The rupiah has already weakened more than 1% against the US dollar this year, the worst-performing currency in Asia after the Indian rupee

[MELBOURNE] Indonesian markets are set for a fresh bout of volatility on Tuesday (Sep 9) that may prompt central bank intervention after Sri Mulyani Indrawati was removed as the nation’s finance minister.

The rupiah is poised to weaken when onshore trading resumes after forwards on the currency slid more than 1 per cent against the US dollar in overnight trading to the weakest since May. The nation’s dollar bonds trended lower, while two US-listed exchange-traded funds tracking Indonesian equities fell, suggesting local stocks will open lower.

Indrawati’s exit ratchets up pressure on Indonesian assets amid concern over populist policies from Indonesian President Prabowo Subianto, and came just days after the country saw its worst anti-government protests in years. While new finance minister Purbaya Yudhi Sadewa said that he will keep Indonesia fiscally healthy, Indrawati enjoyed widespread respect among global investors.

“It’s not entirely what we like”, and comes on top of a creep in central-bank statements that suggest less independence in policymaking, said Carl Vermassen, a portfolio manager at Vontobel Asset Management. “It’s the sort of events that would motivate us to reduce risk.”

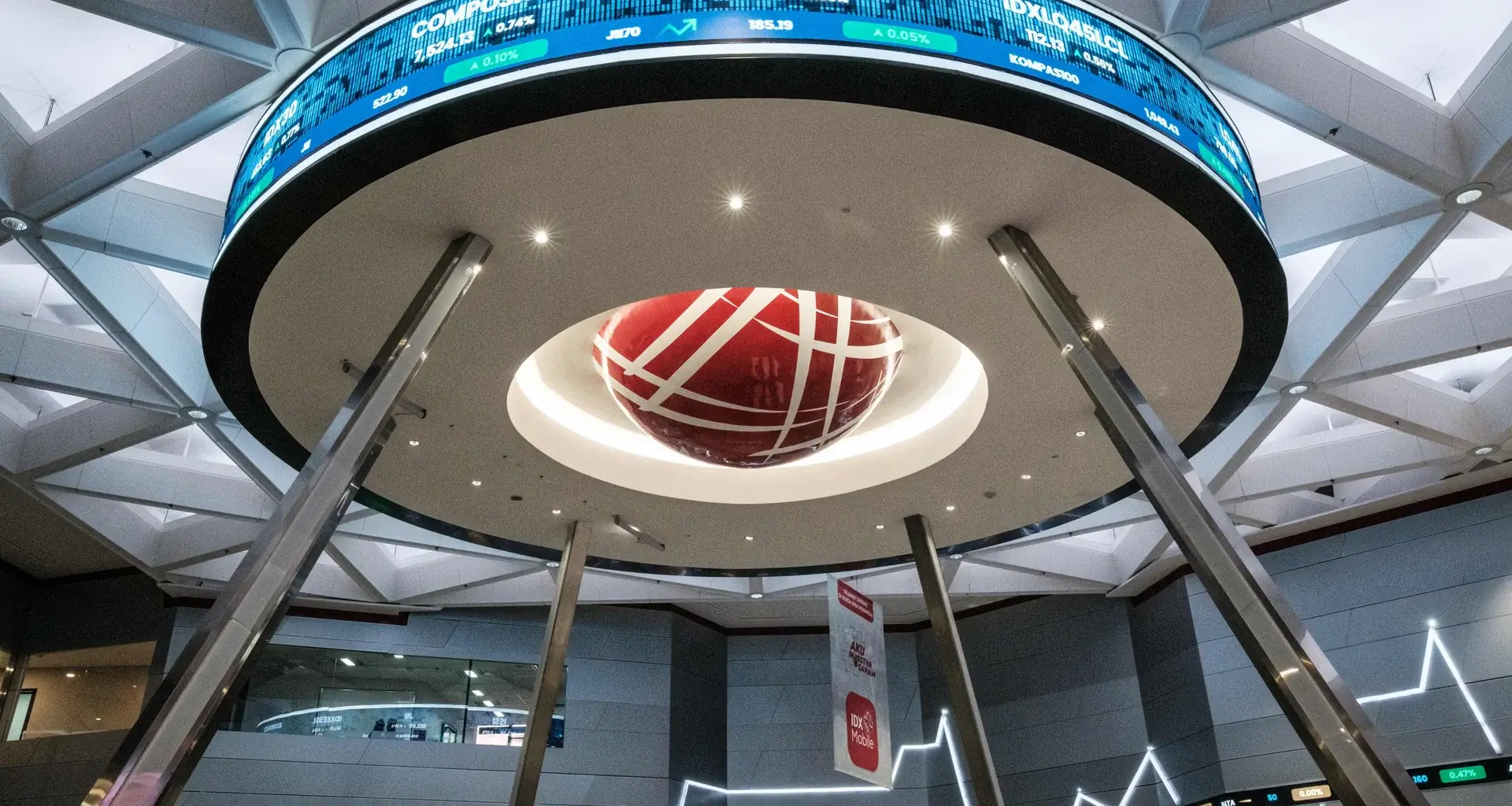

The rupiah has already weakened more than 1 per cent against the US dollar this year, the worst-performing currency in Asia after the Indian rupee, due in part to the soft economy and dovish central bank. The benchmark Jakarta Composite Index of stocks has gained 9.7 per cent this year, underperforming Asian emerging-market peers.

Concerns earlier this month that Indrawati would resign following the protests have also hit Indonesia’s markets, with overseas investors selling about US$845 million of stocks and bonds this month, according to data compiled by Bloomberg.

Traders are now on watch for signs that Bank Indonesia (BI) will intervene in the currency and bond markets, which it typically does during times of market stress to ensure adequate liquidity.

“We think BI will be focusing on FX stabilisation in the near term,” and won’t cut interest rates this month, Helmi Arman, an economist at Citigroup in Jakarta, wrote in a note to clients. “Increased perceived uncertainty could accentuate foreign portfolio investment outflows that have already begun in the week after the social unrest in late August.” BLOOMBERG