“While my expenses are well under control, I haven’t been able to give enough attention to building up my savings,” he said.

Moving to a new city for work can be a game-changer for your career, but it also comes with new financial challenges. A higher salary might not always lead to a bigger bank account if you’re not prepared for the realities of relocation.

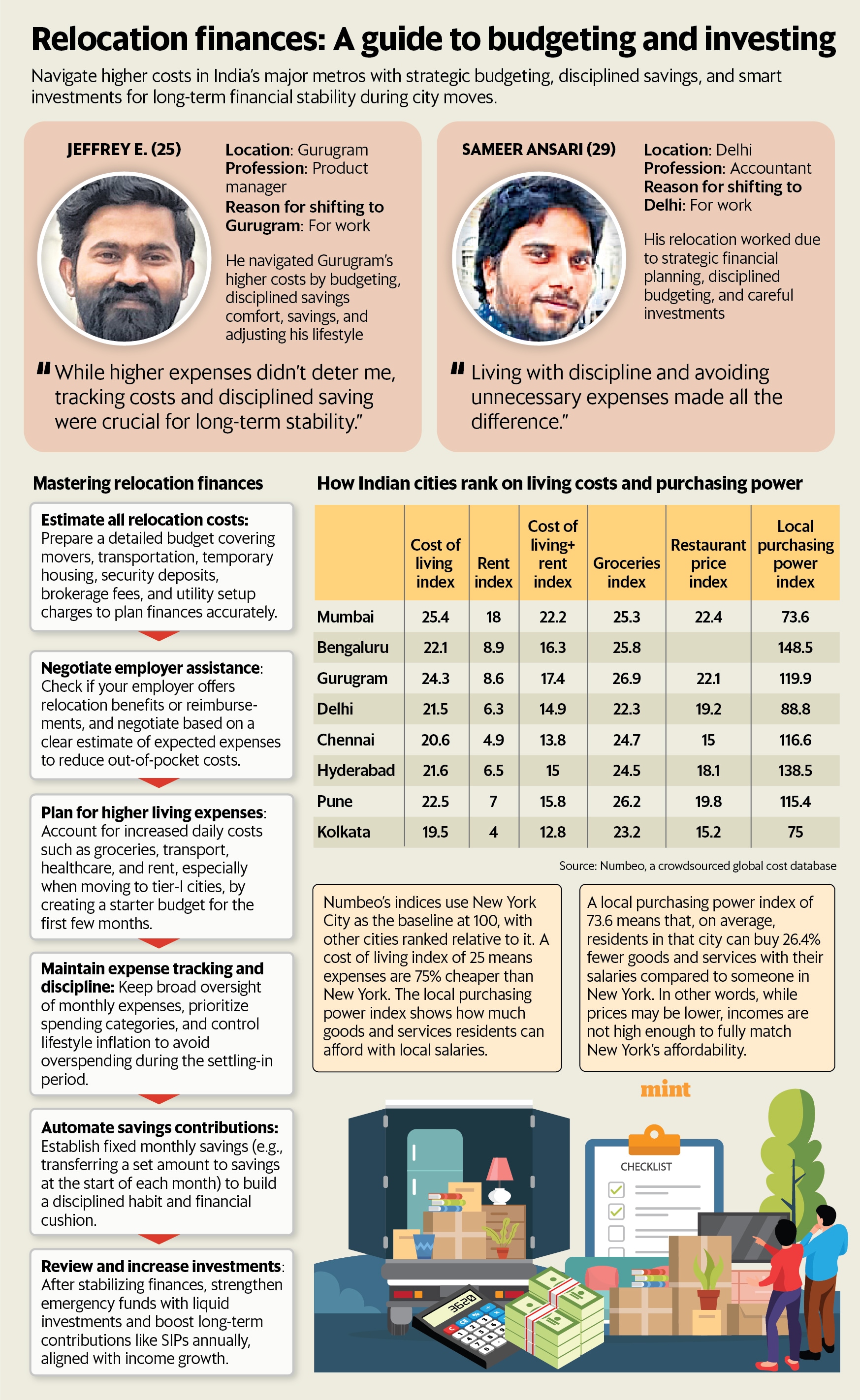

View Full Image

Graphic: Gopakumar Warrier/Mint

Here’s a guide to help you navigate the financial journey of a big move.

