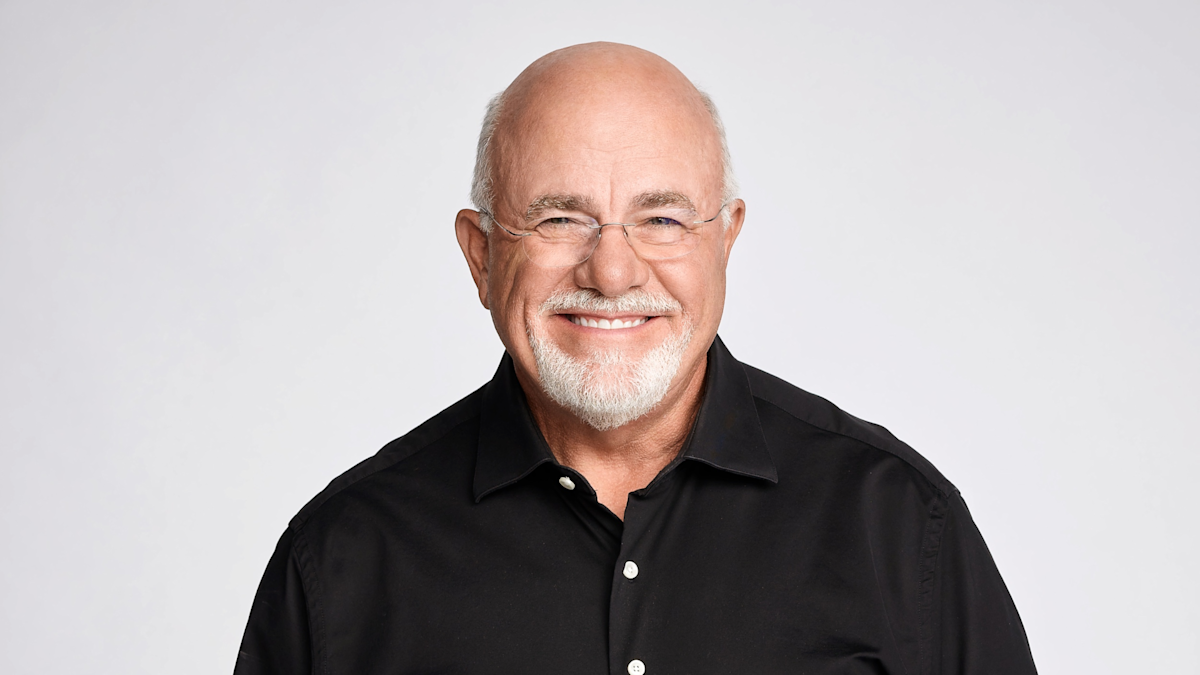

Financial guru and radio personality Dave Ramsey is well known for his “7 Baby Steps” — a financial plan designed to help individuals get out of debt, save money and build wealth. But while some feel his principles are solid, others disagree with their mathematical effectiveness.

Be Aware: The $50 Mistake Warren Buffett Says Everyone Should Avoid

Read Next: 6 Things You Must Do When Your Savings Reach $50,000

So where is the discrepancy occurring? Are Ramsey’s principles helpful or harmful when it comes to building wealth?

Andrew Latham is a certified financial planner and content director at SuperMoney.com. He insists the answer is not cut and dry and may have more to do with the psychology of the individuals applying these principles rather than the principles themselves.

“Ramsey’s advice is genuinely good and incredibly helpful for getting people on track, especially if they feel lost or overwhelmed,” Latham said. “But, in some cases, especially for those who are more financially savvy or disciplined, there’s room to optimize.”

In other words, Ramsey’s principles can guide individuals who possess little financial knowledge and lack the patience to learn — which, let’s face it, is many people. Its focus is on the emotional victory of achievable wins, rather than big ones that are more demanding and focused on the long term.

Learn More: 10 Genius Things Warren Buffett Says To Do With Your Money

Having seen his clients implement Ramsey’s money principles, Latham offered the following pros and cons:

Zero-based budgeting is one of Ramsey’s core teachings, in which every dollar is assigned a specific job, whether that’s spending, saving, donations or debt repayment. These assignments should equal — and thus zero out — your income, leaving no idle income without a task. Latham said that zero-based budgeting is a practical tool, which can help build discipline and stability. It also helps individuals gain insight into their spending.

Ramsey’s recommended $1,000 emergency fund is wise to save for a rainy day — or to simply create a habit of saving in general. This is sound advice for anyone.

Ramsey teaches a debt-snowball method, whereby debts with the smallest balance are paid off first. Latham stated this works well for individuals who need motivation and quick wins.

Ramsey considers credit cards nothing more than a debt trap. His firm stance against using credit cards “makes sense for people who struggle with overspending or carrying balances,” Latham said. Zero-tolerance on this financial tool removes the temptation to abuse it.

Ramsey promotes paying off all debt prior to investing. If individuals are risk-averse, this provides a guaranteed “return” equal to the interest rate saved — especially when it comes to high-interest debt like credit cards, which would exceed any realistic investment returns.

Ramsey’s debt snowball method “works well for those who need behavioral wins,” Latham said, but it is not necessarily the most mathematically beneficial. Alternatively, Latham recommended the debt-avalanche method (where debts with the highest interest rates are prioritized) to save more money over the long term, as well as slash repayment timelines.

Contrary to Ramsey’s view, Latham insisted credit cards should not be universally off limits. If a person can trust themselves to use cards wisely, it’s an opportunity to recoup hundreds to thousands of dollars each year.

“When used responsibly and paid off in full each month, they can offer rewards, improve credit scores and provide consumer protections,” he said.

Ramsey’s advice doesn’t distinguish between good debt and bad. Paying off all debt prior to investing can delay wealth building — particularly if (hypothetically) one carries a low interest student loan (at 3.5%) and the market’s annual return averages between 7% and 10%. Additionally, not contributing to a 401(k) with an employert match is essentially turning down free money, which grows over time.

Ramsey’s approach can be especially effective for changing behavior and building foundational habits.

“But once someone is financially stable, adjusting the plan to match their specific goals, discipline and financial situation can lead to better long-term outcomes,” said Latham, who favors a more flexible, balanced strategy when it comes to increasing personal wealth.

“This could include zero-based budgeting, building a starter emergency fund, focusing on high interest debt first (above 6%-7%), using credit cards only if spending is under control and beginning to invest early to take advantage of compound growth,” he said.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: I’m a Financial Planner: Here’s How Following Dave Ramsey’s Money Advice Affects Wealth Building