Insight Focus

The wheat market has officially reached oversold territory. The possibility of a sharp move upward on fundamental news is increasing due to higher volatility. As prices drop below the cost of production, we could start to see some supply erosion in the form of smaller planted areas.

Market Enters Oversold Territory

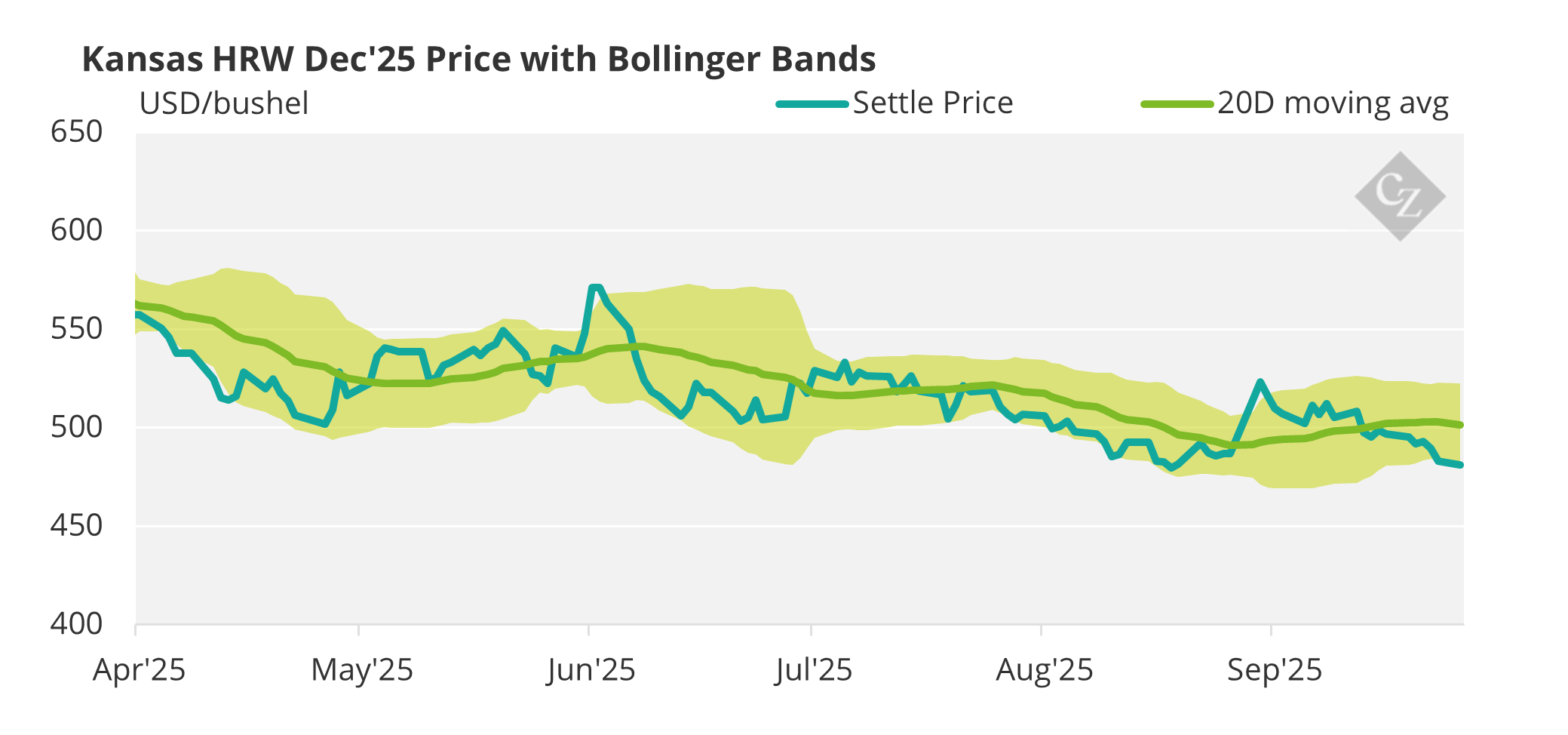

The price chart below shows Kansas HRW Dec ’25 contract over the last six months.

The teal price line is the underlying futures price.

The three lines around the price are referred to as the Bollinger bands. The middle, green, line is a simple moving average, while the shaded area reflects expanding or contracting volatility of prices.

