Augmented Reality In Retail Market Summary

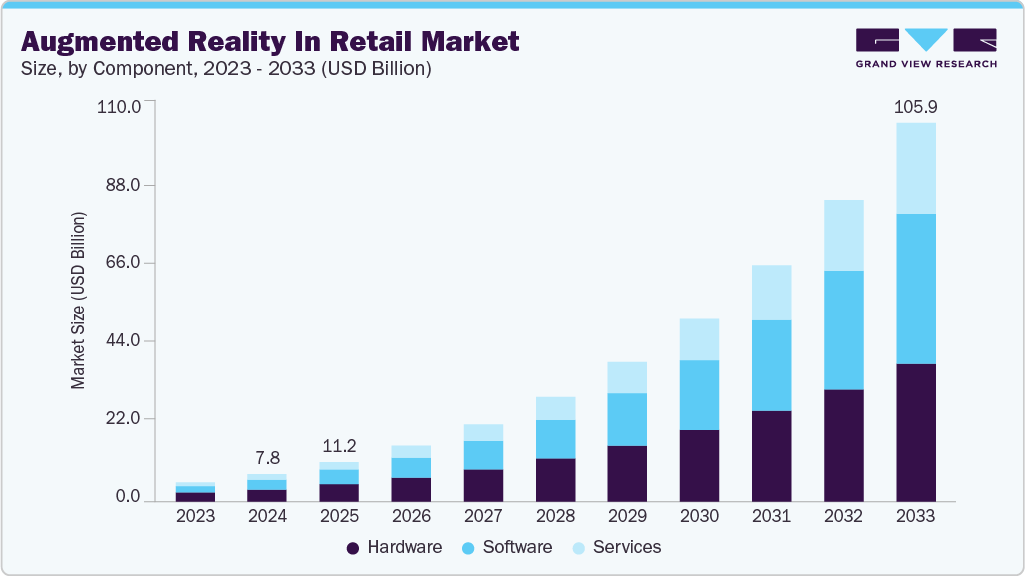

The global augmented reality in retail market size was estimated at USD 7.84 billion in 2024 and is projected to reach USD 105.87 billion by 2033, growing at a CAGR of 32.4% from 2025 to 2033. The market growth is primarily driven by the adoption of AR-based virtual try-on solutions, the expansion of AR-powered social commerce, the deployment of AR smart mirrors in retail stores, and the integration of AR with AI for personalized shopping experiences.

Key Market Trends & Insights

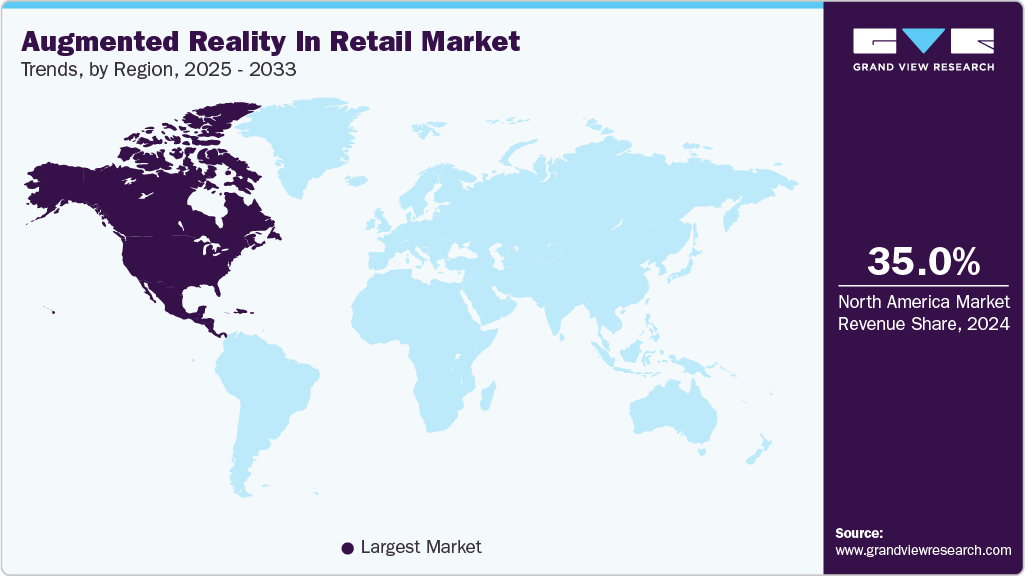

North America dominated the global augmented reality in retail industry with the largest revenue share of over 35.0% in 2024.

