Report Overview

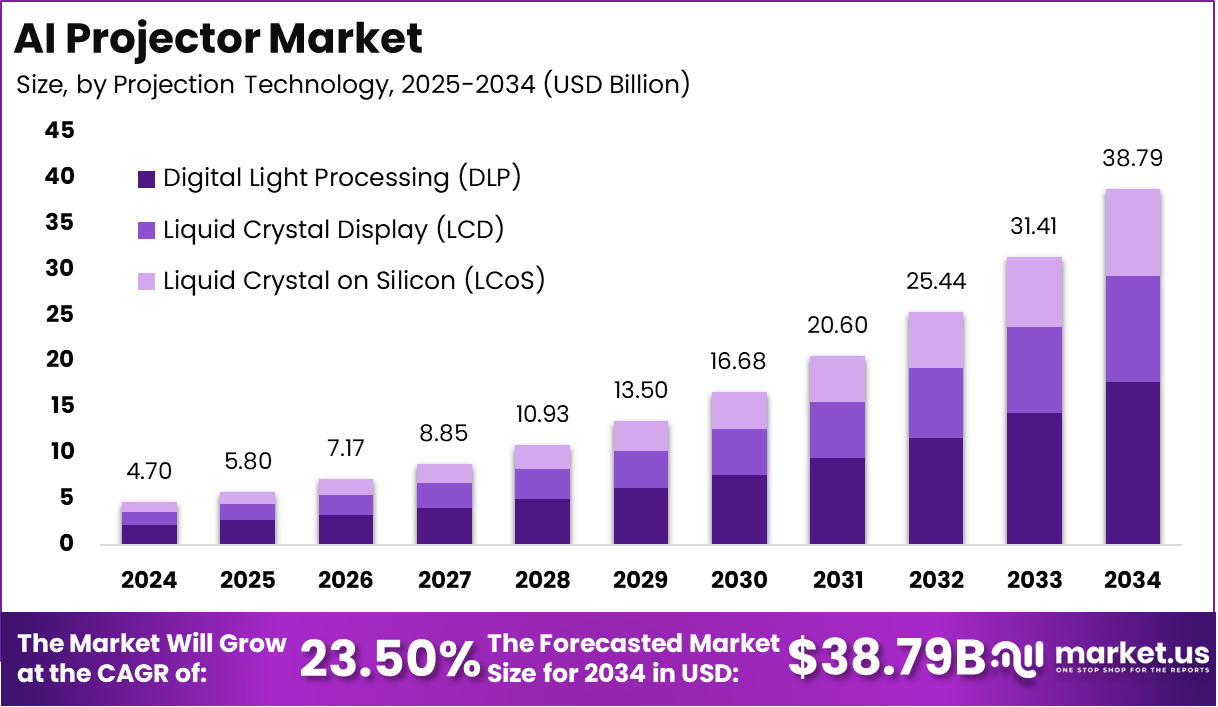

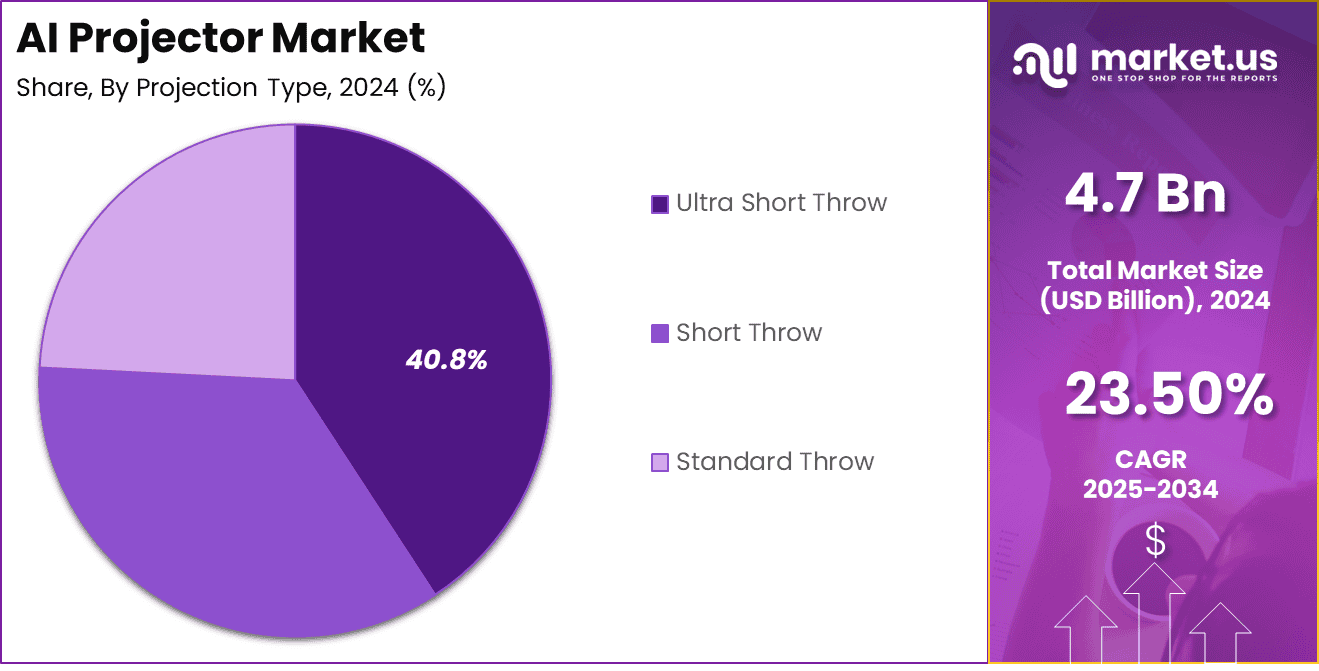

The AI Projector Market is witnessing rapid technological transformation, driven by the integration of artificial intelligence into visual and display systems. Valued at USD 4.7 billion in 2024, the market is projected to reach approximately USD 38.79 billion by 2034, expanding at a strong CAGR of 23.5%. AI projectors are redefining the visual experience by incorporating advanced image recognition, real-time optimization, and adaptive brightness and focus adjustment capabilities. These features enable intelligent projection based on environmental conditions, enhancing both visual clarity and energy efficiency. The technology is increasingly being adopted across education, corporate, entertainment, and residential sectors, where smart connectivity and automation are becoming essential.

