Report Overview

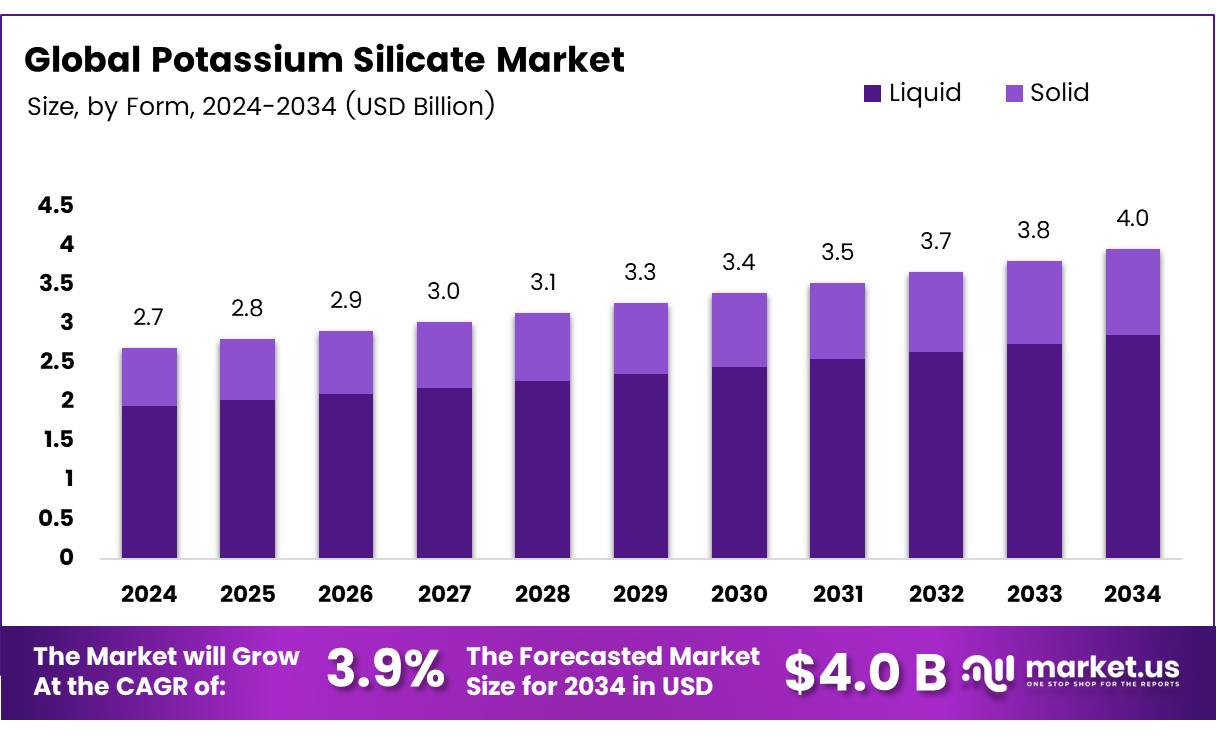

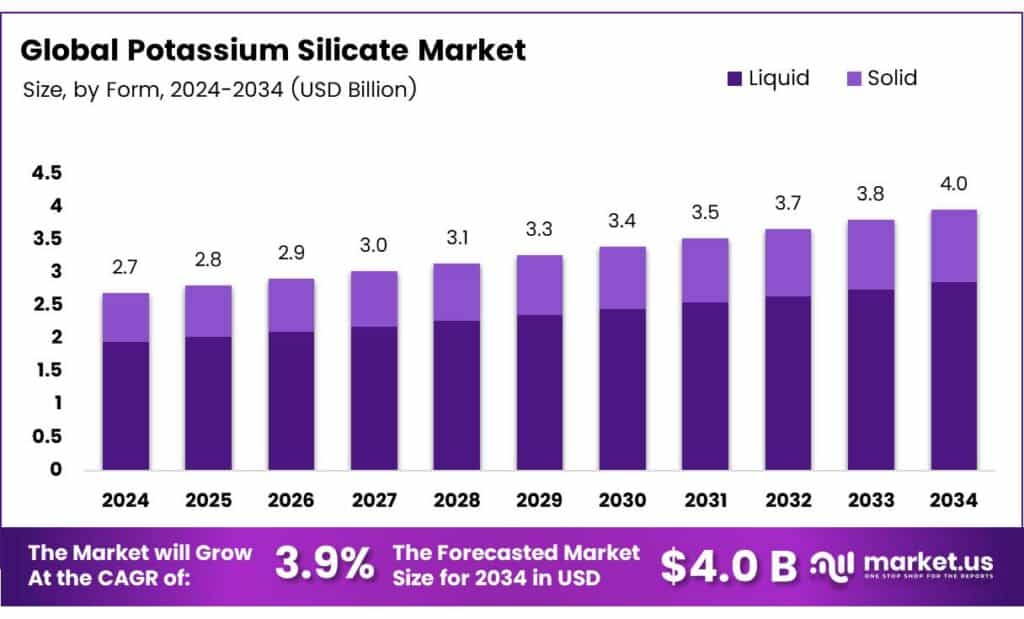

The Global Potassium Silicate Market size is expected to be worth around USD 4.0 Billion by 2034, from USD 2.7 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

Potassium silicate is produced by solubilizing silica sand in water through a chemical reaction involving a potassium source, such as potassium carbonate or potassium hydroxide, and magnesium hydroxide. The mixture is calcined at approximately 900°C to create a slow-releasing potassium fertilizer containing over 20% citrate-soluble potassium. This compound is particularly beneficial in agriculture, as it enhances rice resistance to diseases and pests.

Silicate mineral paints, also known as silicate paints, utilize potassium silicate as a binder. During the drying process, the potassium silicate fuses with mineral pigments, fillers, and the mineral surfaces it is applied to, such as plaster, concrete, stone, or brick. This fusion creates a highly weather-durable coating, making silicate paints ideal for protecting and enhancing the longevity of these surfaces.

Sandstones are sedimentary rocks composed of particles ranging in diameter from 0.0625 to 2.00 mm. They consist of four main components: grains, matrix, cement, and, in some cases, porosity. The sand-sized particles form the rock’s framework, while the matrix, a finer-grained material, fills the spaces between these grains and is deposited concurrently with them. Cement binds the grains and matrix together, and porosity, when present, contributes to the rock’s structure and permeability.

In lotic water systems, ion concentrations vary significantly over time and space due to changes in flow characteristics and the microenvironment. Bicarbonate ions typically account for about half of the total ion presence, while sulfate and chloride ions contribute 10%–30%. Carbonate ions play a minor role compared to bicarbonate ions, but both contribute to water alkalinity and hardness—erosion of carbonate rocks, such as limestone, dolomite, and magnesite.

Key Takeaways

The Global Potassium Silicate Market is projected to reach USD 4.0 billion by 2034 from USD 2.7 billion in 2024, with a CAGR of 3.9%.

Liquid potassium silicate held a 72.2% market share in 2024 due to its solubility and compatibility with fertilizers, coatings, and adhesives.

