Chemical Catalyst Market Overview

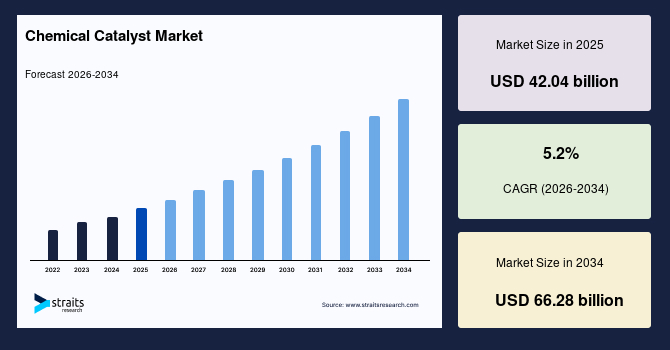

The global chemical catalyst market size was projected at USD 42.04 billion in 2025 and is anticipated to grow from USD 44.08 billion in 2026 to USD 66.28 billion by 2034, growing at a CAGR of 5.2% from 2026-2034. Key growth drivers include petrochemical and refining: investments and regulatory compliance, policies, and corporate commitments toward decarbonisation

Key Market Insights

Asia Pacific held a dominant share of the global chemical catalyst industry with a market share of 41.5% in 2025.

The North America region is growing at the fastest pace, with a CAGR of 5.9%.

Based on catalyst type, the Heterogeneous catalysts are estimated to grow at a CAGR of 5.6%.

Based on end-use industry, refining led with a market share of 48% in 2025.

The U.S. is the largest end market for chemical catalysts in 2025.

Market Size & Forecast

2025 Market Size: USD 42.04 billion

2034 Projected Market Size: USD 66.28 billion

CAGR (2026-2034): 5.2%

Largest region in 2024: Asia Pacific

Fastest-growing region: North America

Market Trends

Energy-Transition Catalysis: Hydrogen, Electrolysis, and Sustainable-Fuel Catalysis

There is a rapid increase in catalyst demand driven by the shift to low-carbon technologies like hydrogen and sustainable fuels. Both companies and governments are investing heavily in technologies such as electrolysis and fuel cells, which require specialized catalysts and precious-metal formulations.

For example, in November 2024, BASF Environmental Catalyst and Metal Solutions (ECMS) opened a new laboratory in Hannover, Germany, dedicated to advancing research on anode and cathode platinum group metal (PGM)-containing catalysts and components.

This trend is visible in corporate capital investments and project pipelines, expanding the market for companies with expertise in these high-growth subsegments.

Catalyst Recycling, Circular Supply, and Precious-Metal Recovery

Recycling and recovery of precious metals from spent catalysts is an environmental imperative and a commercial opportunity. As PGM prices and supply concerns remain topical, catalyst recovery services and closed-loop programs that reclaim platinum, palladium, and rhodium become commercially attractive. Several major catalyst producers and metallurgical service providers expanded recycling partnerships and capacity to secure secondary feedstocks and offer end-of-life services to industrial customers. By providing recycling contracts and buy-back schemes, catalyst makers can increase customer loyalty, reduce metal exposure, and generate new revenue streams.

Market Drivers

Petrochemical and Refining Investment and Regulatory Compliance

Refining and petrochemical industries remain the largest single users of chemical catalysts. Tighter fuel specifications, emissions standards, and complex conversion processes require continuous catalyst replacement and frequent upgrades. Moreover, environmental compliance sustains ongoing replacement cycles for environmental catalysts and associated precious-metal consumption.

For example, in May 2025, Honeywell announced plans to acquire Johnson Matthey’s Catalyst Technologies, enhancing Honeywell’s offerings in energy transition, particularly in Sustainable Aviation Fuel (SAF) and blue hydrogen.

Overall, regulatory drivers combined with capital project pipelines in Asia and the Middle East create steady chemical catalyst market demand in traditional segments.

Policy and Corporate Commitments to Decarbonisation

Government policies and corporate net-zero commitments are driving real capital investments in technologies that require specialized catalysts. This includes electrolyzers, fuel cells, and CO₂ utilization pilots. For example, in 2024, BASF announced new investments in hydrogen component labs and production facilities in Germany to capitalize on this demand. The progression of national hydrogen strategies and SAF blending policies is turning these policy signals into concrete projects and catalyst procurement. Public funding and industrial partnerships for low-carbon projects are helping to accelerate this process, making catalyst demand from these new builds and retrofits a high-growth segment.

Market Restraint

Project Timing and Capital-Expenditure Cyclicality

Chemical catalyst market demand for large industrial applications is often tied to the timing of specific projects, such as refinery upgrades. Macroeconomic uncertainty, fluctuating commodity prices, or geopolitical events can cause delays in these projects, which in turn delay catalyst orders and installations. For example, in mid-2025, several major suppliers reported that customer projects were postponed due to an uncertain investment climate. This adds revenue volatility for catalyst suppliers, who must balance inventory and R&D spending against unpredictable order timing.