The true cost of relocation

Relocation often involves more than just rent and bills. You have to consider a new city’s culture and commute, which can significantly impact your finances and well-being.

“In bigger cities, expenses tend to rise in proportion to income, so savings don’t increase as much as one would expect,” said Vivek Banka, founder, GoalTeller, a financial planning firm.

If you’re moving from a city where you live with your parents to a metro like Bengaluru or Mumbai, your rent will be substantial, and other lifestyle expenses are likely to increase. The salary hike should be enough to cover these costs. If you end up saving less, the move might not make sense from a financial perspective.

“Another critical factor to consider is the commute time. In cities like Mumbai and Bengaluru, people often underestimate the time it takes to travel from home to workplace, which can easily take two to three hours a day, impacting both their schedule and emotional well-being,” said Banka. Financially, people must also budget for higher rent if they wish to live closer to work.

Review your insurance coverage

Before you relocate, it’s a good idea to review your financial safety net. If your income has increased, your life insurance needs may also have grown. Your family would need a larger corpus to maintain their lifestyle if something were to happen to you.

“Several websites help you ascertain your human life value which can indicate the gap in life insurance coverage. Guidance is helpful here and unnecessary insurance policies would not be efficient and lead to wasteful expenses,” said Banka.

“If you move to a more expensive city, healthcare costs are likely to rise. It is wise to review your health insurance coverage to check whether it is still sufficient, and increase it if required,” said Mukesh Jindal, senior partner at Alpha Capital, wealth management firm.

It’s also crucial to find out if your employer offers relocation assistance. Ask if they’ll reimburse all your costs or provide a lump sum. You’ll need to have an estimate of expenses like professional movers, transportation, and temporary housing to negotiate for the best possible deal.

Tackle higher daily expenses

Once you’ve made the move, it’s time to settle in and manage the sharp uptick in daily expenses that comes with a tier-1 city.

From groceries to healthcare, the financial transition can be challenging and the first few months in a new city can strain your wallet. The key is to start with a starter budget that accounts for these higher expenses.

“If expenses rise, you may need to temporarily reduce or pause your SIPs,” said Jindal.

Rent is another important thing to consider. When renting an apartment there is also the requirement for a security deposit. In some cities the security deposit may be three months rent, in some it can be a year’s rent. That needs to be arranged for.

You will also need to pay for brokerage expenses. You may try finding a place through some of the online rental sites to save on the brokerage fee.

“Making a list of essentials and sticking to it is one of the simplest yet most effective ways to keep finances under control,” said Pankaj Shrestha, head-investment services, PL Capital Group.

Jeffrey did not track every single expense in detail, but he always maintained a broad estimate of how to allocate his money. To build discipline, he started saving ₹50,000 at the beginning of each month, which automatically kept his expenses in check.

Strengthen your financial foundation

The next step is to get your investments back on track.

“Aim to save at least 20% of income once settled. Your first step should be to strengthen your emergency funds by investing in liquid funds, ensuring liquidity in case of sudden needs,” said Shrestha.

Next, resume or increase contributions to long-term investments such as mutual funds, through SIPs or lump sum , retirement plans, or other goal-based products.

Sameer Ansari, 29, an accountant, born and raised in Mumbai, moved to Qatar for a job. It wasn’t an easy choice—leaving behind family and friends was tough, but he was determined to build a better future. Life in Doha came with its own challenges: the high cost of living and the emotional distance from home.

For six years, he lived with discipline, avoided luxuries, and invested carefully in the stock market and mutual funds. His sacrifice paid off, and he was able to buy his own house after moving to New Delhi.

When relocating to a bustling metro, it’s easy to get overwhelmed by expenses. The key is to plan ahead, save first, invest smartly, and track every expense.