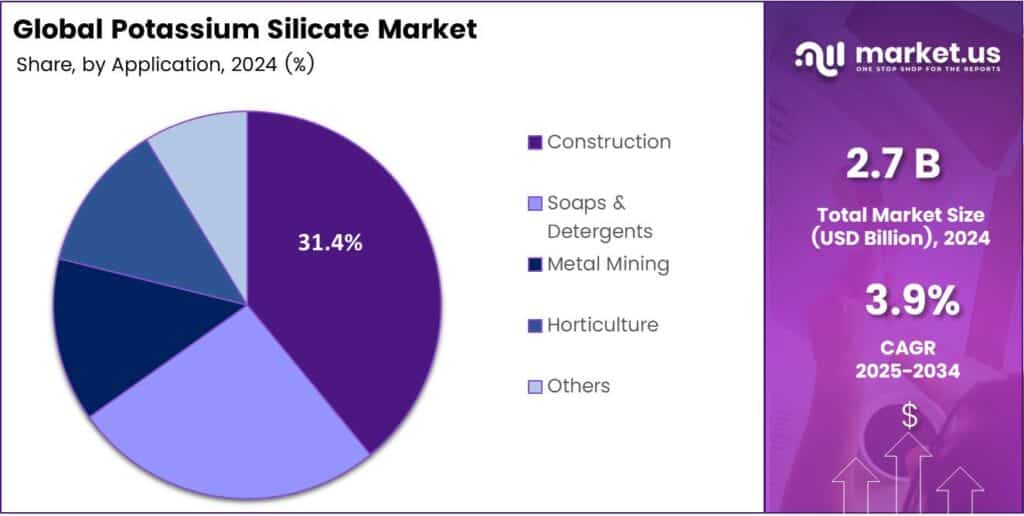

The Construction sector led with a 31.4% market share in 2024, driven by its use in cement, concrete, and fire-resistant coatings.

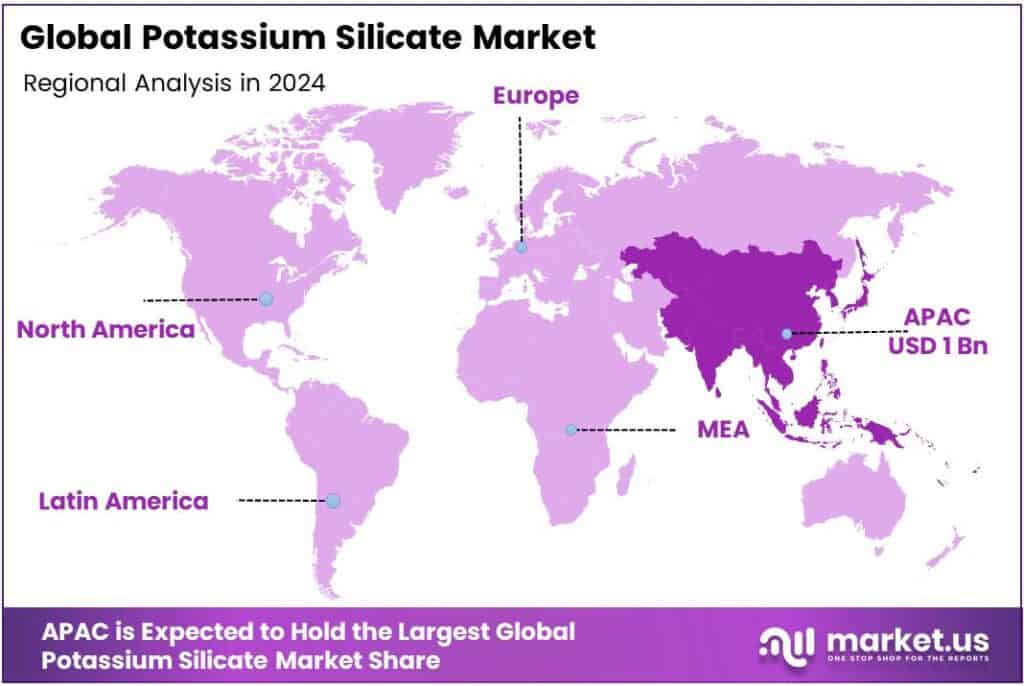

Asia-Pacific dominated with a 38.2% market share in 2024, valued at USD 1 billion, fueled by agricultural and industrial growth.

By Form

Liquid Form Dominates Potassium Silicate Market with 72.2% Share

In 2024, Liquid held a dominant market position, capturing more than a 72.2% share in the global potassium silicate market. Its high adoption is primarily driven by easy solubility, uniform application, and compatibility with fertilizers, coatings, and adhesives.

Liquid potassium silicate continues to gain preference among agricultural users for improving soil strength, reducing nutrient loss, and enhancing crop resistance against pests. The segment’s dominance is also linked to its role in manufacturing flame-retardant coatings and eco-friendly binders.

The liquid form segment is expected to maintain its lead due to rising demand from industrial and construction applications, where its high bonding and corrosion-resistant properties are valued. With ongoing innovation in water-based formulations and sustainable building materials, the liquid form remains the preferred choice for manufacturers and end users seeking better dispersion, stability, and environmental performance.

