![]()

Journalist

Posted: September 10, 2025

Key Takeaways

MYX Finance blasted over 250% in the past two days, jumping from $4 to $18, thanks to massive perpetual traction. Can late bulls benefit from the recent pullback?

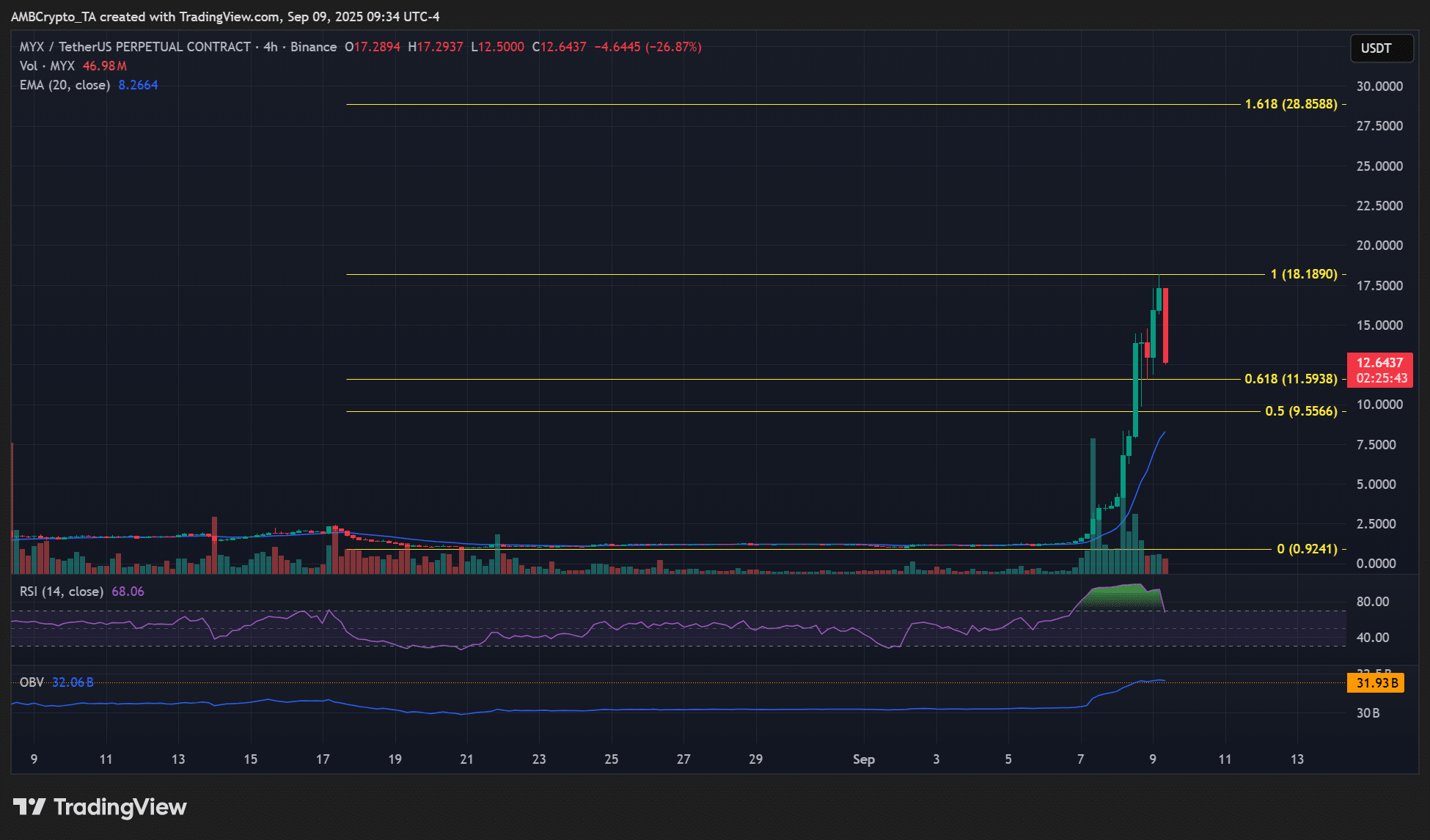

On the 8th September, MYX Finance [MYX] surged by over 298%, rising from $4 to $14. The following day, it extended the rally to $18, allowing bulls to lock in an extra 56%.

The explosive move was triggered by the massive platform’s massive on-chain perpetual volume. According to BNB Chain, MYX Finance topped the volumes on the network alongside PanCakeSwap [CAKE].