Market Opportunity

Advanced Catalyst Manufacturing and Digitalisation

The push for catalysts with better performance, longer life, and lower precious-metal content is another industry trend. This includes innovations like 3D-printed catalyst supports. Additionally, digital tools and predictive maintenance are helping users optimize catalyst replacement cycles.

For instance, in November 2024, BASF announced it would invest in additional production capacity for its X3D technology, a new additive manufacturing technology for catalysts based on 3D printing.

Suppliers are responding by investing in additive manufacturing and R&D centers to shorten the time to market for new formulations. These improvements reduce the overall cost of ownership for end-users and support the use of catalysts in higher-value applications.

Regional Analysis

The Asia Pacific region led the chemical catalyst market in 2025 with a dominant share of 41.5%, due to its vast concentration of refining, petrochemical, and chemical production. Countries like China, India, and South Korea are driving demand with large-scale projects, including new refinery upgrades and petrochemical plant expansions. These projects require massive, multi-year procurement of heterogeneous catalysts for processes like hydrotreating and steam cracking. Furthermore, this region is a growing market for electrocatalysts and hydrogen-related technologies, supported by national roadmaps and pilot projects. The combination of its huge industrial base, ongoing new builds, and emerging clean-tech investments solidifies Asia-Pacific’s position as the largest and most important catalyst market.

China is the largest single national catalyst market by volume. This is because it has the most extensive refinery and petrochemical capacity additions and an aggressive industrial expansion strategy. Major state-owned and integrated companies announce large-scale, multi-year projects that require huge supplies of catalysts for processes like hydrotreating, hydrocracking, and steam cracking. China’s industrial policy also promotes domestic sourcing, which keeps procurement volumes high.

India’s market for chemical catalyst is characterized by steady refinery modernization and expanding petrochemical capacity. Major domestic companies are making heavy investments that drive procurement for catalysts used in hydrotreating and polymerization. The country’s policy focus on self-reliance in petrochemicals creates predictable, large-scale orders for catalysts and process licenses. For suppliers, India is a crucial market where local partnerships are key to navigating and fulfilling large-scale orders.

North America Market Trends

North America stands out as the fastest-growing chemical catalyst market, achieving a CAGR of 5.9%, fueled by strong policy incentives and funding for clean energy. The U.S. Inflation Reduction Act (IRA), for example, has created significant financial incentives for green hydrogen and electrolyzer projects, directly increasing demand for specialized catalysts and components. Major suppliers are also investing in local production and R&D facilities to meet this demand. The market is also growing through refinery and petrochemical retrofits, many of which are adapting to produce renewable fuels, driving a need for new catalytic solutions.

The U.S. is the world’s largest and most diversified end-market for chemical catalysts, blending a massive traditional industrial base with a rapidly expanding low-carbon sector. Recent policy actions, such as the final rules for the Clean Hydrogen Production Tax Credit, have reduced regulatory uncertainty and spurred investment in hydrogen and electrolyzer projects. This has created a new, strong demand for electrocatalysts and hydrogen-processing catalysts. At the same time, the U.S. continues to have significant needs for conventional catalysts for refining and petrochemicals.

Canada’s chemical catalyst market is shaped by a mix of legacy refining activity, industrial, and accelerating clean-energy projects. Federal support for hydrogen and clean fuels provides incentives for electrolyser and hydrogen-related catalyst demand, while provincial programs help finance pilot hydrogen infrastructure and refuelling stations. Canada’s mining and metal-processing capability supports precious-metal supply and recycling, which is relevant for PGM-intensive catalyst flows.

Europe Market Trends

Germany’s chemical catalyst industry is driven by its large chemical industry, high industrial standards, and ambitious decarbonization plans. The National Hydrogen Strategy has supported projects for electrolyzers and CO₂ utilization, which require specialized catalysts. Germany’s strong engineering and R&D capabilities ensure a steady demand for high-performance catalyst components. The ongoing need for catalyst solutions for industrial decarbonization and major steel and chemical transition projects ensures that overall demand remains substantial.

Catalyst Type Insights

Heterogeneous catalysts are the leading subsegment by catalyst type. These are solid catalysts widely used in major industrial processes like petroleum refining and bulk chemical production. Their dominance is driven by their versatility, reusability, and ease of separation from the reaction products. The demand for these catalysts is consistently high due to ongoing needs for fuel production and compliance with stricter emissions standards. Their robust nature and efficiency in large-scale reactions make them indispensable across various industries.

End-Use Industry Insights

Refining accounted for the largest share of 48% in 2025, making it the top end-use industry in the chemical catalyst market. This sector requires vast quantities of catalysts for processes such as hydrotreating, hydrocracking, and reforming. These catalysts are essential for converting crude oil into cleaner, higher-value products like gasoline and diesel. Refineries frequently replace or upgrade their catalyst beds to maximize efficiency and meet evolving product specifications, making this a stable and dominant market segment.

