A reader asks:

I know it’s not exactly market talk but I would appreciate you all talking about how you personally look at emergency funds in cash equivalents. I find it extremely hard to keep cash in markets that keep going up. I know the 3-6 month rule of thumb but I’m curious how you guys personally handle emergency funds.

I agree that your emergency fund should not be an investment decision.

It’s a personal finance decision. These are the factors you should consider when it comes to building the right emergency fund:

Liquidity

Volatility

Other sources of funds/access to credit lines

Variability of your income

Career risk

And the most important variable is your sleep-at-night level. Some people can’t sleep at night without 9-12 months of expenses in cash. Others think that’s an unrealistic goal that leaves too much money on the table.

There’s no right or wrong answer. This one is all about personal preference.

Personally, I fall on the shorter end of the range because I have a diversified income stream and plenty of cash sources to tap in a pinch (HELOC, brokerage account, Roth IRA contributions, etc.). If our emergency cash balance goes beyond a certain threshold, I put it to work in the markets.

However, part of this question does have to do with the markets. You find it “hard to keep cash in markets that keep going up.”

This is really more of an asset allocation question. Cash equivalents over and above your emergency fund level can be a strategic asset class.

Some people hold more cash in their portfolios to be opportunistic. Some hold more cash because they need to take withdrawals from their portfolio and don’t want to sell when stocks are down. Others hold more cash to hedge against rising interest rates and/or inflation. And some people hold more cash because they need it as a shock absorber against volatility.

Cash is not a great long-term investment because it barely keeps up with inflation over the long haul. But if you need to keep an allocation to cash as an emotional hedge I don’t have a problem with it.

You just have to understand the trade-offs.

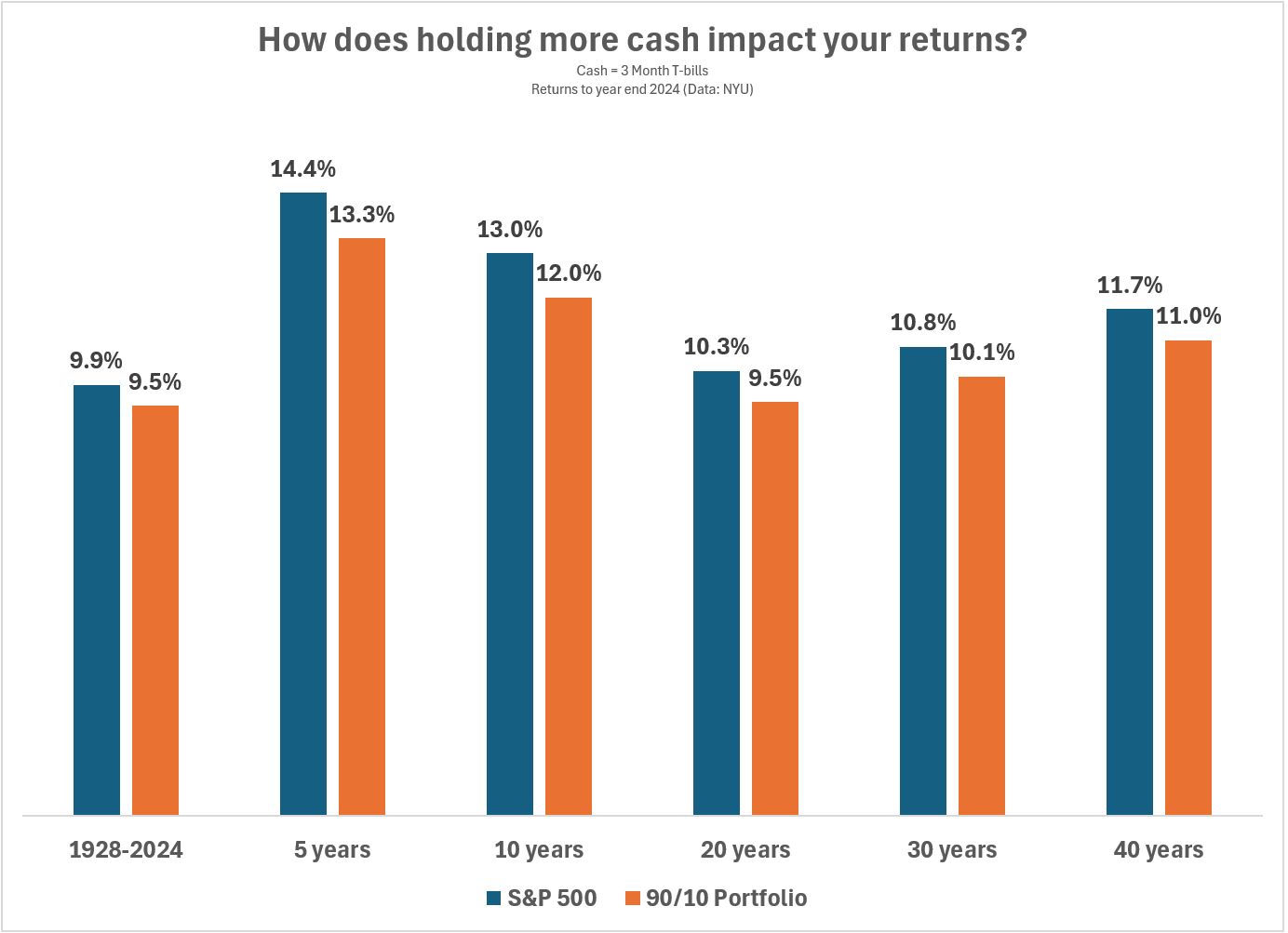

A small strategic allocation to cash doesn’t have a huge impact on your returns. I looked at the differences in annual returns over various time frames using a 100% allocation to the S&P 500 and a 90/10 portfolio made up of 90% stocks and 10% cash (3 month T-bills):

Sure, you would be leaving some money on the table but it’s not a massive difference in returns.

