2m agoMon 15 Sep 2025 at 10:39pm

What’s up with the Aussie dollar? Westpac’s money man says it’s “broken the shackles”

Head of FX Strategy at Westpac Richard Franulovich thinks the Australian dollar is ‘impressing’ in the mid-0.66 cent range,

(Where 100 US cents buys you around 2/3 of that in Australian cents).

Here’s his take on where it’s going:

“AUD finally broke its shackles over the last week, showcasing more emphatic and satisfying forward momentum.

“For the longest of time upside progress has been tough sledding – every fresh high has been marginal, exhausting and oozing with reluctance, even as the building blocks for a bout of more vigorous upside were coming together.

“But over the last week AUD/USD established a more decisive foothold on the 0.66-handle and it’s been trading with a more self-assured tone in the upper-half of its rising channel lately.

Loading

“AUD/USD starts the week at 0.6655 and a range of AUD-crosses are testing multi month highs: AUD/NZD is on the front foot at 1.1178, levels not seen since late 2024, while AUD/JPY is hovering just above 98.00. AUD/EUR has risen from the mat (0.5675), and AUD/GBP is testing six-month highs just above 0.4900.

“Political & fiscal upheaval in Tokyo, Paris and London are periodically challenging EUR, JPY & GBP prospects, while shaky labour market/growth momentum stories are periodically capping CAD, USD & NZD. But AUD has the look of a genuine safe harbour on these metrics.

“To be fair though, other than AUD/NZD, these are hardly eye-catching long-term breakout levels for AUD-crosses. But they are certainly firmer rates than what we have been accustomed to for much of 2025.

“AUD owes a good amount of its latest upside moves to the dovish repricing in Fed expectations and signs that private consumption in Australia is returning to a surer footing (after the stronger Q2 GDP a couple weeks ago). That combination is helping yield spreads track back in AUD’s favour.

“Robust global risk appetite conditions and low levels of global market volatility (despite periodic geopolitical flare-ups), are an ongoing background AUD positive too.”

35m agoMon 15 Sep 2025 at 10:07pm

Fitch Ratings says ANZ’s scandals haven’t changed its risk rating

Yesterday’s settlement between the Australian Securities and Investments Commission (ASIC) and Australia and New Zealand Banking Group Limited (ANZ) has no impact on ANZ’s ratings, says Fitch Ratings.

(The agreement needs to be approved by a court, but it’s a huge whack. Read our summary from yesterday at the bottom of this post.)

The ratings agency says “non-financial risk shortcomings are already reflected in our assessment of ANZ’s risk profile”.

“The settlement relates to non-financial risk issues in ANZ’s Australian markets and retail banking divisions that had been the subject of four separate regulatory investigations by ASIC.

“We previously identified and considered these issues in our ratings. The proposed combined penalty of AUD240 million is manageable for ANZ, equating to less than 4% of net profit after tax in the financial year ended September 2024 (FY24), or about 5bp of risk-weighted assets at end-June 2025.

“The penalty is still subject to Federal Court approval.

“ANZ plans to incur about AUD150 million in FY26 for a remediation programme to address the root causes of non-financial risk issues, but we believe this will similarly have no material impact on earnings or capital.

“Management intends to fund this by deprioritising other investment initiatives.”

ANZ not alone

Fitch says non-financial risk shortcomings have “been a consideration in … ratings of many Australian banks since large-scale issues were first identified by the 2018 banking royal commission”.

An operational risk capital charge of $1 billion applied to ANZ by the APRA (Australian Prudential Regulation Authority) remains the highest amongst Australia’s large banks.

Fitch says this charge is unlikely to be reduced or removed until ANZ can show significant progress in its remediation, which we expect to take several years.

47m agoMon 15 Sep 2025 at 9:55pm

How ‘drops’ impact what you get to know

Fascinating analysis from colleague Gareth Hutchens here that explains a little bit about how information gets from government to you, the reader.

It doesn’t just explain the problem — it proposes a solution.

Check it out.

