Polybag Mailers Market Size and Share Forecast Outlook 2025 to 2035

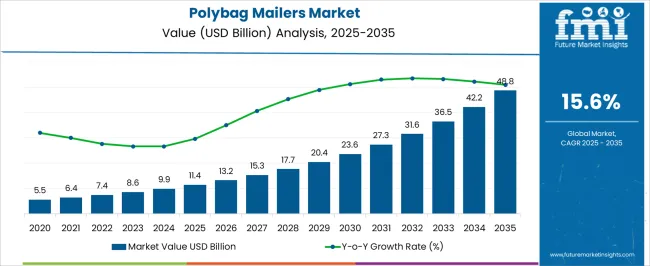

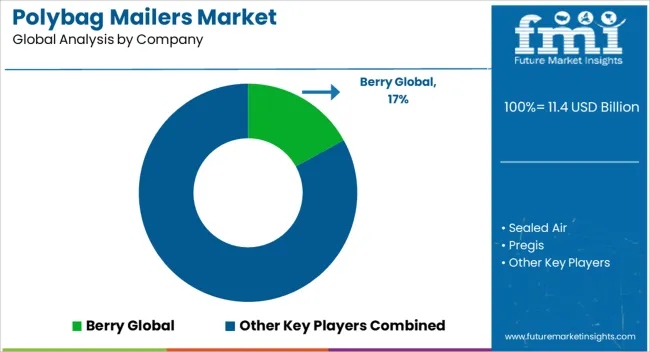

The polybag mailers market stands at USD 11.4 billion in 2025 and reaches USD 48.8 billion by 2035, at a CAGR of 15.6%. That CAGR implies a doubling time of about 4.6 years and a 4.28x scale-up over the horizon. Absolute dollar opportunity totals USD 37.4 billion, with USD 12.2 billion added in 2025–2030 and USD 25.2 billion in 2030–2035, indicating front-loaded base building followed by heavier value capture later. Mid-teens YoY gains are evident across the sequence, with no sharp inflections, which signals disciplined capacity additions and predictable order books. Volume expansion is assessed as the dominant contributor, driven by parcel growth, denser fulfillment networks, and a higher packaging intensity per shipment as return flows increase. Price contribution is seen as secondary and episodic, influenced by polymer feedstock costs and pass-through policies; modest ASP uplift is supported by printable surfaces, tamper evidence, and custom sizes. Dimensional weight economics, sorter compatibility, and inserter throughput advantages underpin conversion from rigid formats, raising line productivity and lowering total landed cost. Channel mix effects matter. D2C and marketplace sellers raise small-parcel counts, while 3PLs standardize SKUs, improving procurement leverage and replenishment cadence. Sensitivities include resin volatility, regulatory mandates on materials, and converter consolidation that could shift bargaining power

Quick Stats for Polybag Mailers Market

Polybag Mailers Market Value (2025): USD 11.4 billion

Polybag Mailers Market Forecast Value (2035): USD 48.8 billion

Polybag Mailers Market Forecast CAGR: 15.6%

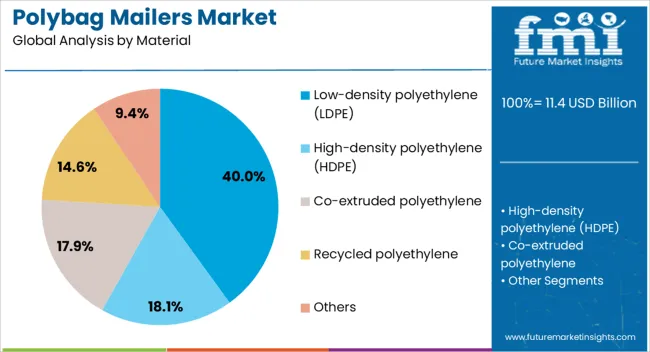

Leading Segment in Polybag Mailers Market in 2025: Low-density polyethylene (LDPE) (40.0%)

