Weather: Concerns in parts of the Canadian Prairies lent support to ICE canola futures, with some regional dryness reported during critical crop stages. India’s monsoon season has been favourable, with rice, corn, and pulse plantings all tracking well ahead of last year, helping ease early-season supply concerns..

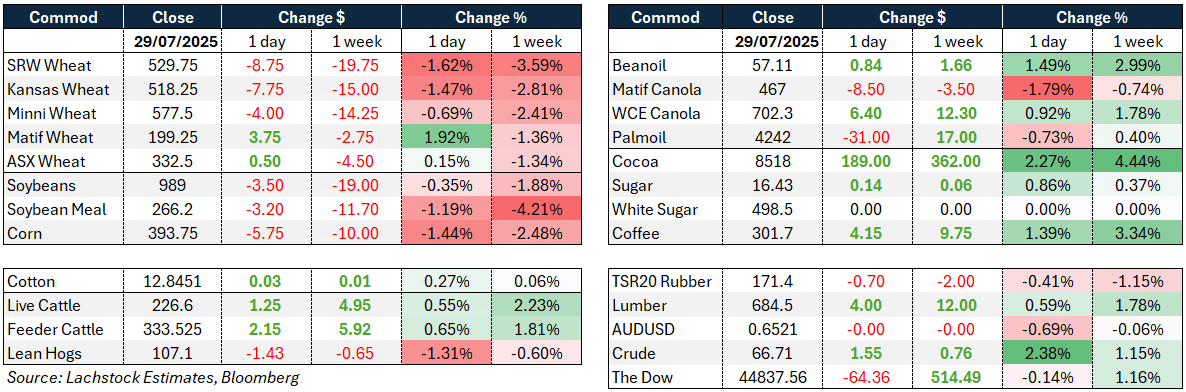

Markets: Grain markets eased overnight as strong US crop ratings, technical selling, and a firmer dollar weighed on sentiment. Argentina’s export tax cuts added pressure, boosting South American competitiveness ahead of key US export windows. Canola outperformed on firmer soyoil, Prairie weather concerns, and a bounce off technical support.

Australian Day Ahead: The conventional–GM spread is likely to narrow slightly today, with GM canola expected to firm and conventional to ease slightly. Cereals are also likely to be softer on the back of weaker futures. Activity to be slow, with much of the trade away in Melbourne for AGIC.

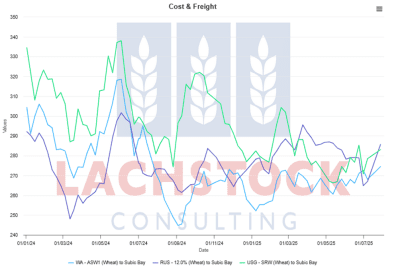

CNF Subic Bay wheat. Source: Lachstock Consulting Estimates

Wheat was the downside leader again overnight, with CBOT Sep off 1.6pc to US$5.29¾/bu — matching its worst monthly close and hitting new contract lows, despite steady demand signals.

Minneapolis wheat posted fresh contract lows as well, even as spring wheat condition ratings slipped 3pts to 49pc G/E — the lowest in years and well below 74pc LY.

The selloff came despite no fresh bearish news — instead, a stronger USD, ongoing fund selling, and poor technicals kept pressure on futures.

Matif Sep dropped €2.50 and Russian cash values edged $1 lower to $238/t, reflecting slow exports and lack of Black Sea farmer engagement.

Harvest in the Baltics is being hampered by rain and logistical bottlenecks, which could limit short-term availability, but this has yet to show up in price support.

Frustration is growing among traders as demand trickles in (notably to the US), yet futures ignore it — Bosse summed it up as “nothing new, but no resolution,” with seasonal lows still elusive despite harvest being 80pc complete.

Other grains and oilseeds

Corn made fresh contract lows in Sep and tested support in Dec, with the market largely ignoring strong export demand and instead focusing on high crop condition ratings (73pc G/E) and near-ideal weather.

Traders are openly speculating the market is pricing in a national yield of 185–186 bu/ac, pushing ending stocks near 2.0bbu — despite fringe states like the Dakotas historically underdelivering in big acreage years.

Demand isn’t the issue — export inspections are running 29pc ahead of last year, and US corn remains the cheapest FOB globally — but the market doesn’t seem to care right now.

Soybeans were softer but more resilient, holding key support levels on the back of improved crop ratings (70% G/E), while traders watch US–China talks with cautious hope ahead of the August export window.

Bean oil continues to lead the soy complex, ripping higher on energy strength and tariff threats on Russian oil, while soymeal drags, setting new contract lows and keeping beans heavy overall.

ICE canola firmed as soyoil and crude rallied, and weather concerns flared in parts of the Canadian Prairies. November cleared key technical levels, and domestic crush data showed a 10pc YoY jump in June — the best month so far this crop year.

Macro

The US dollar index extended its climb to a 5-week high, pressuring ag export competitiveness across the board. The euro, already under pressure, slipped below $1.16 amid investor concern the US–EU trade deal heavily favours the US side.

Trump doubled down on trade leverage overnight, warning countries that continue buying Russian oil — including China and India — could face secondary sanctions. That helped spark gains in bean oil and crude, while injecting further tension into already fragile ag trade relationships.

The US–China trade truce extension, set to expire August 12, remains unresolved after Chinese officials prematurely announced a deal — only to be corrected by US Treasury Secretary Bessent, who said “only Trump will decide.”

Argentina’s sweeping cuts to export taxes on corn (from 12pc to 9.5pc), soybeans (33pc to 26pc), and soy products (31pc to 24.5pc) are shaking up global pricing structures, particularly in the oilseed and meal space.

While the EU–US trade agreement avoided ag tariffs (for now), talks remain tense — with whispers of future exemptions on EU metal tariffs and no clarity yet on digital or pharma levies. The ag sector is left watching from the sidelines, hoping phase two brings clarity.

US economic data continues to support a “wait-and-see” Fed — JOLTS job openings fell and consumer confidence improved. But for ags, the real focus remains on how upcoming sectoral tariffs may be shaped, especially as the August 1 global trade deadline looms.

Australia

More of the same yesterday in the west, with current crop values holding steady — wheat at A$354, barley at $330, and canola at $820.

In the east, track markets were also steady, with new crop canola at $832, wheat at $356, and barley at $316.

Rallying freight markets and a firming Russian FOB have helped make WA wheat the cheapest into Southeast Asia once again.

Delivered markets continue to soften week-on-week, with growers slightly more willing to sell, while consumer demand remains subdued.

There’s been a bit more grower engagement on new crop sales in the east this week, though pricing hasn’t prompted significant volume yet.