Heated Jacket Market Overview

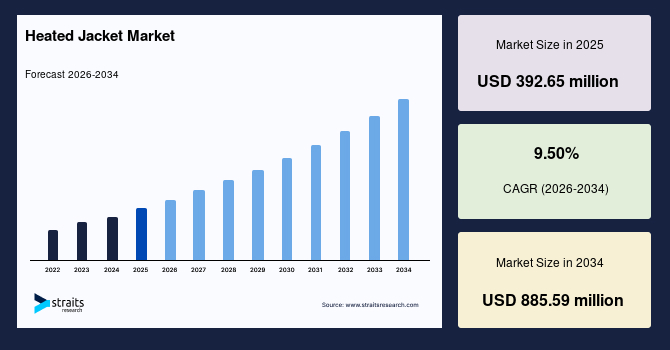

The global heated jacket market size is valued at USD 392.65 million in 2025 and is estimated to reach USD 885.59 million by 2034, growing at a CAGR of 9.50% during the forecast period. The growth is propelled by rising consumer demand for wearable heating in cold climates, advances in compact batteries and flexible heating elements, and greater penetration of functional outdoor apparel in both leisure and industrial segments.

Key Market Trends & Insights

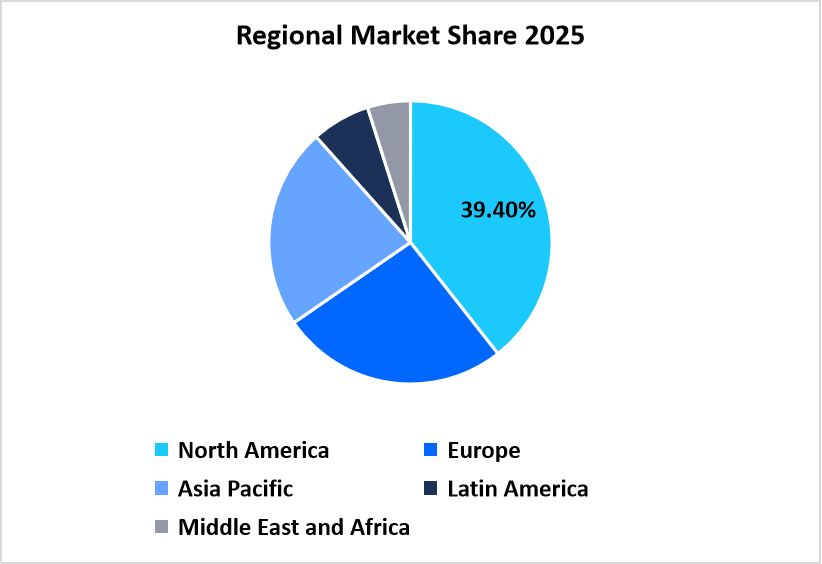

North America dominated the market with a revenue share of 39.40% in 2025.

Asia Pacific is anticipated to grow at the fastest CAGR of 11.3% during the forecast period.

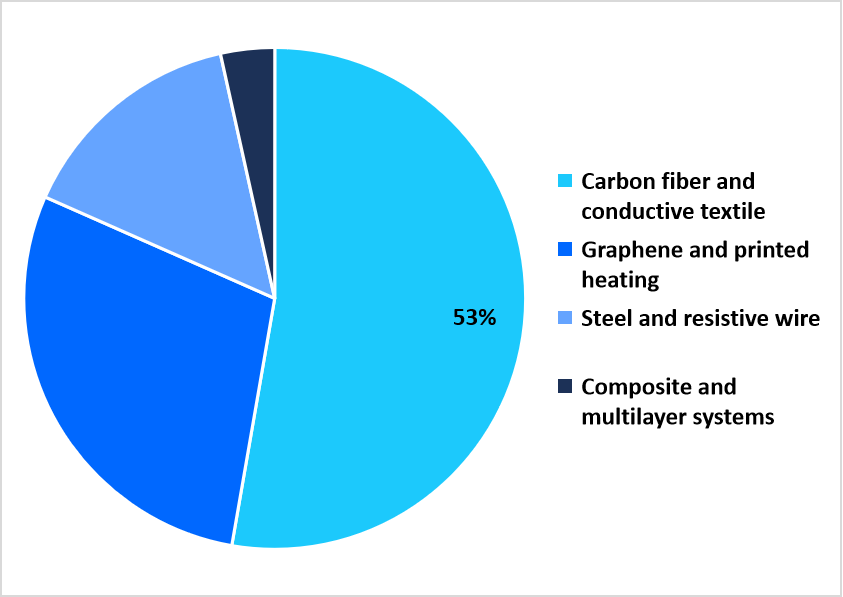

Based on Heating Technology, the carbon fiber and conductive textile segment held the highest market share of 52.7% in 2025.

