Gaskets and Seals Market Overview

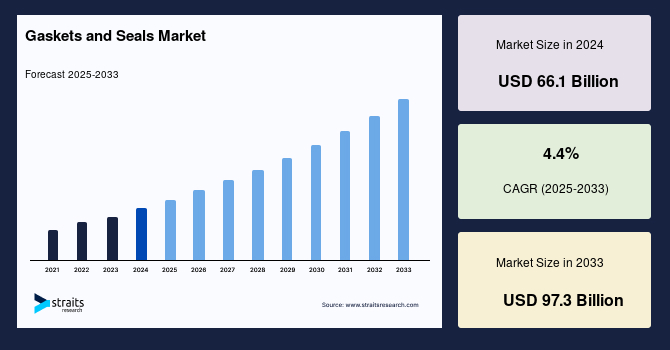

The global gaskets and seals market size was valued at USD 66.1 billion in 2024 and is projected to reach from USD 69.01 billion in 2025 to USD 97.3 billion by 2033, growing at a CAGR of 4.4% during the forecast period (2025-2033). The growth of the market is attributed to expansion of automotive and EV manufacturing, industrial automation and machinery upgrades and energy sector investments.

Key Market Indicators

Asia-Pacific was the largest regional market in 2024, accounting for 45% of global revenues (USD 29.7 billion) and projected to grow at a CAGR of 5.2% during 2025–2033.

Based on technique, the engineered/custom seals segment led the market in 2024 with an estimated 60–65% revenue share and is expected to expand at around 5.0% CAGR, driven by EV, aerospace, and hydrogen applications.

Based on material, the elastomers segment is the dominant material segment in the global market, representing over 40% of demand in 2024, with a CAGR of approximately 4.5% during the forecast period.

Based on technology/design, the engineered/custom seals category held the largest share in 2024 (about 55–60%) and is forecast to grow at 5.0% CAGR, outpacing commodity gaskets and seals.

Based on sales channel, the OEM (original equipment manufacturers) segment dominated in 2024 with nearly 60% market share, projected to grow steadily at a CAGR of 4.3–4.5%.

Based on end-use industry, the automotive segment led the global market in 2024 with an estimated 35% share, expanding at 5.0–5.5% CAGR due to surging EV production and aftermarket demand.

Market Size & Forecast

2024 Market Size: USD 66.1 Billion

2033 Projected Market Size: USD 97.3 Billion

CAGR (2025–2033): 4.4%

Asia-Pacific: Largest market in 2024

North America: Fastest-growing region

This market plays a critical role in ensuring leak-proof operations across diverse applications, including automotive, oil & gas, power generation, aerospace, marine, and general manufacturing. The market is shaped by the increasing demand for reliability, safety, and efficiency in industrial and automotive systems, where gaskets and seals prevent fluid or gas leakage, protect machinery components, and extend equipment lifespan.

In recent years, the industry has experienced strong demand from emerging economies, particularly in Asia-Pacific, which is driving both production and consumption growth. Rising investments in refineries, pipelines, power plants, and large-scale manufacturing hubs are contributing to market expansion. At the same time, advanced sealing solutions for electric vehicles (EVs), hydrogen systems, and renewable energy projects are creating new revenue streams. The aftermarket service and maintenance sector further sustains recurring demand, making the industry a vital component of global industrial infrastructure.

Gaskets and Seals Market Drivers

Expansion of Automotive and EV Manufacturing In 2025

Global EV sales are projected to reach 21.3 million units, up from 17.8 million in 2024. This surge is boosting demand for gaskets and seals, especially high-performance types used in EV drivetrains, battery packs, and thermal management systems. EV components operate at higher pressures, temperatures, and with stringent leakage and safety requirements than many traditional ICE (internal combustion engine) components. Hence, the value share of sealing solutions in vehicle systems is increasing.

Industrial Automation and Machinery Upgrades

The global push toward automation and advanced manufacturing is accelerating demand for gaskets and seals. As factories upgrade to high-performance machinery, precision robotics, and automated conveyor systems, sealing components are critical in ensuring reliability and extending equipment life. The industrial automation spending is expected to surpass $250 billion in 2025; therefore, demand is rising for durable gaskets and seals capable of withstanding higher operating pressures, continuous cycles, and exposure to chemicals and lubricants. This trend is driving growth in Asia-Pacific and Europe, where investment in Industry 4.0 initiatives is strongest.