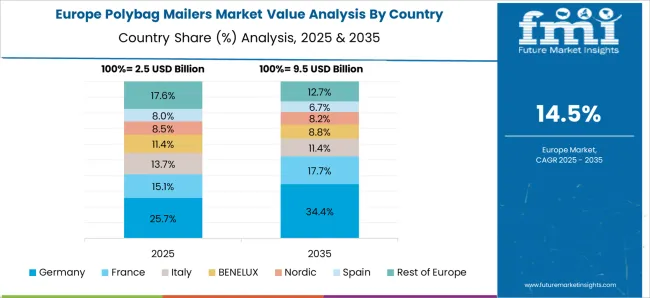

Key Growth Regions in Polybag Mailers Market: North America, Asia-Pacific, Europe

Top Key Players in Polybag Mailers Market: Berry Global, Sealed Air, Pregis, Mondi, Intertape Polymer Group

Polybag Mailers Market Key Takeaways

Metric

Value

Polybag Mailers Market Estimated Value in (2025 E)

USD 11.4 billion

Polybag Mailers Market Forecast Value in (2035 F)

USD 48.8 billion

Forecast CAGR (2025 to 2035)

15.6%

The polybag mailers market draws demand from five parent ecosystems that determine film gauges, sealing formats, and fulfillment workflows. The e commerce and retail packaging market contributes about 25-30%, as direct to consumer brands and marketplaces specify LDPE and LLDPE mailers for small parcel shipping and easy returns. The flexible plastic packaging market adds roughly 18-22%, positioning polybag mailers within blown film formats valued for seal integrity, puncture resistance, and lightweight freight economics. The courier express and parcel packaging market provides approximately 12-15%, where operators adopt tamper evident closures, tear strips, and barcode friendly matte surfaces to accelerate induction. The mailing and shipping supplies market accounts for 10-12%, with distributors and office supply channels merchandising mailers alongside labels, tapes, and accessories for SMB fulfillment. The polyolefin films market supplies another 8-10%, linking upstream resin choices and film recipes to dart impact ratings, opacity, slip additives, and coextruded performance. Across these parents, procurement decisions are influenced by print quality, adhesive performance across temperature bands, compatibility with auto baggers, and dimensional weight optimization in parcel tariffs. Growth is strongest where rigid formats are replaced and parcel volumes surge in peak seasons. In this view, polybag mailers are seen as cost focused, space efficient, and workflow friendly for apparel, soft goods, and returns across omnichannel retail and third party logistics and distribution hubs.

Why is the Polybag Mailers Market Growing?

The Polybag Mailers market is experiencing consistent expansion, supported by the rapid growth of e-commerce, direct-to-consumer retail models, and an increased focus on sustainable packaging solutions. Manufacturers are leveraging material innovations to create lightweight yet durable mailers that reduce shipping costs while ensuring product protection. Advancements in printing technology are enabling high-quality branding on polybag surfaces, enhancing customer experience and brand visibility.

Rising consumer preference for convenience and recyclability is influencing design and production strategies, with growing adoption of eco-friendly polymers and post-consumer recycled content. The sector is also benefiting from supply chain optimization efforts, where polybag mailers contribute to reduced warehouse space usage and improved logistics efficiency.

Regulatory measures encouraging sustainable packaging and the increasing adoption of contactless delivery methods are further driving demand As businesses seek packaging solutions that combine performance, cost-efficiency, and environmental compliance, the market is poised to witness sustained growth across global regions, supported by innovation and strong demand from retail and logistics sectors.

