Key takeaways

Around 1.9 million Australians hold a net worth above $1.55 million AUD, with numbers expected to grow by another 400,000 by 2028.

Real estate makes up 53% of household wealth, much higher than in most other countries. Rising house prices have been the main driver of the surge in millionaires.

Most new millionaires are not billionaires or tycoons, but average Australians whose wealth is tied up in property and superannuation.

Timing and asset choice have created this wealth divide. Those who own the right property in the right locations are reaping the benefits, while others risk being left behind.

If you’ve ever felt that everyone around you seems to be a millionaire these days, you’re not imagining things.

According to the latest UBS Global Wealth Report and reported by ABC news, Australia now boasts one of the highest concentrations of millionaires in the world, and much of that wealth is tied directly to property.

Source: ABC News

The New “Everyday Millionaire”

Once upon a time, the title of millionaire was reserved for captains of industry, celebrities, and elite professionals.

Today, one in ten Australians finds themselves in that category, at least in US dollar terms, which means a net worth of about $1.55 million AUD.

That translates to about 1.9 million Australians, a staggering figure given our population of just 25.8 million.

And UBS expects this number to rise by another 20% by 2028.

In other words, another 400,000 Australians will cross that threshold in just a few years.

But here’s the catch: the vast majority of these “millionaires” are not sipping champagne on yachts.

They’re “Everyday Millionaires”, homeowners whose wealth is largely locked up in real estate.

Why Property Is Doing the Heavy Lifting

Australia stands out globally because property makes up more than half of our personal wealth (53%).

That’s far higher than in countries like the UK, US, or most of Europe.

It’s not surprising when you consider that the average house price now exceeds $1 million, according to the ABS.

Combine that with our compulsory superannuation system, and you have a recipe where middle-class Australians, particularly long-term property owners, suddenly find themselves sitting on seven-figure balance sheets.

And it’s not just the ultra-wealthy driving this trend.

UBS notes that the real growth has been in the “middle bands” of society, where rising real estate values have pushed everyday families into millionaire territory almost by accident.

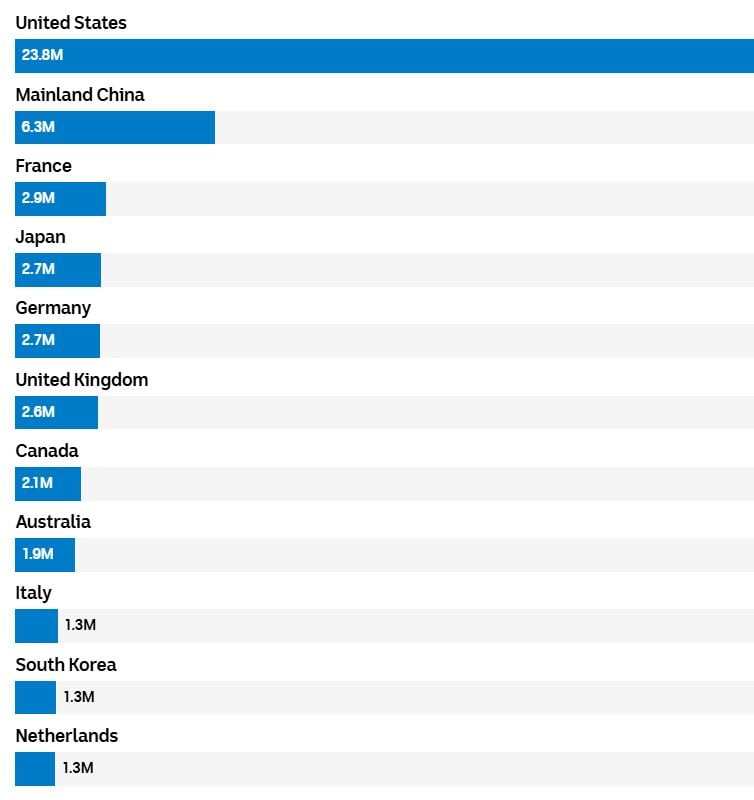

The Global Comparison

Australia now ranks:

8th in the world for the number of millionaires

2nd in the world for median wealth ($411,000 AUD), just behind Luxembourg

5th in the world for average wealth per adult (close to $1 million AUD)

In terms of balanced wealth distribution, Australia also performs well compared to many nations, with the top 10% holding 44% of wealth.

Still, it’s worth remembering that property ownership patterns are driving inequality.

For instance, households earning over $100,000 are nearly three times more likely to own multiple properties compared to middle-income households.

And on a generational level? Baby boomers and Gen Xers are far ahead of Gen Z when it comes to multiple property ownership.

That’s not just a statistic, it’s a challenge for younger Australians trying to break into the market.

What Does This Mean for Investors?

While the headline is that Australia is creating millionaires at record pace, the story beneath the surface is more important for strategic investors.

Here’s what stands out:

Property remains the cornerstone of Australian wealth. The UBS data shows what we already know, owning real estate isn’t just about providing shelter, it’s the primary vehicle for wealth creation in this country.

Wealth is skewed by timing and asset choice. Those who bought property in the right locations over the past couple of decades are now the “everyday millionaires.” Those who didn’t are finding it harder to catch up.

Inequality is being amplified by real estate. Property continues to be the dividing line, between generations, between income groups, and between those who own multiple assets versus those who don’t.

The millionaire label is misleading. Much of this wealth is illiquid, tied up in the family home or investment properties. Being “asset rich, cash flow poor” is a very real situation for many of these newly minted millionaires.

Final Thoughts

The UBS report confirms what I’ve been saying for years: if you want to build long-term wealth in Australia, you can’t ignore property.

But it also highlights the importance of being strategic.

Simply buying “any” property is not enough, you need investment-grade assets that will outperform over time.

So yes, Australia is minting millionaires at a record pace, but the real question is: are you positioning yourself to be one of them?

Or are you sitting on the sidelines, watching property continue to shape the wealth of the nation?

Are you wondering how you should invest in this interesting phase of the property cycle?

If you’re like many property investors, you’re probably wondering what’s the right thing to do at present.

Should you buy, should you sell, or should you just wait?

You can trust the team at Metropole to provide you with direction, guidance, and results.

Whether you’re a beginner or an experienced investor, at times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s exactly what you get from the multi-award-winning team at Metropole.

We help our clients grow, protect and pass on their wealth through a range of services including:

Strategic property advice – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more

Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $4Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney, and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment-grade property. Click here to learn how we can help you.

Property Development – We enable you to become an “armchair developer” and get all the benefits of property development without getting your hands dirty. We take the hassles out of your investment by assisting you with all the expertise you need, from concept to completion, including construction. Click here to see if it’s the right way for you to grow your portfolio.

Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

Property Management – Our stress-free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years, and our properties lease 10 days faster than the market average.

![]()

About Adam Hubbard

Adam Hubbard is a senior Wealth Strategist at Metropole and his many years of real estate and wealth creation experience gives him a holistic perspective with which he helps his clients safely grow their wealth through property.