Weather: Interesting that Rostov is the focus of the drought talk in Russia again. Remember that this was the problem area last year and part of the reason we saw an early rally this marketing year. Early days but this will be interesting should it continue.

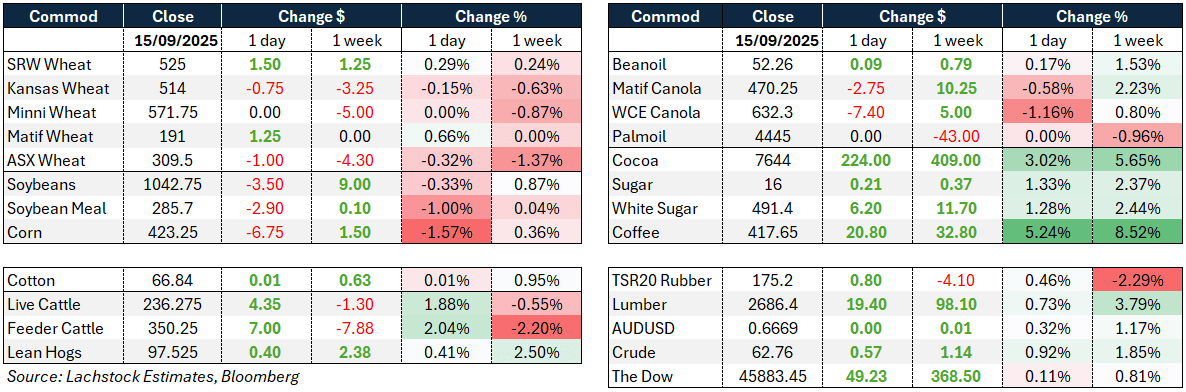

Markets: Lacklustre performance. The AUD will be the big driver this week given the rate outlook in the US. Interesting that it looks like China growth is slowing again, which may cap the AUD.

Australian day ahead: Lack of activity is the best way to describe our markets right now. On paper, there are export margins but the bulk handlers hold all the chips today. Export path costs to a third party are high, and always exposed to the owners leveraging off this ownership to discount to get the business done.

Offshore

Wheat

Markets were mixed to start the week, with Chicago up slightly, Kansas down fractions and Minneapolis unchanged, while MATIF gained modestly. Russian cash stayed flat at $227/t.

Wheat sentiment remains heavy after the USDA lifted global production by 9 million tonnes (Mt) on Friday, effectively resetting expectations. Despite this, US inspections of 755,000t exceeded forecasts and have shipments running 8.3 percent higher year on year.

Russia raised its wheat export tax sharply and declared drought emergencies across five more Rostov districts, now covering 27 out of 43.

China reported state wheat purchases exceeding 100Mt under the minimum-purchase-price policy, and Ukraine’s crop monitoring suggested winter wheat yields are likely below the five-year average.

French farm unions are planning protests over Mercosur and US tariffs, highlighting discontent over import competition.

Markets remain heavily short (464,000 contracts US + MATIF combined), making them susceptible to short-covering rallies, though selling pressure persists.

Other grains and oilseeds

Corn retraced some of Friday’s rally, with CZ falling 6.75c as farmer selling was steady but not aggressive.

Inspections were strong at 1.51Mt, up 43.5pc year on year, though only 8pc of the crop is harvested versus 9pc expected.

Debate continues around the US balance sheet, particularly exports at 2.975 billion bushels and yield questions, with lighter ear weights a risk.

Argentina remains the cheapest origin while Ukraine re-enters the FOB mix.

Brazil’s summer corn planting reached 17pc in the Center-South, slightly behind last year, with Safras projecting 25.4Mt output and national production potential of 142.5Mt.

Iran tendered for 120,000t each of corn, barley and soymeal.

Soybeans slipped 3.5c after initially firming on news of a Trump-Xi call, despite a stronger-than-expected August NOPA crush at 189.8M bushels and lower oil stocks.

Bean inspections topped expectations at 804,000t, running 43pc ahead of last year.

Crop conditions dipped to 63pc, in line with forecasts.

Brazil’s soybean planting has just begun at 0.12pc.

Canada reported constructive talks with China over canola duties, though no resolution yet.

Sunflower oil demand showed with Turkey buying 18,000t, while India’s palm oil imports surged to a 13-month high on price competitiveness.

Macro

Markets face continued geopolitical and macroeconomic headwinds.

Russia is resorting to barter trade for the first time since the 1990s, swapping wheat for Chinese cars and flax seeds for building materials as sanctions distort normal flows.

The US floated fresh energy sanctions on Russia conditional on NATO-wide alignment.

China’s economy showed weaker-than-expected industrial production (+5.2pc y/y) and retail sales (+3.4pc y/y), signaling fading stimulus effects.

In the US, the Empire State manufacturing index collapsed nearly 21 points to -8.7 in September, with sharp declines in new orders and shipments, though forward-looking measures were less negative.

Longer term, a reliable monthly trimmed mean could allow for greater flexibility, but not within the current policy horizon.

Corteva is reportedly exploring a split of its seed and pesticide businesses, echoing wider restructuring pressures in global agribusiness. This follows Bayer’s costly Roundup litigation, highlighting how corporate moves may reshape competition in the farm input space.

Australia

In Western Australia, bids started the week steady with canola $816/t, wheat $330/t and barley $305/t FIS Albany.

Through the east, canola bids were slightly higher to start the week with track Port Kembla bid $787, wheat $328 and barley $294.

Delivered markets for barley are wide with consumers in the south not in a hurry to accumulate, expecting cheaper values on the back of increased planted area and good conditions, though export parity shows we remain highly competitive into all homes.

Chickpea bids are around $650 delivered Brisbane, with harvest about to begin through CQ.