The augmented reality in retail industry in the U.S. led the North America market and held the largest revenue share in 2024.

By component, the hardware segment led the market, holding the largest revenue share of over 45% in 2024.

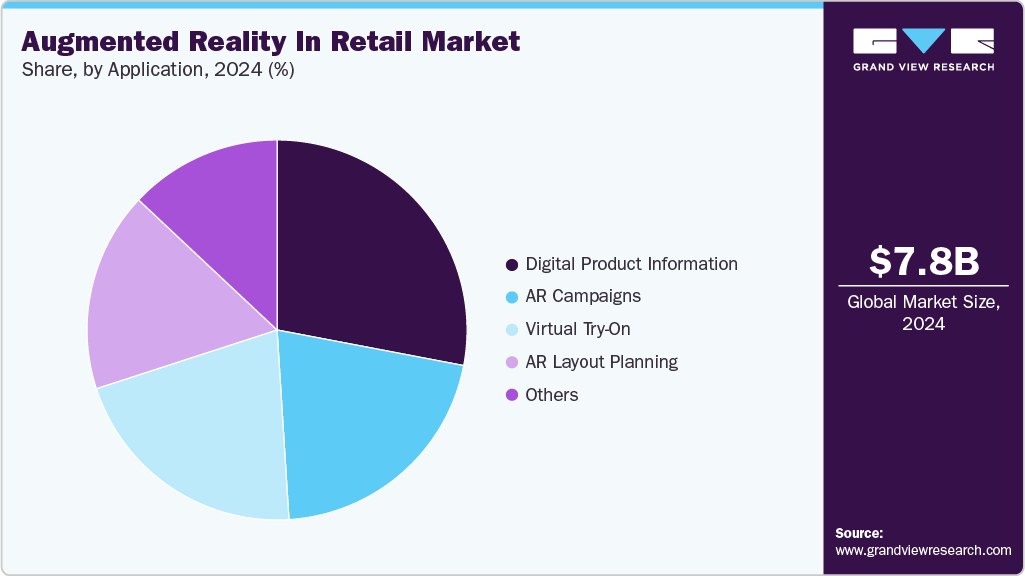

By application, the virtual try-on segment is expected to grow at the fastest CAGR of over 36% from 2025 to 2033.

Market Size & Forecast

2024 Market Size: USD 7.84 Billion

2033 Projected Market Size: USD 105.87 Billion

CAGR (2025-2033): 32.4%

North America: Largest market in 2024

The increasing demand for AR-driven personalized shopping journeys is pushing retailers to deliver experiences that go beyond traditional browsing. The rapid adoption of AR-based product visualization in sectors like furniture, beauty, and footwear is minimizing product returns while boosting buyer confidence. The growing demand for AR-powered virtual shopping assistants and chatbots is creating new standards for real-time engagement and customer service. Retailers are leveraging AR for interactive window displays and pop-up stores, transforming storefronts into immersive brand experiences. The retail store landscape is also being redefined by AR-driven inventory management and staff training solutions, which enhance operational efficiency and customer satisfaction simultaneously.

The increasing demand for virtual try-on features is reshaping the augmented reality in retail industry by enabling customers to preview apparel, cosmetics, and eyewear digitally. This reduces uncertainty and drives higher conversion rates while addressing one of online retail’s major challenges—product returns. Retailers are leveraging AR tools to enhance customer convenience and improve satisfaction. As a result, virtual try-on is becoming an essential capability for competitive retailers.