This was not surprising, as most tokens in this segment, like Hyperliquid [HYPE], and IDEX, have seen aggressive upswings.

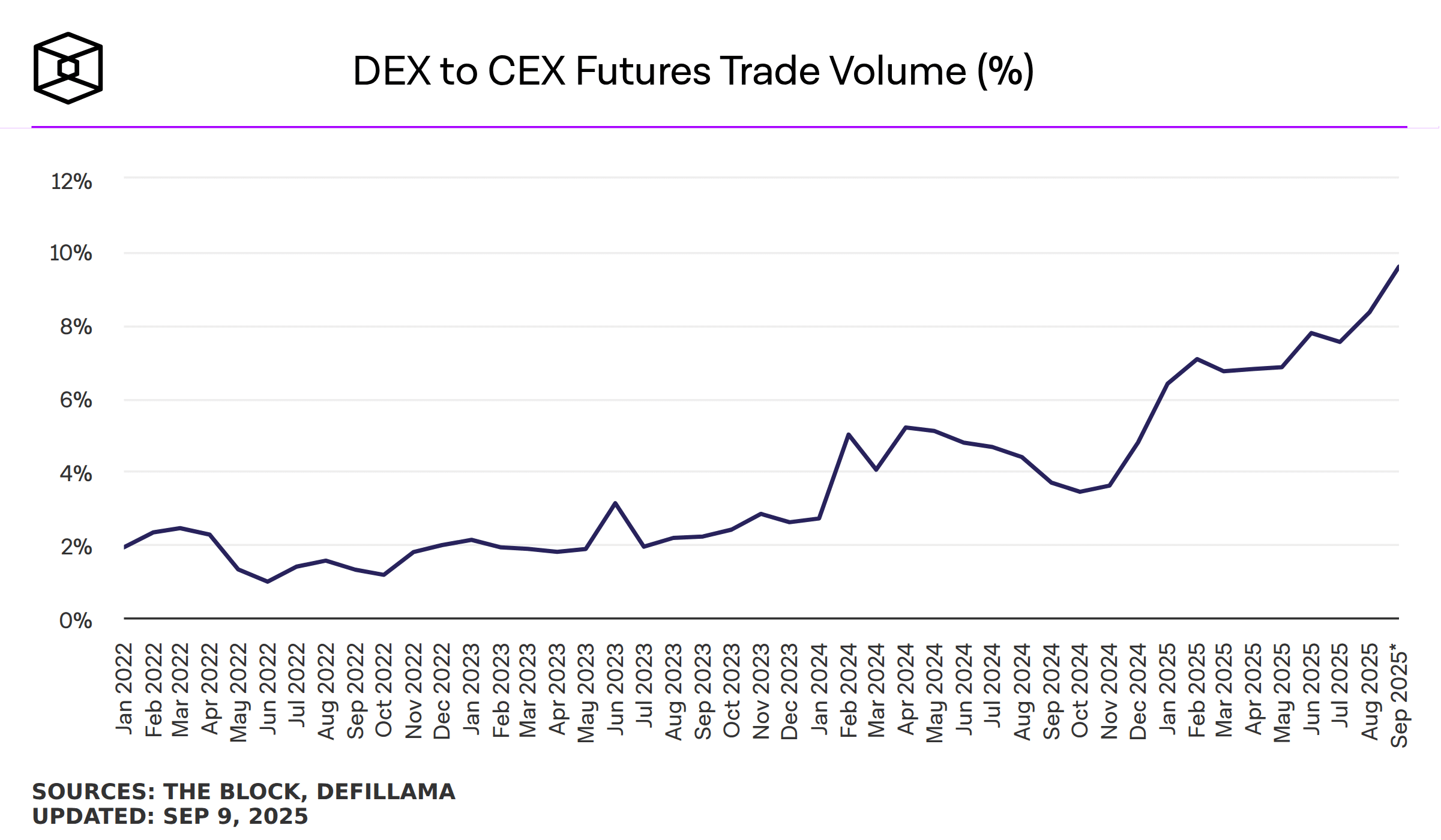

In fact, the overall perpetual volumes handled by decentralized exchanges (DEXes) edged closer to 10% of CEXes, underscoring renewed traction.

Source: The Block

At the time of writing, however, the MYX rally had cooled off slightly, pointing to profit-taking. Will bulls defend $10?

Will MYX hold above $10?

The pullback was close to hitting the golden ratio zone (0.5-0.618 Fib levels, yellow), which was around $10, at press time.