I don’t know if 10% is too much or not enough to help you sleep at night. But holding a little more cash in your portfolio because you’re nervous about the stock market or simply don’t want to experience all of the volatility of a 100% equity portfolio isn’t the end of the world.

However, I wouldn’t get into the habit of trying to do this on a regular basis just because you occasionally get nervous about the stock market. There’s a huge difference between a strategic allocation to cash that you periodically rebalance back to target versus tactically trying to guess when to raise cash and when to put it to work.

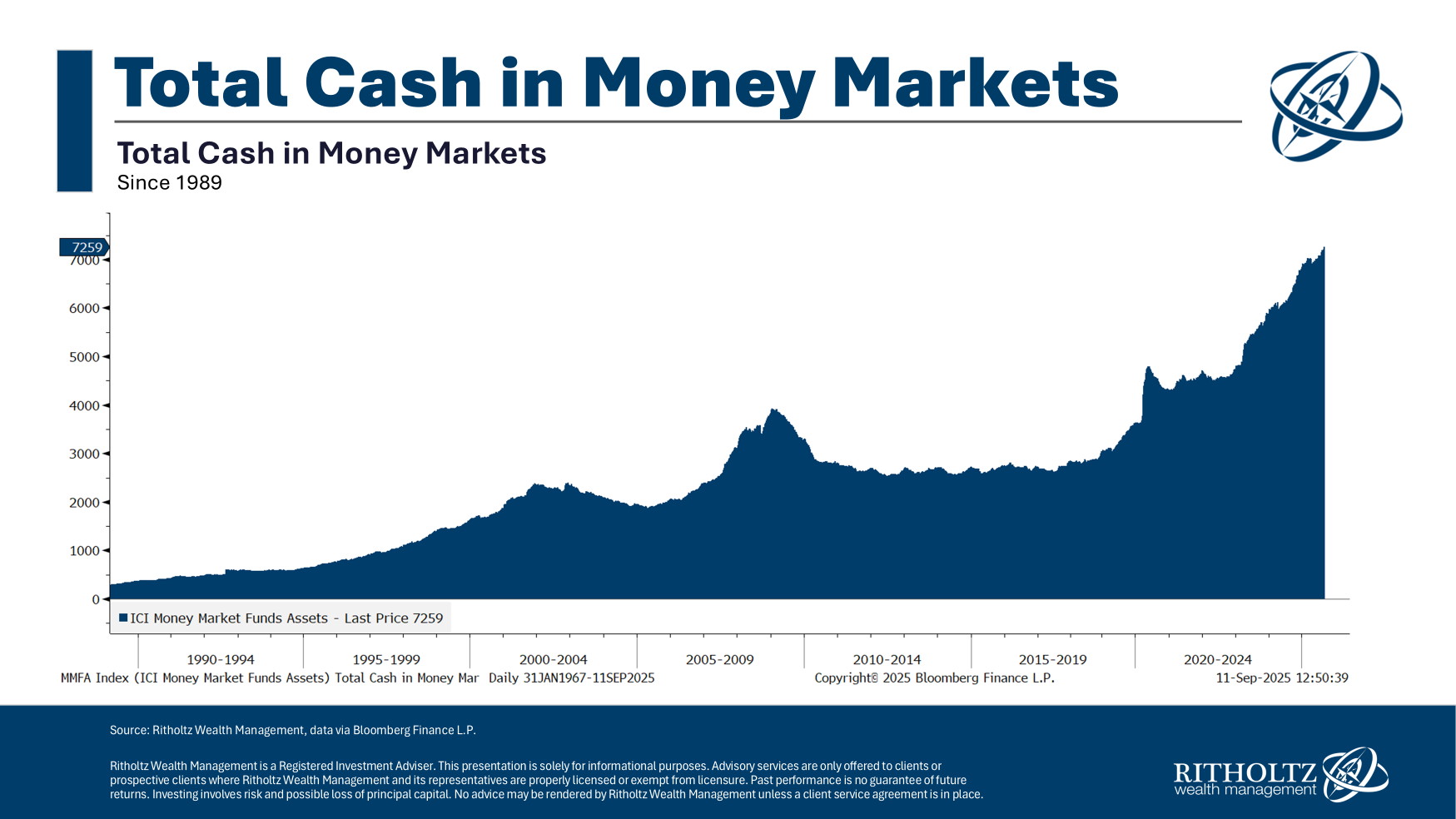

There is a lot of money sitting in cash these days.

That’s more than $7 trillion in money market funds alone, up from $3 trillion or so before the pandemic.

Cash can offer optionality and protection against short-term swings in the markets but forecasting when those short-term swings will take place is a lot harder than it sounds.

Investing based on your feelings is typically a terrible idea. Investing based on a set of rules gives you a much higher probability of success in the long run.

Successful investing boils down to a repeatable process, not a guessing game.

I talked about this question on an all new episode of Ask the Compound:

We also answered questions about diversifying beyond rental properties, when it makes sense to cut back on saving, how to think about RSUs (with help from Joey Fishman) and the Great Wealth Transfer.

Further Reading:

The $84 Trillion Elephant in the Room

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.