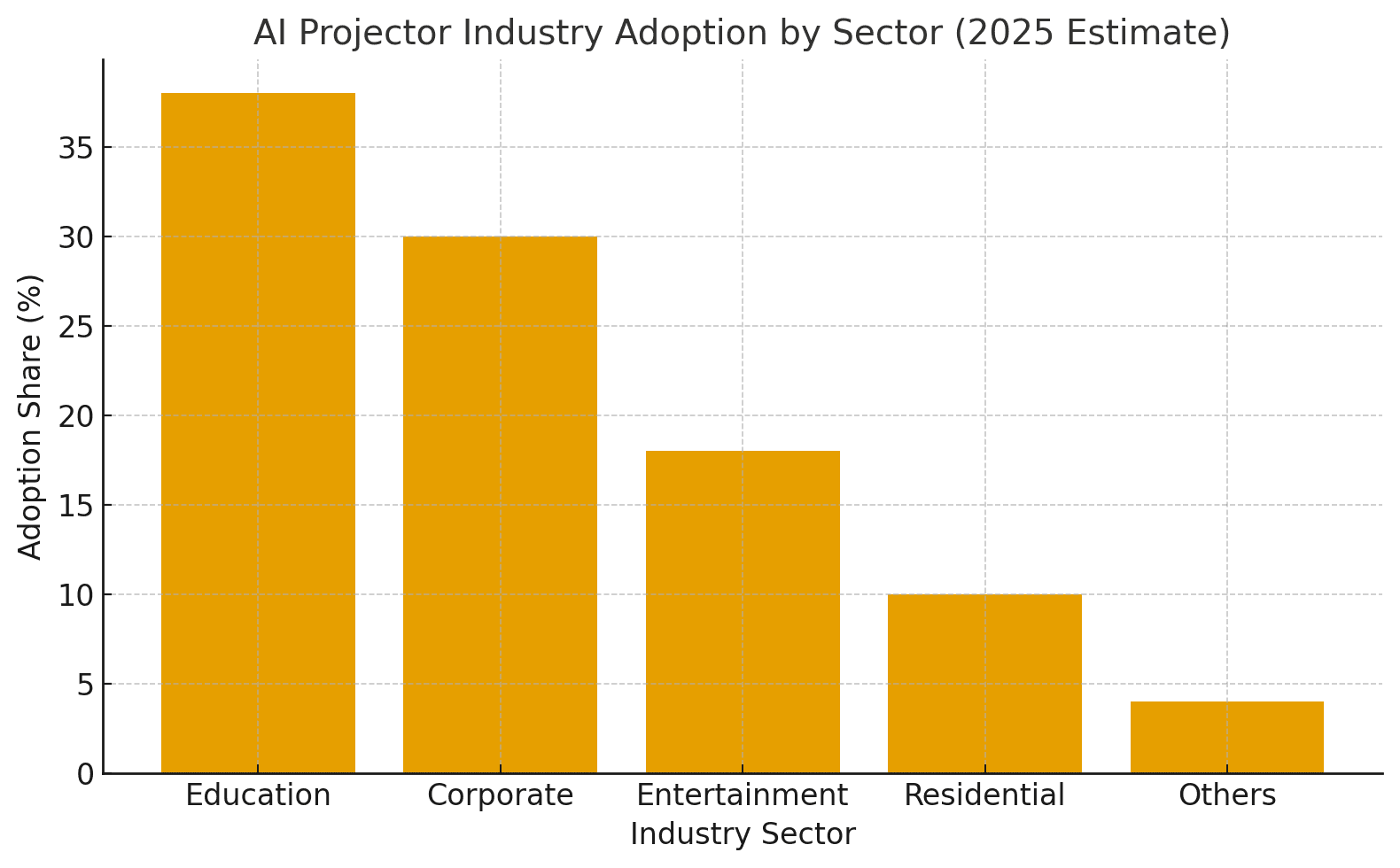

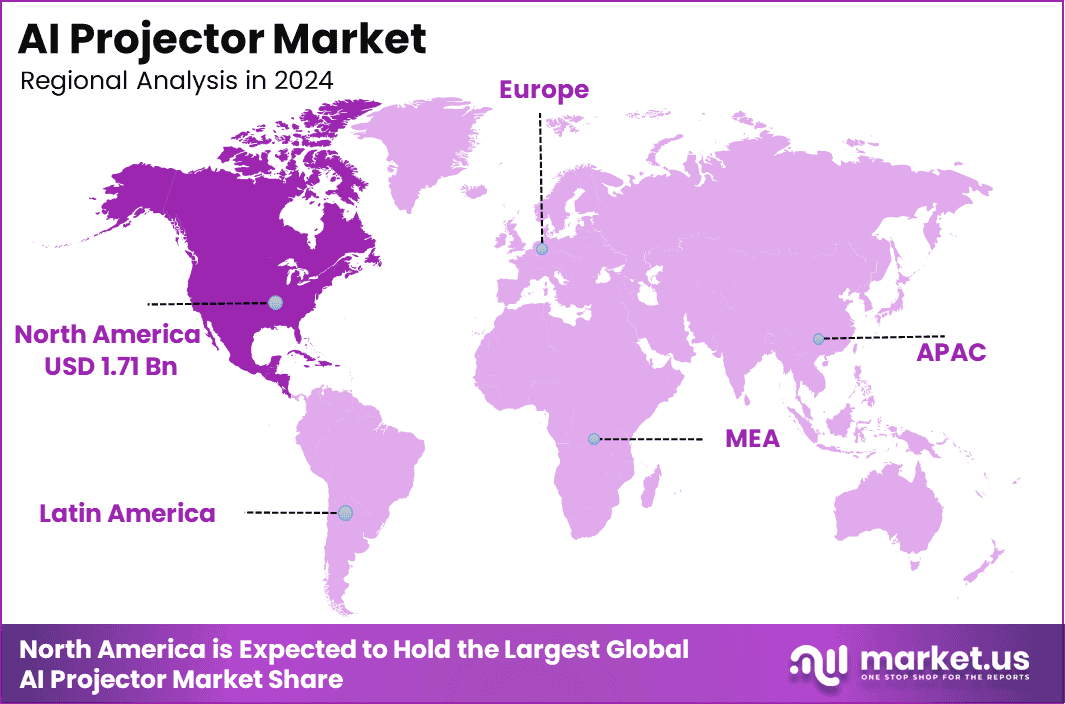

North America accounted for 36.4% of the global market in 2024, with a valuation of USD 1.71 billion, reflecting the region’s strong demand for high-tech display solutions and AI-driven automation. The United States, with a market size of USD 1.45 billion in 2024, is anticipated to grow to around USD 10 billion by 2034 at a CAGR of 21.3%. This growth is supported by the rising use of AI projectors in smart classrooms, virtual collaboration spaces, and home entertainment systems, positioning the US as a key driver of global market innovation.

The AI Projector Market is experiencing dynamic growth as artificial intelligence transforms traditional display systems into intelligent, adaptive visual solutions. AI-powered projectors use advanced algorithms to analyze environmental factors such as lighting, distance, and surface type, automatically optimizing image brightness, focus, and color contrast for superior visual quality. This intelligent automation enhances user experience across education, corporate, and entertainment sectors, where precision, efficiency, and interactivity are increasingly critical. By integrating voice recognition, gesture control, and real-time content adjustment, AI projectors are enabling seamless, hands-free operation and personalized viewing experiences.

The growing trend toward smart classrooms, immersive corporate presentations, and AI-enabled home theaters is fueling widespread adoption. Additionally, advancements in natural language processing and machine learning allow these projectors to interpret commands, suggest content, and adapt to user preferences. The convergence of AI with IoT connectivity and wireless ecosystems further expands their functionality, allowing integration with smart home devices and unified control platforms. Manufacturers are focusing on innovation to improve energy efficiency, portability, and long-term operational reliability. As digital transformation accelerates across industries, AI projectors are emerging as pivotal tools that bridge automation with high-quality visual communication, redefining the next generation of smart display technologies.

In late 2025, Roku launched the Aurzen Roku TV Smart Projector D1R Cube, a sub-$200 device that brings Roku’s TV OS, voice-control and smart-home integration into a portable projector format. This move signals the convergence of smart-home ecosystems and projection hardware, making higher-end features accessible at entry-level price points.

Meanwhile, consumer interest in AI-enabled smart projectors surged: one report shows that search volume for “4K Smart Projector” peaked in April 2025 at 100 (on Google Trends normalized scale) and unit sales on Amazon for home-theatre projectors reached 1,707 units in December 2024 for certain models. Analysts see this as a sign that premium display systems are shifting to embrace AI enhancements (e.g., image-auto-focus, lighting compensation, voice control).

On the funding side, a startup named BiMA (based in Munich) raised €500 in a pre-seed round in October 2025 to launch a “screen-free” immersive projector for children. Although not purely a business-class projector, it underscores investor interest in novel projection formats with AI/experience layers. Finally, hardware startup JMGO previewed an ultra-short-throw laser projector (model O2S Ultra) at CES 2025 (Q4 launch) that includes AI-driven brightness optimization even in sunlight. This marks a clear trend toward AI combined with premium optics and laser-based projection for advanced segments.

Key Takeaways

The global AI Projector Market is expanding rapidly, growing at a CAGR of 23.5% and is driven by increasing demand for intelligent projection systems in education, business, and entertainment applications.

North America led the global market with a 36.4% share, supported by early adoption of AI-enabled display technologies and strong investment in smart classrooms and corporate automation.

The United States accounted for a major share of the region with USD 1.45 billion in 2024 and is projected to reach USD 10.00 billion by 2034, registering a CAGR of 21.3%, reflecting robust demand across both commercial and consumer sectors.

By Projection Technology, the Digital Light Processing (DLP) segment dominated with 45.7% due to superior image clarity, brightness, and energy efficiency preferred in smart and professional environments.

By Projection Type, Ultra Short Throw projectors held 40.8% share, driven by compact design, minimal space requirements, and enhanced interactive display experiences.

By Dimension, 3D projectors accounted for 70.7%, showcasing rising demand for immersive and realistic visual experiences across the education and entertainment sectors.

By Interaction Type, Pen-based systems captured 65.4% market share, supported by the popularity of interactive learning tools in classrooms.

By Resolution, Full HD (1920×1080) projectors represented 48.6%, reflecting preference for high-definition visual output in both academic and corporate use.

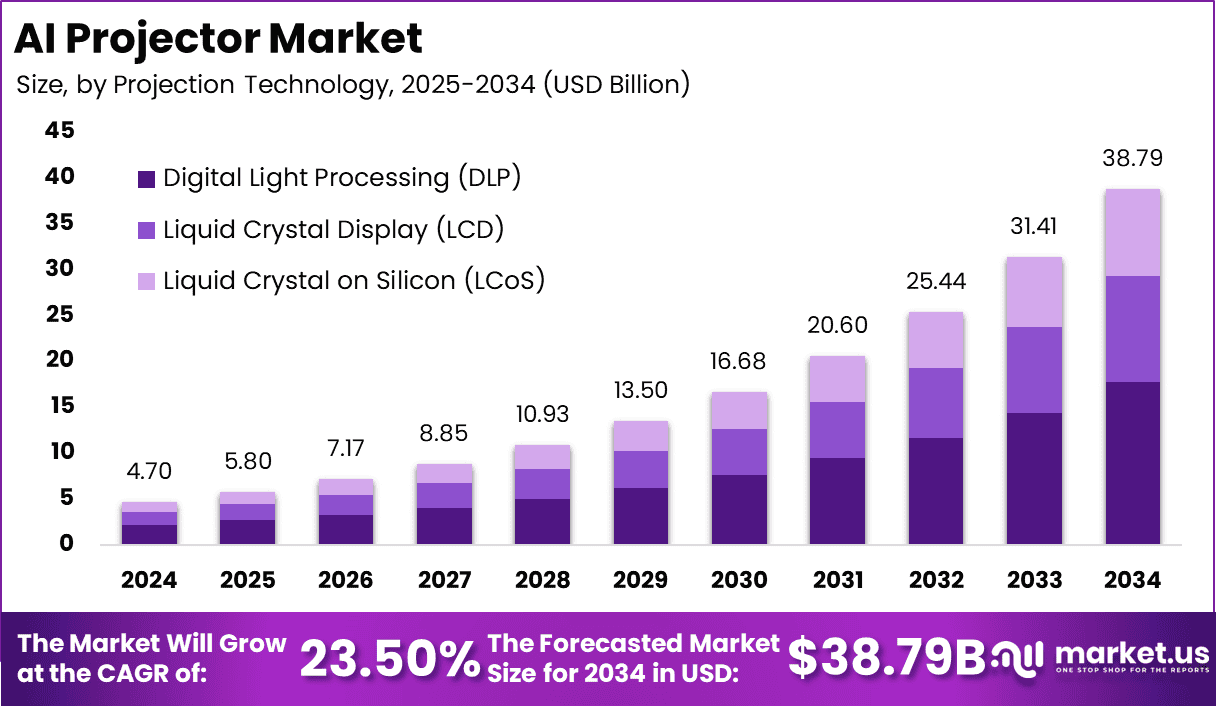

By Application, Interactive Learning accounted for 35.7%, emphasizing the growing integration of AI projectors in digital education platforms.

By End User, Educational Institutions held 32.8%, positioning the education sector as a primary growth driver in AI projector adoption worldwide.