By demographic, the men segment is estimated to register the fastest CAGR growth of 8.25%.

Based on application, the leisure and outdoor sports category dominated the market in 2025 with a revenue share of 48%.

Based on Distribution Channel, the Online distribution segment is projected to register the fastest CAGR of 14.1% during the forecast period.

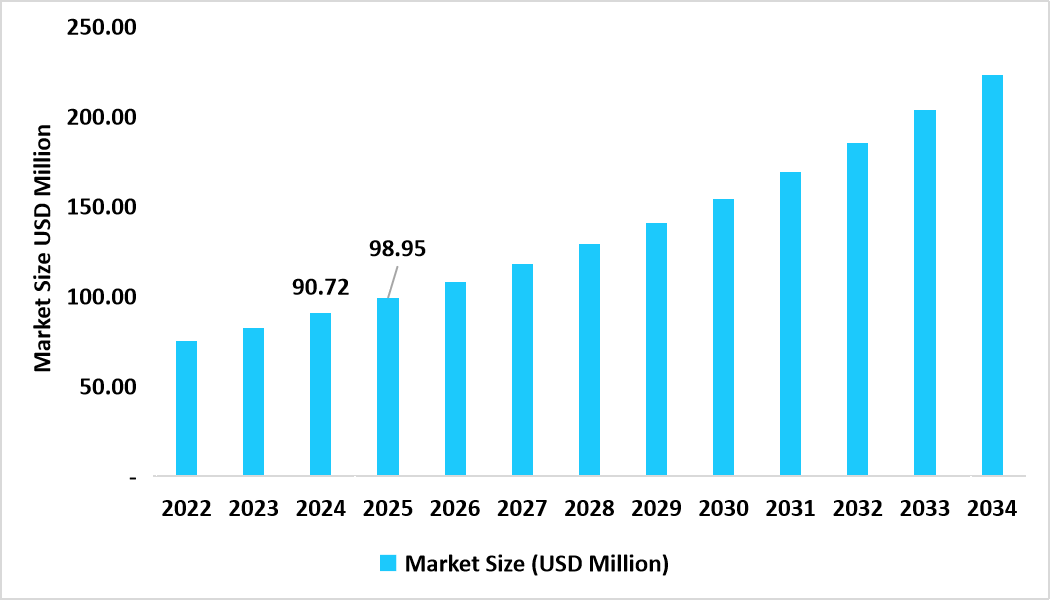

U.S. dominates the market, valued at USD 90.72 million in 2024 and reaching USD 98.95 million in 2025.

Table: U.S. Heated Jacket Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

2025 Market Size: USD 392.65 million

2034 Projected Market Size: USD 885.59 million

CAGR (2026-2034): 9.50%

Dominating Region: North America

Fastest-Growing Region: Asia Pacific

The global market involves the production and sale of outerwear featuring integrated heating elements for personal thermal comfort, which outdoor enthusiasts and professionals in cold environments widely adopt. The market is driven by the increasing participation in outdoor and winter activities, rising consumer awareness of health benefits in cold weather, and continuous technological advancements in battery life and heating efficiency. As consumer expectations evolve toward smarter apparel, heated jackets are well-positioned to transition from niche novelty to a normal part of cold-weather wardrobes.

Latest Market Trends

Smart control and connectivity in heated apparel

Heated jackets are increasingly integrating digital temperature controls, Bluetooth connectivity, and even smartphone apps to monitor and adjust heating levels in real time. This trend enhances user comfort and energy efficiency by allowing precise control of heat output.

For example, The Fieldsheer (Mobile Warming) Backcountry Heated Jacket features Bluetooth connectivity, enabling users to control heat settings and monitor the battery using the MW Connect App.

As fabrics become more conductive and sensors cheaper, the next generation of connected heated apparel is gaining traction.