The rapid growth of AR-driven navigation systems is transforming customer experiences in the augmented reality in retail industry. Shoppers are guided seamlessly to products while receiving real-time promotions, improving engagement and operational efficiency. This technology enhances the in-store journey and increases average purchase values. Large retail stores are adopting AR navigation as a key driver of customer satisfaction and loyalty.

The growing demand for interactive advertising is pushing the augmented reality in retail industry to embrace AR-driven marketing campaigns. Customers engage with products through immersive experiences that create stronger brand connections than traditional ads. Retailers benefit from elevated engagement rates and improved brand visibility. As competition intensifies, AR marketing is becoming a decisive factor in driving loyalty and differentiation.

The rapid adoption of AR features by e-commerce players is revolutionizing the augmented reality in retail industry. Customers can visualize products in their real environments, which reduces hesitation and boosts purchase confidence. This technology helps tackle persistent challenges, such as high return rates, by providing a more informed shopping experience. With AR becoming standard on online platforms, retailers strengthen their value proposition and enhance customer trust.

Component Insights

The hardware segment dominated the market with a share of over 45% in 2024, driven by strong demand for AR-enabled devices such as smart glasses, head-mounted displays, and handheld devices in retail and enterprise applications. Increasing investments by retailers in immersive in-store experiences and virtual try-on solutions further fueled hardware adoption. Technological advancements, including lighter, more durable devices and improved AR display quality, are enabling broader deployment across multiple retail verticals. Looking ahead, while hardware will continue to play a critical role, its growth will be complemented by rising adoption of software platforms and AR services that enhance device functionality and customer engagement.

The services segment is expected to register the fastest CAGR of 35.3% from 2025 to 2033, primarily driven by the surging need for seamless AR deployment and integration across retail channels. Enterprises are increasingly investing in managed services to ensure operational efficiency and consistent user experiences. Strategic consulting is gaining traction as retailers look to align AR solutions with digital transformation roadmaps and customer engagement strategies. Furthermore, the growing demand for training, maintenance, and long-term support is reinforcing the services segment as a critical enabler of sustained AR adoption in retail.

Display Insights

The handheld devices segment dominated the market in 2024, owing to the widespread use of smartphones and tablets as primary platforms for AR retail applications. Retailers are leveraging mobile AR to deliver virtual try-ons, immersive product demonstrations, and interactive marketing campaigns directly to customers. This accessibility and convenience have lowered adoption barriers, making AR experiences more scalable across diverse consumer groups. With ongoing advancements in mobile processors and AR-enabled apps, handheld devices are expected to remain a key driver of AR retail engagement over the forecast period.

The smart glass segment is expected to grow at the fastest CAGR in the coming years, driven by increasing demand for lightweight, wearable AR devices that enhance customer engagement and employee productivity. Retailers and enterprises are adopting smart glasses for virtual try-ons, real-time inventory management, and interactive marketing campaigns. Continuous innovation in display technology, battery life, and connectivity is making these devices more accessible and efficient for large-scale deployments. As adoption accelerates, smart glasses are poised to become a critical tool in bridging physical and digital experiences, complementing software and services in the AR ecosystem.

Retail Insights

The fashion retail segment dominated the market in 2024, supported by the growing adoption of AR-based virtual fitting rooms and smart mirrors. Retailers are leveraging these solutions to enhance personalization, reduce return rates, and create engaging in-store experiences. The seamless integration of AR with e-commerce platforms is also enabling customers to visualize apparel and accessories in real time, boosting purchase confidence. As fashion brands increasingly focus on experiential retail, AR is set to remain a key driver of competitive differentiation in the segment.

The cosmetic retail segment is expected to grow at the fastest CAGR in the coming years, driven by the rising adoption of AR-powered virtual try-on solutions for makeup and skincare products. Consumers are increasingly seeking personalized and contactless experiences that allow them to test shades and styles in real time through mobile apps and smart mirrors. This innovation not only enhances customer confidence but also reduces product returns, a persistent challenge in the beauty industry. As global beauty brands accelerate their digital strategies, AR integration in cosmetic retail is set to become a mainstream differentiator.