Energy Sector Investments

The oil & gas industry, LNG terminals, and power generation facilities remain among the largest consumers of engineered gaskets and seals, as these components are critical for ensuring leak-proof performance under high pressure, temperature, and corrosive environments. Global energy sector capital expenditures are projected to exceed $2 trillion in 2025, with significant allocations toward upstream and downstream oil & gas projects as well as LNG infrastructure. At the same time, the energy transition is creating demand for advanced sealing in hydrogen pipelines, electrolyzers, and renewable energy systems, where conventional materials are often inadequate. This dual demand of maintaining continuity of traditional fossil fuel projects while supporting the shift to renewable energy positions the energy sector as a long-term growth driver for the gaskets and sealants market.

Key Restraints

Raw Material Price Volatility

The gasket and sealant industry is highly sensitive to fluctuations in the cost of synthetic rubber, specialty elastomers, metals, and polymers. Since raw materials account for 60% of total production costs, sudden price swings impact manufacturing margins and limit pricing flexibility, particularly in the gasket segment.

Between 2020-2023, natural rubber prices fluctuated from about US$1.20/kg to US$2.50/kg due to weather issues and supply disruptions in major rubber-producing countries such as Thailand and Indonesia. During that same period, manufacturers of industrial rubber sheets and gaskets found their input costs rising. Rubber constitutes around 60% of production cost in this segment, thereby increasing cost and squeezing profit margins, especially for producers who couldn’t pass on the price hikes to customers.

Intense Pricing Competition in Commoditized Segments

The sheet gasket and standard gasket markets are highly fragmented, with numerous regional and local producers competing on price. This commoditization creates downward pricing pressure, limiting profitability for smaller players that lack advanced product portfolios. While larger manufacturers may leverage volume efficiencies and integrated supply chains to remain competitive, smaller firms often face margin erosion, making it difficult to invest in R&D or expand into high value engineered sealing solutions. This intense competition restrains overall market growth by keeping average selling prices low in commoditized segments of the gaskets and sealants industry.

Opportunities in the Global Gaskets and Seals Market

The industry is ripe with opportunities, particularly as technological, regulatory, and regional dynamics evolve.

Growth in Renewable Energy and EV Applications

The global energy transition is creating new demand for advanced gaskets and seals, as wind turbines, solar systems, hydrogen infrastructure, and electric vehicles all operate under extreme conditions that standard sealing solutions cannot protect against. Wind and solar equipment require weather- and UV-resistant gaskets, hydrogen systems need seals that prevent gas permeation under high pressure, and EV batteries and motors demand lightweight, heat- and moisture-resistant sealing for safety and efficiency.

These specialized requirements are driving innovation in high-performance elastomers, composites, and metallic seals, positioning the gaskets and seals market to capture significant growth opportunities across next-generation energy technologies.

Industrial Expansion in Emerging Economies

Rapid industrialization in countries such as India, Vietnam, and Indonesia is fueling demand for advanced sealing solutions across petrochemical plants, refineries, and large-scale infrastructure projects. Asia-Pacific accounts for over 40% of global gasket and seal consumption, with petrochemicals and energy contributing one-third of that demand. Commodity gaskets are widely used in pipelines and rotating equipment, while engineered sealing systems are required for high-pressure, high-temperature, and corrosive environments in petrochemical and power facilities. Government initiatives such as “Make in India” and Southeast Asia’s expanding role as a global manufacturing hub are accelerating localized production, presenting international suppliers with opportunities to expand regional presence through joint ventures.

Sustainability, Emission Control, and Regulatory Compliance

Stringent emission norms, safety regulations, and energy efficiency requirements are compelling industries to adopt advanced sealing technologies. Mechanical seals and dry gas seals are increasingly favored over older technologies due to their ability to reduce fugitive emissions and improve equipment efficiency. Players offering eco-friendly, durable, and compliant sealing solutions are well positioned to gain competitive advantage in both developed and developing markets.

📊 Preview Report Scope and Structure – Gain immediate visibility into key topics, market segments, and data frameworks covered.

📥 Evaluate Strategic Insights – Access selected charts, statistics, and analyst-driven commentary derived from the final report deliverables.