By Application

Construction Segment Leads with 31.4% Market Share

In 2024, Construction held a dominant market position, capturing more than a 31.4% share in the global potassium silicate market. The strong demand came from its growing use as a binding and sealing agent in cement, concrete, and fire-resistant coatings. Potassium silicate’s ability to enhance the durability and water resistance of building materials has made it a preferred choice among manufacturers focusing on long-lasting infrastructure solutions.

Its eco-friendly and non-toxic nature also supports the shift toward sustainable construction materials across both residential and commercial projects. The construction segment is expected to maintain steady growth, supported by ongoing infrastructure development and renovation activities worldwide.

Increasing urbanization, coupled with a rising focus on green building standards, continues to strengthen potassium silicate adoption in paints, plasters, and surface treatments. The product’s effectiveness in reducing maintenance costs and improving structural protection ensures that the construction sector remains a key consumer of potassium silicate globally.

Key Market Segments

By Form

By Application

Construction

Soaps and Detergents

Metal Mining

Horticulture

Others

Emerging Trends

Growth in Silicon Fertiliser’s Role in Crop Resilience

In recent years, the spotlight has shifted toward silicon-based fertilisers — including solutions such as Potassium silicate — because they help crops withstand stress and improve yield. For example, a 2022 review found that silicon fertilisation can enhance a plant’s nutrient balance and lodging resistance by improving root and stem strength.

These figures reflect more than just market value — they show that growers and agronomists are increasingly adopting compounds like potassium silicate for foliar sprays or soil amendments to boost resilience against drought, salinity, and plant disease. When applied as a foliar treatment or root drench, potassium silicate allows uptake of silicic acid, which then helps plants form improved cell walls and defence mechanisms.

From a policy perspective, regulatory authorities such as the United States Department of Agriculture (USDA) consider potassium silicate as an approved fertilizer source for several crops, including wheat, rice, and barley. In 2024 and beyond, the uptake of potassium silicate in agriculture looks set to accelerate as growers seek added value and improved crop health with reduced chemical footprint.

Drivers

Infrastructure Decarbonisation Boosting Material Innovation

Across the built environment, there is increasing pressure to reduce embodied carbon and enhance the durability of construction materials. Government programmes are actively supporting this transition. In the United States, the Environmental Protection Agency (EPA) launched a label programme in August 2024 under the Federal Buy Clean Initiative to identify clean construction materials, backed by over USD 100 million investment under the Inflation Reduction Act.

This policy environment favours materials that can demonstrate enhanced performance and a lower carbon footprint. Potassium silicate plays into this trend: in construction, it acts as a densifier, binder, and corrosion inhibitor. When infrastructure programmes prioritise long-life buildings and sustainable products, the use of advanced silicate binders becomes more appealing.

Governments pushing major renovation or new-build programmes create demand for materials that deliver lower maintenance, improved durability, and lower impact. Again, in 2024, the US rule for new or renovated federal buildings aims to slash emissions by 2 million metric tons of CO₂, roughly. This maps directly to the use case of potassium silicate in concrete densification, fire protection, and corrosion resistance.

Restraints

Feedstock Availability and Price Fluctuations

Even as demand rises for potassium silicate, one of the key restraints is supply-chain stress on its raw materials, notably silica and potassium carbonate (or equivalent potash feedstock). The chemical industry literature notes that irregular supply of silica and fluctuations in feed cost are major hurdles.

A report states that manufacturing requires high-temperature calcination of silica sand and potash derivatives (temperatures of 1100-2300 °F), and the process is energy-intensive and subject to fossil-fuel cost and environmental regulation. In addition, regulatory regimes on mining and environmental clearance for silica sand extraction often slow production ramp-up or increase costs.

From the user end, a higher cost of raw materials may translate into higher product prices, reducing adoption in cost-sensitive applications, some commodity construction uses, or basic fertiliser applications. Given the competitive alternatives, sodium silicate may provide a lower-cost route; cost sensitivity becomes a tangible barrier.

Opportunity

Expansion into Emerging Agriculture Markets

One major growth opportunity for potassium silicate lies in agronomic advancement in emerging regions facing soil stress, drought, salinity, or high-value horticulture growth. Research shows that silicon fertilisation, including potassium silicate, improves plant resistance and yield. For instance, foliar or root-drench application of potassium silicate allows silicon uptake, which supports defence mechanisms in plants.

In many Asia-Pacific and tropical zones, soils are heavily weathered and deficient in plant-available silicon, making the value of silicon fertilisers more pronounced. Silicon fertilisation can increase soil exchange capacity, improve soil water capacity, and benefit crops under stress. Given the rising demand for higher yields and quality crops (vegetables, fruits, rice, wheat), and the growing emphasis by governments on sustainable agriculture and crop resilience.

Therefore, producers and suppliers of potassium silicate can position themselves to tap into this agricultural expansion, particularly by partnering with agri-chemical companies, supporting farmer trials, and aligning with subsidy programmes in countries like India and China that are promoting soil health and micronutrient support. In short, the emerging agricultural opportunity offers both volume growth and new-market entry for potassium silicate.

Regional Analysis

Asia-Pacific leads with a 38.2% share and a USD 1.0 Billion market value.

In 2024, Asia-Pacific held a dominant position in the global potassium silicate market, accounting for a 38.2% share valued at around USD 1 billion. The region’s leadership is strongly driven by its expanding agricultural, construction, and industrial sectors. Countries such as China, India, Japan, and South Korea are major contributors, supported by robust industrialization and increasing demand for eco-friendly materials.

Potassium silicate is widely utilized in this region for applications in fertilizers, coatings, welding rods, and detergents due to its cost-effectiveness and performance stability. Agriculture remains a key growth pillar in Asia-Pacific, where potassium silicate is extensively used as a silicon-rich fertilizer that enhances crop yield, soil structure, and pest resistance.

Government initiatives promoting sustainable farming in India and China have further encouraged its adoption. In construction, rapid infrastructure expansion and the shift toward green building materials have boosted its use as a binding and sealing agent. Additionally, Japan and South Korea are investing in high-performance coatings and adhesives that leverage potassium silicate for fire and heat resistance.

Asia-Pacific is expected to maintain its dominance, supported by growing manufacturing capabilities and favorable regulatory frameworks promoting environmentally safe materials. The region’s continued push for sustainable agriculture, rising investments in chemical processing, and increasing public infrastructure spending will sustain its strong presence in the global potassium silicate market, reinforcing Asia-Pacific as the central hub for both production and consumption.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Lanxess leverages its strong chemical industry expertise to produce high-quality potassium silicate. The company focuses on serving diverse industrial sectors, including agriculture, where its products are used as soluble fertilizers and crop strengtheners, and construction, where they act as binders and additives. Their strategic emphasis on innovation and sustainable solutions helps them maintain a significant market presence.

BASF holds a formidable position in the potassium silicate market. The company utilizes its vast production infrastructure and extensive R&D capabilities to offer high-purity products for a wide array of applications. These include use in detergents and cleaners, construction materials, and welding electrodes. BASF’s global distribution network and strong technical customer support provide a significant competitive advantage.

Evonik distinguishes itself through a strong focus on specialty chemicals and innovation in the potassium silicate space. The company provides tailored solutions for demanding applications, particularly in construction, where its products enhance the durability of cement and coatings, and in agriculture for soil stabilization and plant health. Evonik’s strategy involves developing high-value, performance-oriented products that offer specific functional benefits.

Top Key Players in the Market

Lanxess

BASF

Evonik

Wacker Chemie

Arkema

PQ Corpo

Solvay

Kemira

AkzoNobel

Ashland

PPG Industries

Clariant

Recent Developments

In 2025, BASF announced that in 2024 it generated sales of €11 billion with products that have come to market in the past five years. They also reported €2.1 billion in R&D investments and 1,159 new patent applications 45% focused on sustainability.

In 2025, Evonik announced the launch of a new business line, Smart Effects, which merges its Silica and Silanes business lines under the Advanced Technologies segment. The merger is intended to streamline operations, combine expertise in silane chemistry + silica particle design, automotive & tire, electronics, and building protection.

Report Scope