Expansion in industrial, safety, and professional use cases

Beyond leisure and fashion, heated jackets are penetrating professional sectors such as construction, oil and gas, cold-storage logistics, military, and first responders. Workers in outdoor cold environments often face hypothermia risk or productivity loss in low temperatures. Heated jackets help maintain thermal comfort while preserving mobility in such conditions.

For instance, Milwaukee’s M12 Heated TOUGHSHELL Jacket and M12 Heated AXIS Jacket with HEXON HEAT TECHNOLOGY are designed for jobsite durability and offer up to 12 hours of run-time on low.

Moreover, more tool and equipment brands are launching lines of heated apparel targeted at trade professionals, bundling heating jackets with their battery ecosystems, targeting B2B sales, and boosting the market’s reach.

Market Drivers

Increasing outdoor recreation, cold climate commuting, and adoption in emerging markets

The expansion of cold-weather lifestyles, encompassing both increased outdoor activity and rising affluence in emerging markets, is significantly driving the market. Across high-latitude and high-altitude regions, a global surge in winter sports, trekking, and cold-climate commuting is increasing the need for non-bulky, high-performance thermal solutions. Businesses are launching products to support this demand.

For example, in April 2025, Venture Heat Men’s MAX 26W Heated Down Jacket with HeatSync was launched. This premium, 4-zone heated jacket with down insulation and a 9-hour runtime caters specifically to the growing demand from winter sports and extreme outdoor recreation enthusiasts.

Advances in battery technology and power efficiency

The improvement in battery energy density, power management circuits, and low-power heating materials (e.g., carbon-fiber threads, graphene) is a major driver propelling the market. As batteries become lighter and more capable, jackets can deliver longer heating durations without bulk. This lowers the barrier of discomfort and extends practical usage windows, making heated jackets more appealing for daily wear rather than occasional novelty.

Market Restraint

High cost and affordability barrier

Heated jackets command a premium over conventional insulated jackets due to embedded electronics, sensors, battery systems, and more complex manufacturing. In many markets, consumers are not yet willing to pay the extra margin, particularly where cold-season wear is occasional. The higher initial cost slows adoption, particularly in price-sensitive regions.

Market Opportunity

Material and heating innovation

The growing convergence of textiles and electronics presents a major opportunity for innovation in the heated jacket market. Advances in conductive fabrics, flexible heating elements, and sustainable battery systems are transforming product design toward lighter, safer, and more energy-efficient apparel.

For instance, the Clim8 SAS’s smart heating technology uses multiple embedded sensors to continuously monitor the wearer’s profile, activity, and ambient temperature, automatically adjusting the heat in real-time for personalized comfort.

Overall, strategic collaborations between textile manufacturers and electronics developers will accelerate the commercialization of third-generation e-textile jackets, merging functionality, comfort, and smart adaptability for both consumer and industrial applications.

Regional Analysis

North America dominated the market in 2025, accounting for 39.40% market share. The region’s market is driven by a mature outdoor recreation market, an established industrial segment that values heated workwear, and strong OEM activity linking apparel to existing battery ecosystems. Additionally, the region’s strong retail and e-commerce infrastructure supports quick product distribution. These factors together create a large and well-served market, making North America the dominant region by revenue.

The U.S. leads the regional market through a combination of corporate workwear adoption, a large outdoor-sports consumer base, and strong product innovation from consumer and industrial brands. OSHA/NIOSH guidance and occupational safety awareness also make heated jackets a practical option for employers managing cold-weather worksites. Together, these factors make the U.S. the single largest national market in North America for heated apparel.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 11.3% from 2026-2034, driven by the large manufacturing scale, rapid urbanization in cold zones, rising disposable incomes, and fast e-commerce adoption. Countries such as Japan and South Korea lead in wearable innovation, while China provides scale manufacturing and large domestic distribution channels. As the middle classes grow in colder regions and cross-border e-commerce lowers entry barriers, consumer demand for practical heated apparel increases.

China leads APAC by volume through fast e-commerce adoption, scaling capabilities in textile and electronics manufacturing, and a large domestic market for outdoor recreation and cold-zone commuting. Local brands and global OEMs manufacture competitively priced heated jackets aimed at urban commuters, motorcycle riders, and outdoor enthusiasts. Government support for advanced materials and manufacturing helps lower unit costs and speeds product rollout across domestic and export channels, supporting robust growth in 2025.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe is an important market driven by advanced materials research, active smart-textiles programs, and consumer sensitivity to product durability and sustainability. European research and innovation programmes are lowering technical barriers for thin, flexible heating solutions and for integrating conductive fabrics into commercial garments. Consumer adoption is strongest in Northern and Alpine countries where cold-weather outdoor sports are common, but product innovation and regulatory emphasis on safe wearable electronics support commercial adoption across the EU.