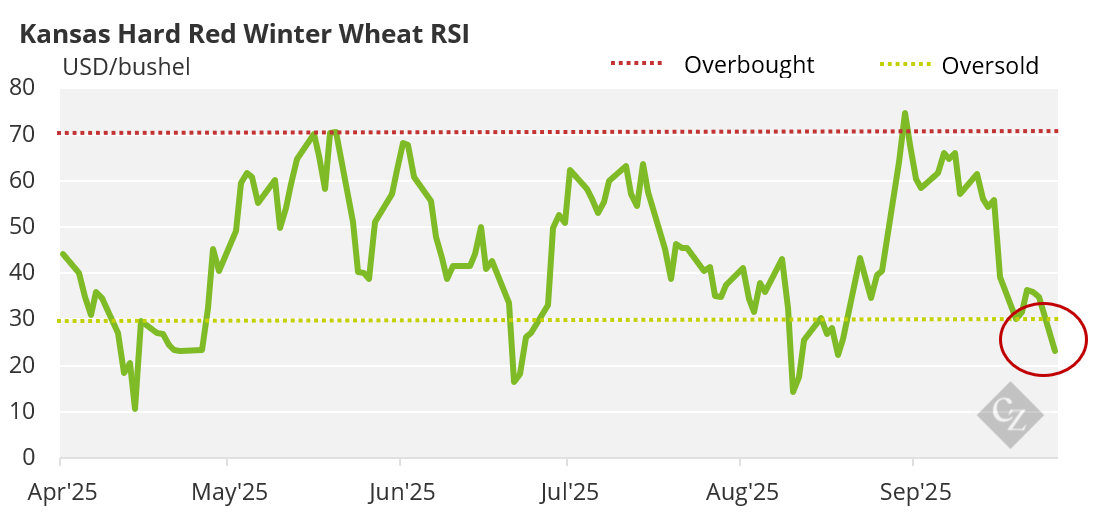

This chart is termed the Relative Strength Index (RSI) of the market.

In simple technical terms the market is clearly weak, as prices push the bottom Bollinger band line lower, demonstrating little enthusiasm for participants to stop the decline.

The upper and lower Bollinger bands grow wider apart, as demonstrated with the most recent fall over the last couple of weeks. Volatility is increasing as is the possibility of a significant price movement when a trigger sparks a move upwards.

The RSI concurs with low numbers, showing an equally weak market. However, we are starting to see that Kansas HRW has reached numbers below 30, shown in red in the bottom right hand corner of the chart. This is an indicator that the market is entering what is termed ‘oversold’ territory. This is a tool used by analysts to aid predicting a change in direction.

These technical tools on their own do not constitute a reason to expect a huge turn around in price movement. They are nonetheless a good indicator that if a fundamental factor sparks any type of rally, the market is well positioned to see a reasonable uplift as prices have been inherently weak.

