AUSTRALIAN wool prices increased again this week extending the longest run in weekly price rises since 2019.

AUSTRALIAN wool prices increased again this week extending the longest run in weekly price rises since 2019.

The Australian Wool Exchange said the market continued its unblemished start to the 2025/26 wool selling season, recording an overall positive result for the seventh consecutive selling series.

“This is the longest run of weekly rises since 2019 and the first time that the market has risen for the first seven weeks of a season since 1979.”

AWEX said the 29,594 bales on offer nationally received excellent support, as buyers were in an aggressive mood in the rapidly rising market. Brokers passed in just 2.8 percent.

“On the first selling day all sectors of the market recorded healthy gains.

“This was reflected in the benchmark Eastern Market Indicator which rose by 17 cents for the day, this was the largest daily rise in the EMI since March,” AWEX said.

“On the second day the market continued to rise, all sectors of the market again recording gains, pushing the EMI up by a further 13 cents.

“This extended the run of daily EMI rises to twelve,” AWEX said.

“This is the longest upward run of the EMI since June 2011.”

AWEX said although some of the rises in the EMI over this run were relatively small, when accumulated they have become a significant upward trend.

AWEX said although some of the rises in the EMI over this run were relatively small, when accumulated they have become a significant upward trend.

“The EMI started the run (8th of July) at 1208 cents/kg clean.

“It is now 1291 cents, an 83-cent or 6.9pc increase.”

AWEX said the EMI also rose in US dollar terms, adding US24 cents for the series.

“This was the third successive series where the EMI rose in both Australian and US dollar terms.”

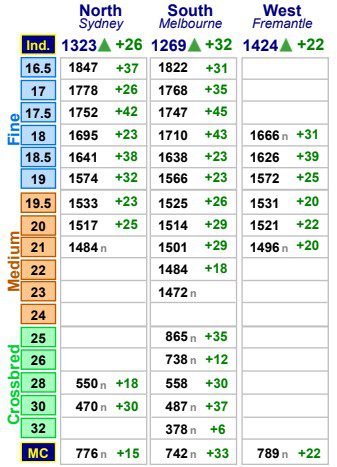

AWEX said the crossbreds also performed very well again in this series, pushing the MPGs up into ranges not seen for years.

“The largest gains in this series in percentage terms were all achieved by the crossbred sector, with 28 and 30 microns the best for the second week in a row.

“The oddment sector also had a very positive series, this was reflected in the Merino Carding Indicator which rose by an average of 23 cents.”

Lowering supply starting to impact – AWI

Australian Wool Innovation said since trading solidly around the 1200ac mark for May and June, the Eastern Australian Market Indicator EMI been steadily grinding away for the past two months but thankfully to a dearer trend.

“This week saw somewhat of an acceleration to that trend with a very healthy 2.4pc or 30 cents/kg clean added to that leading indicator of the overall state of the wool pricing.

“The EMI now sits at the highest weekly closing basis since the beginning of May in 2023.”

AWI said the trade feedback is that the environment and conditions of trade are “starting to feel right again.”

“This applies to both prices and sentiment.

“Most participants are comparing the current state of confidence back to where we were in March 2025 before the United States government tariff decisions impacted immediately and heavily upon global economic trade,” AWI said.

“Perhaps the larger impact – than the seemingly improving demand side – is the supply factor.

“Traders and indent buyers are anecdotally reporting the lowering supply story is beginning to take effect with mills and overseas interests.”

AWI said the consensus is “everyone is behind in their purchasing” and there “just won’t be enough wool to go around if mills want to run anywhere near their optimum capacity.”

Just over 28,000 bales are currently rostered for sale for next week.

Sources – AWEX, AWI.