Role of AI

Artificial intelligence plays a transformative role in advancing the capabilities of modern projectors, turning them from simple display devices into intelligent visual systems. AI-powered projectors use advanced algorithms to automatically adjust brightness, focus, and color balance based on room lighting and distance, ensuring optimal image quality in any environment.

Through machine learning and computer vision, these projectors can recognize objects, faces, and gestures, enabling real-time interaction and adaptive presentations without manual calibration. Voice recognition and natural language processing further enhance convenience, allowing users to control settings or launch applications hands-free.

AI also enhances personalization by learning user preferences and usage patterns to recommend modes, display formats, and energy settings. In educational and corporate settings, AI projectors analyze content to highlight key points or generate summaries for improved engagement. Integration with IoT systems enables synchronization with smart devices, creating unified and efficient workspace environments.

In entertainment, AI enhances 3D visualization and motion tracking, providing a more immersive experience. Moreover, AI contributes to predictive maintenance by monitoring performance data and alerting users before potential issues arise. Overall, AI transforms projectors into intelligent, adaptive, and interactive tools that redefine visual communication and user experience across industries.

AI Industry Adoption

Adoption of smart and AI-enhanced projectors is gaining strong traction, particularly in the education and corporate sectors. For instance, the global interactive projector market overlaps with AI-enabled display technologies. In North America, the U.S. has become a leading adopter, driven by hybrid learning models, digital‐classroom investments, and enterprise training facilities adopting interactive or AI-enhanced projection solutions.

Large‐scale educational institutions and enterprises are among the early adopters: schools are deploying ultra-short-throw and laser projectors with interactive touch, voice, and gesture features; corporations are integrating projection units into smart meeting rooms to facilitate collaboration across remote/hybrid teams. Meanwhile, emerging markets inthe Asia-Pacific are accelerating adoption as governments and institutions invest in digital infrastructure and indoor/outdoor projection systems.

However, overall adoption of fully AI-enabled projectors is still in the relatively early stages compared with other display technologies. Some firms and institutions are cautious because of installation complexity, interoperability concerns, and the relative premium cost. As hardware prices decline and more content/interactive workflows emerge, analysts expect adoption to broaden significantly over the next 3-5 years.

Analysts’ Viewpoint

From the analyst’s lens, the AI Projector market presents a compelling story of transformation and opportunity. AI-enabled projectors are moving beyond traditional projection devices into intelligent visual engines that dynamically adapt to environments, deliver interactive experiences, and bridge the gap between displays and smart workflows.

Analysts believe that the combination of rising demand for immersive learning, hybrid working spaces, and home entertainment will continue to fuel adoption. In particular, the education sector, with its push for digital classrooms and interactive learning, is viewed as a cornerstone driver. Corporations upgrading huddle rooms and executive suites also contribute substantially.

However, analysts caution that the growth path isn’t entirely smooth. The market demands strong hardware-software integration, ensuring AI features deliver measurable value (not just gimmicks) such as automatic focus, ambient light adjustment, and real-time content adaptation.

Cost, installation complexity, and compatibility with existing infrastructure are noted as meaningful obstacles when buyers weigh replacement or upgrade decisions. Regional variations matter: North America and mature markets are frontline adopters, while growth in Asia-Pacific, Latin America, and MEA requires tailored solutions, localisation, and more modest budgets.

US Market Size

The United States represents one of the most dynamic and innovation-driven markets in the global AI projector landscape. Valued at USD 1.45 billion in 2024, the market is projected to reach around USD 10.00 billion by 2034, expanding at a strong CAGR of 21.3%.

This rapid growth is primarily attributed to the country’s advanced technological ecosystem, widespread adoption of AI-enabled devices, and increasing integration of smart display solutions across education, corporate, and residential sectors. The demand for intelligent projection systems is rising as organizations and consumers seek enhanced interactivity, automation, and energy efficiency in visual communication.

In the education sector, AI projectors are being widely deployed in digital and hybrid classrooms to support interactive learning and real-time content engagement. Corporate offices are also investing heavily in AI-driven presentation systems for smart meeting rooms and collaborative environments.

Additionally, the home entertainment segment is witnessing significant growth as consumers embrace AI projectors for immersive 3D and voice-controlled experiences. Major manufacturers in the US are focusing on integrating AI with IoT and voice assistants to deliver seamless smart-home compatibility. Overall, the US market is expected to remain a major contributor to global innovation and revenue growth in AI projector technologies over the next decade.

Investment and Business Benefits

Investing in AI-powered projectors offers clear business advantages. For example, AI features such as automatic calibration, brightness and focus optimization, and image up-scaling significantly improve visual quality and reduce the need for manual setup. In educational settings, this translates into more engaging interactive learning experiences, while in corporate or home-theatre environments it means fewer interruptions, simplified installation, and higher user satisfaction.

From a cost-perspective, AI projectors help lower operational overhead. Automatic adjustments to ambient light and content type help extend lamp life (or laser or LED module life), cut energy consumption, and reduce maintenance. This improved total cost of ownership makes them a compelling choice for institutions with tight budgets.

