Report Overview

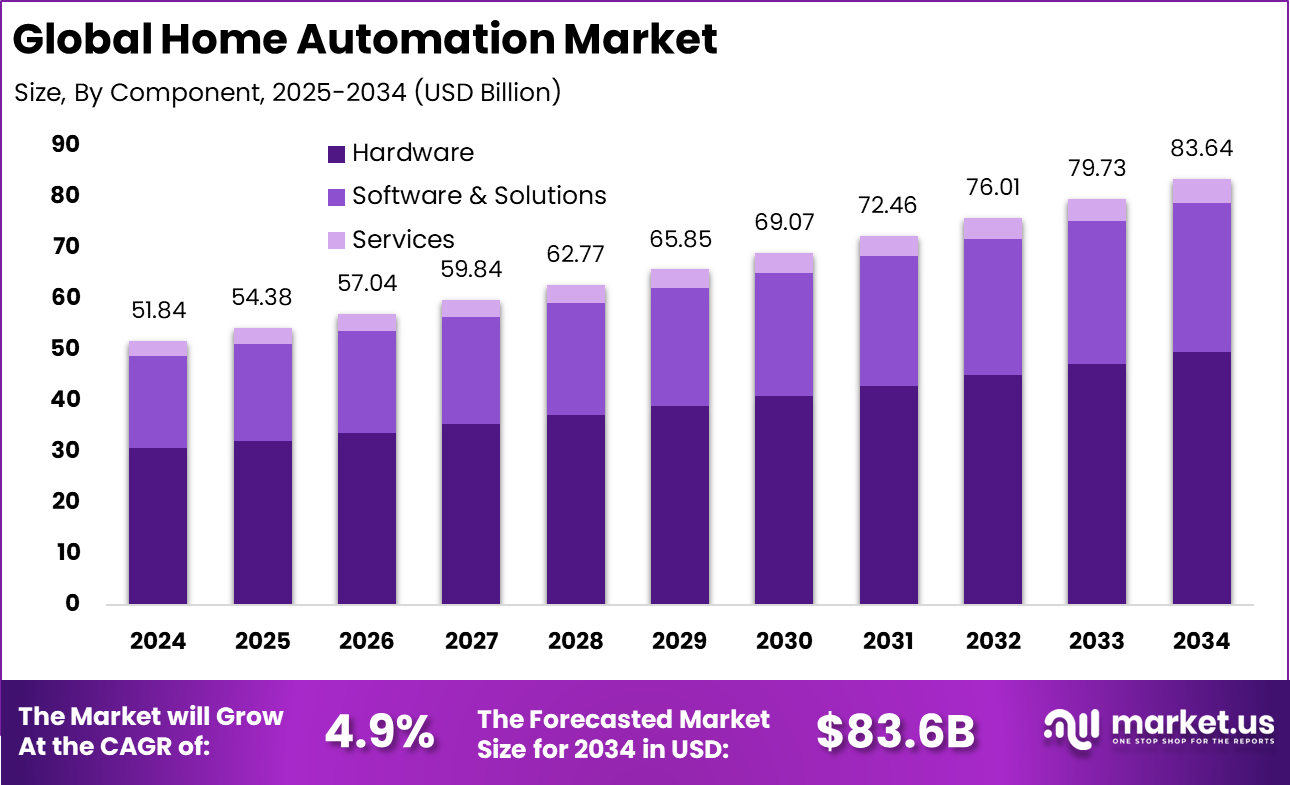

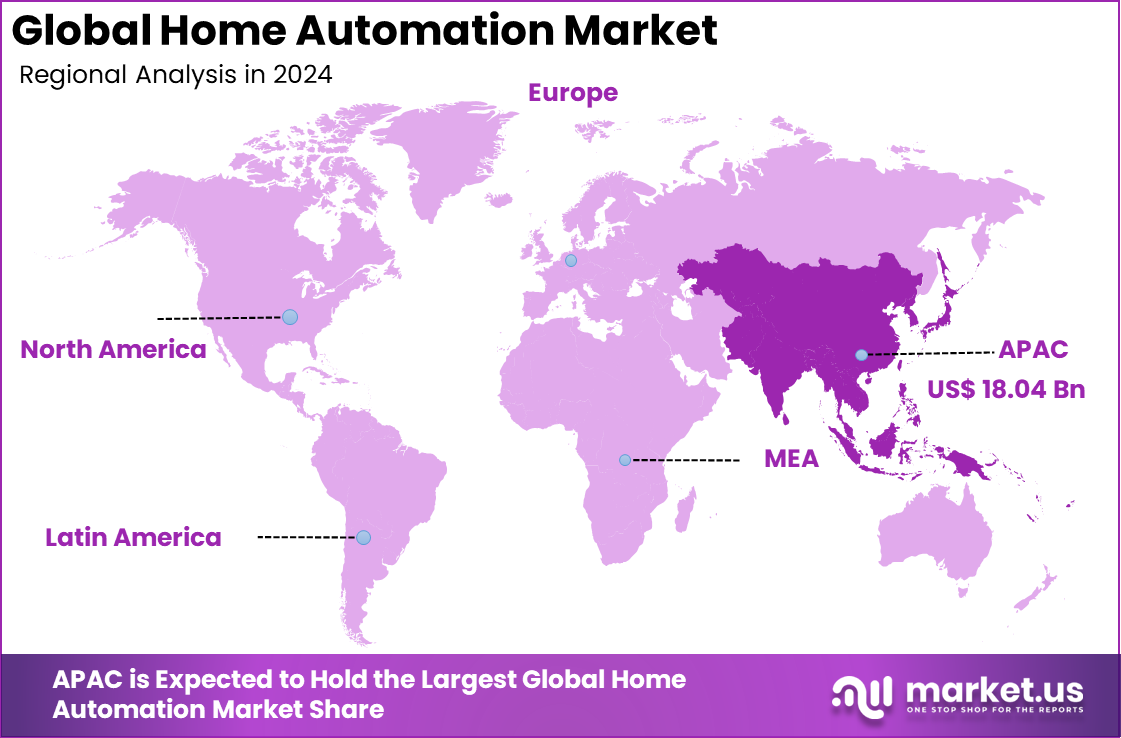

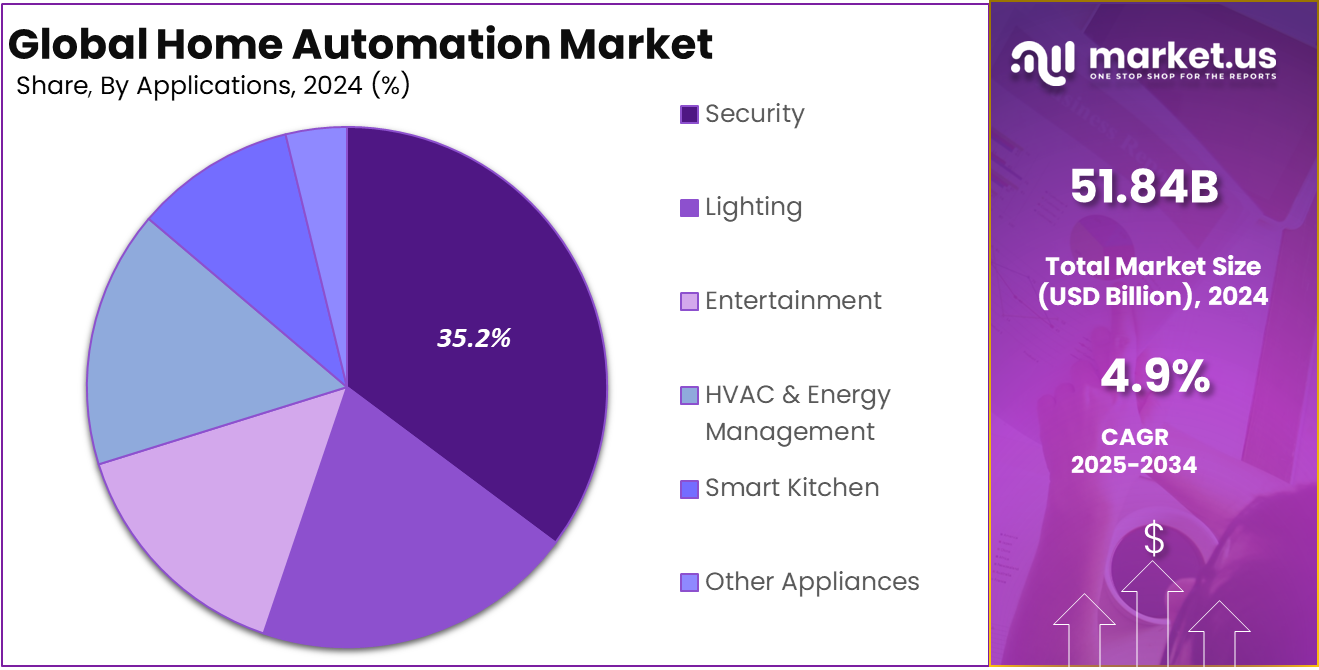

The Global Home Automation Market size is expected to be worth around USD 83.64 billion by 2034, from USD 51.84 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 34.8% share, holding USD 18.04 billion in revenue.

The home automation market includes systems, devices, software, and services that allow homeowners to monitor, control, and automate home functions such as lighting, climate control, security, appliances, and entertainment systems. It covers both new homes built with built-in automation and retrofits of existing homes using smart devices. Devices often communicate via wireless or wired protocols and integrate with central hubs, mobile apps, or voice assistants.

Top driving factors for the home automation market include the increasing demand for energy-efficient and smart security solutions. For instance, homeowners are adopting smart