What is the Cell and Gene Therapy Quality Control and Analytics Market Size?

The global cell and gene therapy quality control and analytics market is expanding rapidly with AI-driven data analysis, automation, and real-time quality assessment tools. The market growth is driven by the increasing prevalence of genetic disorders and advancements in gene editing technologies.

Cell and Gene Therapy Quality Control and Analytics Market Key Takeaways

North America dominated the cell and gene therapy quality control and analytics market, accounting for approximately 43% in 2024.

The Asia Pacific region is expected to grow at a strong CAGR of 33.5% from 2025 to 2034.

By testing type, the sterility testing segment contributed the largest market share, accounting for approximately 24% in 2024.

By testing type, the potency testing segment is expanding at a double-digit CAGR of 21.5% CAGR between 2025 and 2034.

By analytical method, the polymerase chain reaction (PCR) segment held the largest market share of 28.6% share in 2024.

By analytical method, the mass spectrometry segment is expected to grow at an approximately 23.8% CAGR between 2025 and 2034.

By application area, the oncology segment led the market by holding the largest share of 37.4% in 2024.

By application area, the genetic disorders segment is growing at a solid CAGR of 28.3% between 2025 and 2034.

By end-user, the pharmaceutical and biotechnology companies segment contributed the biggest market share of 54.2% in 2024.

By end-user, the contract development and manufacturing organizations (CDMOs) segment is expanding at a notable CAGR of 23% CAGR between 2025 and 2034.

What is Cell and gene therapy quality control and analytics?

The cell and gene therapy quality control and analytics market is driven by several factors, including the increasing prevalence of chronic diseases, a shift toward personalized medicine, technological advancements, and a rise in funding and investment. This market encompasses the global industry involved in ensuring the safety, efficacy, and compliance of cell and gene therapies through rigorous testing and analytical processes. This sector is critical in the development, manufacturing, and commercialization of advanced therapeutic modalities, including CAR-T therapies, gene editing, and regenerative medicine.

The quality control and analytical tools ensure and enhance the efficiency and accuracy of products, providing real-time decision-making abilities to reduce human errors and ensure that cell & gene therapies meet regulatory quality standards. Emerging technologies, such as single-cell analysis, organ-on-a-chip technology, purpose-built platforms, and microfluidic-based systems, are driving significant growth in the market.

Key Technological Shifts in the Cell and gene therapy quality control and analytics Market?

The cell and gene therapy quality control and analytics market is undergoing a major technological transformation, driven by advancements in areas such as artificial intelligence (AI), machine learning (ML), next-generation sequencing (NGS), real-time analytics, and digitalization. Pharmaceutical and biotechnology companies are increasingly focused on addressing challenges related to product complexity, high costs, and strict regulatory compliance. As a result, the industry is shifting toward data-driven, automated, and real-time analytical solutions to improve safety, efficiency, and cost-effectiveness. Advanced technologies such as PCR, qPCR, and droplet digital PCR are being used to assess gene integration and vector copy numbers, while flow cytometry provides detailed functional profiling of therapeutic products.

Thermo Fisher Scientific is a key player driving this technological shift, with innovations in AI-powered predictive analytics, real-time monitoring, and automation. Other major contributors, including Lonza, Danaher, Bio-Rad, and Merck KGaA, are also advancing consistency and optimization in cell and gene therapy manufacturing through continued innovation.