Segmental Analysis

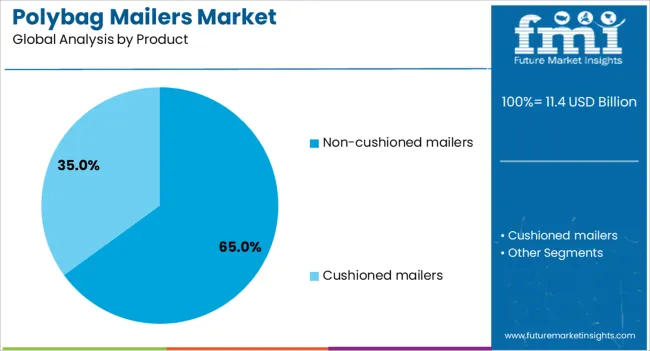

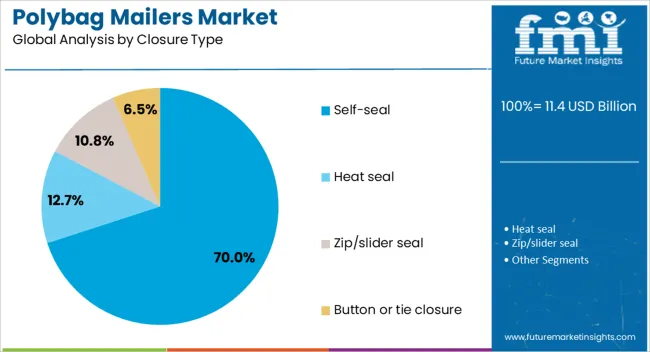

The polybag mailers market is segmented by material, product, closure type, application, and geographic regions. By material, polybag mailers market is divided into Low-density polyethylene (LDPE), High-density polyethylene (HDPE), Co-extruded polyethylene, Recycled polyethylene, and Others. In terms of product, polybag mailers market is classified into Non-cushioned mailers and Cushioned mailers. Based on closure type, polybag mailers market is segmented into Self-seal, Heat seal, Zip/slider seal, and Button or tie closure. By application, polybag mailers market is segmented into E-commerce & retail, Apparel & footwear, Electronics & accessories, Healthcare & pharmaceuticals, and Others. Regionally, the polybag mailers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Low-density polyethylene (LDPE) Material Segment

The low-density polyethylene material segment is projected to hold 40% of the Polybag Mailers market revenue share in 2025, making it the leading material type. This dominance has been attributed to LDPE’s balance of flexibility, strength, and lightweight properties, which make it ideal for protecting a wide range of shipped products. Its moisture resistance and ability to withstand rough handling during transit have strengthened its adoption among e-commerce and logistics companies.

The segment has also benefited from LDPE’s compatibility with various printing techniques, enabling high-quality custom branding. Furthermore, LDPE mailers can be produced in both virgin and recycled forms, aligning with increasing sustainability goals.

Cost-effectiveness in production and ease of large-scale manufacturing have ensured steady supply capabilities, supporting its continued market leadership The adaptability of LDPE to incorporate features such as tamper-evident seals and opaque finishes has also contributed to its popularity, ensuring that it remains the preferred material choice for high-volume shipping needs.

Insights into the Non-cushioned mailers Product Segment

The non-cushioned mailers product segment is anticipated to hold 65% of the Polybag Mailers market revenue share in 2025, emerging as the leading product type. Its growth has been driven by the rising demand for lightweight packaging that reduces shipping costs without compromising product safety for non-fragile items. Non-cushioned mailers are favored for their cost-efficiency in production, ease of storage, and lower material usage, which also appeals to environmentally conscious businesses.

The segment has gained further traction through its suitability for a wide range of retail goods such as clothing, accessories, and documents. Their thinner structure allows for efficient bulk storage and distribution while still offering durability against tears and punctures.

The ability to produce these mailers in varying thicknesses and sizes to meet diverse shipping requirements has added to their appeal Coupled with their compatibility with automated packing systems, non-cushioned mailers have become a staple in high-volume logistics and retail operations.

Insights into the Self-seal Closure Type Segment

The self-seal closure type segment is expected to account for 70% of the Polybag Mailers market revenue share in 2025, positioning it as the dominant closure type. Its popularity has been supported by its ability to streamline packaging operations by eliminating the need for additional sealing materials such as tapes or staples. Self-seal mechanisms offer a secure and tamper-evident closure, which enhances product safety during transit and improves customer confidence.

The convenience of quick sealing has made this closure type especially attractive for high-throughput e-commerce fulfillment centers. The segment has also benefited from its adaptability across various material types and product categories, ensuring widespread use.

Additionally, the consistent sealing performance of self-seal closures reduces the risk of package failure, minimizing returns and replacement costs for businesses As demand for efficient, user-friendly, and reliable packaging solutions continues to grow, the self-seal closure type remains a preferred choice for both retailers and logistics providers.

What are the Drivers, Restraints, and Key Trends of the Polybag Mailers Market?

Polybag mailers gain traction as parcel volumes rise and shippers seek fast packing, carrier ready formats for apparel, accessories, and small devices. Cost volatility, regulatory obligations, and uneven recovery infrastructure remain barriers, making dependable specifications and supplier stability essential. Custom sizes, double seals, tear strips, and automation ready formats create clear upside, while lined and anti static variants extend use cases. Compliance focused inks, adhesive choices, and verified claims shape procurement, as brands leverage seasonal artwork and data enriched graphics. These dynamics indicate durable relevance for polybag mailers across omnichannel distribution.

