Key Points

IonQ and D-Wave Quantum are taking a different approach to quantum computing.

Avoiding tech giants when seeking quantum computing stocks with massive upside is key.

10 stocks we like better than IonQ ›

Finding and identifying stocks with the potential to go parabolic is no easy task. Instead of the stock chart looking like a steady, straight line going up, the curve resembles a parabola, indicating massive growth that occurs very quickly. This could happen in the quantum computing space if the technology becomes commercially relevant, sending the stocks of companies involved in this space up incredibly quickly.

I’ve got two picks that are prime candidates for this kind of growth, and each looks like an intriguing buy today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

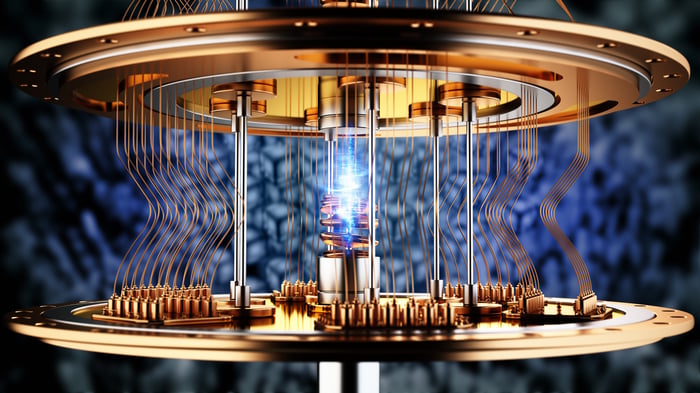

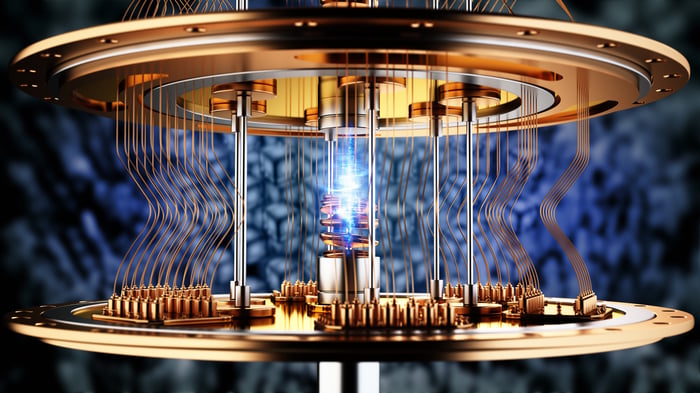

Image source: Getty Images.

The tech giants have a significant funding advantage

The quantum computing landscape is filled with many companies vying to achieve quantum computing supremacy. However, there’s a massive dividing line between the participants in this race. First, you have established legacy tech players that are developing quantum computing for their own use as well as to sell to others. This includes giants like Alphabet, Microsoft, and International Business Machines. These companies have a substantial amount of resources to invest in quantum computing, making them formidable competitors.

But David and Goliath stories exist for a reason, and the Davids in this story are the quantum computing start-ups.

These are businesses that only have one pursuit: To become relevant in the quantum computing space. They have no backup business, and the only funding they receive is from research contracts or issuing shares on the public market to raise money. There is no backup plan for these competitors, so it’s quantum computing or bust. This creates a kind of scrappiness that’s difficult to compete with, and these companies could easily rise from their relatively small sizes to join the tech titans mentioned above someday.

When a stock is already as big as the tech giants listed above, it’s nearly impossible for the stock to go parabolic, so I’m focusing on the quantum computing pure plays to find companies with massive upside.

Two that I think have the most potential are IonQ (NYSE: IONQ) and D-Wave Quantum (NYSE: QBTS). These two are taking a unique approach to quantum computing, and I think it’s what could make them successful stories in the long run.

IonQ and D-Wave Quantum are approaching quantum computing from a different standpoint

Nearly all companies involved in quantum computing are taking the same approach: Superconducting. This involves cooling a particle down to near absolute zero and using its properties to power quantum calculations. While this approach yields fast gate processing speeds, it is incredibly expensive and can be inaccurate.

IonQ and D-Wave aren’t taking this approach. Instead, IonQ is using the trapped ion technique, while D-Wave employs quantum annealing. IonQ’s trapped ion approach doesn’t require the particle to be cooled to nearly absolute zero — it can be done at room temperature. Furthermore, it yields world-record-holding accuracy. This comes at the cost of gate processing speeds, but I think the market is more likely to adopt a more accurate and cheaper solution. As a result, IonQ could become the industry leader if it stays on its path.

D-Wave uses quantum annealing, which enables it to solve optimization problems by identifying the lowest energy state within the system. This makes it a great technology for many quantum computing applications, although it may not be useful for every computing application in which end users envision quantum computing being applicable. Still, optimization problems include problem sets like shipping logistics, which could be one of the largest applications for quantum computing.

Both companies are taking different approaches compared to the established companies in this field. I think this is a very smart move on their part, as it allows them to offer a different solution, potentially at a cheaper price point. This could create a niche market at the beginning, allowing them to expand their market share over time and potentially become the primary players in this important and emerging field.

However, there’s no guarantee that either will pan out, so investors need to keep their position sizing relatively small in case one of these businesses fails. By devoting no more than 1% of their total portfolio value to either of these investments, investors can ensure that they capture the parabolic upside without being significantly affected if the stock becomes worthless.

I’m bullish on both IonQ and D-Wave, and each could be a solid stock pick over the next decade if they achieve quantum computing supremacy.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $672,879!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,086,947!*

Now, it’s worth noting Stock Advisor’s total average return is 1,066% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, International Business Machines, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Disclaimer: For information purposes only. Past performance is not indicative of future results.