Photos of the ever-growing line of regular Sydneysiders looking to buy gold at Martin Place continue to do the rounds on social and traditional media.

And who can blame these gold bugs?

With the debasement trade in full swing and gold prices showing no signs of slowing down, you can see why people are desperate to get their hands on the precious metal.

Martin Place is ground zero for the new Gold Rush in Australia

Of course, it also tells a story about whether gold now finds itself in bubble territory, akin to the classic story of getting stock tips off your taxi driver, but that’s a discussion for another article.

Gold and Bitcoin have enjoyed excellent years, with gold up 56.5% and Bitcoin up roughly 60% over the last 12 months.

Almost anyone would be happy with that kind of return, but anyone looking to wring more out of the debasement trade didn’t need to look very far to do so.

Just as Nvidia is the biggest winner in the AI arms race, it’s often the companies in the “picks and shovels” role that come out ahead.

For those who aren’t familiar with it, the term comes from the Gold Rush. With so many people desperate to strike it rich, it was those selling the picks and shovels to prospectors who made most of the money, not the prospectors themselves.

Almost two centuries later, it looks like it remains as good a play as it did back then. Instead of buying gold or Bitcoin, you’d have been better off buying the companies powering the trend – the miners themselves.

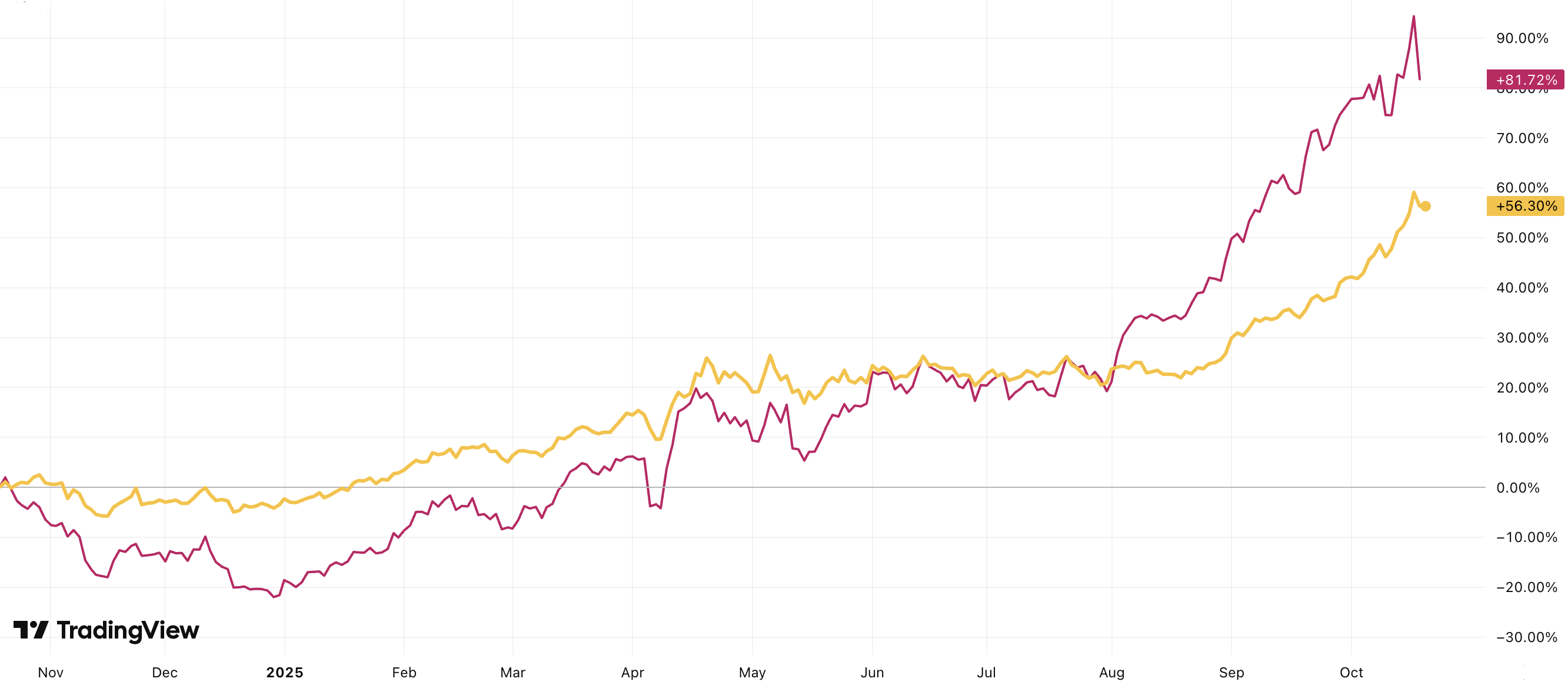

The VanEck Gold Miners ETF (NYSE: GDX), which tracks the performance of the world’s largest gold miners, is up 81% over the last 12 months, and 122.8% in 2025.