Rising e commerce and parcel volumes

Adoption of polybag mailers is being propelled by rising parcel movements from direct to consumer brands, marketplaces, and third party logistics networks. Shippers favor mailers for their light weight, flexible form, and ability to fit diverse stock keeping units without void fill. Dimensional weight fees are being managed more effectively when soft goods, accessories, and small electronics ship in mailers rather than cartons. Operations teams value fast pack speeds, easy sealing, and compatibility with scan and ship workflows. Retailers shifting toward ship from store and micro fulfillment have treated mailers as a default format for apparel, footwear, and hardlines with protective inner wraps. Printability supports branded experiences and clearer barcodes, while tamper evident closures and high opacity improve privacy and reduce returns fraud. In this context, polybag mailers are viewed as an efficient carrier ready format that balances protection, pack time, and cost across omnichannel distribution models.

Cost headwinds and recycling infrastructure gaps

Growth is constrained by resin price volatility, freight rates, and energy costs that elevate total landed cost for converters and brand owners. Regional restrictions on single use items add compliance complexity, while extended producer obligations raise administrative and fee burdens in certain jurisdictions. Post consumer recovery of flexible films remains inconsistent, with sorting contamination and limited curbside collection undermining circular flows. These gaps can influence brand choices toward alternative formats for public perception reasons, even when mailers meet performance needs. On the line, sealing failures, ink scuffing, and tear propagation from sharp edges create quality complaints when specifications are not tightly controlled. Supply chain risks for films, adhesives, and closures continue to lengthen lead times during demand spikes. Smaller e commerce sellers face minimum order quantities and artwork prepress costs that reduce agility. Together, these pressures make specification discipline and supplier reliability decisive for wider adoption.

Opportunities in customization and automation ready designs

Clear opportunities exist in application specific sizes, double seal closures for easy returns, and integrated tear strips that accelerate unpacking. Converters are developing co extruded structures with improved stiffness, puncture resistance, and ink adhesion that maintain pack speeds on high throughput lines. Variable data printing for serialized barcodes and promotional codes is being requested to streamline fulfillment and marketing. Bubble lined and foam lined variants expand use into fragile accessories, while anti static formats support small electronics and components. Automation ready bags with wicketed stacks, fanfold formats, and machine readable marks enable faster changeovers on auto baggers. Retailers are adopting color blocking and premium matte finishes to elevate perceived value in doorstep deliveries. White label offerings for third party logistics providers allow unified branding across merchant networks. These avenues position polybag mailers as a configurable platform rather than a commodity, creating room for margin and stickier partnerships.

Trends in compliance, materials, and channel expansion

Procurement teams are prioritizing carrier certified dimensions, drop testing to defined protocols, and clear spec sheets that simplify multi site deployment. Inks with low odor and low migration profiles are being preferred for apparel contact zones, while adhesives are selected for cold chain transit tolerance without residue on returns. Documentation around recyclability claims and resin identification is being requested to satisfy retailer audits and marketplace policies. Direct to consumer brands are adopting seasonal artwork and limited runs, enabled by shorter print setups and digital workflows. Subscription commerce and influencer led product drops are widening the use of preprinted mailers with campaign assets. Regional converters are expanding near customer capacity to reduce transit time and improve emergency coverage. The market is moving toward data enriched packaging, where scannable graphics link to order tracking, exchange portals, and customer care, reinforcing loyalty beyond the initial unboxing moment.

