August brought a third straight month of job growth to Connecticut, with employers adding 900 positions amid signs of stress in the national and state labor markets.

The unemployment rate held steady at 3.8%—tied for 22nd lowest in the country—for a fourth consecutive month, although first-time unemployment claims increased 40% over July filings.

There were 4,066 first-time unemployment claims in August, 46% more than a year ago.

CBIA president and CEO Chris DiPentima said the modest job growth numbers, while encouraging, were “tempered by the growing underlying weakness in the labor market.”

“Connecticut’s added just 3,920 jobs through the first eight months of the year—at 0.2%, that’s half the pace of national job growth, which is also slowing.

“Our labor force numbers are really concerning, with the population of those working or looking for work down 4,100 people last month alone and 12-month growth essentially flat.”

Hiring Challenges

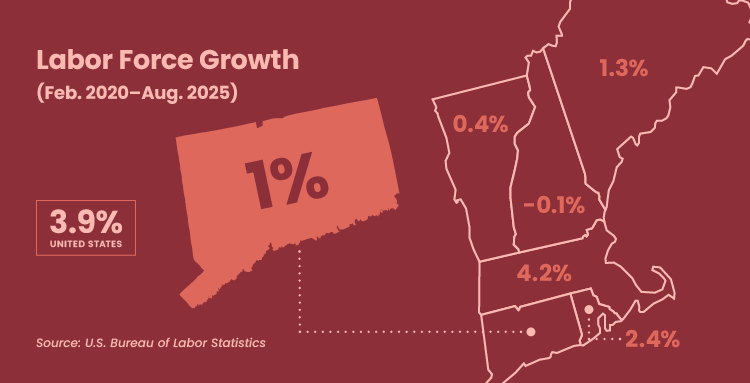

Connecticut’s labor force has grown just 1% over pre-pandemic levels, second-slowest in the region after New Hampshire, and well behind the national average of 3.9%.

DiPentima highlighted Connecticut’s population growth struggles, noting the state ranked 40th in the country for net domestic migration last year, losing almost 6,000 residents to other states.

“International migration offset those losses—more than 36,000 people immigrated here last year, with 20% of Connecticut’s workforce born outside the U.S.,” he said.

“However, immigration alone is not the solution for attracting the residents and workers needed for long-term, sustainable job and economic growth.”

CBIA’s 2025 Survey of Connecticut Businesses, released earlier this month, showed that hiring and retention is difficult for 76% of employers, with skills gaps and the high cost of living cited as key factors.

“Businesses are doing what they can—private sector weekly wages are up 3.2% over the last 12 months, and workforce development is the top investment priority for most employers,” DiPentima said.

“Employers noted that lowering healthcare and energy costs must be lawmakers’ top priorities, with housing and childcare also among Connecticut’s main affordability challenges.”

Regional, National Picture

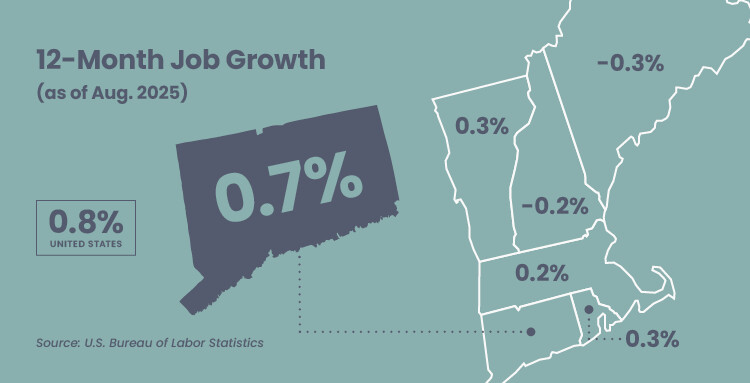

Connecticut’s 12-month job growth rate is 0.7%, tied for 27th fastest among all states and the best in the New England region.

Rhode Island’s growth rate is 0.3%, followed by Vermont (0.3%), Massachusetts (0.2%), New Hampshire (0%), and Maine (-0.3%).

The U.S. average is 0.8%, with the country seeing a dramatic slowdown in recent months.

South Carolina has the best year-over-year job growth of any state at 3.1%, followed by Hawaii (1.9%), New Mexico (1.9%), Utah (1.7%), and South Carolina (1.6%).

Connecticut’s labor participation rate declined slightly in August to 64.6%, 16th best in the country.

Workplaces remained stable, with the state’s voluntary quits rate falling to 1.3%, a 12-month low and tied with Massachusetts for the lowest in the country. The U.S. quits rate was 2%.

Job openings fell 5.3% to 71,000, with the hiring rate falling to 2.9%, tied for 45th among all states and four-tenths of a point lower than the national average.

Industry Sectors, Labor Markets

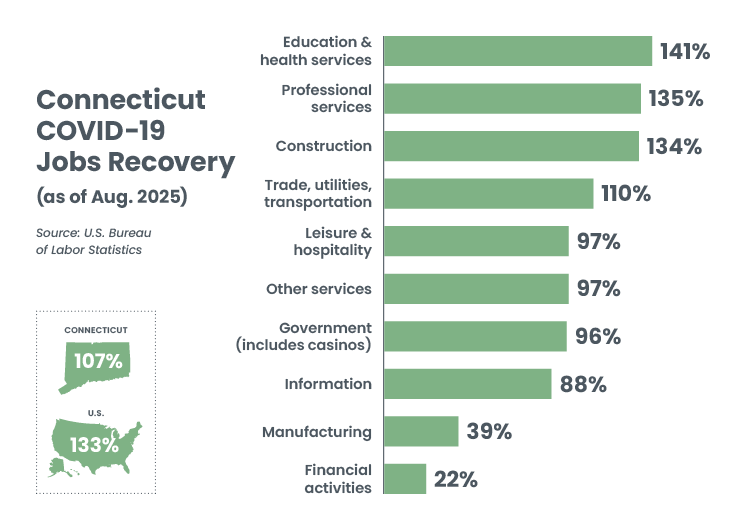

Four of Connecticut’s 10 major industry sectors posted employment gains in August, led by education and health services, which added 1,700 jobs (0.5%).

Manufacturing gained 700 positions (0.5%), the sector’s best monthly performance in more than three years (excluding June 2025, which was impacted by the end of the Pratt & Whitney machinists’ strike).

However, the sector has only recovered 39% of pandemic job losses, with year-over-year employment down 1,800 (-1.2%).

Other services added 500 jobs (0.8%) and financial activities gained 200 positions (0.2%), with year-over-year gains at 2,500 (2.1%)—the best percentage performance of any sector—and pandemic recovery at 22%.

Construction and mining employment declined for a third consecutive month, down 600 jobs (-0.9%) in August for a 12-month loss of 1,400 (-2.2%).

Trade, transportation, and utilities shed 500 jobs (-0.2%)—the fourth consecutive month of losses—with year-over-year gains at 400 (0.1%).

Information lost 300 jobs (-1%), followed by professional and business services (-300; -0.1%), government (-300; -0.1%), and leisure and hospitality (-200; -01%).

Three of the state’s five major labor market areas posted gains in August, with Bridgeport-Stamford-Danbury (0.1%) and Waterbury-Shelton (0.3%) each adding 500 jobs.

Hartford-West Hartford-East Hartford—the state’s largest labor market—gained 200 jobs (0.03%).

Norwich-New London-Willimantic (-0.3%) and New Haven (-0.1%) each lost 400 jobs last month.