In other words, the psychological $10 level could become a key support to watch in the near term.

Source: MYX/USDT, TradingView

If $10 holds, a potential recovery to $18 or $28 could offer an extra 55% to150% gains. The OBV (On Balance Volume) was still high, underscoring massive trading volume and interest that could still push the token to tag the upside targets.

But the oversold conditions on the lower and higher timeframes indicated that the rally could still be due for more cool-off.

A breakdown below the $9.5, could reinforce sellers’ market edge, and dent the bullish thesis idea described above.

Why bulls need to defend $10

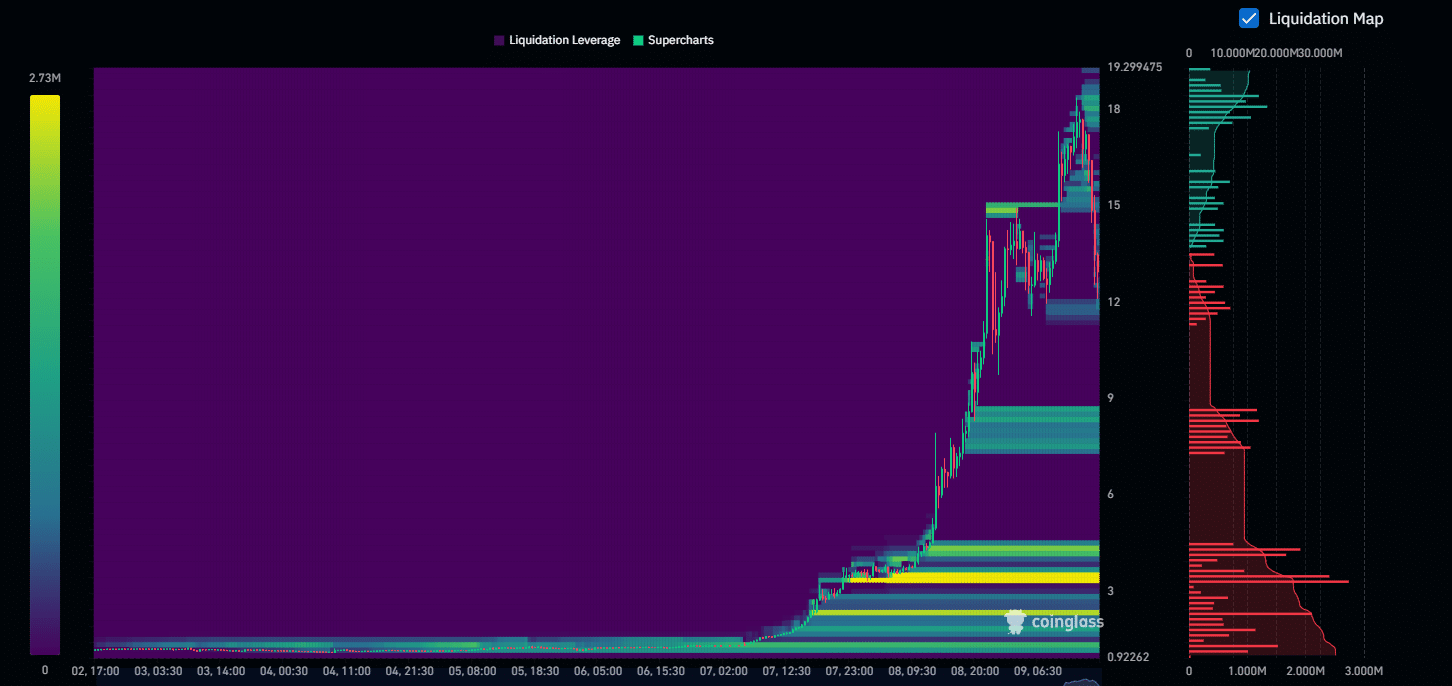

That said, losing $10 and clearing the liquidity below $9, could increase the risk of dropping back to $3. This was based on the liquidity pools that were at $12, $9 and $3.

In a liquidity hunt-driven price action, MYX could tag $12 and $9. But a sustained stay below $10 would make the massive liquidity zone at $3 (yellow) a potential price magnet.

Source: CoinGlass

The September trading volume has boosted MYX to rally more than 4x. And more gains could be likely if bulls defend $10 psychological support.

However, the uptrend could derail if the level is lost.

Next: Cathie Wood bets big on Ethereum, dumps Robinhood – Details