Analysis of Polybag Mailers Market By Key Countries

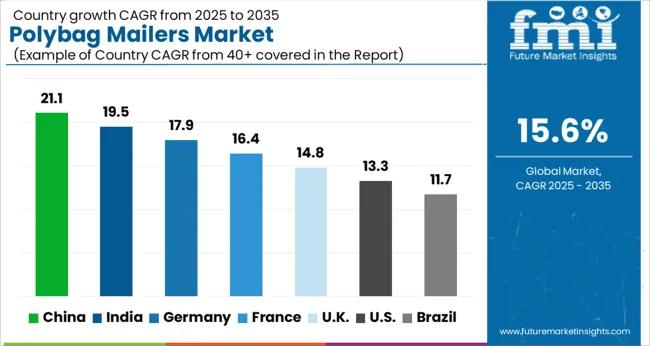

The polybag mailers market is forecast to grow at a global CAGR of 15.6% from 2025 to 2035. China leads with 21.1%, followed by India at 19.5% and France at 16.4%, while the UK grows at 14.8% and the USA at 13.3%. China and India post strong growth premiums above the global baseline, supported by large e-commerce ecosystems and domestic manufacturing strength. France records solid growth with branding and regulatory-driven innovations. The UK and USA show steady expansion with strong e-commerce adoption and customized packaging strategies. Asia remains the fastest-growing region, while Europe and North America sustain high-value applications. The analysis spans over 40+ countries, with the leading markets shown below.

Expansion Outlook for Polybag Mailers Market in China

China is projected to lead the polybag mailers market with a CAGR of 21.1% from 2025 to 2035. The dominance is fueled by the rapid growth of e-commerce platforms and logistics expansion across tier-1 and tier-2 cities. Online retailers are adopting lightweight, durable, and customizable mailers to reduce shipping costs and improve branding. Manufacturing strength in polymers and packaging materials provides cost advantages to local producers, while global companies leverage partnerships with domestic suppliers. Increased focus on product protection and tamper-evident designs is driving innovation. The rise of cross-border e-commerce adds further momentum to demand.

E-commerce growth driving bulk adoption of polybag mailers.

Strong manufacturing ecosystem ensuring competitive cost structures.

Cross-border retail expansion fueling demand for durable mailers.

Growth Prospects for Polybag Mailers Market in India

The polybag mailers market in India is forecast to expand at a CAGR of 19.5% during 2025–2035. E-commerce growth, fueled by mobile penetration and digital payments, is significantly boosting demand for cost-effective packaging. SMEs and large online marketplaces are adopting polybag mailers for apparel, electronics, and accessories due to their lightweight and secure features. Domestic manufacturers are scaling production with emphasis on tamper-proof closures and eco-conscious materials. Government initiatives for digital retail expansion and rising demand in tier-2 and tier-3 cities are creating strong market pull. Export opportunities are also increasing as Indian manufacturers cater to global e-commerce packaging needs.

Digital retail expansion fueling adoption across SMEs and major platforms.

Local producers focusing on tamper-proof and eco-conscious mailers.

Export potential rising with competitive domestic production.

Growth Prospects of Polybag Mailers Market in France

France is projected to grow at a CAGR of 16.4% in the polybag mailers market from 2025 to 2035. The expansion is supported by strong e-commerce adoption and consumer preference for secure, branded packaging. Retailers are increasingly adopting custom-printed mailers to enhance brand visibility and customer engagement. Regulatory compliance regarding packaging safety and material quality is driving innovation among local manufacturers. French suppliers are investing in research to improve durability and lightweight performance. The market is also benefitting from the growth of cross-border retail logistics within the EU, where mailers are favored for cost-effective shipping solutions.

Custom-printed mailers gaining traction for brand enhancement.

Regulatory compliance pushing higher quality packaging solutions.

EU logistics growth boosting adoption of polybag mailers.

Demand Assessment of Polybag Mailers Market in the United Kingdom

The UK market is forecast to grow at a CAGR of 14.8% between 2025 and 2035. The rise of e-commerce, particularly in apparel and lifestyle products, is driving demand for secure and lightweight mailers. Retailers and logistics companies prioritize tamper-evident and resealable features to improve product safety. Branding and customization trends are gaining traction, with retailers using printed designs to improve customer recall. Imports continue to play a significant role, though local suppliers are expanding to meet retailer specifications. Logistics firms favor polybag mailers due to their efficiency in reducing parcel weight and shipping costs.

Apparel and lifestyle sectors fueling bulk demand for mailers.

Tamper-evident and resealable features improving adoption.

Customization for branding gaining wider consumer attention.