locks, surveillance cameras, and motion sensors, enhancing safety and convenience. Alongside this, growing internet penetration and disposable incomes, especially in developed regions, boost consumer interest. Convenience plays a huge role; voice assistants and smartphone apps allow users to effortlessly control home environments, increasing adoption rates globally.

Demand analysis reveals that connected homes are becoming popular in both residential and commercial sectors. The need for secure, energy-saving, and comfortable living spaces drives the uptake of smart thermostats, automated lighting, and security systems. The trend accelerated during the COVID-19 pandemic when 70% of people adjusted their homes for increased time spent indoors, with 51% purchasing at least one smart device. This shift has maintained momentum as remote working and smart living preferences continue to rise.

For instance, in September 2025, Tata Power launched its EZ Home Automation Solutions in Siliguri, aiming to promote smart and sustainable living in India. The solution enables consumers to control lighting, fans, and appliances through a mobile app or voice assistants, enhancing convenience and energy efficiency. By expanding its smart home offerings to Tier-II cities, Tata Power is tapping into India’s growing demand for affordable and accessible home automation, supporting the broader adoption of sustainable digital lifestyles.

Key Takeaway

Hardware components dominate with 59.4%, reflecting strong demand for devices such as sensors, controllers, and smart hubs.

Hybrid technology leads at 42.1%, as consumers prefer integrated solutions combining wired and wireless systems.

Security applications account for 35.2%, driven by rising demand for surveillance, intrusion detection, and smart locks.

Retrofit installations capture 58.4%, supported by adoption in existing homes seeking smart upgrades.

Asia Pacific holds 34.8%, showcasing strong growth from urbanization and increasing smart home adoption.