Cell and gene therapy quality control and analytics Market Outlook

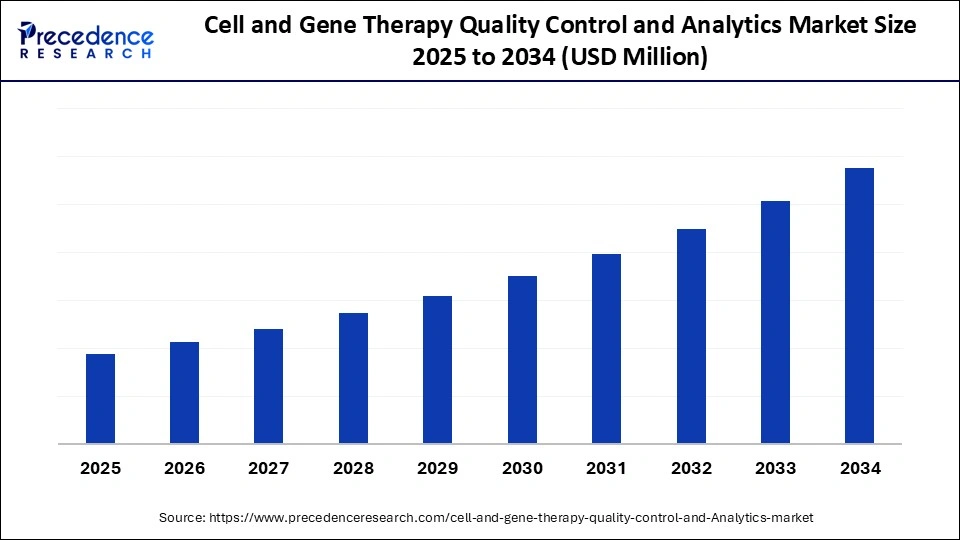

Industry Growth Overview: The cell and gene therapy quality control and analytics industry is projected to grow rapidly from 2025 to 2034, driven by rising demand for advanced therapies and stricter regulatory standards. Growth is further fueled by an increasing number of clinical trials, strong demand for innovative therapies, and supportive regulatory initiatives aimed at accelerating development and approvals.

Global Expansion: Pharmaceutical and biotechnology companies, along with contract development and manufacturing organizations (CDMOs) such as Lonza, Catalent, and Thermo Fisher Scientific, are expanding their quality control and analytical services globally. Regions like North America and Asia-Pacific are at the forefront, supported by advancements in healthcare IT infrastructure and increased investments in biopharmaceuticals.

Major Investors: The sector is attracting strong investment from biopharmaceutical companies, CDMOs, private equity and venture capital firms, and specialized service providers. Companies like Bio-Rad Laboratories, QIAGEN, and bioMérieux SA are driving innovation in analytical technologies, enabling more precise and efficient testing for advanced therapies.

Market Scope

Report Coverage

Details

Dominating Region

North America

Fastest Growing Region

Asia Pacific

Base Year

2025

Forecast Period

2025 to 2034

Segments Covered

Testing Type, Analytical Method, Application Area, End-User, and Region

Regions Covered

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa

Market Dynamics

Opportunity

Partnerships Between Stakeholders to Validate Emerging Technologies

Partnerships between stakeholders, such as biopharma companies, CDMOs, tech firms, and academic institutions, are key to validating emerging technologies in cell & gene therapy quality control. These collaborations accelerate the development and adoption of advanced tools like AI-driven analytics, rapid sterility testing, and real-time monitoring systems. Joint validation builds regulatory confidence, reduces development risk, and ensures new solutions meet industry standards. As a result, partnerships open market opportunities by enabling scalable, cost-effective, and compliant QC solutions tailored for complex CGT products. This ecosystem approach fosters innovation while reducing time-to-market for new therapies.

In October 2025, Made Scientific and Streamline Bio collaborated and successfully validated Streamline Bio’s AI-driven precision robotics platform in a live cell therapy production setting. Following initial success at Made Scientific’s Princeton facility, the partners are moving toward GMP integration and launching early-adopter programs. The fully robotic system aims to address key CGT manufacturing challenges, including complexity, high costs, and quality variability.

Segments Insights

Testing Type Insights

What Made Sterility Testing the Dominant Segment in the Market in 2024?

The sterility testing segment dominated the cell and gene therapy quality control and analytics market, capturing approximately 24% of the share. This growth is driven by increased demand for quality assurance, advancements in rapid testing methods, the development of allogeneic products, and stringent regulatory compliance. Pharmaceutical and biotechnology companies are heavily investing in quality control infrastructure and specialized services to manage the increasing volume of complex CGT products, fueling the need for comprehensive sterile processing and release testing. The rapid transition from traditional to advanced techniques is further boosting the adoption of sterility testing due to its reliability.

Meanwhile, the potency testing segment is projected to grow at the fastest CAGR of 21.5% during the forecast period. This is because potency testing plays a critical role in measuring the biological activity and therapeutic potential of products, a key requirement for regulatory approvals. The rising complexity of therapies drives demand for robust and innovative potency assays to ensure product safety, efficacy, and consistent quality.

Analytical Method Insights

Which Analytical Method Dominates the Cell and gene therapy quality control and analytics Market?

The polymerase chain reaction (PCR) segment dominated the market, holding approximately 28.6% share in 2024. This is due to its high sensitivity and rapid turnaround. This analytical method serves as a core technology for product characterizations, like transgene expression analysis and vector copy number (VCN) determination. The polymerase chain reaction (PCR) can detect low-abundance targets, in part, through cutting-edge technologies such as real-time PCR (qPCR) and digital PCR (dPCR). The ability of this model to identify and quantify specific genetic modifications in cell and gene therapy is contributing to the growth.

The mass spectrometry segment is expected to grow at an approximate 23.8% CAGR over the projection period, driven by its ability to offer cutting-edge analytical capabilities for complex therapies, such as cell & gene therapies. This model provides the necessary molecular-level characterization for compact products, ensuring their safety and efficacy. Mass spectrometry accelerates the drug development process by detecting impurities. The detailed, structured information about biomolecules provided by mass spectrometry makes them essential in drug development.

