Is his dream of a nest egg stuck in neutral? Ramsey reveals why high earners stall early in life.

On paper, Jackson’s debt-free status and $200,000 annual salary might look like an easy ticket to financial freedom.

But in reality, the 25-year-old heavy-duty mechanic from Canada admits he’s often staring at a bank account that doesn’t reflect his hard work or financial progress.

“I get my paychecks and I pay my bills with it and then I don’t look at my account all that much,” he said on a recent episode of The Ramsey Show. “I just kind of know there’s always a good chunk of change in there and it usually fluctuates between $15,000 and $25,000.

“But it’s not really going ahead from there because I’m kind of just living, you know?”

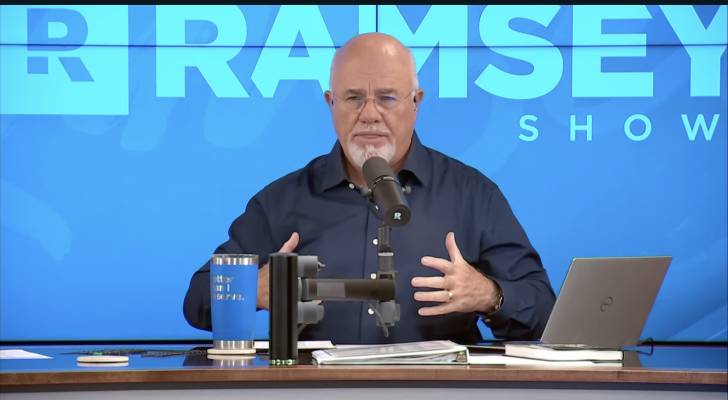

Jackson’s situation isn’t unusual, but celebrity finance personality Dave Ramsey believes his “healthy disgust” with his lack of progress at such a young age certainly is. Here’s why many high-income people struggle to accumulate meaningful wealth.

Jackson’s difficulty holding onto his high income isn’t unique. According to A 2024 report by Leger, 47% of Canadians live paycheck to paycheck.

Lifestyle creep and untamed budgets appear to drive many people to spend as much — or even more — than they earn. According to Ramsey, the biggest mistake high earners make is a lack of intentionality with their money.

Jackson, however, is determined to avoid that mistake.

“I feel like I make too much money to not have some sort of a plan and I don’t want to feel like a fool who squanders a fortune,” he tells Ramsey, who responds with a compliment: “Just asking the question puts you in the top 5%, dude.”

Ramsey’s advice? Start with a robust budget.

That’s where Monarch Money’s expense tracking system comes in. The all-in-one money app seamlessly connects all your accounts in one place, giving you a clear view of where you’re overspending.

It also helps you monitor your expenses and payments in real time.

Within the app you have the option to choose either Category or Flex budgeting depending on your preference. The first involves assigning an amount of money to specific spending categories, and the second works by tracking your spending in flexible categories each month.

Story Continues

Whichever is best for you, Monarch Money keeps budgeting simple so you spend with intent.

This breakdown gives you a clear picture of your spending habits and helps identify areas where you can cut back. For a limited time, you can get 50% off your first year with the code MONARCHVIP.

Read more: What is the best credit card in Canada? It might be the RBC® British Airways Visa Infinite, with a $1,176 first-year value. Compare it with over 140 more in 5 seconds

According to Ramsey, the only way to be intentional with your money is to set up a spending plan before the income arrives.

“We’re going to write it down — before the month begins — where every dollar is going to go,” he told Jackson. “Give every dollar an assignment. Contract with yourself. If you have a spouse, do it with your spouse.”

A tight monthly budget should help Jackson earmark cash for necessary expenses, discretionary spending, taxes and emergencies — and ideally leave extra for savings and investments.

You should consider keeping six to 12 months’ worth of expenses in an emergency fund to meet any unexpected bills.

You can earn 3.3% interest on every dollar you save with EQ Bank’s Personal Account — provided you sign up for a direct deposit of at least $2,000 monthly. That’s roughly seven times higher than the interest rate offered on traditional savings accounts by big-name banks.

EQ Bank charges no fees or minimum balance requirements, and you can withdraw your funds 24/7 from any ATM in Canada for free. Plus, deposits of up to $100,000 are insured by the CDIC, so you have peace of mind while parking your retirement savings.

Once you have your emergency fund set up, consider investing 15% or more of your income to prepare for retirement.

Regardless of the specific retirement age you’re aiming for, you’ll need discipline to reach any early retirement goal. Automating your investments is an easy way to make that process happen in the background, without much extra thought.

You can make RRSP contributions directly from your paycheck, but you can also set up direct deposit into a high interest savings or investment account, like a a discount brokerage account with CIBC Investors’ Edge.

CIBC Investors’ Edge offers low commissions on trades and no or minimal account maintenance charges, depending on the size of your portfolio.

When you set up a Regular Investment Plan (RIP), you can automatically deposit funds from your bank account into your Investor’s Edge account on a schedule you choose (e.g., weekly, monthly) to take advantage of dollar cost averaging.

Pay no account fees for RRSPs with a balance of $25,000 or more and TFSAs with a balance of $10,000 or more. For non-registered accounts, the platform waives maintenance fees if the account balance exceeds $10,000.

Build your portfolio with CIBC Investor’s Edge and get up to 100 free trades and over $200 in cash back.

1. YouTube: I Make $200,000 and Have Nothing To Show For It (April 21, 2025)

2. Leger: North American Tracker September 2024 Edition

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.