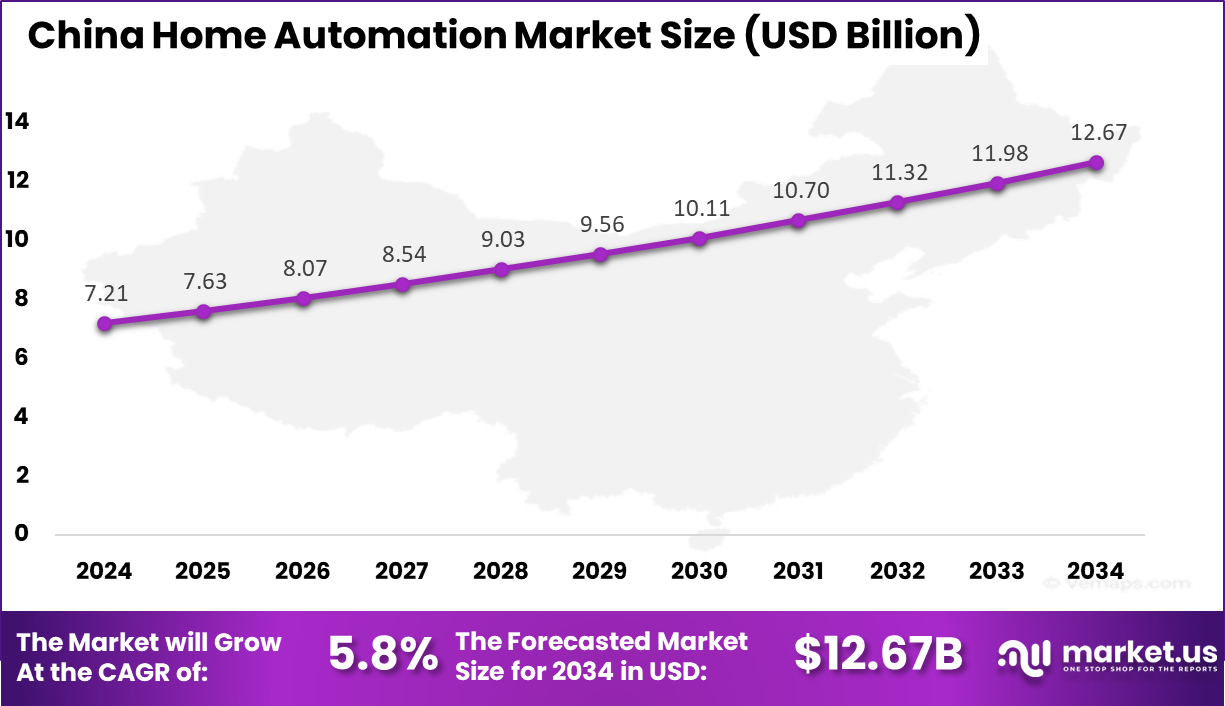

The China market reached USD 7.21 billion and is growing at a CAGR of 5.8%, supported by government initiatives and rising middle-class adoption.

Analysts’ Viewpoint

Increasing adoption technologies in home automation are IoT-based devices, AI integration, and interoperability standards such as Matter, which allow seamless communication among various smart devices. Energy-autonomous sensors, cloud computing, and voice-activated controls contribute to making homes smarter while reducing maintenance costs. These technologies attract users looking to reduce utility bills, add convenience, and improve home security effectively.

Key reasons for adopting home automation include energy savings, enhanced security, and improved lifestyle convenience. Automated lighting and temperature controls lower electricity consumption, cutting costs by avoiding unnecessary usage. Security systems with remote monitoring and AI-powered facial recognition enable rapid responses to threats. Furthermore, home automation frees users from routine chores by automating tasks, allowing more leisure and peace of mind.

Investment opportunities in the home automation market are huge. The rapidly expanding market invites investment in hardware, software, and service providers. Emerging markets in Asia, Latin America, and the Middle East present untapped potential driven by urbanization and rising income levels. Investors can benefit from trends like mergers and acquisitions as companies seek to broaden portfolios and innovation pipelines. Government incentives supporting energy-efficient technologies further stimulate business growth prospects.