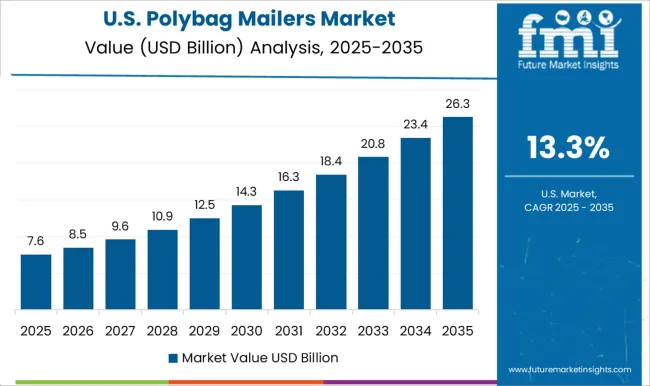

Future Insights into Polybag Mailers Market in the United States

The USA market is projected to grow at a CAGR of 13.3% through 2035. The surge in e-commerce and direct-to-consumer business models is driving bulk adoption of polybag mailers. Lightweight, durable, and cost-efficient packaging solutions are in demand for apparel, electronics, and healthcare shipments. Retailers are emphasizing branded and customized packaging as part of customer experience strategies. Domestic manufacturers are innovating with stronger sealing mechanisms and multilayer designs to improve product security. While imports from Asia remain significant, local players are focusing on supplying premium-grade mailers for high-value products. Logistics and retail companies view polybag mailers as cost-effective and scalable packaging solutions.

Direct-to-consumer businesses driving consistent demand.

Innovations in sealing and multilayer designs boosting reliability.

Brand-focused packaging strategies strengthening adoption rates.

Competitive Landscape of Polybag Mailers Market

Competition in polybag mailers has been decided by speed to ship, print quality, and integration at the pack station. Berry Global is viewed as the scale anchor, with multi-plant coverage, custom graphics, and film engineering that supports high throughput at fulfillment centers. Sealed Air competes through padded and unpadded mailers paired with in-line packing equipment, so pick, pack, and label steps are simplified. Pregis is positioned around automated bagging cells and service programs that cut changeover time and carton touches. Mondi focuses on retail and 3PL programs where national stocking, quick artwork cycles, and consistent bag performance are prioritized. Intertape Polymer Group competes with a broad mailer assortment and channel depth into distributors and e-commerce platforms. Awards tend to be won where uptime guarantees, carton reduction, and proven parcel protection are demonstrated. Total landed cost matters. So do lead times. Strategy has centered on three levers. First, tighter coupling with automation vendors so wicketed bags and rollstock feed reliably at high cycles. Second, faster artwork and plate workflows so seasonal drops and limited runs are turned around without excess inventory. Third, regionalized inventory and VMI so spikes in parcel volume are absorbed without expediting. Product brochure content is precise. Unpadded poly mailers are listed with coextruded opaque films, common sizes from small apparel to bulky soft goods, lip dimensions suitable for auto apply labels, and hot melt self seal closures that show tamper evidence. Padded variants describe bubble or foam interiors, corner strength, and drop performance notes. Options include easy open tear strip, dual seal for returns, write on white surfaces, barcode friendly inks, antistatic grades for electronics, wicketed stacks for auto baggers, and printer compatible rolls for print-and-apply lines. Typical claims emphasize seam strength, adhesive bond reliability, surface glide through sortation, and consistent opening force at the tear strip.

Key Players in the Polybag Mailers Market

Berry Global

Sealed Air

Pregis

Mondi

Intertape Polymer Group

Scope of the Report

Item

Value

Quantitative Units

USD 11.4 Billion

Material

Low-density polyethylene (LDPE), High-density polyethylene (HDPE), Co-extruded polyethylene, Recycled polyethylene, and Others

Product

Non-cushioned mailers and Cushioned mailers

Closure Type

Self-seal, Heat seal, Zip/slider seal, and Button or tie closure

Application

E-commerce & retail, Apparel & footwear, Electronics & accessories, Healthcare & pharmaceuticals, and Others

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

Berry Global, Sealed Air, Pregis, Mondi, and Intertape Polymer Group

Additional Attributes

Dollar sales by product type (mono layer, coextruded, bubble lined), closure type and format (peel and seal, wicketed, zip), and end use (e commerce, 3PL, retail and postal). Demand dynamics are driven by parcel growth, print driven branding needs, and compatibility with automated inserters. Regional trends indicate strong traction in North America and Europe, with rapid capacity adds in Asia Pacific supporting export programs and private label replenishment.