A Continually Weak Market

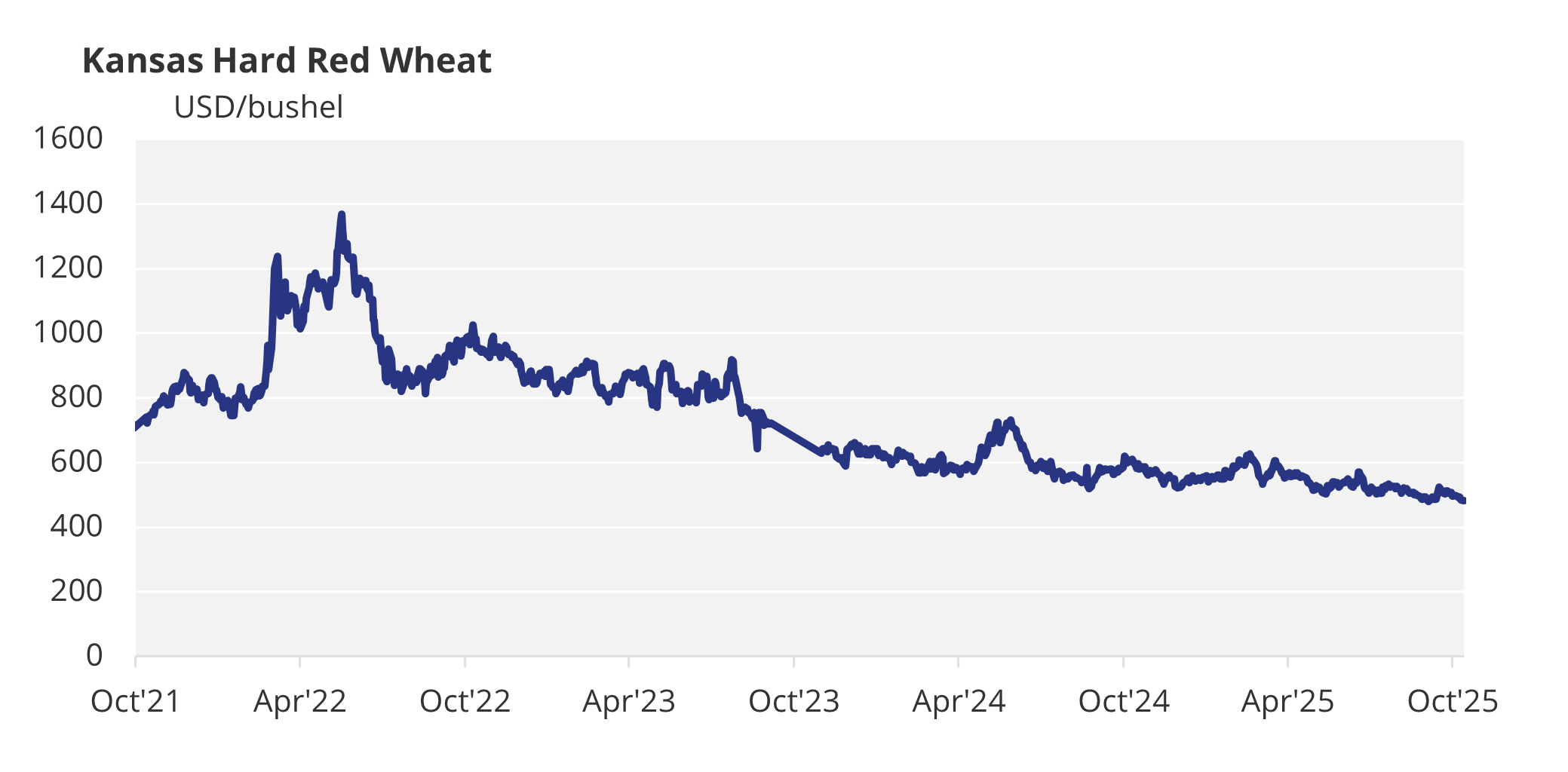

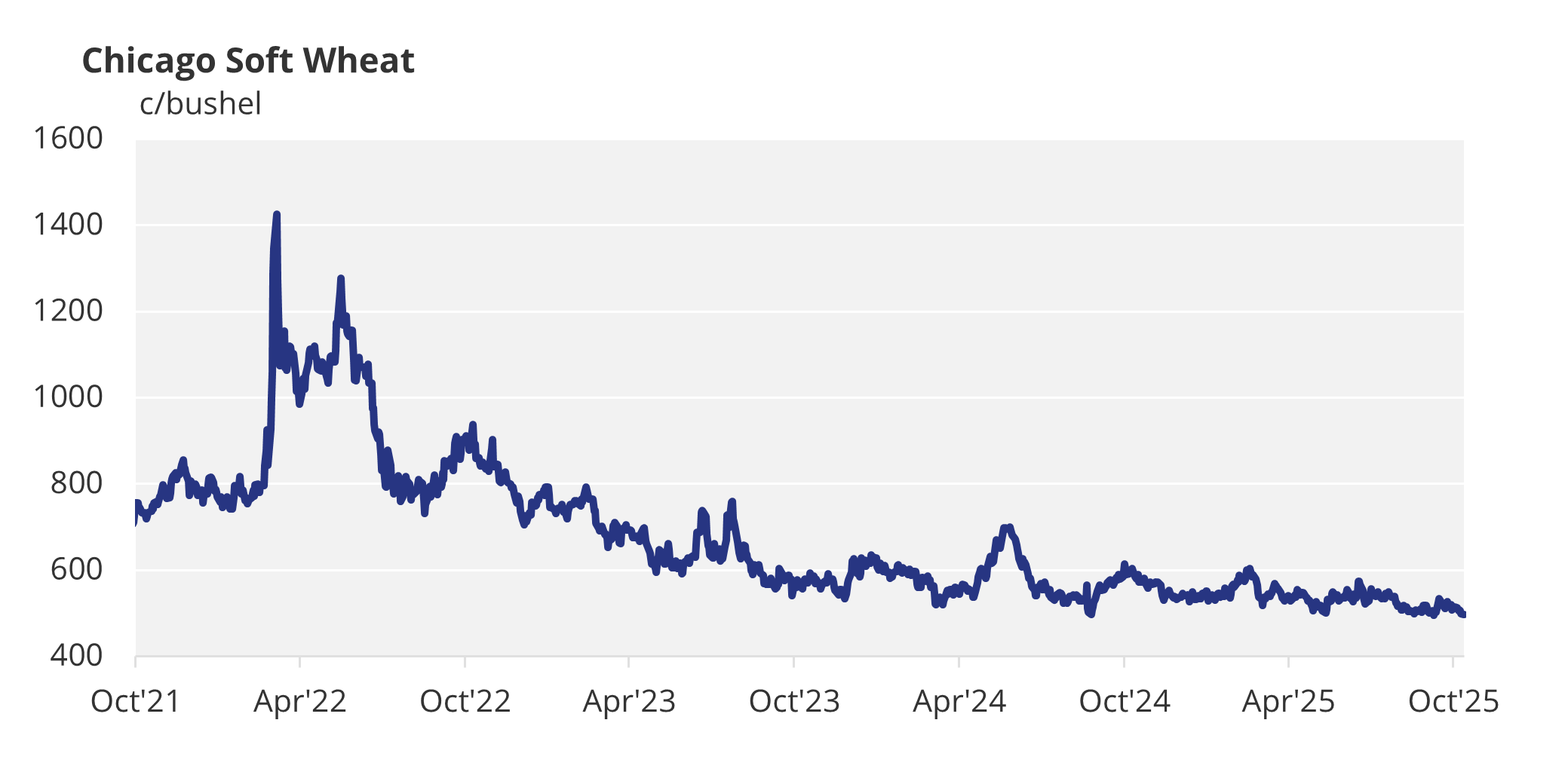

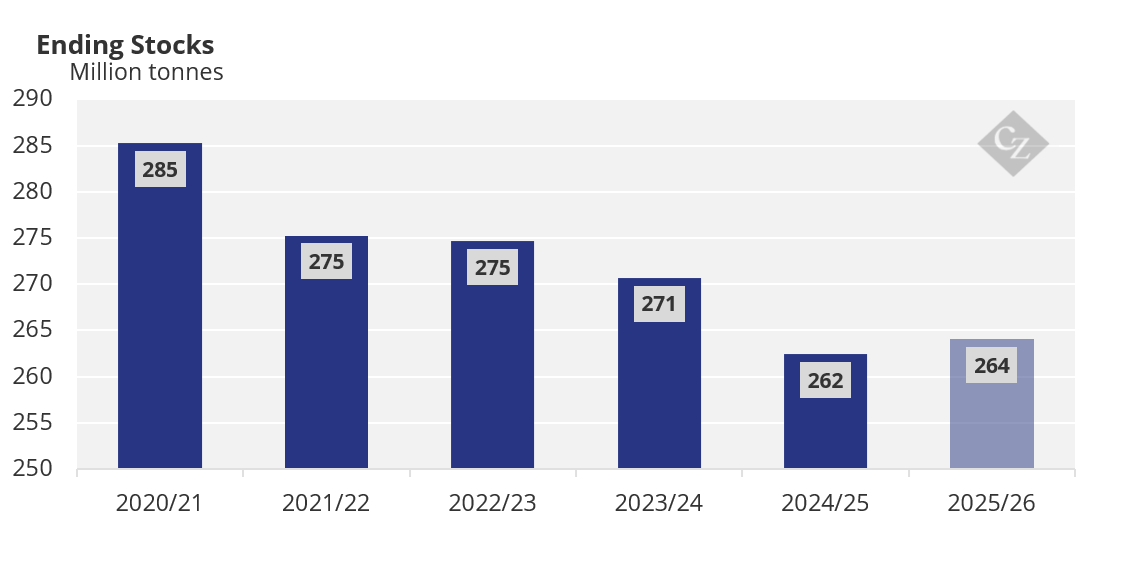

On every exchange, wheat prices have been declining for at least three years. The decline in values has been impressive given the fundamentals of reducing supply versus demand.

The wheat market has been under the spell of the bears to a greater or lesser extent since the price peak in mid-May 2022, following Russia’s invasion of Ukraine.

I have commented in the past couple of years that the wheat market has become more resilient and far less fazed by the world of geopolitics and conflicts than it was in the decades prior to February 2022.

Nonetheless, what we see today, in terms of values vs fundamentals, does create an interesting set of circumstances.