Business benefits from home automation extend to increased customer satisfaction, operational efficiency, and revenue growth. For service providers, offering customizable and scalable smart home solutions can differentiate products in a competitive market. Automated systems reduce energy wastage, enhancing sustainability credentials for homeowners and businesses alike. The technology also facilitates new business models like subscription-based services, performance monitoring, and predictive maintenance.

Role of Generative AI

The role of generative AI in home automation is becoming increasingly significant. In 2025, about 85% of industry leaders see generative AI as a key driver of innovation within home automation systems. This technology powers personalized user experiences by automating routine tasks, adapting to user preferences, and enhancing security features.

For example, generative AI can automate customer service inquiries related to smart home devices, improving efficiency and satisfaction by approximately 57%. More broadly, 65% of organizations regularly use generative AI across various business functions, including home automation, marking a shift from experimental use to essential operational integration.

China Market Size

The market for Home Automation within China is growing tremendously and is currently valued at USD 7.21 billion, the market has a projected CAGR of 5.8%. The market is growing rapidly due to rising urbanization, a growing middle class, and strong consumer interest in smart living technologies. Government initiatives supporting smart city development and energy efficiency are also fueling adoption.

Additionally, China’s robust manufacturing ecosystem and leading tech companies like Xiaomi and Huawei are driving innovation and affordability in smart home devices. Additionally, widespread adoption of smartphones and voice assistants, alongside growing real estate developments that integrate smart home systems, is fueling strong demand across urban and semi-urban regions.

For instance, in May 2024, ABB expanded its electrification portfolio by acquiring Siemens’s wiring accessories and home automation business in China. The acquisition included smart door locks, wiring devices, and intelligent building systems, enabling ABB to strengthen its position in the rapidly expanding Chinese smart home market.

In 2024, Asia Pacific held a dominant market position in the Global Home Automation Market, capturing more than a 34.8% share, holding USD 18.04 billion in revenue. This dominance is due to rapid urbanization, rising disposable incomes, and increasing demand for smart technologies across major economies like China, India, Japan, and South Korea.

Government-led smart city initiatives and growing awareness of energy efficiency further accelerated adoption. The region also benefits from strong local manufacturing capabilities and the presence of leading tech companies, making smart home solutions more affordable and accessible to a broad consumer base.

For instance, in June 2025, Lauritz Knudsen Electrical unveiled EnConnect, a new home automation solution tailored for the Indian market, underscoring Asia Pacific’s dominance in the global home automation sector. With rising urbanization, growing disposable incomes, and strong demand for energy-efficient solutions, the region has become a hub for innovation and adoption of smart living technologies.

Component Analysis

In 2024, The Hardware segment held a dominant market position, capturing a 59.4% share of the Global Home Automation Market. This dominance is driven by high demand for physical devices such as smart sensors, cameras, switches, and control panels that form the backbone of any home automation system.

As more households adopt connected solutions, the need for reliable, scalable, and interoperable hardware continues to grow. Moreover, advancements in device miniaturization and affordability have made hardware solutions more accessible to mainstream consumers.

For Instance, in August 2022, ABB announced an investment in Mavenoid, an AI-driven hardware support platform, to simplify troubleshooting and reduce costs in home automation hardware. The partnership focuses on enhancing customer support for connected devices such as sensors, controllers, and smart switches, which are essential to smart home ecosystems.

Technology Analysis

In 2024, the Hybrid segment held a dominant market position, capturing a 42.1% share of the Global Home Automation Market. This dominance is due to its ability to combine the strengths of both wired and wireless technologies. This approach offers greater flexibility, reliability, and scalability, meeting the needs of both new constructions and retrofit projects.

Hybrid systems provide stable connectivity for critical functions while supporting wireless expansion for added convenience. Their enhanced security, stable connectivity, and adaptability to complex setups have made them the preferred choice for large-scale residential automation solutions.

