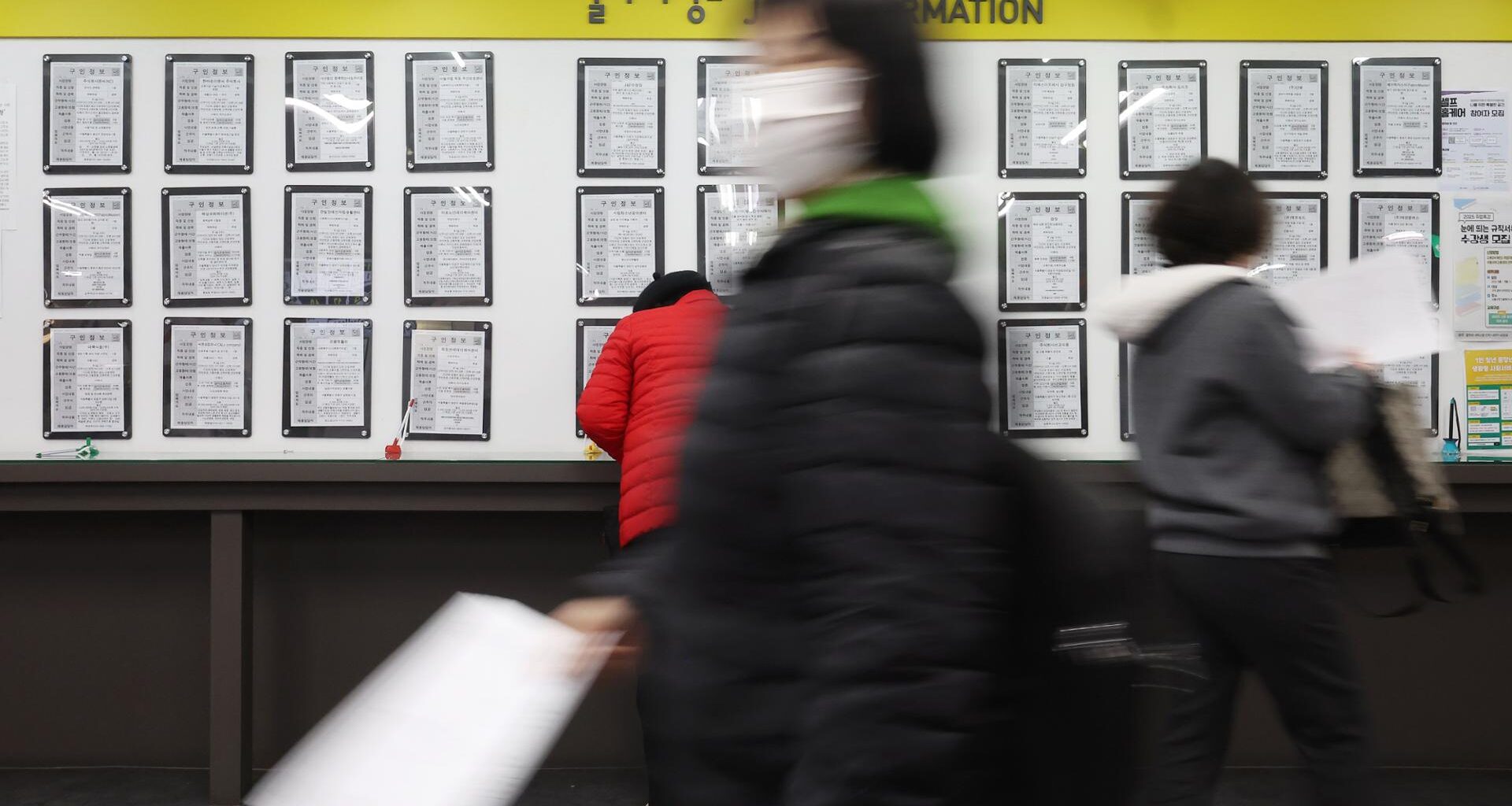

Job seekers look at postings at an employment support center in western Seoul’s Mapo District, Wednesday. Yonhap

Large businesses in Korea are seeking to cut their domestic investments next year in favor of expanding offshore spending, a survey showed Sunday, triggering concerns that corporate capital may increasingly flow abroad and slow down local economic activity.

According to a survey commissioned by the Korea Enterprises Federation (KEF) of CEOs and senior executives at 229 companies, 47.1 percent said they plan to maintain this year’s level of domestic investment next year.

Among large businesses with more than 300 employees, however, 40 percent said they plan to scale down their domestic investments next year, while 35 percent intend to keep it unchanged.

For overseas investment, 45.7 percent said they would expand spending, and 28.3 percent said they would maintain the current level.

The trend is tied closely to the impact of the United States’ tariff policies. Throughout this year, Korean corporations have faced mounting pressure to increase their investments in the U.S. in response to tariff measures pushed by the Donald Trump administration. As companies prioritize allocating their limited resources to U.S. expansion to avoid duties, there are growing concerns that domestic investment and job creation could be sidelined.

President Lee Jae Myung, center, speaks during a meeting with Korea’s top conglomerate leaders at the presidential office in Yongsan District, Seoul, Nov. 16. Second from left is Samsung Electronics Executive Chairman Lee Jae-yong, and fourth from left is SK Group Chairman Chey Tae-won. Yonhap

During a meeting with leaders of Korea’s top conglomerates on Nov. 16, President Lee Jae Myung said that increased U.S. investment should not come at the expense of domestic spending, urging business leaders to ensure that such concerns do not materialize.

In response, top conglomerates announced their long-term domestic investment plans. Samsung Electronics said it will spend 450 trillion won ($306.1 billion) over the next five years and hire 60,000 people over that period. SK Group said it will invest 128 trillion won by 2028, while Hyundai Motor Group pledged to invest 125.2 trillion won over the next five years.

The figures represent an increase in capital expenditures from previous years, but industry officials said most of the spending reflects long-term investment plans that conglomerates had already established, and that only a limited portion will be fresh investment funds.

Hyundai Research Institute also said in its September report that the growth rate of domestic facility investment will slow from 1.8 percent this year to 1.5 percent next year. It said the impact of U.S. tariffs is expected to fully materialize in 2026, worsening trade conditions and reducing export demand.

“Corporate resources are limited, and companies are already required to make hefty investments for the transition to artificial intelligence,” a conglomerate official said. “Some top companies may be able to stretch their budgets for domestic investment, but it will be difficult for most businesses to maintain the same level of domestic investment while expanding facilities in the U.S. at the same time.”

Job creation is expected to follow a similar trend. The KEF survey showed that 59 percent of respondents expect employment levels next year to remain similar to this year, while 32.3 percent anticipated a reduction. Only 8.7 percent said they plan to increase hiring.

“Many large enterprises indicated that they are likely to scale down investment and employment next year,” a KEF official said. “To encourage investment, regulatory burdens must be eased and measures for greater labor market flexibility are required.”