Application Insights

The digital product information segment dominated the market in 2024, driven by the growing need for immersive product visualization and real-time information across retail environments. Retailers are leveraging AR to provide interactive product details, specifications, and comparisons, enhancing the overall customer shopping experience. Increasing adoption of smartphones, tablets, and AR-enabled devices has facilitated easy access to digital product content both in-store and online. Moving forward, the segment is expected to maintain a strong presence as brands invest in advanced AR platforms and integrate analytics to deliver personalized, data-driven product experiences.

The virtual try-on segment is expected to grow at a significant CAGR in the coming years, owing to the growing shift toward e-commerce and omnichannel retail strategies. Consumers increasingly expect realistic, interactive AR experiences that allow them to visualize products before purchase, improving confidence and reducing return rates. Retailers are integrating virtual try-on into mobile apps, websites, and in-store kiosks to create seamless shopping journeys. Enhanced AR software and AI-driven personalization are further accelerating adoption, positioning virtual try-on as a transformative tool in retail digital transformation.

Regional Insights

The North America augmented reality in retail industry dominated the global market with a share of over 35% in 2024, owing to the rapid adoption of AR-powered e-commerce platforms that improve product visualization. Retailers are heavily investing in immersive marketing campaigns to enhance customer engagement and brand differentiation. In addition, widespread consumer awareness and access to advanced AR hardware are strengthening the region’s leadership position.

U.S. Augmented Reality in Retail Market Trends

The U.S. augmented reality in retail industry dominated the North American market with a share of over 70% in 2024, fueled by strong technology adoption among leading retailers such as Walmart and Amazon. The presence of advanced digital infrastructure is accelerating the integration of AR solutions in both online and offline channels. Moreover, consumer preference for personalized and interactive shopping experiences is sustaining strong AR demand.

Europe Augmented Reality in Retail Market Trends

The Europe augmented reality in retail industry is expected to grow at a CAGR of over 30.0% from 2025 to 2033, driven by increasing investments in digital transformation across the retail sector. European retailers are embracing AR for fashion and beauty try-on solutions to attract younger, tech-savvy shoppers. In addition, the expansion of AR-based advertising campaigns is improving customer engagement across key markets.

The augmented reality in retail industry in Germany is expected to grow at a significant rate in the coming years, primarily driven by the country’s focus on Industry 4.0 and smart retail innovation. Local retailers are adopting AR for furniture and home décor visualization, empowering customers to design personalized spaces. Furthermore, collaborations between retailers and technology startups are fueling faster AR adoption.

The UK augmented reality in retail industry is expected to grow at a significant rate in the coming years, owing to the rising popularity of AR-enabled social commerce platforms. Retailers are also leveraging AR to create immersive in-store experiences that attract younger demographics. In addition, government-backed digital initiatives are supporting innovation and accelerating AR penetration in the retail ecosystem.

Asia Pacific Augmented Reality in Retail Market Trends

The Asia Pacific augmented reality in retail industry is expected to grow at the fastest CAGR of over 35% from 2025 to 2033. The increasing demand for AR-driven mobile shopping apps is fueling adoption across diverse consumer segments. Furthermore, regional players are investing in AR-powered gamification strategies to strengthen brand loyalty and drive higher engagement.

The China augmented reality in retail industry is primarily driven by the massive growth of e-commerce giants integrating AR to enhance product experiences. Retailers are rapidly deploying AR try-on solutions for fashion, beauty, and accessories to reduce return rates. In addition, government support for digital innovation is creating favorable conditions for AR expansion in retail.

The Japan augmented reality in retail industry is fueled by high consumer readiness for advanced technologies and immersive experiences. Retailers are adopting AR smart mirrors and interactive displays to improve in-store engagement. Moreover, the country’s strong electronics ecosystem is accelerating the development and deployment of AR hardware and solutions.

Key Augmented Reality In Retail Company Insights

Some of the key players operating in the market include Apple Inc., Samsung Electronics Co. Ltd., and among others.