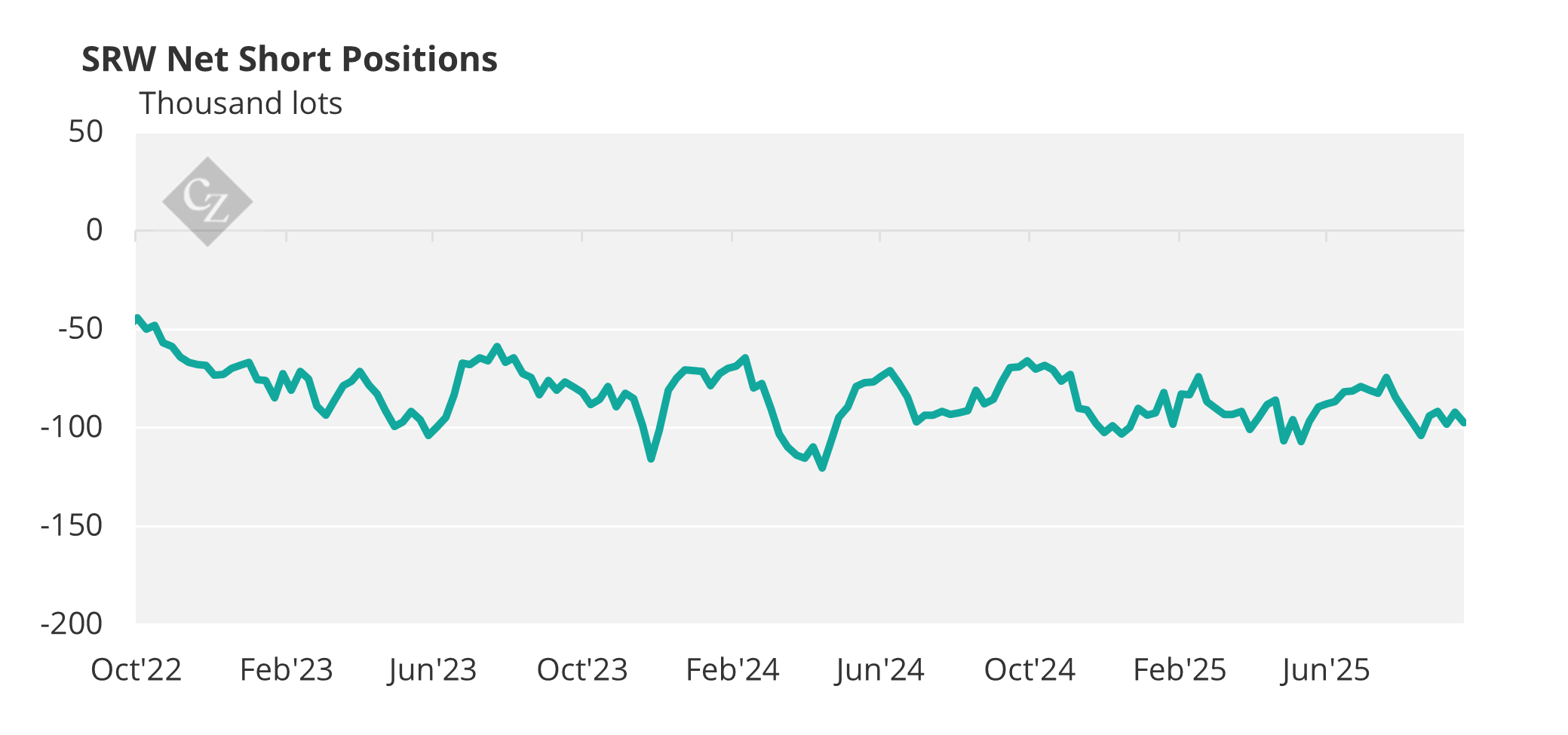

The simple facts are that we have low stocks, low prices, farmers that can see no profit at current values and yet the funds continue to be active sellers with big shorts on the futures markets. This does not follow our usual logical thought processes.

Herd Mentality Pressures Market

In May 2022 I wrote an article pointing out that wheat prices were too high and would inevitably fall, even if they continue their rise in the short-term. My thought process was based upon simple fundamentals and economics.

Demand erosion: Prices were too high for the big North African importers. If the populations of these lower-income nations, which are large consumers of wheat-based products, cannot afford to pay market prices, they will buy less.

However, they still have to eat, so they continue buying – but less — which erodes demand.

