1h agoThu 23 Oct 2025 at 7:52pmMarket snapshotASX futures: +0.6% 9,052 points

Australian dollar: +0.4% 65.13 US cents S&P 500: +0.6% to 6,738 pointsNasdaq: +0.9% to 22,941 pointsDow Jones: +0.3% to 46,734 pointsFTSE: +0.7% to 9,578 pointsEuroStoxx 600: +0.4% to 574 pointsSpot gold: +1.7% to $US4,136/ounceBrent crude: +5.2% to US65.83/barrel Iron ore: +0.6% $US104.8/tonne Bitcoin: +1.9% to $US110,076

Values approx. at 7:37am AEDT.

19m agoThu 23 Oct 2025 at 9:16pmVIDEO: BHP hits out at the government as iron ore negotiations with China continue

I went along to BHP’s annual general meeting in Melbourne yesterday. It was the mining giant’s first AGM held in the city since 2017.

It was also the first under new chair Ross McEwan, the former NAB chief executive.

Here’s a quick wrap of what went down:

Loading…38m agoThu 23 Oct 2025 at 8:57pmA closer look at the S&P 500

Here’s a look at where things landed on Wall Street’s benchmark index overnight.

The S&P 500 added 0.6% to close at 6,738.

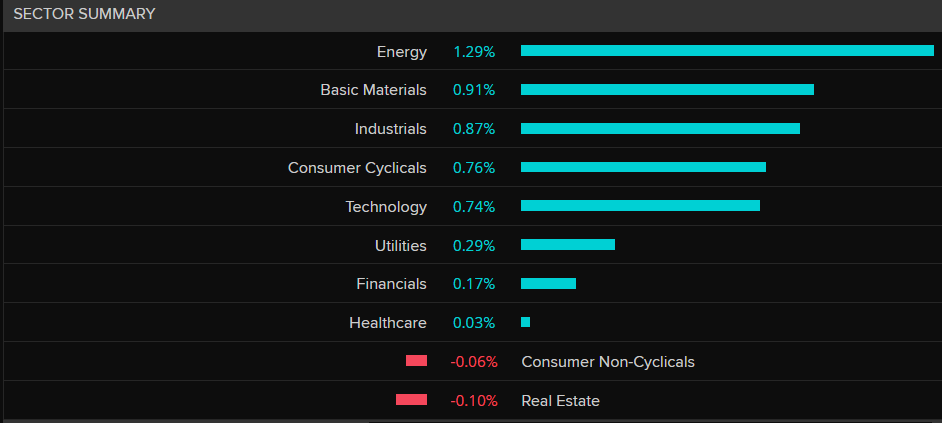

Sector-wise, energy finished on top. Real estate was the biggest loser.

S&P 500 sector summary (LSEG)

S&P 500 sector summary (LSEG)

