Data released in the U.S. prior to the government shutdown painted an optimistic picture of the economy.

Second-quarter economic growth was revised up to 3.8% annualised, and consumer spending grew by 2.8% in the third quarter.

Although comforting, these data raise a question: why is growth so resilient when other economic indicators, including employment and consumer confidence, suggest weakness?

The strong investment in data centres helps to explain the U.S. economy’s outperformance.

Advertisement

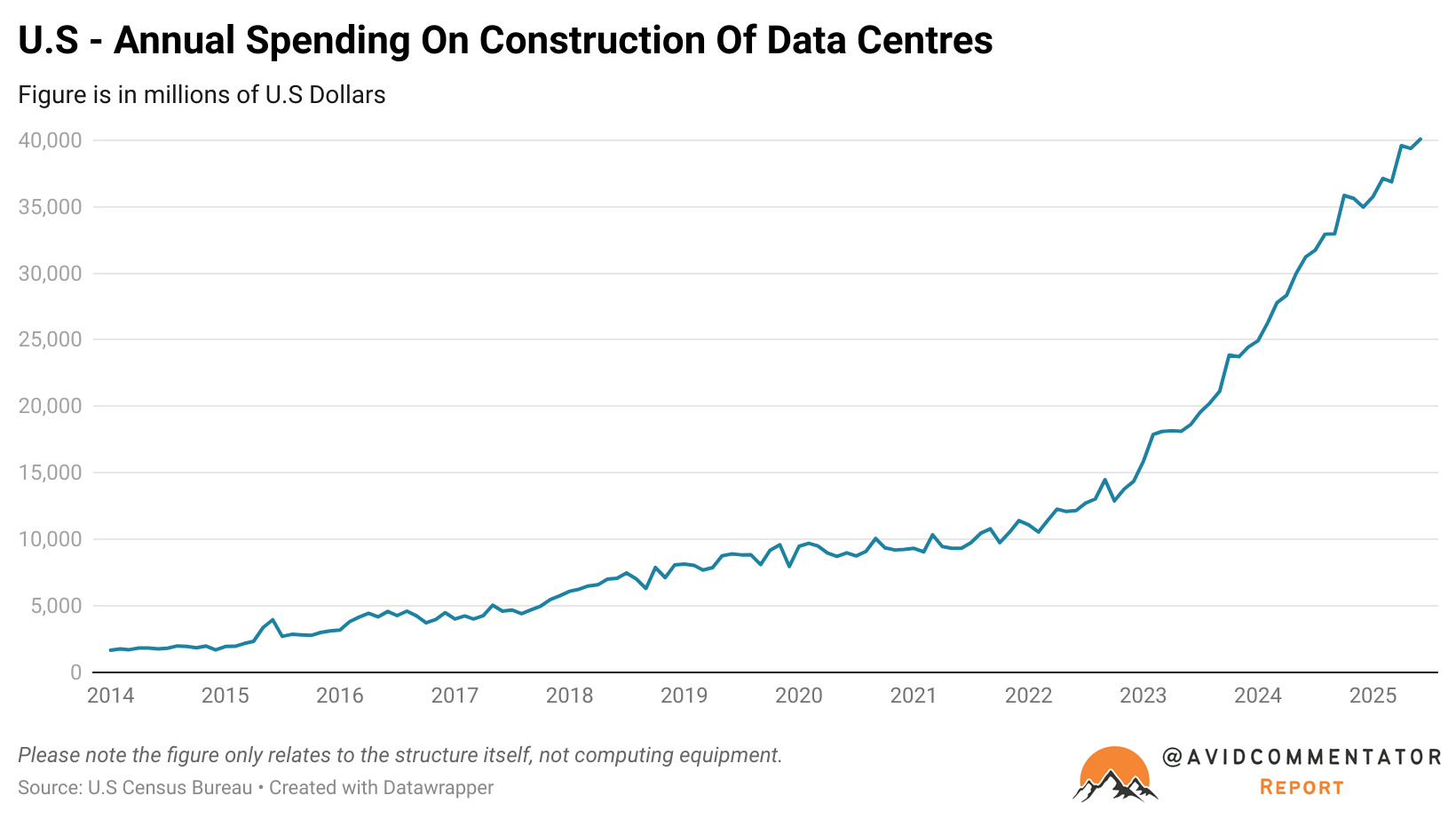

The amount of investment in data centres in the United States is undergoing a meteoric rise:

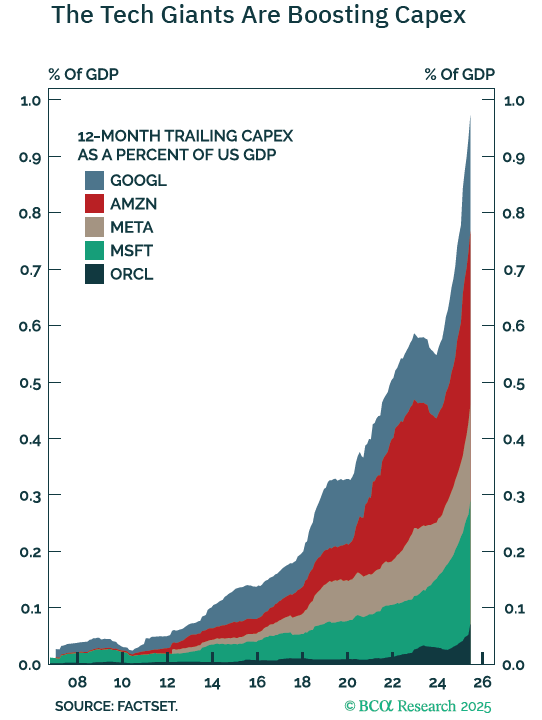

The five largest tech companies are investing almost the equivalent of 1% of U.S. GDP in this cause:

Advertisement

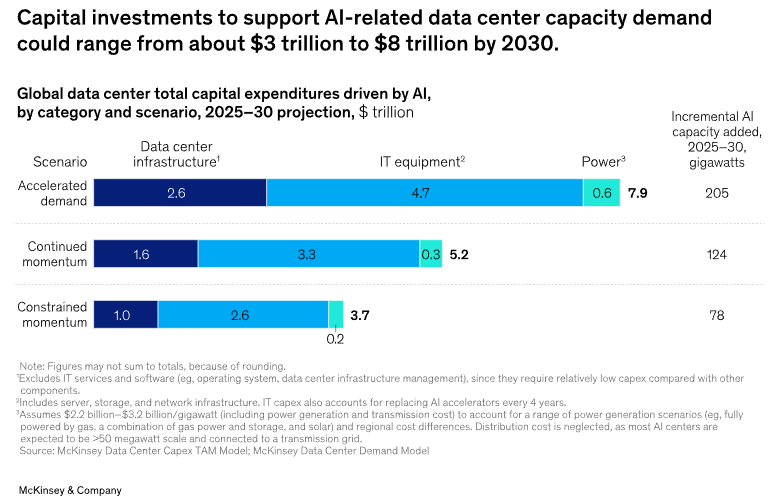

McKinsey forecasts that investments to support AI-related data centre capacity demand could range from around $3 trillion to $8 trillion by 2030:

Advertisement

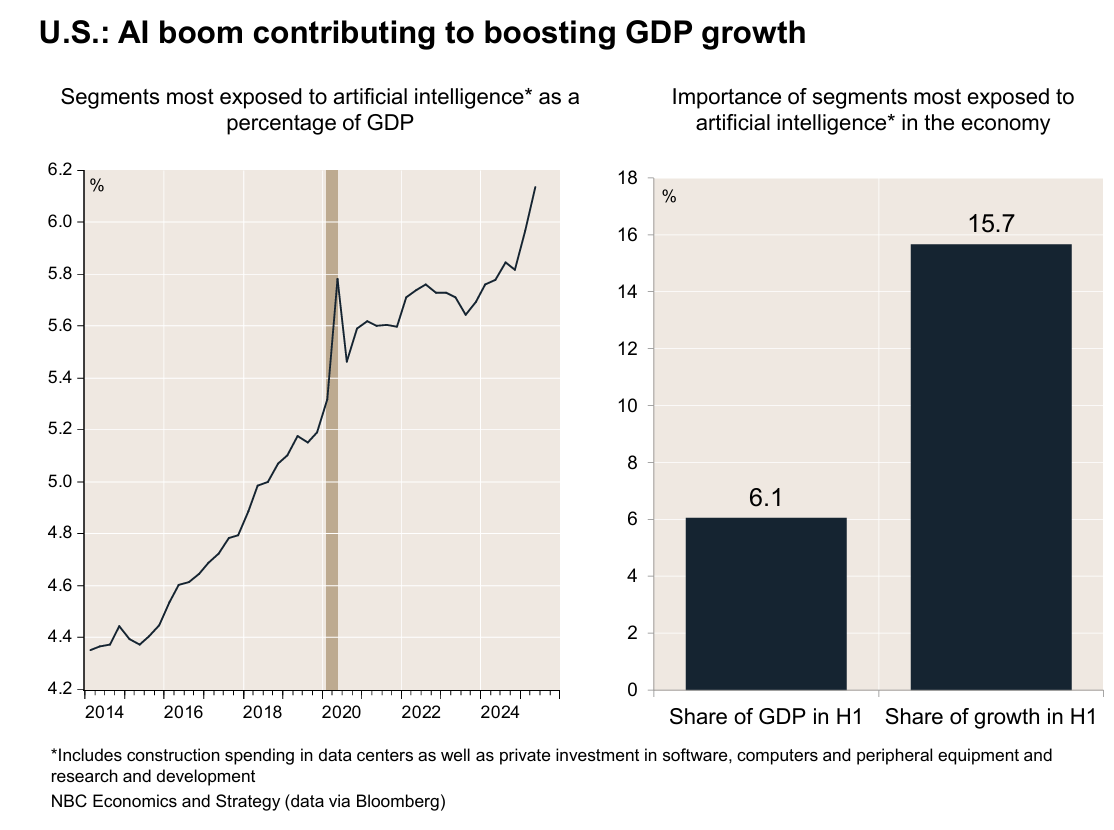

The following chart from the National Bank of Canada examines the surge in artificial intelligence investment and spending via the performance of sectors most exposed to AI, namely: construction spending on data centers, investment in software, investment in computers and peripherals, and investment in research and development:

“The first thing that stands out is the increase in the size of these sectors relative to the overall economy in recent years”, the National Bank of Canada wrote.

Advertisement

“But even more striking is their disproportionate contribution to growth in the first half of the year, with no less than 15.7% of the economic expansion attributable to these sectors, which account for only 6.1% of GDP. And we are only talking here about the direct effects on growth, leaving aside other indirect factors such as the additional consumption generated by the wealth effect linked to the rise in the share prices of companies most directly linked to AI”.

“The sheer scale of this boom, and the fact that it is concentrated in the hands of a few very large companies, may also explain the discrepancy between solid economic growth and rather subdued business confidence indices, with the difficulties of non-AI sectors likely being drowned out in economic data by spending in sectors most exposed to the technology”.

“And if the investment plans of big tech companies are to be believed, the AI bonanza should continue to contribute to growth over our forecast horizon”.

The associated boom in the stock market that has accompanied the AI data centre boom has greatly increased the wealth of the richest Americans, driving a corresponding rise in consumption spending:

“Federal Reserve data indeed shows that the share of household financial assets allocated to stocks reached a historic high of 45.4% in the second quarter of 2025, up 12 percentage points over the past ten years”, the National Bank of Canada wrote.