A change in mentality: As the world realised that major exporters Russia and Ukraine would continue to ship vessels despite Russia’s invasion, the fuel to stoke the price fire was extinguished. A few short covering corrections have appeared since, such as in July’23 when Russia withdrew from the Black Sea Grain Agreement. Otherwise, the bears have driven the market continually downward.

The price falls since mid-2022 have continued as funds have maintained their short positions as seen in the chart below.

The active fund selling into rallies over such a prolonged period has generated a feeling of herd mentality.

This is where each time a rally occurs, there is an underlying feeling that the funds will come in and sell. This has proved correct and allowed others to jump on the fund band wagon and profit from what is perceived as inevitable fund selling.

Ultimately, there is a theory that if at some point this mentality proves to be wrong, so be it, as the multiple times it has already provided profit will outweigh the time that it makes a loss.

Demand: There has been lacklustre buying appetite. We continue to see hand-to-mouth buying with limited further forward pricing, as the carries see premiums that seem unattractive to buyers.

Supply: There has been a reasonable harvest, steadily increasing production numbers across the Northern Hemisphere. Sales have been driven by farmers needing cash or storage over price, forcing a proportion of sales into the dwindling market.

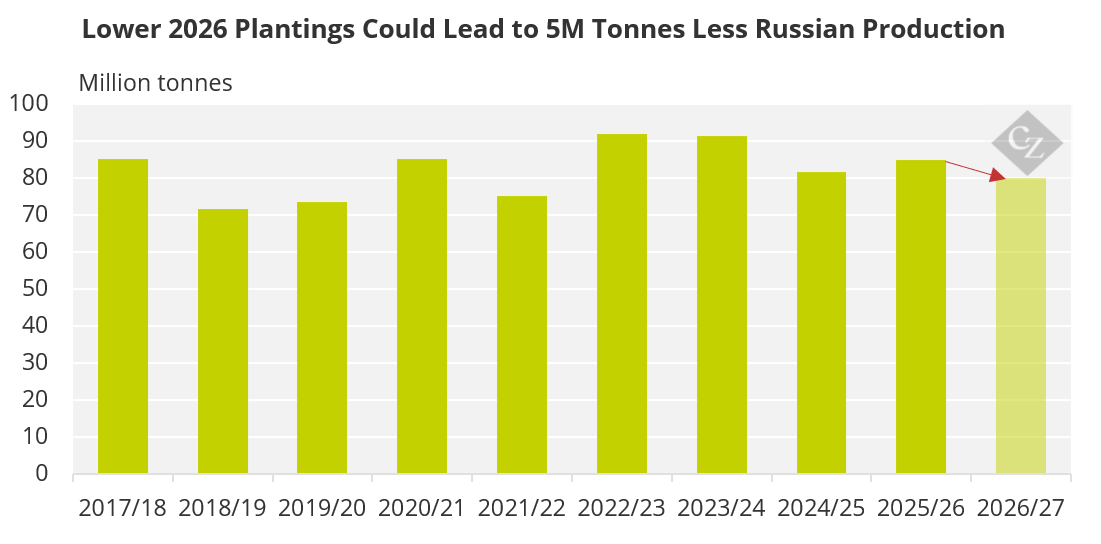

Even the recent report from Russia, citing a 6% reduction in 2026 wheat plantings did nothing to spark any buying interest. This comment alone could wipe 5 million tonnes off supply next year.

This is a clear reminder that in the same way high prices create demand erosion, 2025 prices may be starting to see some supply erosion due to below cost-of-production values.

What to Look Out For

In the same way prices had to drop in May 2022, we sit here in October 2025 with little enthusiasm to push prices higher. Farmers will sell what they need to for either cash or storage but likely little else and consumers are content to bet on the fact that prices will continue to fall further forward.

The basic technical makeup of the market suggests that values are reaching oversold territory.

Prices can always drop further, but it is hard to see values dropping significantly from here as farmer selling has all but dried up in many regions. If we assume (and this is a big assumption) everyone plants the acres they intend to, that will add pressure to the market.

But what we do know is that, if prices sink lower, there could be a switch from arable farming to other kinds. With strong milk prices and high beef prices, there could be less hard winter wheat planted in the US. With Russia already having announced lower plantings and adverse weather conditions in Argentina and Australia, negative planting news from major producers could have quite a bit of impact.

But with farmers reluctant to sell more than they absolutely have to below levels of around EUR 200 in Europe and USD 6 in the US, it seems the demand side might crack first.