Catalyst Class Insights

Supported catalysts like oxides, zeolites, alumina, and carbon supports dominate the market. These catalysts, which use materials like alumina, silica, or zeolites, are preferred because they maximize the active surface area of the catalytic material, improving efficiency while reducing costs. They are foundational to a wide range of applications, from petrochemicals to environmental control. Their widespread use and cost-effectiveness make them the most prevalent class in the market.

Competitive Landscape

The global chemical catalyst market is highly fragmented, with large integrated suppliers offering comprehensive services, including R&D, manufacturing, technical support, and precious-metal management. Specialized Firms focus on niche areas such as specific chemistries, structured supports, or metal recovery.

Johnson Matthey historically combined precious-metal processing, emissions catalysts, and industrial catalyst technology with strong R&D in environmental and process catalysts. In 2025, JM chose to divest its Catalyst Technologies business segment to focus capital and strategy on legacy Clean Air activities and platinum-group metal processing.

Latest News

In May 2025, Johnson Matthey announced an agreement to sell its Catalyst Technologies business to Honeywell for approximately £1.8 billion.

List of key players in Chemical Catalyst Market

BASF

Johnson Matthey

Honeywell (UOP)

Haldor Topsoe

Umicore

W.R. Grace

Albemarle

Clariant

Shell Catalysts and Technologies

Axens

Topsoe

Zeolyst

Lummus

Albemarle

BASF Environmental Catalyst and Metals

Honeywell UOP

Recent Developments

In March 2025, BASF announced the commissioning of a 54 MW water electrolyzer with an annual hydrogen capacity of up to 8,000 tonnes. The facility is part of BASF’s push into hydrogen-related components and signals supplier readiness to serve green-hydrogen projects that require electrocatalysts, components, and coating technologies.

In April 2025, Umicore announced an expansion project to increase production of homogeneous catalysts at its Catoosa, Oklahoma, site. The expansion secures multi-ton supply for customers and underpins partnerships with chemical manufacturers that require consistent, high-quality homogeneous catalytic materials.

Report Scope

Report Metric

Details

Market Size in 2025

USD 42.04 billion

Market Size in 2026

USD 44.08 billion

Market Size in 2034

USD 66.28 billion

CAGR

5.2% (2026-2034)

Base Year for Estimation 2025

Historical Data2022-2024

Forecast Period2026-2034

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends

Segments Covered

By Catalyst Type,

By End Use Industry,

By Catalyst Class,

By Region.

Geographies Covered

North America,

Europe,

APAC,

Middle East and Africa,

LATAM,

Countries Covered

U.S.,

Canada,

U.K.,

Germany,

France,

Spain,

Italy,

Russia,

Nordic,

Benelux,

China,

Korea,

Japan,

India,

Australia,

Taiwan,

South East Asia,

UAE,

Turkey,

Saudi Arabia,

South Africa,

Egypt,

Nigeria,

Brazil,

Mexico,

Argentina,

Chile,

Colombia,

Explore more data points, trends and opportunities Download Free Sample Report

Chemical Catalyst Market Segmentations

By Catalyst Type (2022-2034)

Heterogeneous catalysts (solid catalysts used in fixed-bed, slurry, fluid-bed)

Homogeneous catalysts (soluble organometallics, acid/base catalysts)

Biocatalysts (enzymes for specialty chemicals/pharma)

Electrocatalysts (electrolysis, fuel cells, CO₂ electroreduction)

Photocatalysts (solar-driven conversions)

By End Use Industry (2022-2034)

Refining (hydrotreating, hydrocracking, reforming, FCC)

Petrochemicals (steam cracking, polymerisation, aromatics)

Chemicals and intermediates (synthesis of bulk and specialty chemicals)

Environmental and emissions control (auto catalysts, stationary NOx/SOx control)

Energy transition (electrolyzers for green H₂, fuel cells, CO₂ conversion)

Pharmaceuticals and fine chemicals (selective hydrogenation, chiral catalysts)

By Catalyst Class (2022-2034)

Precious-metal catalysts (Pt, Pd, Rh, Ir, Ru)

Base-metal catalysts (Ni, Fe, Cu, Co)

Supported catalysts (oxides, zeolites, alumina, carbon supports)

Structured and monolithic catalysts (washcoats, monoliths, honeycombs)

By Region (2022-2034)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global chemical catalyst market size was projected at USD 42.04 billion in 2025 and is anticipated to grow from USD 44.08 billion in 2026 to USD 66.28 billion by 2034, growing at a CAGR of 5.2% from 2026-2034.

Petrochemical and refining investment and regulatory compliance and policy and corporate commitments to decarbonisation are anticipated to boost market growth.

Asia Pacific region has the largest share of the market.

The key players operating the market include BASF, Johnson Matthey, Honeywell (UOP), Haldor Topsoe, Umicore, W.R. Grace, Albemarle, Clariant, Shell Catalysts and Technologies, Axens, Topsoe, Zeolyst, Lummus, Albemarle; BASF Environmental Catalyst and Metals, Honeywell UOP

Refining end user segment dominated the market with a share of 48% in 2025.