Advertisement

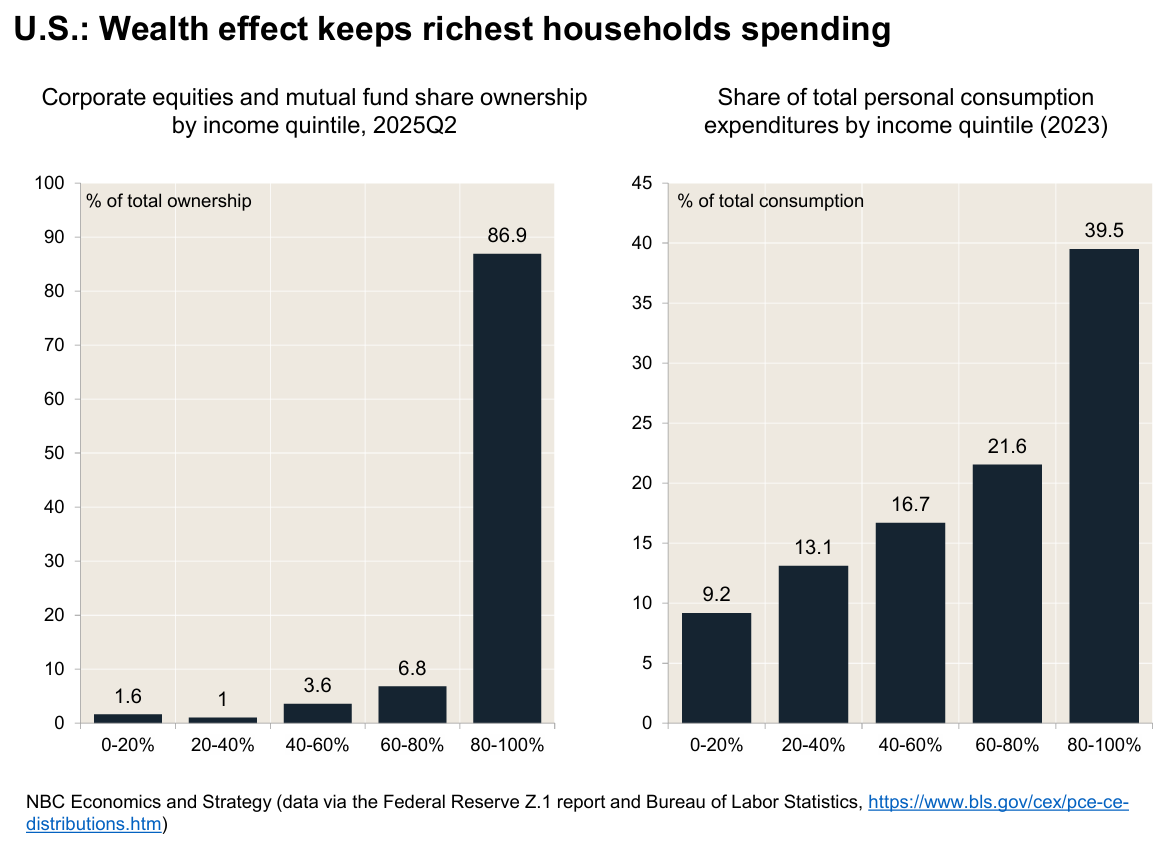

“No one will be surprised to learn, however, that stock market gains are not evenly distributed across the population, with no less than 86.9% of all corporate stocks and mutual funds held by the top 20% of earners. It is this concentration that partly explains the current resilience of consumption”.

“While poorer households may currently be responding to the deterioration in labour market conditions by reducing their spending, this restraint is probably more than offset by an increase in outlays among the wealthiest households, whose total revenues are much more dependent on market performance”.

“And seeing how these individuals account for nearly 40% of total consumption, a figure higher than that of the lowest three income quintiles combined, it is easy to understand how the increase in the wealth of the richest can overshadow the pessimism of the majority of households when it comes to economic growth”.

“In fact, consumption by the top 20% of earners alone accounts for no less than 26.8% of total GDP in the United States. In Canada, this figure is only 17.3%”.

In other words, the bounty from the AI data centre boom is flowing into the pockets of the U.S. mega-rich, which is increasing the nation’s already extreme wealth inequality.