With one eye on the future, the AI chipmaker has signalled a strong commitment to quantum computing as the sector draws investor interest.

Photo courtesy of Nvidia

US chipmaker Nvidia has dramatically signalled the importance of quantum computing for the future of the company with three startup investments in the space of a week.

Between the 4th and the 10th of September, the company took part in funding rounds for the US’s Quantinuum, which raised $600m, Australia’s PsiQuantum, which raised $1bn, and QuEra, also from the US, in which it invested an undisclosed sum.

All three are developing quantum computing hardware using different techniques to generate qubits. PsiQuantum uses photons, Quantinuum trapped ions, and QuEra neutral atoms. This diversity suits Nvidia. Just as the chipmaker has become a general supplier welcomed by all the major AI developers, its main quantum offering is the CUDA-Q platform, which is designed to help users run applications on any type of hardware.

Nvidia’s $4trn+ valuation is based on being indispensable to the growth of AI, especially as tech companies shell out more and more cash on infrastructure. With the most cutting-edge chip designs, which rely on the company’s proprietary software to work best, its position can sometimes appear unassailable.

This could change over the coming years, however, as domestic and Chinese chipmaking rivals come up with alternatives, or generative AI fails to deliver the kind of profits needed to justify the extraordinary level of investment it is receiving, causing market confidence – and demand for chips – to collapse.

Now the company is positioning itself to be in front of what may be the next seismic development in computing. The investments are a show of confidence in the sector after CEO Jensen Huang suggested in January that useable quantum computers may still be 20 years away – comments that immediately sent the share price of some prominent listed quantum companies tumbling.

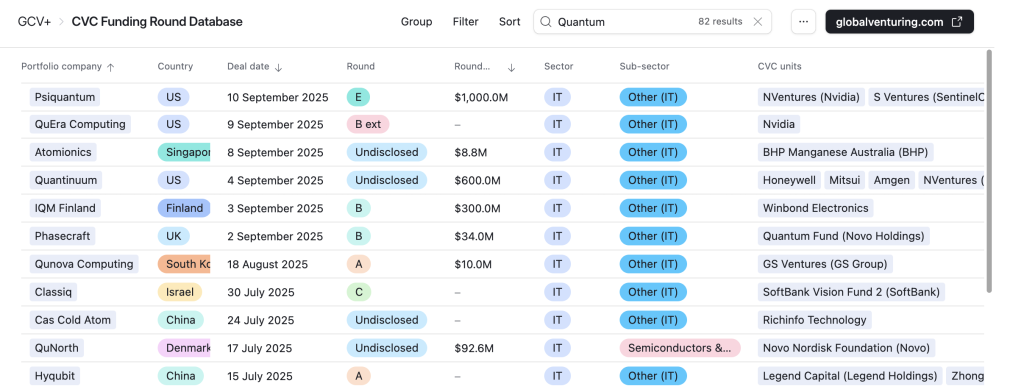

The chip giant’s interest is part of a wider trend. GCV recently reported on how our data showed a jump in corporate investment in quantum computing startups in the first half of 2025.

With five deals in September already, interest appears to remain high. But what is more striking is the large sums of money the recent funding rounds have drawn in, which is a step-change from the last 18 months of fundraising and is more reminiscent of the investment AI startups are drawing in. This is making valuations leap: following the Nvidia-backed funding rounds, PsiQuantum and Quantinuum have been valued at $7bn and $10bn, respectively.

In addition to the three deals Nvidia participated in, UK quantum algorithm developer Phasecraft raised $34m in a series B round co-led by Novo Holdings. IQM Finland, which makes both hardware and software, raised $300m at series B, with backing from Winbond Electronics, which makes memory chips.

Startup investment is not the whole story. IBM is considered one of the world leaders in quantum computing research and development, driving innovation in-house. In a recent interview with GCV, however, the head of its venture capital unit indicated growing appetite for engaging with startups. It invested in Qedma in July, an error correction startup.

While September’s spike in funding shows that sentiment for quantum computing as an emerging technology has changed. Nvidia won’t be the only corporate trying to get an early foothold.

See all the corporate-backed funding rounds for quantum computing companies in the CVC Funding Round Database