Apple Inc. is a market leader in AR retail, leveraging its ARKit framework to enable immersive shopping experiences on iOS devices. The company specializes in AR applications that allow customers to virtually try on products such as clothing, eyewear, and furniture directly from their devices. Apple’s integration of AR with its hardware ecosystem provides retailers with scalable solutions for both online and in-store engagement.

Samsung Electronics Co. Ltd. is a key player in AR retail, offering AR-enabled devices and immersive shopping experiences. The company specializes in mobile-based AR applications that allow customers to visualize products in real environments before purchasing. Samsung’s focus on integrating AR with smartphones and smart displays supports seamless retail interactions and personalized shopping journeys.

Magic Leap Inc. and Vuzix Corporation are some of the emerging market participants in the market.

Magic Leap Inc. is an emerging AR player specializing in immersive retail experiences through its lightweight AR headsets. The company focuses on interactive product demonstrations, virtual try-ons, and enhanced in-store engagement for retailers. By combining hardware and software, Magic Leap enables brands to create unique, experiential shopping environments.

Vuzix Corporation develops smart glasses designed for retail applications, making it an emerging player in AR-powered customer engagement. The company specializes in AR solutions for inventory management, product visualization, and employee-assisted shopping experiences. Vuzix’s devices help retailers improve both operational efficiency and the in-store customer journey.

Key Augmented Reality In Retail Companies:

The following are the leading companies in the augmented reality in retail market. These companies collectively hold the largest market share and dictate industry trends.

Apple Inc.

Microsoft Corporation

Samsung Electronics Co. Ltd.

Sony Group Corporation.

HP Development Company, L.P.

Qualcomm Inc.

Magic Leap Inc.

Vuzix Corporation.

Lumus Ltd.

NexTech AR Solutions Corporation.

Upskill

Zugara Inc.

Recent Developments

In August 2025, RayNeo partnered with Ant Group to integrate AR glasses with Alipay’s digital payment solutions, enhancing in-store and cross-border transaction experiences. RayNeo’s X3 Pro AR glasses enable hands-free, voice-activated payments through both Alipay QR codes and the Alipay Tap! merchant terminal. This partnership aims to expand the use of AR glasses across daily services, positioning them as multifunctional personal assistants.

In June 2025, Wyr.ai partnered with Vuzix to launch an AI-driven quality assurance inspection platform powered by Vuzix’s M400 smart glasses. The solution leverages XR and AI to streamline inspection processes, including defect detection, barcode scanning, color and pattern matching, and automated reporting. Targeting industries such as apparel, textiles, jewelry, and handicrafts, it delivers hands-free, real-time inspections that enhance accuracy, efficiency, and transparency in quality control.

In May 2025, HCLTech, in collaboration with CareAR (a Xerox company) and ServiceNow, introduced an augmented reality-based IT infrastructure solution aimed at transforming operations with remote assistance, digitized workflows, and AR-driven troubleshooting. The solution is designed to support industries such as retail by reducing downtime, enhancing efficiency, and enabling proactive management of IT systems. For retailers, this means quicker resolution of in-store technology issues, ensuring uninterrupted operations and improved customer experiences.

Augmented Reality In Retail Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.22 billion

Revenue forecast in 2033

USD 105.87 billion

Growth rate

CAGR of 32.4% from 2025 to 2033

Base Year of Estimation

2024

Actual Data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, display, application, retail, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Apple Inc.; Microsoft Corporation; Samsung Electronics Co. Ltd.; Sony Group Corporation; HP Development Company, L.P.; Qualcomm Inc.; Magic Leap Inc.; Vuzix Corporation; Lumus Ltd.; NexTech AR Solutions Corporation; Upskill; Zugara Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Augmented Reality In Retail Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global augmented reality in retail market report based on component, display, application, retail, and region.

Component Outlook (Revenue, USD Million, 2021 – 2033)

Hardware

Software

Services

Display Outlook (Revenue, USD Million, 2021 – 2033)

Application Outlook (Revenue, USD Million, 2021 – 2033)

Retail Outlook (Revenue, USD Million, 2021 – 2033)

Regional Outlook (Revenue, USD Million, 2021 – 2033)