Germany combines strong industrial demand (workwear, logistics) with a sophisticated outdoor apparel market and nearby technical textile research clusters. German manufacturers and distributors prioritise product standards, durability, and washability, which support heated jackets designed for professional and recreational use. Public-private R&D collaboration and vocational sectors that operate in cold conditions (construction, energy) sustain B2B uptake.

Latin America Market Insights

Latin America is a growing market for heated jackets in 2025. The growth is concentrated in countries with substantial seasonality or high-altitude climates and among urban consumers seeking functional winter apparel. Consumer imports, specialty outdoor retailers, and growing e-commerce channels currently drive adoption. Industrial adoption is emerging in cold-storage logistics and outdoor works.

Brazil is the largest Latin American market for heated apparel by revenue because of its large population, regional climatic diversity (highlands and southern winters), and a mature outdoor sports culture. Retailers and e-commerce channels import and sell heated jackets for skiing trips, mountain tourism, and urban commuters in cooler regions. Brazil’s mix of retail reach and outbound travel supports steady, retail-led growth in heated apparel.

Middle East and Africa Market Insights

The Middle East and Africa (MEA) region shows demand for heated jackets in a few submarkets. Gulf countries (UAE, Saudi Arabia) host affluent expatriate and outdoor sports communities that import premium heated apparel for mountain resorts and winter travel, creating luxury and specialty retail demand.

The UAE acts as a regional hub for premium and imported outdoor apparel, including heated jackets, because of high per-capita spending and strong retail tourism. Dubai’s luxury retail infrastructure and duty-free distribution channels make it a convenient market for premium heated apparel brands. Additionally, private sector procurement for niche industrial or hospitality uses supports limited B2B demand.

Heating Technology Insights

Carbon fiber and conductive textile heating dominated the market with a revenue share of 52.7% in 2025 due to their cost, durability, and user comfort. Carbon-based heating threads can be easily woven or laminated into garments to create thin, flexible heating zones that conform to body motion, survive normal garment use, and provide even heat distribution.

Graphene and printed heating technologies are the fastest-growing because they promise ultra-thin, highly uniform heating with minimal bulk and potentially lower material use over time. Printed conductive inks and graphene films can be patterned precisely to create zoned heating, integrated sensors, and embedded circuit traces without bulky wiring.

By Heating Technology Market Share (%), 2025

Source: Straits Research

Demographic Insights

Men’s segment dominates the heated jacket market at a CAGR of 8.25% in 2025 due to strong ties with heavy-use activities like motorcycling, winter sports, outdoor trades, and early product positioning by brands. Heated apparel lines were primarily developed for performance and utility for sectors with higher male participation. Professional procurement often purchases larger volumes for male-dominated trades, further adding revenue weight.

The women’s segment is the fastest-growing because brands are increasingly designing heated jackets with female-specific fit, fashion sensibility, and colorways, which broadens appeal beyond utility use. As outdoor recreation participation by women rises and the market for athleisure and fashion-tech grows, women seek heated garments that blend thermal performance with flattering cuts and lighter profiles.

Application Insights

Leisure and outdoor sports constitute the single largest application, holding a revenue share of 48% because the initial consumer adoption of heated jackets centered on skiing, snowboarding, motorcycling, and winter hiking. Recreational customers value the enhanced comfort, reduced layering, and improved mobility that heated jackets provide. Outdoor retailers and specialist brands have developed product lines tailored to performance athletes and enthusiasts, and seasonal marketing concentrates demand.

Industrial and trades applications are expanding fastest because employers increasingly see heated jackets as a productivity and safety tool in cold environments. Heated workwear reduces cold-related downtime, improves worker dexterity, and can reduce cold-stress health risks. As more occupational safety standards acknowledge personal heating solutions, institutional adoption will accelerate.

Distribution Channel Insights

Online distribution dominates the market with a CAGR of 14.1% as it offers a wide geographic reach, direct consumer access, and efficient inventory management. Heated jacket brands use e-commerce to present technical specifications, thermal performance data, and customer reviews, which are critical purchase drivers for technical apparel.