Another key benefit is differentiation and competitive positioning. Organisations that deploy smart display systems signal innovation and future-readiness—from smart classrooms to immersive boardrooms—enhancing brand reputation and stakeholder perception. For manufacturers, embedding AI features allows premium pricing, recurring services (firmware upgrades, analytics) and stronger customer loyalty.

Finally, investment in AI-projectors enables forward-looking business models. Beyond the hardware sale, vendors can bundle analytics, content-optimisation services, remote diagnostics and IoT-connected management. This creates additional revenue streams and aligns with the broader trend toward “smart” devices rather than just “smart hardware”.

By Projection Technology

The Digital Light Processing (DLP) segment dominated the AI projector market with a 45.7% share, driven by its superior image quality, color accuracy, and high contrast ratios compared to other projection technologies. DLP projectors use micro-mirror technology that ensures smooth motion, reduced image blur, and consistent brightness, making them ideal for classrooms, conference rooms, and home entertainment systems. Their compact design, longer lifespan, and lower maintenance requirements further enhance adoption in both portable and fixed installations.

Liquid Crystal Display (LCD) projectors hold a notable share due to their affordability and strong color reproduction, making them suitable for educational and small business applications. Liquid Crystal on Silicon (LCoS) projectors, while more expensive, offer the highest image precision and are gaining traction in high-end and professional visualization systems. However, the balance of performance, cost efficiency, and reliability continues to position DLP technology as the preferred choice in the AI projector market.

By Projection Type

The Ultra Short Throw segment accounted for 40.8% of the AI projector market, emerging as the leading projection type due to its ability to display large images from a very short distance. These projectors are increasingly preferred in educational institutions, corporate environments, and home entertainment setups where space efficiency and easy installation are critical. The combination of AI technology with ultra-short throw optics allows automatic keystone correction, focus adjustment, and wall detection, delivering distortion-free visuals even in compact spaces. Their minimal shadow interference and user-friendly setup make them ideal for interactive and collaborative applications.

Short-throw projectors are gaining steady adoption, particularly in mid-sized classrooms and meeting rooms, offering flexibility with moderate projection distances while maintaining image clarity. Standard Throw projectors continue to serve large auditoriums and theaters where long-distance projection is required. However, the ongoing shift toward compact, AI-enhanced, and interactive display environments positions the Ultra Short Throw segment as the key growth driver in the AI projector market.

By Dimension

The 3D segment dominated the AI projector market with a 70.7% share, highlighting the growing demand for immersive and interactive visual experiences across education, entertainment, and corporate sectors. AI-enabled 3D projectors provide lifelike depth perception and realistic image rendering by analyzing visual data in real time and adjusting brightness, focus, and color balance automatically.

These capabilities are especially valuable in virtual classrooms, simulation-based training, and gaming environments where enhanced visualization improves engagement and comprehension. The combination of 3D projection with AI algorithms allows for dynamic scene adaptation, reducing motion blur and ensuring optimal viewing from different angles.

In contrast, 2D projectors maintain relevance in traditional display applications where simplicity and cost-effectiveness are prioritized, particularly in small offices and residential settings. However, as industries increasingly embrace interactive and experiential technologies, 3D AI projectors are expected to remain the preferred choice, driving innovation and redefining visual communication standards globally.

By Interaction Type

The Pen-based segment accounted for 65.4% of the AI projector market, establishing its dominance due to its effectiveness in interactive learning and presentation environments. Pen-based AI projectors allow users to write, draw, and annotate directly on projected surfaces, enhancing collaboration and engagement in classrooms and corporate meeting rooms. The integration of AI enables precise gesture recognition, automatic calibration, and content saving, improving usability and interaction accuracy. These systems are especially popular in educational institutions where digital learning tools are increasingly replacing traditional whiteboards.

Touch-based projectors, while growing steadily, are more commonly used in collaborative workspaces and entertainment applications where finger-based control and multitouch gestures offer flexibility. However, pen-based systems continue to hold a larger market share because of their superior writing precision, lower error rates, and better compatibility with structured learning or presentation environments. The ability to combine AI-driven handwriting recognition, object detection, and smart content sharing further strengthens the position of pen-based projectors as the preferred choice for professional and educational use cases.

By Resolution

The Full HD (1920×1080) segment held the largest share of 48.6% in the AI projector market, reflecting strong demand for high-resolution visual quality across educational, corporate, and home entertainment applications. Full HD projectors strike the ideal balance between image clarity, performance, and cost, making them the most widely adopted resolution standard. The integration of AI enhances these systems with features such as automatic color correction, ambient light adjustment, and intelligent content scaling, ensuring optimal projection quality across varied environments. Their compatibility with multiple devices and streaming platforms further supports widespread adoption in both professional and personal use cases.

HD (1280×720) projectors maintain steady demand among budget-conscious consumers and small institutions, offering reliable performance for basic presentations and learning purposes. WXGA (1280×800) models are favored in educational setups for their broader aspect ratio, suitable for displaying interactive learning content. Meanwhile, 4K and above projectors are gaining traction in premium segments, offering ultra-high-definition visuals ideal for immersive experiences in home theaters and design applications. However, the affordability, versatility, and AI integration advantages continue to position Full HD projectors as the dominant choice in the market.