Gold miners have outperformed gold

Gold (gold) 1-year performance vs VanEck Gold Miners ETF (red) (Source: TradingView)

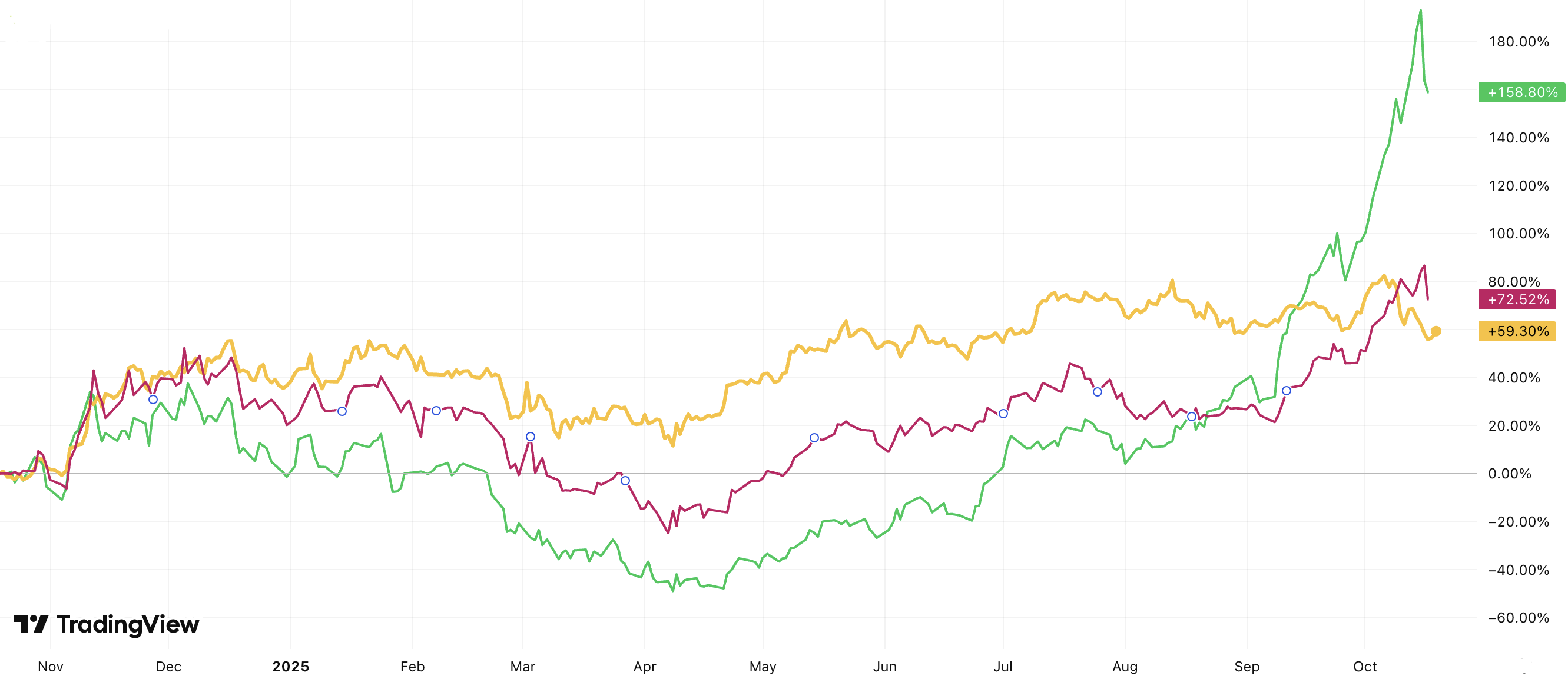

It’s the same story for Bitcoin.

CoinShares Bitcoin Mining ETF (NYSE: WGMI), which tracks Bitcoin mining companies, is up 158.8% over the last year.

The Betashares Crypto Innovators ETF (CRYP), which, in its own words, provides “picks and shovels exposure” to crypto companies, including miners, is up 72.5% over the last 12 months.

Bitcoin (gold) 1-year performance vs CoinShares’ WGMI ETF (green) and Betashares CRYP ETF (red) (Source: TradingView)

Closer to home, the Australian-based (but US-listed) data centre company IREN Ltd (NASDAQ: IREN) is up an impressive 531% over the last year, after it pivoted from Bitcoin mining to AI.

If that’s not an example of the ultimate picks and shovels play, I don’t know what is. IREN CEO Dan Roberts spoke to Livewire about its move to AI earlier this year.

Of course, the lesson of the Gold Rush was that you’re unlikely to strike it rich by jumping on a trend and that anything driving that type of mania will come to an end sooner rather than later.

After all, even the picks and shovels proprietors eventually ran out of willing customers. It doesn’t mean they didn’t make money in the meantime.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire