KUALA LUMPUR, Dec 3 — Ramu Krishnan Sinnamuthry was 54 and nearing retirement when he bought an insurance policy in 2023 from Allianz Life Insurance Malaysia Berhad that covered health care, as well as death and total and permanent disability.

His medical plan came with an RM1.5 million annual limit and covered hospitalisation as well as outpatient cancer treatment. At RM469 a month, the premium was steep for a sales executive preparing to leave the workforce, but he viewed it as a necessary safeguard as he entered the next phase of his life.

Now 57 and earning a living as a ride-hailing driver, Ramu is facing stage four tongue cancer. Two years after he bought the policy – and despite multiple hospital visits, scans, and biopsies – Allianz has yet to pay a single sen toward his care.

“I was told by my agent that if I was not on any medication, I could use it [my insurance] after three months,” Ramu, who lives in Kuala Lumpur, told CodeBlue during an interview on October 29.

CodeBlue previously reported, based on a nationwide survey of 855 private specialists, that insurers commonly deny claims submitted within the first two years of a policy, a practice many policyholders only discover when they attempt to make a claim. Many said they had been told by agents that claims could be made after three or six months.

Ramu’s 93-page policy contract, sighted by CodeBlue, show that Allianz imposes a 30-day waiting period during which no illness-related claims are payable, and a 120-day waiting period for “specified illnesses,” including hypertension, cancers, cardiovascular diseases, tumours, cysts, ENT conditions, urinary stones, hernias, and vertebro-spinal disorders.

Ramu developed two new medical conditions after buying his policy. Hypertension was first detected in September 2024 – about 17 months after his policy took effect on April 26, 2023 – placing it well outside any waiting-period restriction. His cancer diagnosis began with a CT-scan admission in July this year, more than two years after policy inception.

Yet in both episodes, his requests for a guarantee letter (GL) were denied.

The first GL rejection – for his hypertension visit last year – cited the need for “further review”. Ramu paid approximately RM2,000 out of pocket for a check-up and medication at ParkCity Medical Centre in Kuala Lumpur; he said he had decided not to proceed with admission and pay-and-claim because it would have cost about RM20,000.

Ramu sought subsequent care at University Malaya Medical Centre (UMMC) and later a public health clinic.

But that decision, he later learned, would become central to Allianz’s second denial. When he sought a GL for a CT-scan admission at the same private hospital in July that marked the start of his cancer diagnosis, the insurer told him it could not “investigate” his earlier hypertension episode because no claim had been submitted at the time.

As a result, his cashless facility was suspended and he was instructed to claim for that 2024 hypertension episode.

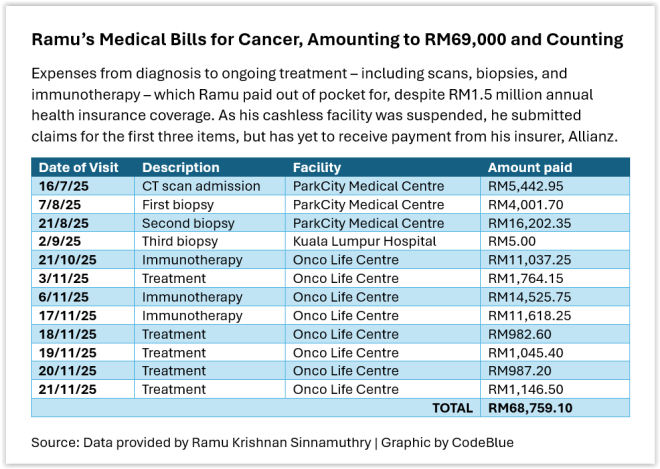

Ramu has since spent close to RM69,000 on diagnostic procedures and cancer treatment over the past four months.

“I thought insurance meant I’d be protected,” he told CodeBlue. “I didn’t expect to fight for it while fighting cancer.”

The Questions Kept Coming: ‘Why Do They Need Records From 2017?’

Ramu has submitted more than a dozen reports, referral letters, receipts, and forms for his cancer claims. As part of Allianz’s investigation into his hypertension episode – the issue that seems to be preventing his cancer claims from being processed – the insurer has asked him to produce medical records dating back to 2017, six years before his policy began.

“It’s very absurd. Why do they need records from 2017?” Ramu said, in a mix of frustration and disbelief. During the interview, he appeared visibly tired and spoke in a hoarse voice. In August, the middle-aged man weighed just 47 kg. “It’s like I murdered someone.”

As part of its investigation into his non-claim hypertension episode, Allianz, through his agent, provided two multi-page questionnaires dated September 8 – one for him to complete, and another for his “regular treating doctor from a clinic” covering the period 2017-2023. This would be his general practitioner (GP) at Klinik Yakin Bahau, Negeri Sembilan.

CodeBlue sighted the doctor’s completed seven-page questionnaire that stated that Ramu had been clinically fit and healthy throughout those years, up until his hypertension diagnosis in 2024.