For instance, in November 2021, Climax Technology introduced its Hybrid Intruder Alarm System Control Panel, designed to integrate both wired and wireless devices. This innovation highlights the growing relevance of the hybrid segment in home automation, offering users the reliability of wired connections with the flexibility of wireless expansion.

Application Analysis

In 2024, The Security segment held a dominant market position, capturing a 35.2% share of the Global Home Automation Market. This dominance is due to rising concerns over residential safety and increasing demand for real-time surveillance. Consumers are prioritizing smart security solutions such as video doorbells, motion detectors, smart locks, and surveillance cameras.

Integration with mobile apps and voice assistants has made remote monitoring and control more convenient. This growing awareness, combined with advancements in AI-powered threat detection, continues to position security as a leading application within smart home ecosystems.

For Instance, in August 2025, TELUS expanded its SmartHome Security offerings in Canada, emphasizing the growing importance of the security segment in home automation. The platform integrates smart cameras, door locks, motion sensors, and 24/7 monitoring services, enabling homeowners to manage safety through a single connected ecosystem.

Fitment Analysis

In 2024, The Retrofit segment held a dominant market position, capturing a 58.4% share of the Global Home Automation Market. This dominance is due to the increasing demand for smart solutions in existing residential buildings. Many homeowners prefer upgrading current infrastructure rather than investing in new construction, making retrofit systems highly attractive.

These solutions are cost-effective, easy to install, and compatible with a wide range of devices. The growing availability of plug-and-play devices and wireless connectivity options has further boosted adoption, making retrofit an attractive option for mainstream homeowners.

For Instance, in April 2025, smart home automation firm RYSE secured $2 million in media inventory to accelerate the adoption of its retrofit smart home solutions. RYSE specializes in devices that can upgrade existing window shades and blinds into smart, automated systems without the need for full replacements.

Emerging trends

Emerging trends in home automation focus on voice and gesture controls becoming more intuitive and context-aware, powered by advances in AI. In 2025, smart homes are expected to handle about 39% of household task automation, reflecting steady growth. Key technological trends include energy-efficient smart devices, deeper AI integration with IoT, and enhanced security features.

For example, voice assistants now understand complex commands and emotions better, offering a more natural interaction with home automation systems. Additionally, the proportion of users owning multiple connected devices continues to rise, reflecting greater market penetration and consumer comfort with automation technologies.

Growth factors

Growth factors driving home automation adoption include increased consumer demand for convenience, energy efficiency, and security. The proliferation of smartphones and voice-enabled assistants is making smart homes more accessible and appealing.

Government incentives, smart city initiatives, and expanding 5G networks also play a significant role. For instance, the integration of AI with IoT is boosting energy-saving functionalities and personalized control. A rising middle class and urbanization, especially in regions like Asia-Pacific, further fuel this demand, alongside declining costs of smart devices.

Key Market Segments

By Component

Hardware

Lighting Control

Security & Access

HVAC Control

Entertainment Control & Others

Smoke Detector

Others

Software & Solutions

Services

By Technology

Cellular

Wireless

Hybrid

Others

By Application

Security

Lighting

Entertainment

HVAC & Energy Management

Smart Kitchen

Other Appliances

By Fitment

New Construction

Retrofit

Drivers

Growing Penetration of IoT and Smart Devices

The rapid expansion of IoT devices and falling costs of sensors and controllers are making smart home technologies more accessible than ever. As more homes integrate smart lighting, thermostats, and appliances, consumers benefit from greater convenience, control, and energy savings.

Interoperability between devices is also improving, which simplifies the user experience and accelerates adoption. This growing connectivity is a key force driving the home automation market into the mainstream, especially in urban and tech-forward regions.

For instance, in August 2025, Google launched Gemini for Home, a smarter voice assistant designed for its Nest smart devices, reinforcing the growing penetration of IoT and connected solutions in home automation. The upgraded assistant enables more intuitive control over lighting, security, and appliances, while supporting contextual understanding for smoother interactions.