By Application

The Interactive Learning segment accounted for 35.7% of the AI projector market, emerging as the leading application area due to the increasing adoption of digital education and smart classroom technologies worldwide. AI-powered projectors are transforming traditional teaching environments by enabling real-time interaction, intelligent content recognition, and adaptive display optimization based on classroom lighting and audience engagement.

These systems allow teachers and students to annotate, highlight, and manipulate content directly on the projection surface, promoting active learning and improved retention. The integration of AI-driven voice and gesture recognition further enhances collaboration and accessibility in educational settings.

Presentation and Collaboration applications are gaining momentum in corporate environments where businesses are adopting AI-enabled projectors to improve meeting productivity and hybrid communication efficiency. Interactive Signage and Display solutions are expanding across retail and public spaces for dynamic advertising and customer engagement.

Simulation and Training applications, particularly in aviation, defense, and healthcare, are leveraging AI projection for realistic visualization and scenario-based instruction. Entertainment and Gaming segments are also experiencing growth with AI-enhanced 3D and motion-sensing capabilities that deliver immersive experiences. Overall, interactive learning continues to dominate as institutions prioritize smart education technologies to foster engagement and digital transformation.

By End User

The Educational Institutions segment dominated the AI projector market with a 32.8% share, driven by the rapid digital transformation of classrooms and the widespread adoption of smart learning environments. Schools, colleges, and universities are increasingly integrating AI-enabled projectors to enhance interactive teaching, real-time content visualization, and collaborative participation.

These projectors support pen-based and touch-based input, allowing educators and students to annotate, draw, and engage with multimedia content directly on projected surfaces. The ability of AI systems to automatically adjust brightness, focus, and contrast according to classroom conditions further improves learning experiences while reducing instructor workload.

Corporate Enterprises represent the second-largest end-user segment, with growing demand for AI projectors in smart meeting rooms and collaborative workspaces that support hybrid communication. Government and Public Sector institutions are deploying AI-based projection systems for digital training, public awareness programs, and data visualization.

Healthcare Providers are adopting them for medical training and 3D diagnostic presentations, while Retail and Hospitality sectors use AI projectors for dynamic visual marketing and immersive guest experiences. Museums and Exhibition Centers are increasingly employing AI projectors to create interactive displays and virtual exhibitions. However, the strong emphasis on digital education continues to make Educational Institutions the most prominent end-user group in the global market.

Key Market Segments

By Projection Technology

Digital Light Processing (DLP)

Liquid Crystal Display (LCD)

Liquid Crystal on Silicon (LCoS)

By Projection Type

Ultra Short Throw

Short Throw

Standard Throw

By Dimension

By Interaction Type

By Resolution

HD (1280×720)

Full HD (1920×1080)

WXGA (1280×800)

4K and Above

By Application

Interactive Learning

Presentation and Collaboration

Interactive Signage and Display

Simulation and Training

Entertainment and Gaming

By End User

Educational Institutions

Corporate Enterprises

Government and Public Sector

Healthcare Providers

Retail and Hospitality

Museums and Exhibition Centers

Others

Regional Analysis

North America accounted for 36.4% of the global AI projector market, with a total value of USD 1.71 billion in 2024, establishing itself as the dominant regional market. The region’s growth is driven by strong adoption of smart technologies, widespread digital transformation initiatives, and the presence of major AI hardware manufacturers and innovators. Educational institutions across the US and Canada are increasingly implementing AI-powered projectors to modernize classrooms, promote interactive learning, and enhance student engagement. The region’s corporate sector also shows robust adoption, with companies using AI-integrated projectors for smart conferencing, hybrid meetings, and collaborative visualization.

Within North America, the United States leads the market with a 2024 valuation of USD 1.45 billion and is projected to reach approximately USD 10.00 billion by 2034, growing at a CAGR of 21.3%. The US market’s expansion is fueled by continuous innovation in AI display systems, integration with IoT and voice-controlled ecosystems, and the increasing demand for high-definition, automated projection systems in education, enterprise, and home entertainment. The combination of advanced infrastructure, strong consumer purchasing power, and rapid adoption of next-generation display technologies positions North America, particularly the US, as the central hub for AI projector development and deployment.

Regional Analysis and Coverage

North America

Europe

Germany

France

The UK

Spain

Italy

Russia

Netherlands

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Singapore

Thailand

Vietnam

Rest of Latin America

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Rest of MEA

Driving Factors

The AI-projector market is propelled by rapid advances in hardware and smart algorithms. Enhanced image processing, voice/gesture control, ambient-light sensing, and auto-focus project a smarter, more intuitive experience.

The rise of hybrid teaching and corporate meeting rooms accelerates demand for interactive visual systems, while home entertainment upgrades (4K, ultra-short throw, immersive 3D) open further growth. Governments and institutions increasingly invest in smart classrooms, and manufacturers embed AI/IoT features for connectivity and convenience. Together, these forces drivethe adoption of AI-enabled projectors as key tools for communication, education, collaboration, and entertainment.

