Healthcare has been the worst-performing sector in the S&P 500 this year. But when it comes to unlocking potential capital growth ahead, that may not be all bad news. And that’s especially true if we dig a little deeper, and zoom into healthcare segments that are home to innovation.

Looking at the big picture, there’s no sugarcoating the numbers. The S&P 500 is tallying gains of about 10% in 2025. But healthcare is practically flat, leading the sector laggards.

With a diverse universe of companies ranging from drugs to robotics to insurers, healthcare is a challenging sector home to both disruption and defense positioning, and — lately — to an underwhelming performance track record.

“What’s most interesting in healthcare right now is that the entire sector seems to be significantly undervalued,” TMX VettaFi’s Sector Expert Rafael Silva said. “Healthcare stocks are currently trading at a 10% discount to their fair value, which is one of the cheapest the sector has been in over five years.”

To quote U.S. Bank, the healthcare sector is a “paradox” for investors. It’s a complex sector, full of opportunities and drivers. But it’s also volatile and vulnerable to booms and busts tied to innovation.

Health Tech: Strong Fundamentals

As we near the fourth quarter, it may be prime time to revisit the laggards and look for gems. In that effort, consider health tech.

As a segment, it’s populated with companies that are capital intensive, heavily focused on R&D, disrupting the drugs, therapies, and tools in healthcare.

There are several ETFs that capture this slice of the market, such as the ROBO Global Healthcare Technology and Innovation ETF (HTEC), the Global X HealthTech ETF (HEAL), the Fidelity Disruptive Medicine ETF (FMED), and others. Each brings a unique take to a set of stocks that are all in the business of disrupting healthcare and advancing treatment and solutions.

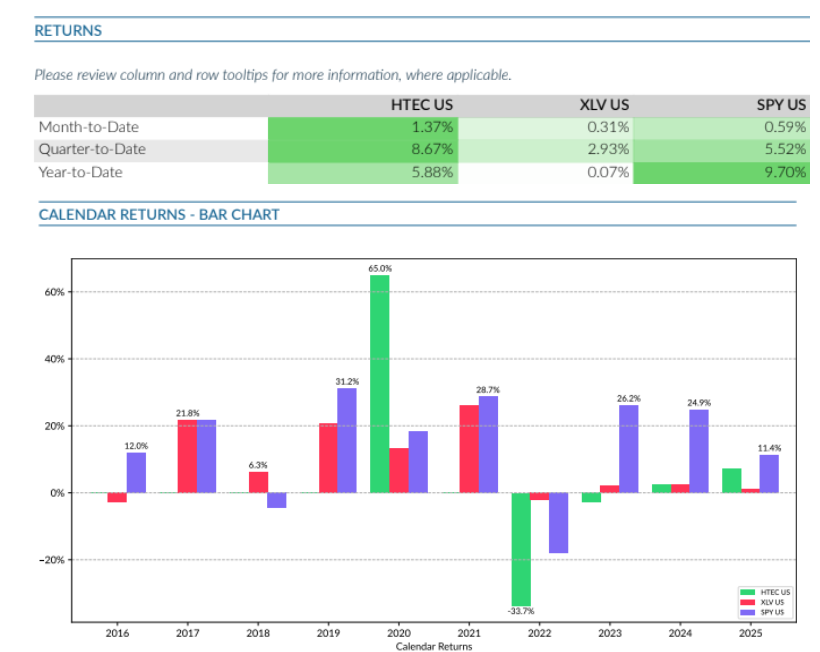

Using HTEC as an example for the category, we see the burgeoning upside momentum in this part of the market. HTEC, which tracks a VettaFi index, has crossed above its 50- and 200-day moving averages in August. It is now retesting its 2025 highs with gains of nearly 25% since the market’s April 8 lows.

These returns still represent a lag to the S&P 500’s 29% returns in the same period, but they also represent notable outperformance relative to the broader healthcare sector — as measured by the Health Care Select Sector SPDR Fund (XLV) — which is up only 3% since April.

Health tech is having its best relative year to healthcare since 2020, even though it remains a valuation-play based on historical data.

Source: VettaFi PRO

Valuation, Deal Making & Innovation

“HTEC itself is trading at the very bottom of its historic EV/sales ratio,” Silva said. “We see this as a temporary anomaly caused by short-term concerns that are likely to correct over time, especially given the inelastic demand for healthcare and ongoing demographic changes.”

Compelling valuation is only one supportive factor in a trifecta of potential drivers of future returns in health tech. There’s also accelerating innovation and M&A activity.

As Silva highlights, things like genomics — “we’re now able to test for cancer in a blood draw,” he said — and robotics, where “60% of all knee surgeries in the US are done by robots today,” are all rapid growth areas. There’s also the burgeoning path of AI-driven drug discovery.

“Drug discovery is the No. 1 expense for biotechs. Any improvement here would be massive [for companies],” Silva explained. “There’s an estimated $236 billion in revenues from 190 drugs at risk by 2030 with patents expiring. That will likely spur even more deals and make sure that the segment keeps investing heavily in R&D.”

“It seems the market hasn’t fully priced in the value of this organic and inorganic growth,” he added.

Under the Hood

HTEC and XLV only have about a third of the portfolios in common. It’s a similar story with HEAL and FMED. These funds look beyond healthcare sector companies and invest in some technology, consumer staples, even financial names as well — companies that are disrupting healthcare today.

A look at HTEC’s top 10 holdings includes biopharmaceutical companies developing new therapies, surgical solution innovators, medical researchers, and biotechnology names.

Source: ROBO Global

On Sale

Healthcare investors know too well that the sector is volatile even if it’s seen as defensive. But whether searching for capital growth or for diversification in the face of a top-heavy, near-record-highs market, it could be that healthcare — and more specifically, segments like health tech — offer a compelling opportunity.

If nothing else, from a valuation perspective, the entire sector is cheap, and health tech seems to have the wind at its back.

“The macroeconomic headwinds that have been pressuring the sector, like high-interest rates and inflation, are now starting to ease. At the same time, the fundamental demand for healthcare remains strong,” Silva said. “It looks like a sector with strong long-term growth prospects that is currently on sale.”

VettaFi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for HTEC, for which it receives an index licensing fee. However, HTECis not issued, sponsored, endorsed, or sold by VettaFi. VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of HTEC.

For more news, information, and analysis, visit the Thematic Investing Content Hub.

Earn free CE credits and discover new strategies