Restraint

High Installation and Integration Costs

Despite attractive benefits, the home automation market faces a notable restraint from high initial installation and integration costs. Setting up comprehensive smart home systems involves hardware purchases, professional installation, wiring, and sometimes upgrading existing infrastructure – all of which can be expensive.

Additionally, smart devices from different manufacturers often lack universal communication standards, creating compatibility issues that complicate installation and increase costs. This can deter cost-sensitive consumers, especially in emerging economies or lower-income segments where affordability is a major concern.

For example, the integration difficulties and costs are particularly challenging where existing homes require extensive retrofitting to support advanced automation. This price barrier slows market penetration and adoption rate, restricting the market mainly to early adopters or wealthier households. Privacy concerns and cybersecurity risks with connected devices also amplify hesitation among potential buyers looking for secure, cost-effective solutions.

Opportunities

Energy-Efficient Smart Solutions

The growing emphasis on sustainability and energy conservation opens a strong opportunity for home automation providers. Advanced smart home systems use AI and machine learning to optimize energy consumption automatically, such as adjusting heating, cooling, and lighting based on user behavior and environmental conditions.

This creates additional value by reducing energy bills and supporting eco-friendly living. Smart home integration with renewable energy sources and smart grids further enhances energy efficiency and environmental benefits. Predictive analytics and AI-powered systems increase comfort while lowering energy use, appealing to environmentally aware consumers and regulatory bodies promoting energy efficiency.

For instance, in August 2024, LG Electronics announced the acquisition of Dutch smart home platform provider Athom, known for its Homey smart hub. This move is aimed at strengthening LG’s portfolio of AI-powered smart home technologies, integrating Athom’s open ecosystem with LG’s ThinQ platform.

Challenges

Cybersecurity Regulations and Compliance

With homes increasingly connected, cybersecurity has become a top concern. Governments worldwide are tightening data privacy regulations, demanding stronger protection for user data. Companies operating in this space must navigate a complex and evolving compliance landscape, often across multiple jurisdictions.

Meeting these requirements entails significant investments in secure infrastructure, frequent software updates, and transparent data policies. Failure to comply risks legal penalties and also damages brand trust and customer confidence.

For instance, in February 2025, Renesas Electronics partnered with Applus+ Laboratories to achieve PSA Certified Level 1 CRA Extension for three of its new microcontroller groups, reinforcing cybersecurity compliance in connected devices, including home automation systems. This certification ensures that Renesas’ MCUs meet stringent global standards for cyber resilience and data protection.

Key Players Analysis

One of the leading players in January 2025, Johnson Controls expanded its smart building capabilities by acquiring Dutch building automation specialist Webeasy. This strategic move strengthens Johnson Controls’ position in the European market, particularly in the small-to-medium scale building automation segment. The acquisition aligns with its vision to deliver more integrated, scalable, and secure smart building solutions globally, supporting increased energy efficiency, digital control, and sustainability in commercial and residential infrastructure.

Top Key Players in the Market

Johnson Controls Inc.

Honeywell International Inc.

Schneider Electric

Siemens

Legrand

Apple Inc.

Resideo Technologies Inc.

Robert Bosch

ABB

Loxone Electronics GmbH

Vivint, Inc.

Nice S.p.A.v

eufy

The Domotics

OKOS

Others

Recent Developments

In January 2025, Siemens showcased its vision at CES 2025, highlighting the convergence of AI, software-defined automation, and data-driven infrastructure for smarter homes and buildings. The company emphasized how integrating intelligent automation with digital twins and edge computing can enhance flexibility, sustainability, and resilience in residential and commercial spaces.

In June 2024, Resideo Technologies Inc. completed its acquisition of Snap One, the parent company of the Control4 smart home platform. This strategic acquisition enhances Resideo’s capabilities in professionally installed smart home solutions and strengthens its position in the connected home market.

Report Scope