Restraint Factors

Despite its growth potential, the AI-projector market faces significant restraints. The high upfront cost of advanced models (AI features, laser/LED light source, ultra-short throw optics) can deter budget-conscious buyers. The complexity of installation, calibration, and integration with existing AV ecosystems increases total time and cost.

Alternative display technologies (large LED/OLED screens, interactive flat panels) offer simpler deployment and compete directly. Maintenance and lamp-replacement costs remain a concern for legacy systems. Further, in some regions, infrastructure (power, projection surface, ambient lighting control) is weak, slowing the deployment of premium AI-projectors. These factors collectively restrain faster, broader market adoption.

Growth Opportunities

The AI-projector market holds sizable growth opportunities. Penetration in emerging geographies (Asia-Pacific, Latin America, MEA) remains low, offering a broad white-space for expansion. The education sector—moving toward digital and interactive learning—presents a strong use-case for AI-enhanced projectors, especially ultra-short throw and interactive models.

Enterprise and training/simulation applications (healthcare, government, corporate) also demand richer visual tools. Integration with cloud, analytics, and content services allows manufacturers to move beyond hardware into recurring-revenue models. 3D, gaming, VR/AR-linked projection, and smart-home ecosystems represent further premium segments for growth.

Challenging Factors

Key challenges could slow momentum in the AI-projector arena. Ensuring reliable AI performance (accurate gesture/pen recognition, ambient compensation, multilingual support) demands ongoing R&D and can raise costs. The fragmentation of software/firmware ecosystems and the need for seamless integration across multiple devices/platforms complicates adoption.

Buyers may struggle to demonstrate clear ROI from “smart” features versus traditional projectors. Supply-chain constraints (semiconductors, optics), rapid obsolescence of tech, and competition from substitute display tech (smart TVs, flat panels) also represent headwinds. Vendors must deliver compelling value, usability, and ecosystem support to overcome these challenges.

Competitive Analysis

Major established manufacturers such as Seiko Epson Corporation and BenQ Corporation continue to dominate the landscape, each leveraging deep R&D capabilities, broad product portfolios (including laser, ultra‐short throw and interactive models), and global distribution networks. A recent report indicates that Seiko Epson and BenQ collectively account for over 35% of market share. Their strength lies in trusted brand recognition, extensive service infrastructure, and strong positions in the education and corporate segments.

Mid-tier players such as Optoma Technology Inc. and Touchjet Inc. differentiate themselves by focusing on niche segments such as ultra-short-throw, portable interactive systems, or hybrid learning models. For instance, Optoma has been cited as a leading DLP projector manufacturer and is known for innovation in high-performance display technologies.

Meanwhile, technology conglomerates such as Dell Technologies Inc. and LG Electronics offer integrated solutions (projector + collaboration platforms + service) to tap enterprise demand for smarter meeting and classroom environments. The involvement of players like Panasonic Corporation and Barco N.V. further raises competitive intensity particularly in large‐venue and high-end projection segments—these firms specialise in high brightness, laser systems, and 3D/immersive installations.

Overall, the competitive environment features a tiered structure: incumbents with scale and breadth (Epson, BenQ), niche innovators pushing feature differentiation (Optoma, Touchjet), and ecosystem players bundling hardware with services (Dell, LG). Success in this market increasingly depends on offering AI-enabled features (auto-focus, ambient adjustment, interaction), ultra-short-throw form factors, bundled software/analytics, and strong after-sales support. Vendors that fail to move beyond hardware-only offerings risk being squeezed by smarter, software-driven competitors.

Top Key Players in the Market

Seiko Epson Corporation

BenQ Corporation

Touchjet Inc.

Dell Technologies Inc.

Optoma Technology Inc.

Panasonic Projector & Display Corporation

LG Electronics

Otek World

Barco

Aytexcel Pvt Ltd

Other Major Players

Major Developments

January 2025: JMGO Introduces Mini Triple-Laser AI Projector Series

At CES 2025, JMGO showcased its new N1S 4K, N1S SE and N1S Nano projectors, featuring triple-laser systems and built-in AI functionality. The N1S 4K model (~187×165×191 mm) launched globally in March 2025 and delivers 1,200 CVIA lumens brightness, BT.2020 color gamut coverage and AI-driven gimbal adjustment for flexible use.

July 2025: Seiko Epson Corporation Partners with Bose Corporation to Develop Projectors with “Sound by Bose

Epson announced a new series of projectors co-developed with Bose, set to hit the U.S. and Chinese markets in September 2025. The collaboration melds Epson’s projection hardware strengths with Bose’s audio innovation to offer immersive visual and sound experiences.

July 2025: Panasonic Projector & Display Corporation Sale-Off Collapses, Business Retained

Panasonic’s proposed sale of its projector business (estimated ≈ USD 800 million) to ORIX Corporation was terminated in July 2025. Panasonic will retain its projection division as a wholly-owned subsidiary under Panasonic Connect, reaffirming its commitment to the projector unit and its MEVIX sub-brand.

Report Scope