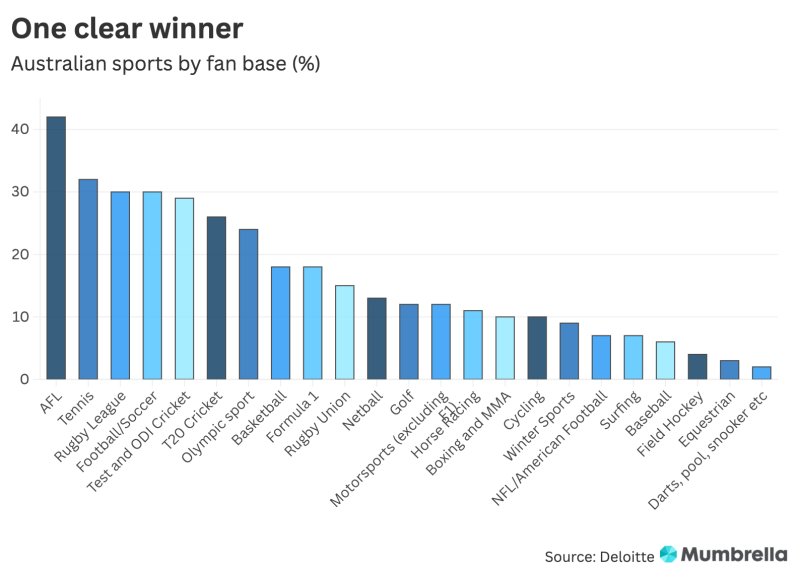

Recent jousting between the AFL and NRL as to which sporting code is Australia’s most popular has apparently been laid to rest in a comprehensive media habits survey from Deloitte.

AFL leaves rugby league in the shade when it comes to overall fan numbers, according to the Deloitte Media and Entertainment Insights 2025 report. The report found that 42% of Australians consider themselves an AFL fan – the top Australian sport – compared to 30% for NRL, which rated third after tennis.

Enjoying Mumbrella? Sign up for our free daily newsletter.

The report lands at an inopportune time for the NRL, with the organisation currently in market looking to sell its TV rights. Nine and Foxtel’s existing $1.7 billion five-year rights deal expires in 2027, and Australian Rugby League Commission chair Peter V’landys has said his new deal will beat the $4.5 billion, seven-year contract the AFL signed with Seven and Foxtel in 2022 and due to expire in 2031.

ADVERTISEMENT

Earlier this year, V’landys said his code was “indisputably the number one sport in Australia and the Pacific” because more “girls, boys, women and men” watched, attended or played the game.

His claim received support when the NRL grand final beat the AFL grand final in a ratings head-to-head in October, averaging an audience of 4.5m compared to the AFL’s 4.1m (figures rounded).

The Deloitte rankings of sporting codes by “followership” found that the big four sports – AFL, rugby league, soccer, and cricket – had the highest proportion of “avid” fans. Tennis, rugby league, soccer and cricket all had around the same number of fans (29-32%) while AFL stood out at 42%.

The report surveyed a nationally representative sample of 2000 people aged 16 to 92 (it does not report a margin for error). Another significant finding was a big fall (down 15% year-on-year) in social media consumption, from an average of 6 hours 20 minutes a week to 5 hours and 20 minutes.

That average reduction was driven by falls in all demographic groups, with the exception of the oldest (the “Mature” group, those aged 80 and over). The report bundles together Youtube, Tiktok, Facebook, and Instagram as “social media”: within this grouping, user behaviour naturally varies widely between demos, with younger people mostly consuming video and older people looking at feeds and status updates.

The news was good for businesses relying on subscription revenue, with average spend rising to $78 a month (from $63 a year ago), again with sharply differentiated spend levels depending on demographic.

The rule here is simple: younger people spend more. Gen Z (those surveyed under 28 years old) spend an average of $101 a month on subscriptions, with spend declining in each successive demographic (to an average of $35/month for the over 80s).

In general, concern about the cost of these subscriptions is widespread (78% are worried they are spending too much).