The doctor had in fact become Ramu’s regular provider only in December 2019, when he sought a routine health assessment to renew his Goods Driving Licence (GDL) and was found to be in good health.

If not for that assessment, Ramu would have had virtually no long-term medical records, given his generally clean bill of health. Ramu also did a blood test in 2018 at another private clinic in Selangor, showing normal results, which he said was for a regular medical check-up.

According to the report provided by the Negeri Sembilan GP to Allianz, Ramu visited the clinic only four times between 2019 and 2023: twice for GDL renewal on separate occasions, once for a mild episode of eczema in 2022, and once in 2023 for an acute stressful period at work during which he had difficulty sleeping for a day or two.

Ramu’s GP confirmed that Ramu was not previously treated for any other ailment or chronic disease at the clinic. Nor did the patient complain about or was treated at that clinic for any illness or symptoms “related directly or indirectly” to diabetes, cardiac problems, hypertension, dyslipidemia or hyperlipidemia, or neck pain, among other listed conditions.

Ramu’s policy contract did not declare any investigation or diagnosis of listed diseases, hospitalisation, or medical procedures, or medical tests. Nor did he submit any medical report to Allianz upon purchasing his policy. However, he declared that he smoked six sticks a day.

CodeBlue also sighted Ramu’s eight-page questionnaire from Allianz, in which he was asked to provide “additional information” after the insurer noted that he had “consulted at a hospital recently”.

The broad scope of the questionnaire made it unclear whether the insurer was seeking information about his hypertension or cancer episode. In WhatsApp messages to his Allianz insurance agent, SY, which Ramu shared with CodeBlue, Ramu appeared plainly confused.

“So many questions, some I don’t understand at all,” he wrote. “They are making it more difficult for people like us to claim. The question for me to answer, [is it] based on my recent claims or the one on hypertension? Which one is it?”

There was frequent back-and-forth with SY about what certain questions meant and what he was expected to include. At one point, Ramu told his agent that he had no additional reports to attach because everything had already been submitted with his claims.

From his written responses to Allianz, Ramu appeared to answer the first 10 or 11 questions with reference to his cancer. The questionnaire did not explicitly mention hypertension until Question 12 that stated “based on the information in hand, noted that you have hypertension since year 2023”.

But Ramu answered that his symptoms, “ear pain”, first presented on September 24, 2024, and that the diagnosis established “newly diagnosed hypertension” and “chronic cough”.

The Allianz questionnaire asked to describe when his first symptoms appeared, identify the treating doctor at the time, state the established diagnosis, list any other doctors he had seen for the condition, detail medications taken, and indicate whether he had recurrent episodes.

He was also required to disclose whether he smoked; to specify if he consumed specific types of alcohol – beer, wine, and whisky – and at what frequency and volume; to list every doctor he had consulted in the past five years for any illness; and to declare whether he had ever been diagnosed with any of more than 20 conditions listed in a tick-box section.

Ramu finally submitted his questionnaire, along with his doctor’s, on October 8, after a month of recalling and gathering the required information.

About a month later, on November 12, Allianz issued another claims notification and deferment advice, following the submission of the questionnaires, requesting even more documents for his September 2024 hypertension episode, for which Ramu had submitted a handwritten appeal on July 18 this year explaining why he had not filed a claim then. Among the new requests, as seen by CodeBlue, were:

Referral letter from Poliklinik Kumpulan City, Bandar Sri Damansara.

Letter of authorisation/consent, three copies, to be completed by Ramu.

All investigation reports – blood tests, imaging, ultrasound, endoscopy, medical check-up reports – from 2017 to 2023.

Copy of appointment card from Klinik Kesihatan Taman Ehsan, Kepong.

Blood test results from 19/12/2019, 27/10/2022, 15/05/2023 and 30/11/2023 from Klinik Yakin.

For Ramu, this was the final straw. Upon receiving Allianz’s deferment notice, Ramu’s messages to his insurance agent grew increasingly strained.

“You tell them that I am not submitting any documents anymore. If they want, ask them to go and take it themselves. No more submissions, please understand. Enough is enough,” he told SY.

Ramu told his agent that Allianz had already conducted the necessary checks when approving his application and had “agreed to take me”, and that the insurer should not be demanding “all this” only after he began claiming for cancer.

He also questioned why Allianz had never requested such information in the years he had been paying premiums, but was now asking him to sign multiple forms and produce old records.

“This should have done before you, i.e. Allianz approved my application for medical card, not now,” he said. He also warned SY that if Allianz did not respond to his complaint within 14 days, he would escalate the matter to Bank Negara Malaysia and consider appointing a lawyer.

Allianz sent Ramu a second reminder of its claims deferment advice on November 21 for his hypertension claim.