B2B procurement is the fastest-growing segment because institutional purchases are larger per transaction and often involve recurring orders for fleets, uniforms, or trade crews. As occupational health programs and procurement managers recognize the productivity and safety benefits of heated workwear, contracts between manufacturers and corporate buyers increase.

Competitive Landscape

The heated-jacket market is moderately fragmented, with a mix of specialist heated-apparel brands, power-tool and workwear firms bundling heated workwear with battery ecosystems, and smaller innovators in e-textiles. Competition centres on battery compatibility, heating technology, runtime, durability, and channel reach. Established tool brands and workwear lines drive B2B demand. Price, safety certifications, and brand trust determine rapid uptake among professional buyers and early-adopter consumers.

Ravean: An Emerging Player

Ravean began as a crowdfunded startup focused on lightweight, packable, heated down jackets and has since expanded into charging-enabled and battery-powered outerwear for camping and urban use. Its growth pattern shows product innovation via crowdfunding/online channels, steady Amazon/DTC sales, and an emphasis on travel/camping use-cases (portable battery + long runtimes).

In November 2024, Ravean launched their Heated Hoodie 2.0 on Kickstarter, which features a complete design overhaul and new features.

List of key players in Heated Jacket Market

Ororo

Volt Heat

ActionHeat

Gerbing

Milwaukee Tool

DEWALT (Stanley Black & Decker)

Bosch Professional

Ravean

Venture Heat

Gobi Heat

Venustas

Antarctica Gear

TideWe

Gamma (Gamma Heated)

Merokeety

Fieldsheer

Helios Paffuto

iHood

Moerdeng

WhizMax

Blaze Wear

Warm & Safe

Strategic Initiatives

October 2025 – Ororo celebrated its anniversary by launching limited-edition heated apparel pieces, likely including jackets and vests, as an ode to its original classic styles.

January 2025 – People ran a product feature naming the Ororo Slim-Fit Heated Jacket a top pick for 2025, highlighting its quick heat-up (54 seconds), three heat settings, and up to 10 hours of runtime.

Report Scope

Report Metric

Details

Market Size in 2025

USD 392.65 million

Market Size in 2026

USD 428.54 million

Market Size in 2034

USD 885.59 million

CAGR

9.50% (2026-2034)

Base Year for Estimation 2025

Historical Data2022-2024

Forecast Period2026-2034

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends

Segments Covered

By Heating Technology,

By Demographic,

By Application,

By Distribution Channel,

By Region.

Geographies Covered

North America,

Europe,

APAC,

Middle East and Africa,

LATAM,

Countries Covered

U.S.,

Canada,

U.K.,

Germany,

France,

Spain,

Italy,

Russia,

Nordic,

Benelux,

China,

Korea,

Japan,

India,

Australia,

Taiwan,

South East Asia,

UAE,

Turkey,

Saudi Arabia,

South Africa,

Egypt,

Nigeria,

Brazil,

Mexico,

Argentina,

Chile,

Colombia,

Explore more data points, trends and opportunities Download Free Sample Report

Heated Jacket Market Segmentations

By Heating Technology (2022-2034)

Carbon fiber / conductive textile

Graphene / printed heating (flexible printed inks)

Steel / resistive wire

Composite/multilayer systems

By Demographic (2022-2034)

By Application (2022-2034)

Leisure & Outdoor Sports

Industrial / Construction / Trades

Commuting / Urban Use

Defense / Public Safety / Emergency Services

By Distribution Channel (2022-2034)

Online / E-commerce

Offline retail

B2B / Industrial procurement

By Region (2022-2034)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global heated jacket market size is valued at USD 428.54 million in 2026.

The growth is propelled by rising consumer demand for wearable heating in cold climates, advances in compact batteries and flexible heating elements, and greater penetration of functional outdoor apparel in both leisure and industrial segments.

North America dominated the market in 2025, accounting for 39.40% market share.

Leisure and outdoor sports constitute the single largest application, holding a revenue share of 48% because the initial consumer adoption of heated jackets centered on skiing, snowboarding, motorcycling, and winter hiking.

Top players are Ororo, Volt Heat, ActionHeat, Gerbing, Milwaukee Tool, DEWALT (Stanley Black & Decker), Bosch Professional, Ravean, Venture Heat, Gobi Heat, Venustas, and Antarctica Gear.