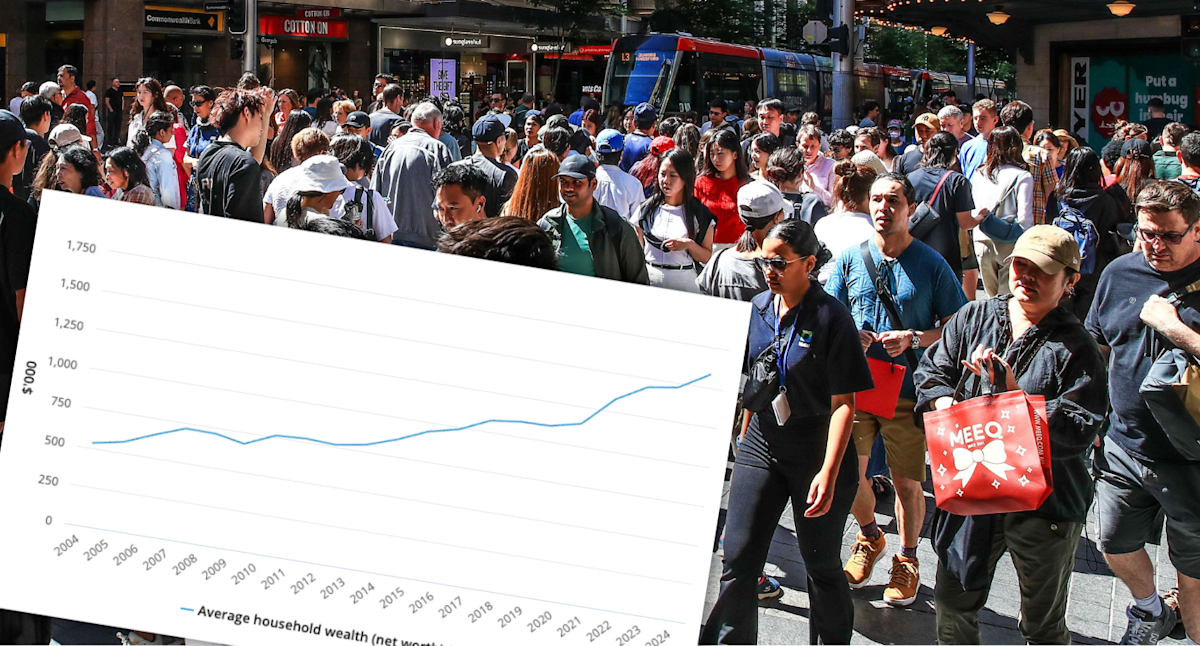

Government metrics shows average household wealth and disposable income has been trending upwards. (Source: ABS/Getty)

Australians are getting wealthier and earning more. But, there’s still a big gap between what we have and what we think we need to be “rich”.

The government’s Measuring What Matters dashboard measures our national wellbeing across five key areas, with the most recent results published this week. One key theme is prosperity, with the data revealing both household wealth and income have been generally trending upwards over time.

Average household wealth hit $1.584 million in 2024. That was up from $858,000 in 2014 and $530,000 in 2004.

RELATED

Household wealth, or net worth, is the difference between the value of a household’s assets and liabilities.

So things like property, vehicles, bank accounts, shares and superannuation, offset by mortgages, loans, credit card debt and other borrowings.

Median disposable household income was $1,192 per week in 2022-23, or $61,984 per year. That’s compared to $876 per week two decades earlier in 2022-23, in June 2023 prices, or $45,552 a year.

Disposable household income is your income after tax, Medicare Levy and Medicare levy surcharge have been deducted.

The Australian Bureau of Statistics notes it can be a better representation of the economic resources available than gross income.

Do you have a story to share? Contact tamika.seeto@yahooinc.com

New Finder research has found Aussies believe they need to earn $398,118 per year to feel rich in 2025, which is more than six times the average disposable household income or a $336,134 gap.

The amount of money people think they need to earn has increased over the last few years.

In 2022, the average Aussie reported needing $336,516 to feel rich, with this year’s data representing a 16 per cent increase.

Finder personal finance expert Sarah Megginson said the reality was that there was only a small percentage of the population who were earning anywhere near $400,000.

“While social media can make us feel inadequate, the reality is that the average Australian earns just over $60,000 – a far cry from the $400,000 some might aspire to,” Megginson told Yahoo Finance.

“True wealth goes beyond your bank account. It’s about feeling content and fulfilled.”

Finder’s Sarah Megginson said only a small percentage of the population earned anywhere near the $400,000 needed to be considered “rich”. (Source: Finder) · Source: Supplied

Income expectations varied by age and gender, with Gen Y saying they needed the most money to feel rich by a long shot at $470,881.

This was followed by Gen X at $416,067, Gen Z at $351,793, and Baby Boomers at $273,648.

Men also felt they needed more money, with the survey of 1,014 respondents revealing that men believed they needed $393,439 per year and women $384,424 to consider themselves affluent.

Finder data also revealed the average Aussie was saving $984 a month in July and had $47,624 in cash savings.

At the same time, though, it found 43 per cent of Aussies had less than $1,000 in savings tucked away.

Megginson said it was important to focus on realistic financial goals and to develop money management skills.

“Look at how much you earn and what your everyday bills and expenses are so you know how much you can afford to spend on luxuries,” she said.

“Using free budgeting tools is a great way to track spending and set a realistic budget, which can help you build your savings.”

Get the latest Yahoo Finance news – follow us on Facebook, LinkedIn and Instagram.