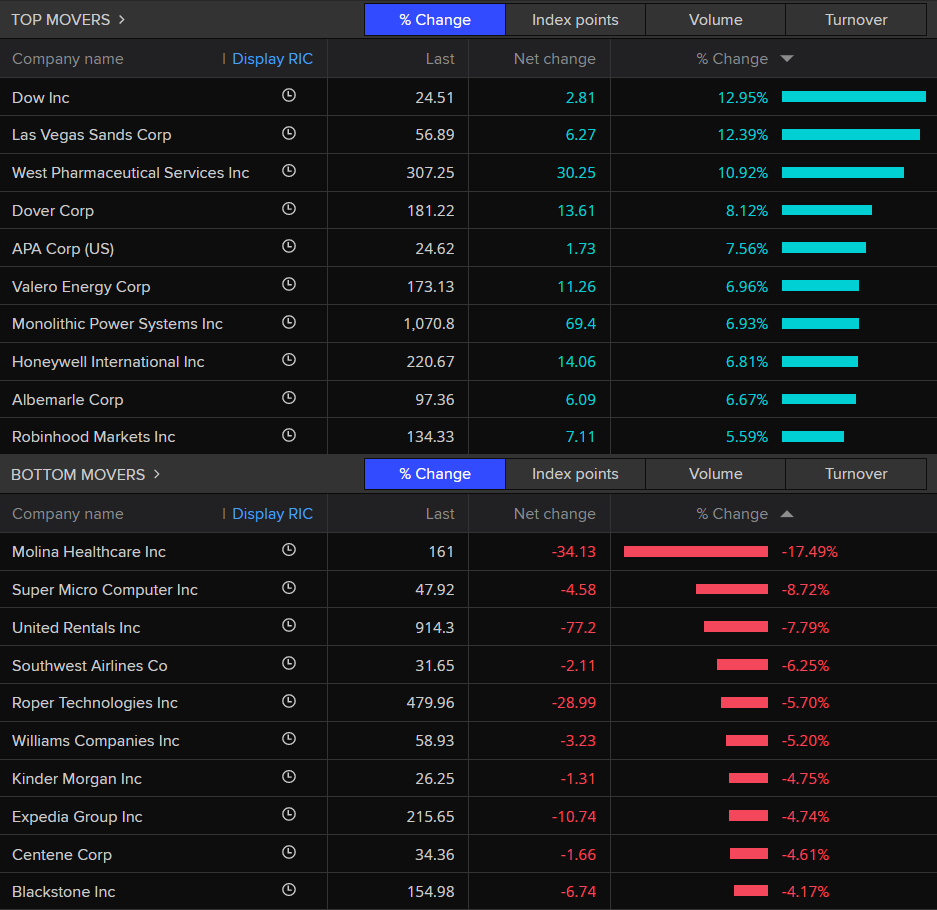

Top and bottom movers:

S&P 500 top and bottom movers (LSEG)1h agoThu 23 Oct 2025 at 8:18pmUS stocks up on tech, while Trump’s plan to meet Xi provides a late morale boost

S&P 500 top and bottom movers (LSEG)1h agoThu 23 Oct 2025 at 8:18pmUS stocks up on tech, while Trump’s plan to meet Xi provides a late morale boost

US stocks have closed higher, led by gains in big tech as investors bought back in following a run of strong earnings results.

US President Donald Trump’s announcement late on Thursday (US time) that he planned to meet Chinese President Xi Jinping next week as part of a trip to Asia also lifted investor morale.

The S&P 500 added 0.6% to close at 6,738, while the Dow Jones Industrial Average climbed by 0.3% to 46,734.

The Nasdaq Composite outperformed, up 0.9% to 22,941, boosted by gains in Nvidia, Broadcom and Amazon. A 3% jump in another key AI player, Oracle, also helped lift the broader market.

1h agoThu 23 Oct 2025 at 8:10pmOil surges 5% after US sanctions Russian firms Rosneft, Lukoil

Oil prices have surged after the US imposed fresh sanctions on Russian oil producers Rosneft and Lukoil in a move that’s rattled global energy markets and pushed prices to a two-week high.

Brent crude rose 5.4% to $US65.99 a barrel, while US West Texas Intermediate gained 5.6% to $US61.79. That’s the biggest one-day jump for both of them since June.

“The announcement of sanctions by the US on Rosneft and Lukoil is a major escalation in the targeting of Russia’s energy sector and could be a big enough shock to flip the global oil market into a deficit next year,” David Oxley from Capital Economics said.

The sanctions have prompted refiners in China and India, which are key buyers of Russian crude, to consider cutting imports to avoid breaching Western banking rules. Several Chinese state-owned oil majors have already suspended purchases, providing further support for prices.

US diesel futures also jumped nearly 7%, widening refining margins to their highest since February.

“Refineries in China and India will need to seek alternative suppliers,” Ole Hansen from Saxo Bank said.

Russian President Vladimir Putin said the measures were “an attempt to put pressure on Russia”, but insisted “no self-respecting country … ever decides anything under pressure”.

Analysts say the impact will depend on how quickly Russia can find new buyers. UBS’s Giovanni Staunovo says India’s refiners, including Reliance Industries, are already preparing to scale back purchases.

Britain and the European Union have also tightened restrictions, adding new Chinese refiners to their Russia sanctions lists.

– with reporting from Reuters

1h agoThu 23 Oct 2025 at 7:40pm

Good morning

The Australian share market is poised to open higher on Friday, following gains on Wall Street.

US investor sentiment was buoyed by news that Donald Trump plans to meet with China’s president, while his sanctions on Russia pushed oil prices higher.

Happy Friday everyone. I’ll bring you more updates shortlty.

Loading

ASX futures: +0.6% 9,052 points

ASX futures: +0.6% 9,052 points