Application Area Insights

How Does the Oncology Segment Dominate the Cell and gene therapy quality control and analytics Market?

The oncology segment dominated the market, with an approximate 37.4% share in 2024, due to the increased prevalence of cancer and advancements in detection and treatment. The complexity of oncology applications, such as chimeric antigen receptor (CAR)-T cell therapies, has increased the demand for specialized quality control and analytical services. These specialized services offer high scalability, helping manufacturers meet stringent regulatory requirements for new therapeutic processes.

The genetic disorders segment is expected to expand at an approximate 28.3% CAGR between 2025 and 2034, driven by the increasing prevalence of genetic disorders and demand for personalized medicines. The specialized quality control solutions develop curative treatments for inherited and rare conditions. The increased demand for precise methods to ensure the safety, efficacy, and consistency of therapies targeting genetic diseases is contributing to the growing development of novel analytical technologies. The technological advancements in gene editing, like CRISPR-Cas9, further add to the demand for specialized QC and analytics.

End-User Insights

Which End-User Segment Contributed the Largest Market Share in 2024?

In 2024, the pharmaceutical & biotechnology companies segment held approximately 54.2%, due to their high investments in development and manufacturing of cell & gene therapies. The demand for quality control has increased to ensure the safety and efficacy of products. The growing demand for personalized medicine and the expansion of clinical trial pipelines in pharmaceutical & biotechnology companies are fueling the adoption of quality control & analytics tools. The ever-increasing number of clinical trials for oncology and chronic disease treatments is driving the need for quality control systems to test, characterize, and ensure the consistency of novel therapies.

The contract development and manufacturing organizations (CDMOs) segment is likely to grow at an approximately 23% CAGR in the upcoming period, due to increased demand for specialized services. Contract development and manufacturing organizations (CDMOs) provide specialized manufacturing expertise, scalability, technical support, and assistance in complying with regulatory requirements. Contract development and manufacturing organizations (CDMOs) are essential in managing the complex and highly regulated process of cell & gene therapy production, which accelerates development. The increasing number of clinical trials, along with the demand for specialized services, is driving this growth.

Regional Insights

What Made North America the Dominant Region in the Market in 2024?

North America dominated the global cell and gene therapy quality control and analytics market, capturing approximately 43% of the share. This leadership is attributed to the region’s well-established healthcare and research infrastructure, strong pharmaceutical and biotechnology presence, and supportive regulatory environment. The rising prevalence of chronic diseases such as cancer, cardiovascular disease, and genetic disorders has boosted demand for cell and gene therapies in the region.

Additionally, North America’s strong focus on adopting AI to accelerate development is driving market growth. The development of digital-first solutions for long-term patient follow-up, strategic partnerships, and significant investments to enhance manufacturing capabilities are further solidifying the region’s position globally.

The U.S. is a major contributor within North America, supported by high chronic disease prevalence, substantial R&D investments, and regulatory approvals for innovative therapies. The country is also seeing significant advancements in AI-integrated manufacturing and quality control, expansion of advanced iPSX cell banks, and collaborations within the CDMO sector to build capacity and enhance capabilities. Growing applications of cell and gene-based treatments for chronic and genetic diseases are fueling the adoption of comprehensive quality control and analytics tools in the U.S.

Asia Pacific Cell and gene therapy quality control and analytics Market Trends

Asia Pacific is expected to grow at a CAGR of approximately 33.5% over the forecast period, driven by the region’s advanced research infrastructure and rising demand for cell and gene therapies. Significant government investments in biotechnology and pharmaceutical research are expanding cell and gene therapy development processes and clinical trial pipelines, which in turn increase the demand for quality control and analytics solutions. Strict safety and efficacy regulations for new drugs and innovative treatments are further accelerating the adoption of these tools within the region’s research infrastructure.

China is a key contributor to regional growth, supported by its large population, increasing prevalence of geriatric disorders, and rising chronic disease rates. The Chinese government’s substantial investments in local pharmaceutical and biopharmaceutical companies are boosting clinical trial pipelines and technological advancements. The high volume of gene and cell therapy clinical trials in China is driving the widespread adoption of quality control and analytical tools.