Regional Analysis

Asia-Pacific

Asia-Pacific dominated the gaskets and seals market with a market share of over 45% in 2024, driven by industrialization, expanding automotive and EV production, and large-scale energy and petrochemical projects. China, accounting for 25% of the global market amounting to $16.5 billion, is leading demand with investments in power generation, refineries, and EV manufacturing. India is the fastest-growing country, projected to expand at 6.8% CAGR, fueled by government initiatives like “Make in India”, which are boosting both domestic manufacturing of sealing solutions and demand for imported high-performance gaskets and seals. Southeast Asian nations such as Vietnam and Indonesia are also driving growth through industrial automation and regional manufacturing hubs.

North America

North America accounts for 24% of the market share in 2024. The United States dominates the region, accounting for 18% of global demand. Growth is supported by strong aftermarket replacement cycles, particularly in oil & gas, power generation, and industrial machinery, as well as stringent regulatory standards requiring high-performance sealing solutions in automotive, aerospace, and chemical applications. Advanced EV production and automation in manufacturing facilities are further boosting demand for specialized gaskets and mechanical seals that meet high reliability and safety standards.

Europe

Europe benefits from mature industrial, automotive, and energy sectors, with Germany and France leading demand for high-performance gaskets and seals. The region’s growth is driven by stringent environmental and safety regulations, pushing manufacturers to adopt durable, low-emission sealing solutions. Expansion of EV manufacturing, renewable energy infrastructure, and advanced chemical processing facilities also fuels demand for engineered sealing products, particularly high-value mechanical seals and specialty gaskets.

Middle East & Africa

The region is experiencing steady demand due to investments in refineries, petrochemical plants, LNG terminals, and power projects, particularly in Saudi Arabia and the UAE. The energy transition is creating additional demand for sealing solutions in hydrogen and renewable energy applications. International suppliers are leveraging joint ventures and localized production to serve the region’s growing aftermarket and new installation needs.

Latin America

Latin America remains a smaller but growing market, with Brazil leading regional consumption through automotive manufacturing, oil & gas, and industrial sectors. Replacement demand is significant due to the heavy use of equipment in mining and refining operations. Meanwhile, infrastructure development and energy sector investments across Chile, Argentina, and Colombia are contributing to steady growth for high-performance gaskets and seals.

Product Type Insights

Seals dominate the gaskets and sealants market, accounting for 62% of revenues in 2024amounting to $41.0 billion and projected to grow at a 5.0% CAGR through 2033. Their leadership stems from critical applications in pumps, compressors, turbines, and engines, as well as rising demand for advanced mechanical seals in EVs, hydrogen systems, and renewable energy equipment. A steady aftermarket replacement cycle sustains growth, as seals require renewal every 5 years. With expanding automotive production, energy infrastructure investments, and industrial machinery upgrades, seals remain the growth engine of the market.

Gaskets held 38% of the market in 2024 (USD 25.1 billion) and are expected to expand at a CAGR of 3.8%. Demand is strongest in oil & gas pipelines, refineries, and chemical plants, where spiral-wound and metal gaskets are critical. Although growth is slower compared to seals due to price competition, engineered gaskets for high-temperature and corrosive environments remain strong value drivers.

End-Use Insights

Automotive and transportation remain the largest end-use industry, particularly with the surge in EV production. Energy and power generation represent another strong growth vertical, as gas turbines, nuclear plants, and renewable systems demand specialized seals. Aerospace and defence also require highly engineered sealing solutions, though in smaller volumes.

Export-driven demand continues to rise, with Asian manufacturers producing a significant share of global gasket and seal output for North America and Europe. The export market is supported by global supply chains for automotive OEMs and industrial equipment, ensuring sustained cross-border demand.

Investment & CapEx Trends

Public infrastructure spending across APAC and the Middle East is generating large-scale demand for industrial sealing solutions in pipelines, power plants, and refineries. Private sector industrial CapEx in machinery upgrades and advanced manufacturing is fueling demand for higher-quality gaskets and seals. Government initiatives such as “Made in China 2025” and “Make in India” are encouraging local production, innovation, and supply chain strengthening, making these regions attractive for both domestic and international investors.

Competitive Intensity, Pricing, and Technological Adoption

The global gaskets and seals market is moderately consolidated in engineered seals but fragmented in commodity gaskets. The top five players account for approximately 28% of the global market, with the remainder distributed among numerous regional and specialty manufacturers.

