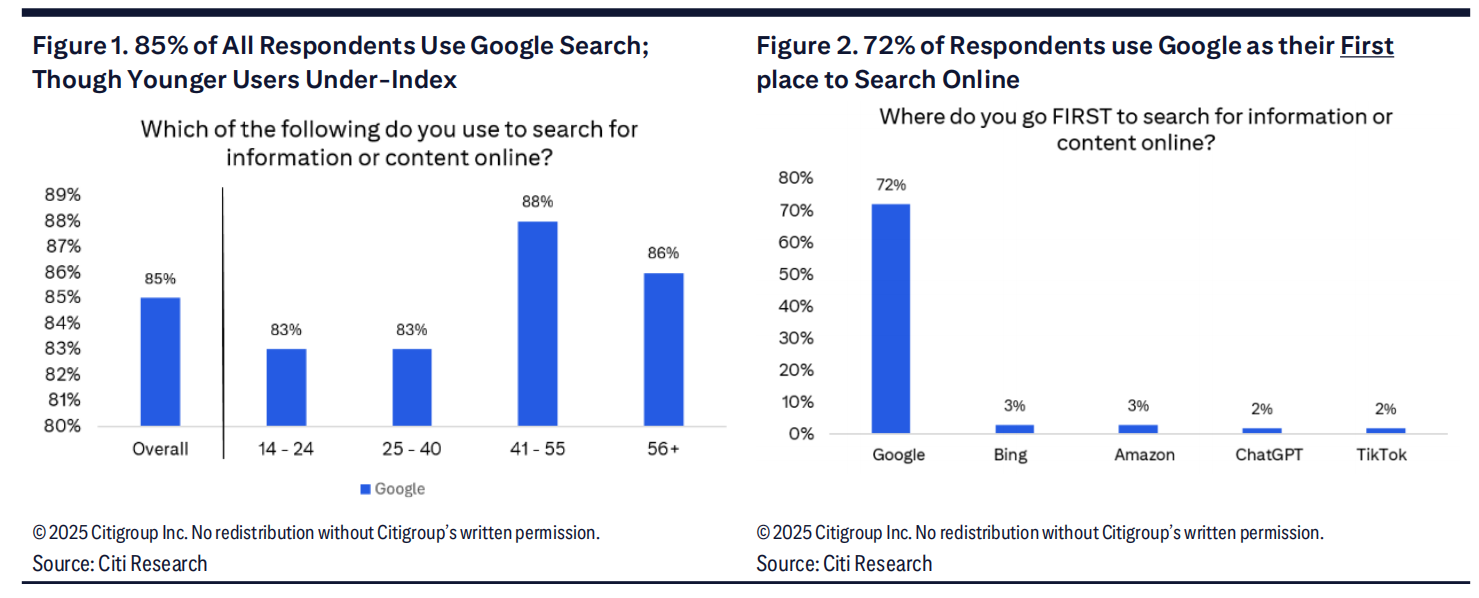

According to a Citi survey, Google Search remains the dominant player: 85% of users use Google Search, and 72% prefer Google (especially among those aged 40 and above). Google still holds an advantage in commercial scenarios such as shopping and travel, while AI Agents are more inclined towards research purposes (translation, Q&A, information aggregation, etc.).

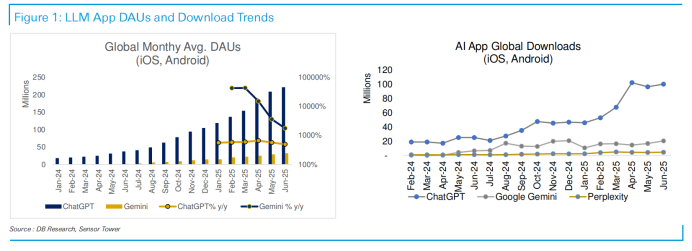

From the DAU data of large models, Gemini’s daily active users have continued to grow, while competitor Perplexity has not yet made a substantial impact on overall market share. This indicates that the previous statement by Apple executives about a decline in Google browser search volume referred only to changes on the iOS platform, not a decline in Google’s overall search volume.

Overall, Wall Street remains bullish on the combination of the Google ecosystem and Gemini, expecting it to bring stronger synergies, enabling it to withstand the challenge from AI-powered search engines and potentially drive greater traffic to the search engine.

How will the stock price perform?

How will the stock price perform?

According to Barchart, large institutional trades are biased towards a bullish direction.

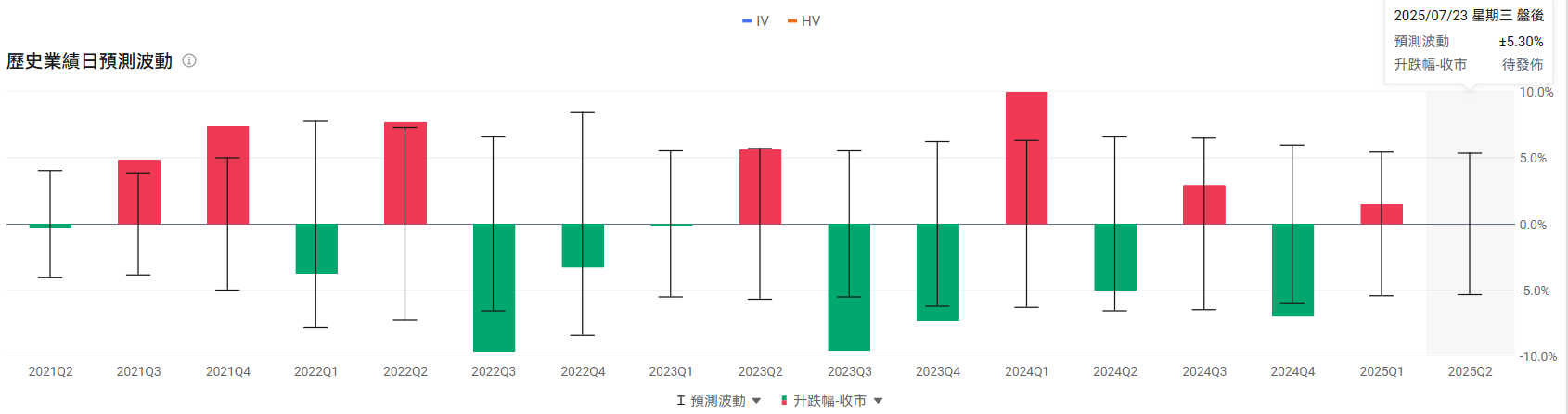

From the perspective of options-predicted volatility, the current forecast is ±5.3%, indicating that the options market is betting on a single-day price movement of more than 5% after the Earnings Reports, which is the lowest predicted level for earnings days in the past two years. This suggests that investors have low expectations for significant fluctuations triggered by Alphabet-A’s Earnings Reports, implying that the market has already priced in most uncertainties.

In comparison, the implied volatility of options on the previous quarter’s earnings day for Alphabet-A was 5.42%, with the actual volatility on that day being 1.47%. In the past five earnings days, there were three increases and two decreases.

mooers

Are you bullish on Alphabet-A’s first-quarter performance?

Welcome to join in predicting the movement of Alphabet-A’s Earnings Reports!

Will it be a significant increase of more than 5%, a normal performance (-5% to 5%), or a significant decrease of more than 5%?

Still up late reviewing financial statements?Futubull AI is now officially launched!Come and use the AI feature to interpret Earnings Reports.

Still up late reviewing financial statements?Futubull AI is now officially launched!Come and use the AI feature to interpret Earnings Reports.

Editor/Kyle