The rise in property values follows the Reserve Bank of Australia’s decision to cut interest rates earlier this year. Since the first of three rate reductions in February, demand for housing has intensified across many parts of the country.

Medium-sized cities such as Brisbane, Adelaide and Perth have seen the most significant growth, with dwelling prices in these areas nearly 10% higher than a year ago, according to PropTrack. In contrast, Sydney recorded a 3.66% increase, while Melbourne’s home values rose by 2.1% compared to August 2024.

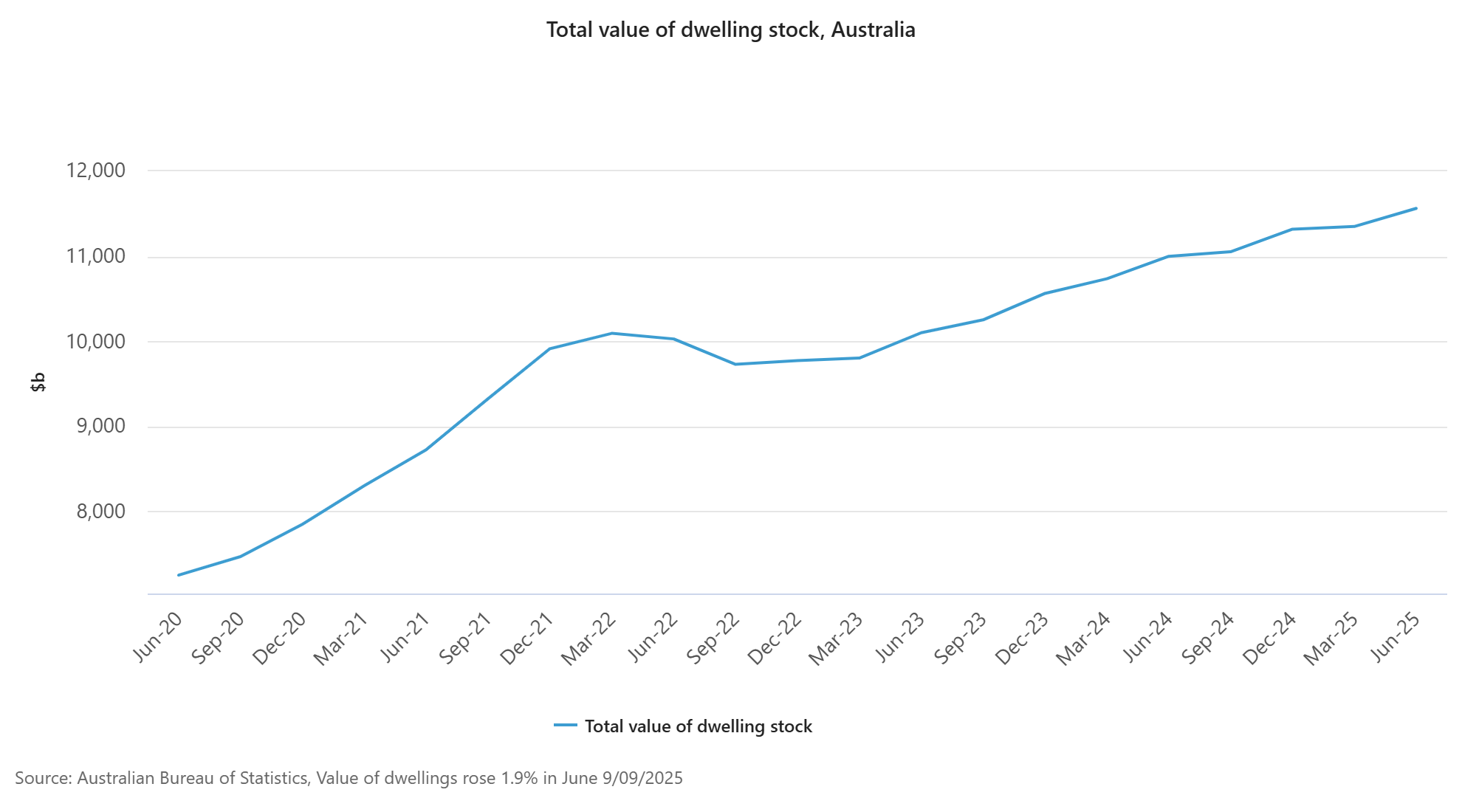

“June quarter’s growth in the value of dwellings followed a 0.3% rise in the March quarter, with rises across all states and territories,” said Mish Tan, ABS head of finance statistics. “The total value of dwellings was 5.1% higher than a year ago.”

ABS lending data released in August indicates that much of the increased activity in the housing market is being driven by investors. The number of new loans to investors rose by 3.5% over the June quarter, while new loans to owner occupiers increased by just under 1%. Tan described lending activity as being at “relatively high levels.”