56m agoMon 15 Sep 2025 at 9:46pm

Xmas hiring sluggish, with worker interest strong but positions harder to find

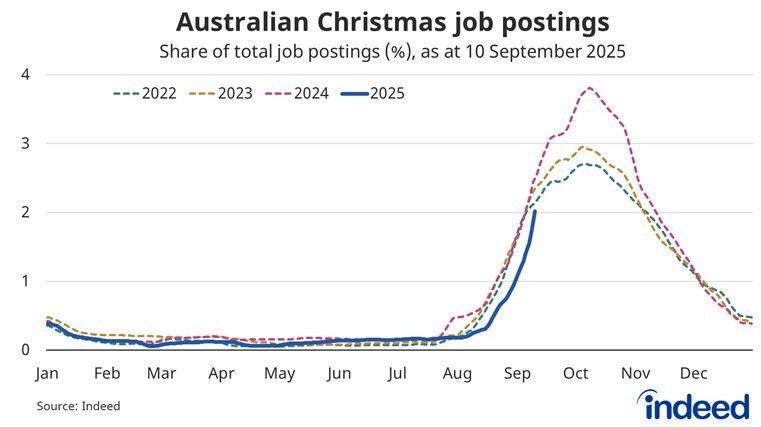

Job website Indeed has an interesting economic marker, a sluggish start to Christmas hiring

Christmas job postings in 2025, as a share of Australian postings, are tracking well behind last year (Indeed)In early September, 2.0% of Australian job postings mentioned Christmas in the job title — down from 2.6% at the same time last year. Jobseeker interest through early September is unusually strong, possibly reflecting higher unemployment and the lingering impact of Australia’s cost-of-living crisis. In early September, 1.6% of jobseeker searches were for Christmas-related jobs, up from 1.2% last year.

Christmas job postings in 2025, as a share of Australian postings, are tracking well behind last year (Indeed)In early September, 2.0% of Australian job postings mentioned Christmas in the job title — down from 2.6% at the same time last year. Jobseeker interest through early September is unusually strong, possibly reflecting higher unemployment and the lingering impact of Australia’s cost-of-living crisis. In early September, 1.6% of jobseeker searches were for Christmas-related jobs, up from 1.2% last year.

Analysis from Callam Pickering, chief economist at job website Indeed suggests Christmas-related job postings “tracking well behind the past three years”.

“Demand for Christmas workers is often determined by the number of products you expect to sell and the number of customers you need to service. Both increase sharply throughout November and December, requiring retailers to temporarily increase their staffing.

“In the June quarter, the volume of retail products sold was 1.5% higher than a year ago. That’s a notable turnaround from the downward trend throughout 2023 and 2024. That’s been achieved via strong population growth, which offset fewer volumes per household.

“Three interest rate cuts from the Reserve Bank of Australia have also supported household spending, along with government subsidies that have partially addressed cost-of-living issues.

“In many respects, retail conditions leading into Christmas this year are brighter than we’ve seen in several years. And yet, hiring trends don’t reflect that optimism.”

Christmas recruitment started late this year

Pickering adds that Christmas-related hiring is perhaps not as bad as it first seems.

“The gap between this year and last has closed considerably in recent weeks, from 55% in mid-August to 21% by September 10. Sluggish hiring may simply reflect delayed hiring rather than reduced hiring.

“Christmas hiring last year peaked in early October before declining sharply throughout November and December.”

1h agoMon 15 Sep 2025 at 9:31pm

Market snapshot

ASX 200 futures: +1% to 8,940 points

Australian dollar: +0.3% to 66.69 US cents

Dow Jones: +0.1% to 45,883 points

S&P 500: +0.5% to 6,615 points – record close

Nasdaq: +0.9% to 22,348 points – record close

FTSE: -0.07% to 9,277 points

EuroStoxx: +0.4% to 557points

Spot gold: +0.9% to $US3,719/ounce

Brent crude: +0.7% to $US67.47/barrel

Iron ore: -0.1. to $US105.31/tonne

Bitcoin: +0.1% to $US115,481

Prices current around 7:30am AEDT.

Live updates on the major ASX indices:

1h agoMon 15 Sep 2025 at 9:27pmGood morning!

Hello, I’m Daniel Ziffer from the ABC business team and I’ll be taking you through the morning on our business, finance and economics blog.

Overnight, Wall Street indices were all positive.

The blue-chip Dow Jones of 30 mega-companies like Boeing and Visa was +0.1% to 45,883 points.

The broader S&P 500, which covers 500 of the largest listed companies in theUS, was +0.5% to 6,615 points — a record close.

The tech-heavy Nasdaq was +0.9% to 22,348 points — another record close.

These numbers are live, and trading is continuing, we’ll update you when there’s a firm closing price.

Our market is set to jump, with the ASX 200 futures index tipping a lift of +1% or 91 points to 8,940 points.

Loading

There’s lots to get to, all of it news, analysis and information and none of it financial advice.

Let’s get started!