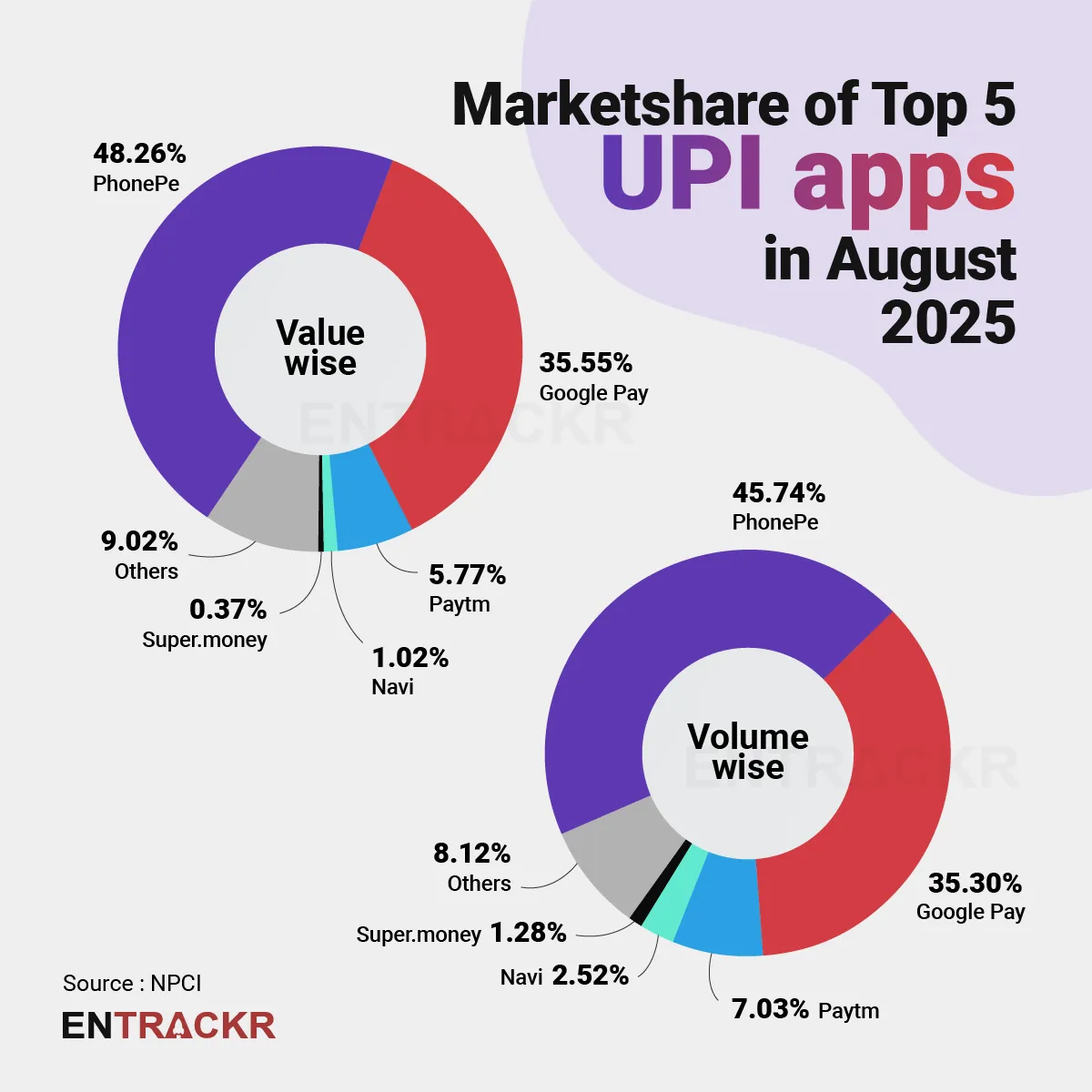

India’s Unified Payments Interface (UPI) crossed 20 billion transactions in August 2025, marking its highest monthly volume ever. PhonePe continued to lead the digital payments market with 9.15 billion transactions, holding a 45.74% share by transaction volume (9.15 billion) and 48.26% by value (Rs 11.99 lakh crore).

According to NPCI data, Google Pay followed with a 35.30% share by transactions (7.06 billion) and a 35.55% share by value (Rs 8.83 lakh crore).

For the first time, PhonePe and Google Pay crossed the 9 billion and 7 billion monthly transaction milestones, respectively. Paytm retained the distant third spot with a 7.03% share by transactions (1.41 billion transactions) and a 5.77% share by value (Rs 1.43 lakh crore).

The trend also suggests that the combined market share of the top three apps, PhonePe, Google Pay, and Paytm, has declined from 93.22% in January to a little over 88% in July. The entry of new UPI apps along with discounts and promotional offers could be driving this customer shift.

Navi registered 504 million transactions (2.52% share by transactions) worth Rs 25,397 crore, while CRED accounted for 150 million transactions (0.75% share by transactions) but a relatively strong 2.24% share by value owing to higher ticket size payments.

Axis Bank Apps, BHIM, Amazon Pay, FamApp by Trio, and super.money rounded out the top 10, each holding less than 1% share by transactions. Notably, super.money surpassed CRED in terms of transaction volume. Entrackr recently reported on their growth over the past 12 months.

In August 2025, UPI spending was led by debt collection at Rs 77,007 crore, groceries at Rs 68,116 crore, and fuel at Rs 34,547 crore. Digital goods including gaming fell 26% to Rs 7,441 crore after real money app bans.