2h agoThu 27 Nov 2025 at 8:23pmMarket snapshotASX 200 futures: -0.4% to 8,599 pointsAustralian dollar: +0.2% to 65.29 US centsS&P 500: +0.7% to 6,813 points (closed for Thanksgiving)Nasdaq: +0.9% to 25,237 points (closed for Thanksgiving)FTSE: +0.02% to 9,694 pointsEuroStoxx: +0.1% to 575 pointsSpot gold: -0.2% at $US4,157/ounceBrent crude: +0.4% to $US63.39/barrelIron ore: -0.2% to $US103.10/tonneBitcoin: +1.4% to $US91,422

Price current around 7:20am AEDT

5m agoThu 27 Nov 2025 at 11:10pmASX opens down

The Australian share market has opened in the red, down -0.3% at 8,593 points.

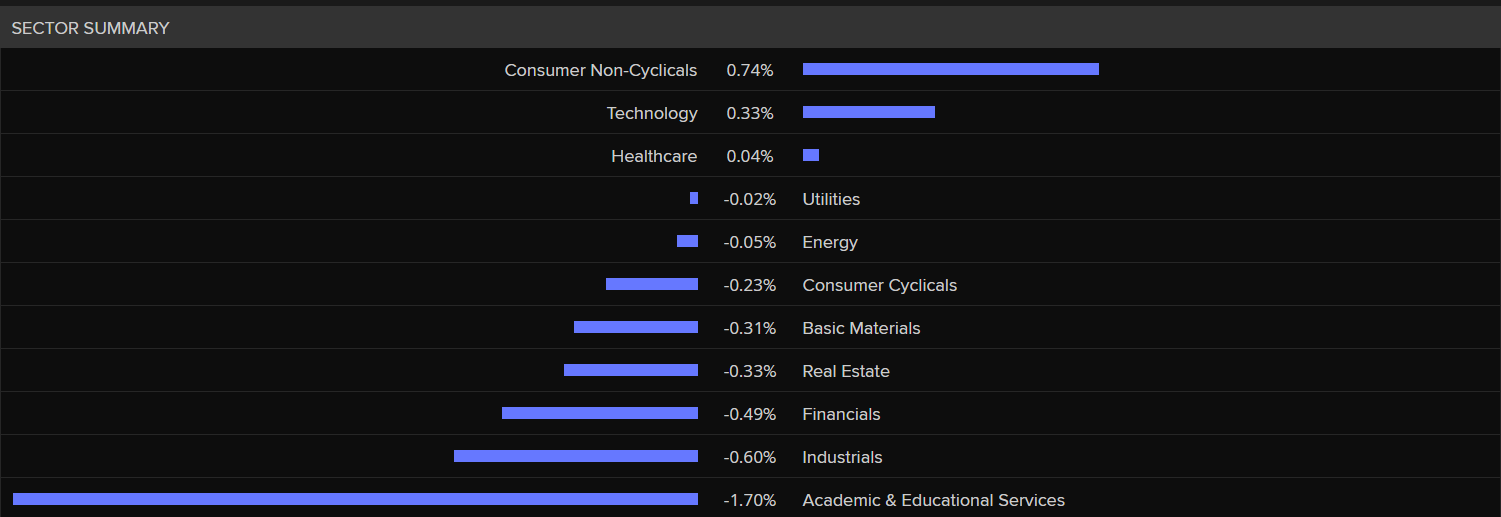

Here is a sector summary:

Sector summary as markets open on Friday morning (Refinitiv)

Sector summary as markets open on Friday morning (Refinitiv)

128 stocks are in the red, 15 unchanged, and 57 gaining.

WiseTech Global is at the top (+3.1%), while SunCorp Group is down the bottom (-2.4%).

21m agoThu 27 Nov 2025 at 10:53pmNovember wrap up

November is looking like a month of mainly negative returns for the US stock market.

ASX200, after being one of the worst-performing developed markets in October, appears on track to repeat that performance this month too.

The exceptions are the Japanese and Korean stock markets, which recorded impressive returns last month and were due for some pullback.

“The ASX200 Health Care sector appears to have formed a triple low at this month’s 34,409 low, picking up earlier lows in the 34,000 area, from October 2023 and March 2020. We like this chart pattern and leaning against the 34,300/33,700 support area we think a 5-10% from here looks achievable in the months ahead,” says IG Market Analyst Tony Sycamore.

Turning to Bitcoin, the digital currency is trading higher at $91,328 (+0.93%). Mr Sycamore says its rebound has been bolstered by rising expectations of a 25-basis point rate cut next month which has also served to boost risk sentiment.

“The rally in Bitcoin this week fits our view and follows the comments that we made in the Traders View report sent on Sunday afternoon – Technical indicators were flashing signs of capitulation at Fridays low, a good sign of a base,” says Mr Sycamore.

“Providing Bitcoin continues to hold above last Friday’s $80,537 low reinforced by the Liberation Day lows $75/74k area, further gains towards $95,000/$100,000 area is likely.”

45m agoThu 27 Nov 2025 at 10:30pmQBEBrokerage Citi cuts price target on QBE Insurance to $AU23.70, retains “buy” ratingQBE, Australia’s largest insurer by market value, on Thursday signalled a softer premium rate growth in its third-quarter updateCiti says moderating premium rate growth and a higher combined operating ratio, stripping out favourable catastrophe and prior-year development, seem to be the main cause Analysts at Jefferies trim price target to $AU23.75 from $AU24.55; maintain “buy” ratingJefferies says while QBE faces certain headwinds related to competitive dynamics, we believe the company has levers to adjust costs while directing capital at segments Eight of 12 analysts rate the stock “buy” or higher, three “hold” and one “sell” or lower; their median PT is $AU23.50, according to data compiled by LSEGStock has fallen 0.8% this year, as of last close

58m agoThu 27 Nov 2025 at 10:17pm

European trading

European stocks edged up on Thursday (Friday morning Australian time), as investor confidence in a US Federal Reserve rate cut next month kept sentiment upbeat.

Bitcoin has also held up above its recent lows, although still has a long way to climb.

STOXX 600 index was up +0.2%, led by gains in defence and tech companies that helped offset losses in healthcare stocks.

“As long as your main engine is going nicely, then a lot of the worries about valuations just get pushed up to the back foot for the time being, until something else comes along,” IG chief markets strategist Chris Beauchamp said.

The most likely catalyst to derail a rally would come in the form of renewed concern over spending on AI, he added.

“That is the market’s kryptonite at the moment,” he said.

1h agoThu 27 Nov 2025 at 10:00pmAsian markets

The Tokyo Core CPI release could be one to watch in Asia today, says Senior Financial Market Analyst Kyle Rodda.

“Speculation has picked up this week that the Bank of Japan may hike rates as soon as December, with inflation remaining sticky and potentially drifting away from target.

“Upside risks to inflation in Japan are also increasing because of a likely deluge of fresh fiscal stimulus from the new Takaichi government as it looks to ramp up domestic manufacturing and defence spending.

“An upside surprise in Tokyo CPI figures could add to expectations of an imminent BOJ hike and support a bounce in the Yen and weigh on the Nikkei.”

1h agoThu 27 Nov 2025 at 9:45pm

US SEC probing Jefferies for bankrupt First Brands dealings, FT reports

The U.S. Securities and Exchange Commission is probing investment bank Jefferies over its relationship with bankrupt auto parts supplier First Brands Group, citing people familiar with the matter.

The SEC is seeking information from Jefferies about whether it gave investors in one of its funds enough information about their exposure to the auto business, the report said.

Jefferies said in October that it had limited exposure to First Brands, which filed for Chapter 11 bankruptcyprotection in September, and said any potential losses would be “readily absorbable.”

Jefferies’ Leucadia Asset Management fund, through its credit fund Point Bonita, held about $US715 million in receivables linked to First Brands. The SEC is investigating whether Point Bonita’s investors were aware of the relationship, according to the FT report.

Jefferies declined to comment.

“The SEC does not comment on the existence or nonexistence of a possible investigation,” an agency spokesperson said.

First Brands did not respond to a Reuters request for comment.

UBSUBSG.S said earlier this month it was winding down investment funds run by its hedge fund unit O’Connor, after suffering losses due to exposure to First Brands.

1h agoThu 27 Nov 2025 at 9:30pmA possible US rate cut?

While Wall Street was closed overnight for the Thanksgiving holiday, Senior Financial Market Analyst Kyle Rodda says investors are feeling hopeful that a December Fed cut may just be around the corner.

“The spike in market pricing [reflects] about an 85% chance of a cut next month,” he says.

Although he says this positivity has “come by virtue of some dovish language from Fed officials who are noted doves and some tier-2 economic data”.

“Arguably, in the absence of substantial data going into the next Fed decision, the markets could be implying that the path of least regret for policymakers is to cut rates, even if there’s persistent upside risks to inflation.

“Nevertheless, the sell-off in stocks were about the lower odds of and greater uncertainty about upcoming US rate cuts. The reversal of that little trend has made stock markets look more bullish, even if that bullishness is at risk of being upset again.”

With December only days away, we will just have to wait and see.

2h agoThu 27 Nov 2025 at 9:15pm

APRA and high risk-home loans

There was a lot of commentary yesterday on APRA’s decision to cap high-risk home loan approvals from early next year.

My colleague Nassim Khadem put this story together for the program:

Loading…2h agoThu 27 Nov 2025 at 9:03pmKen Henry and Australia’s ageing environment laws

On the program last night, Alicia Barry interviewed Former Treasury Secretary, now chair of the Australian Climate and Biodiversity Foundation, Ken Henry, who welcomes the last minute environmental deal between Labor and The Greens.

You can watch it below:

Loading…

2h agoThu 27 Nov 2025 at 9:00pm

The finance report

Keen for a quick snapshot on the market’s movements yesterday? Here’s an update from our wonderful colleague David Chau, with a big focus on APRA and its new restrictions on high-risk lending.

Check it out below:

2h agoThu 27 Nov 2025 at 8:51pm

APRA chair John Lonsdale

In his first TV interview, Australian Prudential Regulation Authority (APRA) chair John Lonsdale chats with Alicia Barry, discussing the banking regulator’s decision to limit high debt-to-income loans to 20% of all new loans approved.

“There’s some early signs of some risks that we’re worrying about,” Mr Lonsdale says.

You can watch the full interview below:

Loading…

2h agoThu 27 Nov 2025 at 8:29pm

Cybersecurity concerns and social media

Cybersecurity experts warn there are a “lot of problems” with the way Snapchat is approaching age verification on its app.

Snapchat — a popular social media messaging platform, is one of the 10 platforms that are part of the social media ban for children under 16, which will start on the 10th of December.

There will be three options to verify age, according to Snapchat — including sending a selfie or government-issued ID to a third-party platform.

You can read the full report from Rudi Maxwell below:

2h agoThu 27 Nov 2025 at 8:20pmASX set to open lower

Good morning and welcome to Friday’s markets live blog, where we’ll bring you the latest price action and news on the ASX and beyond.

The ASX 200 is set to open lower in a few hours time as the ASX 200 futures points down -0.4%.

There was silence on Wall Street as it remained closed overnight Australia time due to the Thanksgiving holiday.

The European markets were slightly up, with Britain’s FTSE at +0.02% and the pan-European Stoxx 600 at +0.14%.

The Australian dollar is slightly up +0.2% to 65.28 US cents.

Brent crude oil is up +0.4%, trading at $US63.39 a barrel.

Spot gold is down at -0.2% to $US4,157.

Iron ore is also down -0.2% to $US103.10 a tonne.

Grab yourself a coffee and see you soon for a morning of business and market updates!