Europe Cell and gene therapy quality control and analytics Market Trends

Europe is a notable player in the global market, contributing to growth due to strong regulatory support from the European Medicines Agency (EMA) and increased government initiatives in Germany and the UK. The strong focus on technological advancements, such as CRISPR-Cas9 gene editing, and growing demands for outsourced quality control solutions are fueling the adoption of quality control and analytics services for cell & gene therapies. Cell therapy expert Lindsay Davies, PhD, FHEA, has discussed the major considerations in the shift to the significant adoption of CGTs in Europe, leading to the broader adoption of quality control & analytics tools and services. (Source: https://www.europeanpharmaceuticalreview.com)

The Cell & Gene Therapy International Europe conference & exhibit hall will be held in December 2025, to showcase the latest cell & gene therapy innovators, who have navigated regulatory challenges and addressed manufacturing hurdles. This conference will address therapeutic developments beyond AAV therapies and CAR-T cell therapies. (Source: https://informaconnect.com)

Country-Level Investments & Funding for the Cell and gene therapy quality control and analytics Industry

U.S.: The National Institutes of Health (NIH) collaborated with the Food and Drug Administration (FDA) to provide funding for regenerative medicine research. The government has allocated more than $40 billion annually for pharmaceutical and biotechnology research and development (R&D) activities.

Canada: Ngen has invested $10.5 million in a $34.8 million project led by OmnioBio for the development of commercial-scale CGT manufacturing. These investments have enhanced automated systems, quality management, and cutting-edge analytics, supporting domestic capacity building.

Germany: In June 2024, the German government applied national strategies for gene & cell-based therapies. These initiatives include funding programs from the Federal Ministry of Education and Research (BMBF).

UK: In 2023, 55% of European venture capital funding for CGT was secured by UK companies. The UK’s biotech companies play a vital role in private investments for cell & gene therapies.

China: In 2023, Chinese biotech secured around $20.61 billion in funding from 69 companies, with an average of $299 million per firm. These investments demonstrate a transition from a focus on generics for innovation and attracting global pharmaceutical companies through licensing deals for novel drugs.

Top Companies in the Cell and gene therapy quality control and analytics Market

Tier I: Market Leaders

These companies are dominant in the market, offering comprehensive quality control and analytical solutions across various stages of cell and gene therapy development.

Company

Key Offerings

Thermo Fisher Scientific

Broad portfolio including next-generation sequencing, PCR/qPCR, and AI-driven analytics platforms.

Lonza Group

Extensive services in cell and gene therapy manufacturing, including quality control and analytics.

Merck KGaA

Offers a range of analytical solutions and consumables for cell and gene therapy applications.

Bio-Rad Laboratories

Provides analytical instruments and reagents for gene therapy quality control.

QIAGEN

Specializes in molecular testing and analytical solutions for gene therapy.

Tier II: Established Players

These companies have a significant presence in the market, offering specialized services and products that support cell and gene therapy quality control and analytics.

Company

Key Offerings

Charles River Laboratories

Provides comprehensive services including quality control testing for gene therapies

Bio-Techne Corporation

Offers tools and reagents for cell and gene therapy research and development.

WuXi AppTec

Provides integrated services including quality control testing for gene therapies.

Catalent, Inc

Specializes in gene therapy manufacturing and quality control services.

Eurofins Scientific

Offers analytical testing services for gene therapy products.

Tier III: Emerging and Niche Players

These companies are emerging players or niche providers that contribute to specific aspects of cell and gene therapy quality control and analytics.

Company

Key Offerings

IQVIA

Provides data analytics and technology solutions for gene therapy development.

F. Hoffmann-La Roche Ltd.

Offers diagnostic solutions supporting gene therapy applications

Samsung Biologics

Provides contract development and manufacturing services with quality control capabilities.

Sangamo Therapeutics

Focuses on gene therapy development with integrated quality control processes.

Galapagos NV

Engages in cell therapy development with an emphasis on quality control.

Recent Developments

In November 2024, NewBiologix launched the Xcell rAAV platform to streamline and accelerate rAAV production for gene and cell therapy. Powered by the engineered Xcell Eng-HEK293 cell line, the platform enables high-quality rAAV production via transient transfection. It offers an end-to-end solution, from DNA synthesis to clinical-grade purification, while built-in analytics ensure quality by assessing capsid ratios, gene integrity, and contaminants, reducing development time, cost, and risk. (Source: https://www.regmednet.com)

In April 2024, Cellares unveiled Cell Q™, the first automated quality control (QC) workcell for cell therapy manufacturing. Exclusive to its Smart Factories, Cell Q™ streamlines the traditionally manual and costly QC process, offering significantly improved throughput, cost-efficiency, and consistency. (Source: https://www.cellares.com)

Segment Covered in the Report

By Testing Type

Sterility Testing

Identity Testing

Potency Testing

Mycoplasma Testing

Endotoxin Testing

Others

By Analytical Method

Flow Cytometry

Polymerase Chain Reaction (PCR)

High-Performance Liquid Chromatography (HPLC)

Mass Spectrometry

Enzyme-Linked Immunosorbent Assay (ELISA)

Others

By Application Area

Oncology

Genetic Disorders

Cardiovascular Diseases

Infectious Diseases

Others

By End-User

Pharmaceutical & Biotechnology Companies

Contract Development and Manufacturing Organizations (CDMOs)

Academic & Research Institutes

Others

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa