It has been a tough 13 months for investors as a combination of factors has kept the market generally volatile with one-year returns still in the negative zone for some frontline benchmarks (as of October).

Debt options across strategies have broadly delivered 5-10 per cent returns in the past one year.

Gold and silver, though, have been on a spectacular rallying spree with one-year returns of 64 per cent and 85 per cent (ETF category averages), respectively.

Earlier, there was slowing domestic demand, moderating government spends, FPI selling pressure, decelerating corporate earnings etc. to contend with.

However, growth appears to be back on track with GDP figures indicating steady increase in Q1FY26, infrastructure spending by the Centre has restarted, income-tax and GST reforms have revived demand and corporate earnings are improving mildly. Inflation is low and further interest rate cuts by the RBI in the coming quarters may not be ruled out.

But international cues are still hazy with penal US trade tariffs, altered supply chains, AI-led disruptions and strained global economic growth.

Decision-making can be tough in the present circumstances.

For investors – new and seasoned – with a moderate risk appetite, this volatile market is a good opportunity to get their portfolios aligned to their long-term goals with the right set of funds.

This Diwali, we suggest three funds – one each from the multi-asset, balanced advantage and large-cap categories – in which you can invest your bonus as a lump-sum (and keep adding more when you can). The multi-asset fund gives you exposure to several asset classes; the balanced advantage helps juggle between equity and debt; and finally, the large-cap fund ensures investments in top companies of the country.

To add a kicker to your portfolio, we also suggest a mid- and small-cap fund each, but via the SIP route over the long term, given the volatility in these funds.

We have excluded the flexi-cap category in this discussion as a lump-sum in the large-cap and SIPs in mid- and small-caps would give exposure across market capitalisation.

A few suggestions here. If your bonus amount is not very large (less than ₹1 lakh), you can consider parking the sum entirely as a lumpsum in the large-cap or multi-asset or balanced fund, depending on whether you have a moderate, conservative and low risk appetite, respectively. Investments in the other two can be considered later when you have a surplus.

In case the bonus is substantial, an average investor can consider a 40:40:20 allocation to the large-cap, multi-asset and balanced advantage fund, respectively.

The SIPs in the mid- and small-cap funds can be started as soon as possible on a monthly basis from your salary surplus.

Asset allocation via single fund

In their pioneering work on investments titled “Determinants of Portfolio Performance II, An Update” that appeared in the Financial Analysts Journal May-June 1991,Gary Brinston, Brian D. Singer and Gilbert L. Beebower showed that 91.5 per cent of a portfolio’s performance depended on asset allocation. Security selection, market timing and other factors only accounted for the remaining 8.5 per cent.

At a time when equities are on a bit of a pause mode in the past one year after a relentless run post Covid, gold is rallying massively due to trade tariffs and global uncertainties as a safe haven, and silver is on an upswing thanks to its heightened demand from in key industries, and debt is holding steady, an investor may struggle to decide the right mix.

Investing in a solid multi-asset fund could help investors with a moderate risk appetite gain from multiple avenues, as the allocation mix or proportion is decided by the fund manager based on valuations, market conditions, macros and internal models.

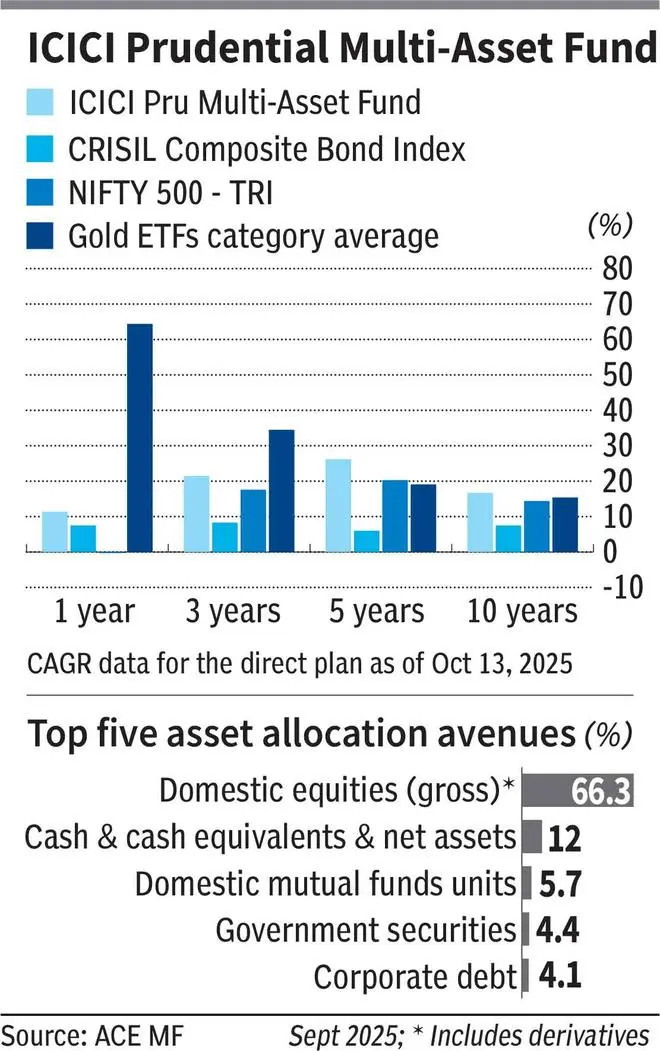

ICICI Prudential Multi-Asset fund is one of the best hybrid funds with a long and consistently healthy track record.

The fund delivers optimal risk-adjusted returns by investing across asset classes. These returns have generally been better than even many equity funds.

On a five-year rolling basis from January 2013 to October 2025, the fund has delivered a mean return 15.8 per cent, which is among the best in the category.

It has delivered more than 12 per cent returns over the above rolling period and time-frame for 80 per cent of the times and more than 15 per cent for over 82 per cent of the times.

Key risk ratios such as Treynor (2.9), Sharpe (0.6), Sortino (1.0) and up/down capture (3.8) are the best in the category.

The Sortino ratio measures the downside risk-adjusted performance, while the Treynor ratio gives the excess returns of the fund over the risk-free rate for each unit of market risk taken. The Sharpe ratio measures the risk-adjusted performance of the fund by taking into consideration the volatility in returns. The up and down capture ratios measure the performance of a fund during market rallies and corrections, respectively.

The fund invests in a mix of equities, derivatives (including exchange traded commodity derivatives: ETCDs), gold/silver ETFs and REITs/InVITs.

ICICI Prudential Multi-Asset fund takes a counter-cyclical approach to investing across asset classes and does not strictly fall in the value/growth styles.

It tweaks equity exposure smartly based on market conditions. So, in the first half of CY21, the fund increased net equity exposure (after adjusting for derivatives exposure) to 78 per cent, but brought it down sharply below 60 per cent for much of CY22, as inflation and increased interest rates hurt markets. As markets cooled off, the fund once again raised exposure to 69 per cent in March-April 2023.

The fund brought down net equity exposure to 49 per cent by August-September 2024 just before market started correcting and thus remained relatively less impacted from the fall.

Currently, net equity exposure is 57.3 per cent. Gold and Silver ETFs (and ETCDs) have accounted for around 10 per cent of the portfolio in the past one year.

Since an asset allocation fund always has an appropriate mix of investments suited to a particular macro-environment, timing becomes less relevant for entry and such a fund also lends itself to lump-sum investments.

Invest with a minimum time horizon of three-five years.

In the current environment, large-caps seem to have some semblance of valuation comfort. NSE data, as of September 30, 2025, indicate that the Nifty 100 TRI trades at a price earnings (PE) multiple of 21.57. The Nifty Midcap 150 TRI is available at a PE of 32.84 times, while the Nifty Small Cap 250 TRI trades at a price earnings multiple of 29.96. The large-cap index is at a stiff discount to lower market-cap benchmarks.

For new as well as seasoned investors, it may be a good time to latch on to large-cap funds now.

The large-cap category has seen schemes struggle to consistently beat standard benchmarks, after SEBI’s recategorisation in 2017-18.

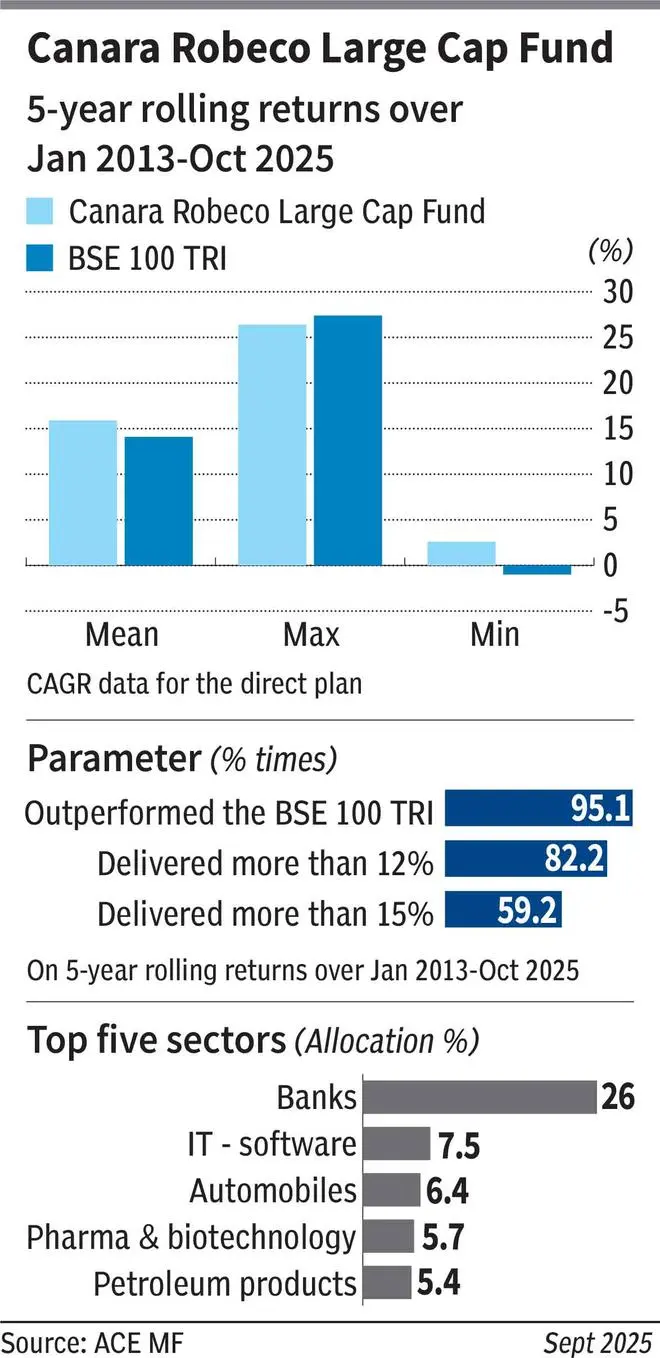

In this regard, Canara Robeco Large Cap (Canara Robeco Bluechip Equity earlier), with a 15-year track record is among the best performers in the category in terms of consistency in beating its benchmark BSE 100 TRI and delivering healthy returns.

Over the medium to long term, the fund has outperformed the BSE 100 TRI by 1-2 percentage points on a point-to-point basis.

In terms of consistency, the fund stands out. On five-year rolling returns from January 2013 to October 2025, the fund has beaten the BSE 100 TRI over 95 per cent of the time, placing it among the best in the category. The mean return over this period was a robust 15.9 per cent, while for the BSE 100 TRI, it is 14.1 per cent.

Also, on a five-year rolling basis over the above-mentioned period, the fund has delivered more than 12 per cent for 82.2 per cent of the time and over 15 per cent for a little shy of 60 per cent of the time.

Key ratios such as up/down capture (1.17), Sortino (0.55), Sharpe (0.35) and Treynor (1.4) are quite robust and among the best in the category.

This inference for the risk ratios is based on returns from October 2020 to October 2025.

Canara Robeco Large Cap always maintains its blue-chip focus with around 90 per cent or more investments made in such stocks. It rarely gets into mid-cap firms.

Banks have always been the fund’s favourite and this has especially been helpful given that the segment itself has done well over the past year or so.

The fund has juggled segments smartly and has caught the macro trends well. In 2023 and 2024, it pared exposure to FMCG companies as consumer demand started slowing.

In 2023, the scheme also managed to latch on to automobiles, and gain from the rally in the segment.

In recent portfolios, it has upped stakes in IT and pharma, as valuations turn comfortable and the segments turn the corner, albeit slowly.

Overall, the fund is a robust performer, with a combination of value and growth styles, manages risk well and delivers outperformance over the long term.

Balancing act

A simpler hybrid category that straddles only two asset classes – equity and debt – is also a great avenue for investors with a moderate risk appetite to park their Diwali bonus or at least a portion of it.

Balanced Advantage funds follow the above mandate and a select few have done exceedingly well in the dynamic markets over the past three-four years.

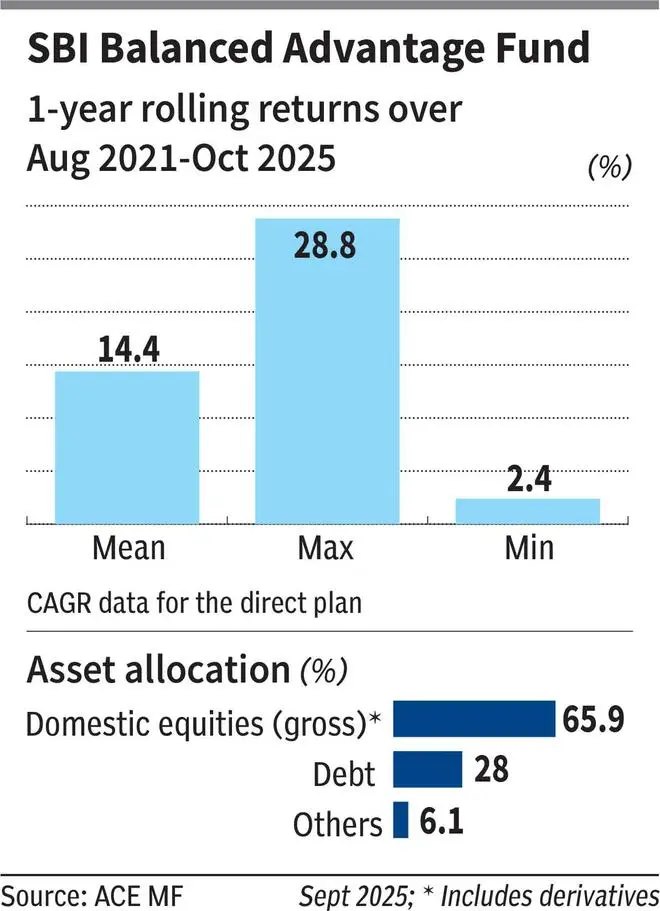

SBI Balanced Advantage fund: With a track record of over four years, it has been one of the best in the category and delivers optimal risk-adjusted returns.

On one-year rolling periods over the past four-odd years, the fund has delivered positive returns all the time.

It has given more than 10 per cent returns 57 per cent of the time and in excess of 12 per cent returns for 54 per cent of the time.

The mean return over the above-mentioned rolling periods and four-year time-frame, is a solid 14.4 per cent, which is among the best in the category.

The gross equity exposure of the fund is kept at least at 65 per cent. Derivative exposures are also taken for hedging.

The debt portion is generally restricted to highly-rated securities (A1+, AA and AAA) and G-Secs. Preference is seen for the medium duration maturity profile of four-five years.

Equity exposure is predominantly to large-cap stocks, with mild investments in mid- and small-caps.

Risk metrics are optimal and among the best in the category.

A lump-sum investment can be considered in the fund for medium-term goals of up to five years.

The fund also lends itself to systematic withdrawal plans (SWPs) for those wanting periodic income from an invested lump-sum.

Small-cap charmer

Investors looking for better returns, but without the ability to take inordinate risks, small-cap funds may normally not be easy to hold. However, small sums invested via the SIP route could still appease moderate risk appetites and reward well over 7-10-year timeframes.

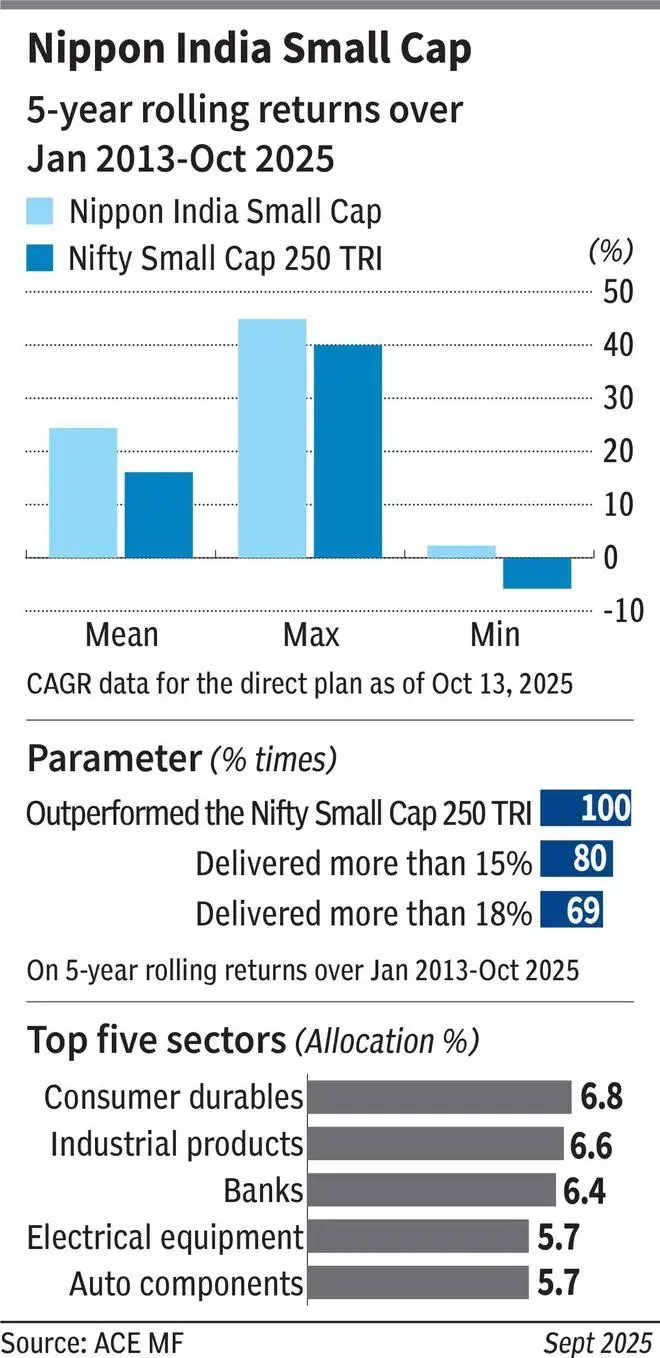

Nippon India Small Cap is a standout performer in the category with an extraordinary track record over the long term.

The scheme as a 15-year track record and has always been among the top few across equity fund categories.

Over the longer terms of five years or more, the fund has delivered 5-6 percentage points more than the Nifty Small Cap 250 TRI on a point-to-point basis.

Return consistency has been spectacular. On a five-year rolling returns basis from January 2013 to October 2025, the fund has outperformed its benchmark all the time (100 per cent). Nippon India Small Cap’s mean returns over the above rolling period and time horizon is a staggering 24.4 per cent, more than 8 percentage points higher than the Nifty Small Cap 250 TRI’s 16 per cent.

The fund has given more than 15 per cent return for 80 per cent of the times in a five-year rolling basis from January 2013 to October 2025 and more than 18 per cent return for 69 per cent of the time.

A monthly SIP for 10 years in the fund would have given 23.7 per cent (XIRR), while the benchmark would have yielded 18.6 per cent over the same period.

Key ratios such as up/down capture (1.36), Sortino (0.6), Sharpe (0.44), and Treynor (2.7) are among the best in the category, going by the five-year data from October 2020 to October 2025.

From a portfolio construction perspective, heavy diversification has held the key over the past few years as its asset size has risen sharply (over ₹66,000 crore).

Nippon India Small Cap fund sticks to its mandate of having at least 65 per cent of the portfolio in small-cap stocks. It also takes exposure to large- and mid-cap stocks, to the extent of 25-30 per cent of the portfolio depending on market conditions.

Another aspect to note is the number of stocks it holds. From over a 100, a few years ago, the fund now invests in 235 stocks (September 2025 portfolio) spread across market caps making it extremely well-diversified.

No concentration in individual stock exposures are seen and even individual sectors contribute much less than 10 per cent of the overall portfolio.

Growth at reasonable price seems to be the guiding philosophy of the fund.

Consumer durables (as demand revives), industrial products (holdings across markets), banks (best performers in recent times) and electrical equipment (burgeoning transmission & distribution industry) are main sector components of the recent portfolio.

Overall, it is a good fund to start long-term SIP investments (lump-sum investments are currently not allowed). A horizon of at least seven years or more is necessary to make the most of the fund.

Mid-cap outperformer

Another category that lends itself to SIP investing more than lumpsums is mid-cap funds.

The mid-cap funds segment is one of the toughest in terms of attempting to beat benchmark returns, that too consistently. Indeed, over the past 20 years, when rolling returns are taken for long periods of five years, mid-cap indices deliver among the highest, ahead of large or even small-caps.

Very few mid-cap funds tend to outperform over the long term.

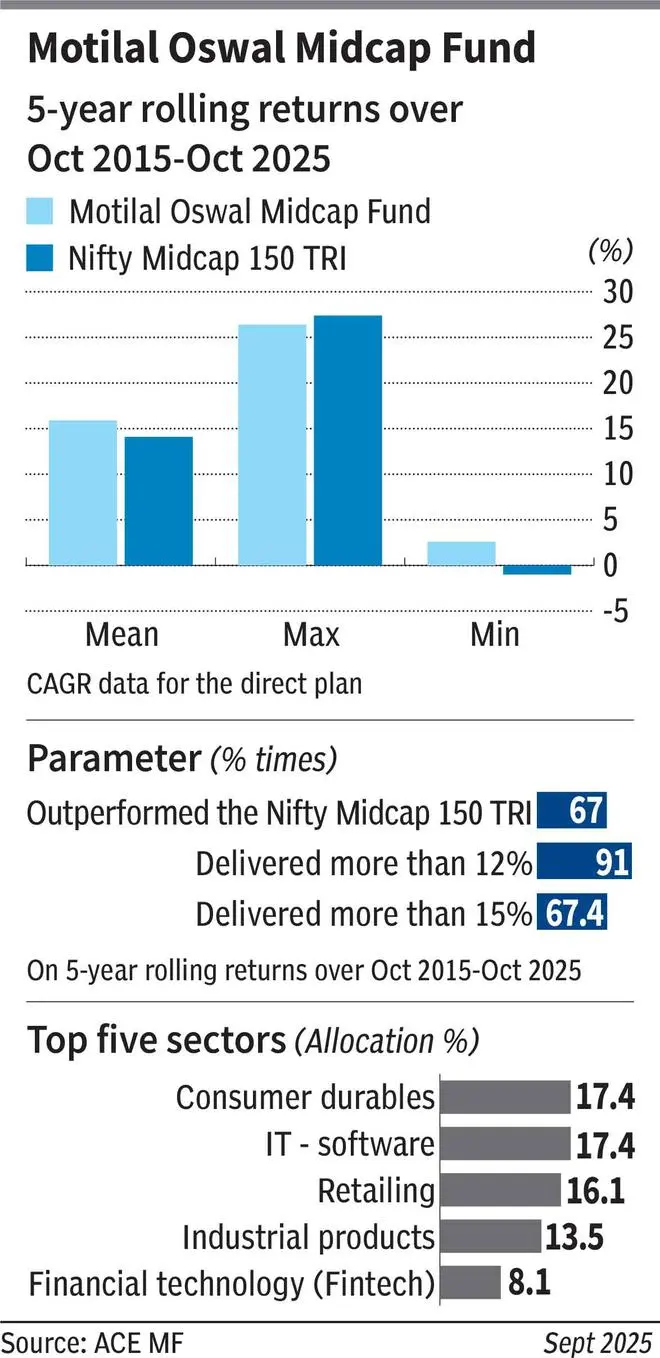

In this regard, Motilal Oswal Midcap Fund is a standout performer and has delivered solid returns over the 10-plus years of its operations.

When rolling five-year returns are taken over the 10-year period from October 2015 to October 2025, the fund has outperformed the Nifty Midcap 150 TRI during 67 per cent of the time. The fund has delivered mean returns of 21.7 per cent over the above-mentioned rolling period and timeframe, while the Nifty Midcap 150 TRI managed 20.4 per cent.

Motilal Oswal Midcap Fund gave more than 15 per cent for over 67.6 per cent of the 10-year period (October 2015 to October 2025) on a five-year rolling basis and gave more than 18 per cent returns nearly half the time.

A monthly SIP over the past 10 years would have given a return of 23.4 per cent (XIRR), while a SIP in the Nifty Midcap 150 TRI would have yielded 18.6 per cent over the same period.

Key ratios such as up/down capture (1.36), Sortino (0.64), Sharpe (0.46) and Treynor (2.6) are among the best in the category, going by the five-year data from October 2020 to October 2025.

As one of the largest mid-cap funds (assets of almost ₹35,000 crore), Motilal Oswal Midcap invests in mid-cap stocks to the tune of over 65 per cent of the portfolio. However, it also invests in large-caps to the extent of 15-20 per cent of portfolio.

The scheme also does not hesitate to take cash and debt positions to the tune of even 25 per cent or more during volatile markets or when suitable investable avenues aren’t available.

As a mid-cap fund, the focus is growth oriented. The portfolio can be concentrated at times when there are high-conviction bets.

Though its sector bets can seem off beat – IT as the top holding, for example – the stocks selection explains the choices.

So, even as frontline IT firms struggle with growth, the likes of Persistent Systems and Coforge (long-term holdings of the fund) have chartered a strong path and markets have rewarded these firms. Similarly, industrial product companies such as Polycab and KEI are held by the fund for long and have done well.

Manufacturing players such as Dixon Technologies, Kaynes Technology etc. figure in prominence.

There is a tilt towards nimble and new-age companies in the portfolio.

Overall, with a minimum of seven-plus years of time horizon, the fund can be a good addition to an investor’s portfolio when done via the SIP route.

Published on October 19, 2025