Performance in recent years

Freudenberg Sealing Technologieshas expanded aggressively into EV sealing and battery technologies, supported by strategic acquisitions such as Trygonal Group. Its focus on high-value, engineered solutions has strengthened revenue stability.

Trelleborg Sealing Solutionscontinues to maintain steady growth through OEM contracts, product innovation, and certifications in critical industries.

SKFhas integrated seals into its broader rotating equipment portfolio, leveraging synergies with its bearings business.

John Cranehas launched advanced dry gas seals and emission-reducing technologies, aligning with global environmental regulations and boosting aftermarket sales.

Garlock (EnPro Industries)and other specialty players have carved niches in chemical, mining, and oil & gas applications, enhancing profitability through premium engineered products.

Over the past three years, leaders have increasingly focused on innovation, aftermarket services, and sustainability-driven product launches to defend margins and strengthen long-term positioning.

Recent Developments

Freudenberg Sealing Technologies acquires Trygonal Group (2024)to expand rapid prototyping and custom sealing capabilities.

Henkel signs agreement to acquire Seal for Life Industries (2024), strengthening its sealing and coating solutions for infrastructure and renewable energy.

Kadant acquires Dynamic Sealing Technologies (2024), expanding into specialized sealing components with a deal valued at $55 million.

John Crane launches next-generation dry gas seal (2025), designed to reduce emissions and enhance reliability in critical rotating equipment.

Gaskets and Seals Market Segmentations

By Product Type (2021-2033)

Gaskets

Flat / sheet gaskets (compressed fiber, non-asbestos, rubber sheet)

Spiral-wound gaskets

Ring gaskets

Ring-joint (RTJ) gaskets

Corrugated gaskets

Metal jacketed gaskets

Seals

Static seals (O-rings, flange seals)

Rotary seals (shaft and lip seals)

Mechanical seals (used in pumps, compressors, turbines)

Lip seals / radial shaft seals

Specialty seals (cryogenic, vacuum, bellows seals)

By Material (2021-2033)

Elastomers (NBR, EPDM, FKM/Viton, silicone)

PTFE & fluoropolymers

Graphite & flexible graphite

Metals & alloys (steel, nickel-based)

Fiber & compressed non-asbestos (CNAF, aramid fiber)

Engineered polymers & composites (PEEK, reinforced thermoplastics)

By Technology / Design (2021-2033)

Standard / commodity gaskets & seals

Engineered / custom seals (application-specific, certified)

Smart / instrumented seals (integrated sensors, condition monitoring)

By Sales Channel (2021-2033)

OEM (original equipment manufacturers)

Aftermarket / MRO (maintenance, repair & operations)

Distributors & eCommerce

By End-Use Industry (2021-2033)

Automotive (ICE vehicles, EVs)

Oil & Gas / Petrochemical

Chemical Processing

Power Generation & Utilities (thermal, nuclear, renewable)

Aerospace & Defense

Marine & Shipbuilding

Industrial Machinery & Manufacturing

Healthcare & Medical Devices

Electronics & Semiconductors

Construction & HVAC

By Region (2021-2033)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Spain

Italy

Russia

Nordic

Benelux

Rest of Europe

APAC

China

Korea

Japan

India

Australia

Taiwan

South East Asia

Rest of Asia-Pacific

Middle East and Africa

UAE

Turkey

Saudi Arabia

South Africa

Egypt

Nigeria

Rest of MEA

LATAM

Brazil

Mexico

Argentina

Chile

Colombia

Rest of LATAM

Frequently Asked Questions (FAQs)

The global gaskets and seals market size was valued at USD 66.1 billion in 2024 and is projected to reach from USD 69.01 billion in 2025 to USD 97.3 billion by 2033.

Expansion of Automotive and EV Manufacturing, Industrial Automation and Machinery Upgrades and Energy Sector Investments are some of the factors driving the growth of the global market.

Asia-Pacific dominates the global market.

Top 15 Global Players are Freudenberg Sealing Technologies, Trelleborg Sealing Solutions, SKF, Parker Hannifin, John Crane (Smiths Group), EnPro Industries (Garlock), Dana Incorporated, ElringKlinger, Federal-Mogul (Tenneco), Flowserve Corporation, Eagle Burgmann, Valmet, James Walker, Greene Tweed, Hutchinson.

Seals dominate the gaskets and sealants market.