Ironically, just two months before his cancer work-up began, Allianz had issued a repricing letter in May, informing him that his monthly premium would increase to RM505 beginning April 26, 2025, with further annual increments of 8 per cent over the next four years.

Ramu has since been paying the higher rate.

Amid his frustration, Ramu signed letters of authorisation and consent that allowed Allianz to retrieve the medical records it needed directly from clinics and hospitals.

‘I Am Sick and Tired’: Running Between Hospitals As Cancer Worsens

Meanwhile, Ramu’s cancer claims remain in limbo.

Beyond Allianz’s investigation into his hypertension episode, Ramu has filed three separate claims related to his cancer:

CT-scan admission (RM5,442.95, submitted on July 28, 2025).

First biopsy that confirmed cancer (RM4,001.70, submitted on August 20, 2025).

Second biopsy performed to identify the primary tumour site (RM16,202.35, submitted on September 4, 2025).

These three claims totalled RM25,647. All procedures were done at ParkCity Medical Centre.

Each claim came with its own set of paperwork. For every submission, Ramu was required to produce at least eight documents: a claimant statement, the e-invoice, a copy of his identification card, the e-payment form, medical reports, original receipts, an itemised bill, and relevant diagnostic reports.

He made repeated trips to ParkCity Medical Centre’s medical records unit to retrieve every referral letter, medical report, and supporting document needed for his submissions, all while his health deteriorated. Each record typically took at least 14 working days to obtain.

At one point, exhausted and struggling to keep up with the requests, Ramu asked his insurance agent to help collect the documents for him. “I submitted all, keep asking me to submit this and that, I think this one you have to help me.”

His cancer claims span consultations with two specialists (an ENT surgeon and an oncologist), as well as his GP, who initially referred him for further evaluation. They also involve multiple referral letters, a CT scan, two biopsy reports, medical reports, admission records and hospital bills, many of which were not immediately available after each visit.

As Diagnosis Deepened, So Did The Costs

Following his second biopsy and referral to an oncologist at ParkCity Medical Centre, Ramu was subsequently referred to Kuala Lumpur Hospital (HKL) in August as they have “all the facilities” to give Ramu a clearer picture of his diagnosis.

At that point, Ramu was receiving differing but escalating assessments of his cancer.

“ParkCity Medical Centre ENT (ear, nose and throat) told me that this is a cancer and hasn’t spread to other places, so this should be the beginning,” he told CodeBlue. “That’s why the ENT wanted to do the second biopsy, to check whether it had gone deeper or to find the cause of it.”

An oncologist at ParkCity Medical Centre then suggested that the disease likely originated at the base of the tongue. “The PMC oncologist said that this is a tongue cancer, below the tongue, and recommended me to ENT HKL as they have all the facilities,” Ramu said.

At HKL, an ENT specialist performed Ramu’s third biopsy in September. Two weeks later, the results confirmed the worst. “She told me that the cancer is at stage four with tumours in the throat,” Ramu said. “It is a tongue cancer with tumours on the throat.”

HKL clinicians recommended a major surgery followed by radiotherapy – an aggressive treatment plan that Ramu was unable to accept. He preferred to explore medication-based options instead.

Today, Ramu pays between RM10,000 and RM15,000 out of pocket every two weeks for immunotherapy at Onco Life Centre in Bangsar South, in addition to oral chemotherapy that he takes twice daily. That translates to RM360,000 a year, which would still fall below Ramu’s RM1.5 million annual limit — if his insurance covered it.

“Government hospitals like HKL don’t provide immunotherapy because the cost is high – that’s why I have to go to private,” he said.

The documents referenced and sighted by CodeBlue for this story were provided by Ramu.

A System With No Timelines Or Recourse

Malaysia has no mandatory timelines for insurers to process medical claims or issue GLs. In the absence of such requirements, applications for guarantee letters or reimbursements can sit indefinitely “under review”, with no deadline for resolution.

In fact, Ramu’s insurance agent told him last August that there was no deadline for document submission for his claims, saying documents could be submitted within a year. According to Allianz’s website, the insurance company processes claims within seven working days “once we have received all the necessary documents”. Upon approval, payment will be issued within seven working days.

When contacted, Allianz declined to comment on Ramu’s case, saying it was bound by “strict confidentiality and data protection obligations”.

“We note your intention to publish an article on this matter. We respectfully reserve all our rights in this matter to take all necessary steps to protect our Company’s reputation,” an Allianz Malaysia Berhad spokesperson told CodeBlue yesterday.

In the meantime, Ramu is living a Kafkaesque nightmare of navigating the bureaucracy of Malaysia’s private health insurance system, as his claims remain delayed and unpaid while battling advanced cancer. His savings are dwindling; he expects to withdraw from his Employees’ Provident Fund (EPF) next.

Last November 23, Ramu signed a consent letter that his insurance agent brought to him. Two days later, Ramu asked SY, who is registered as an agent with the Life Insurance Association of Malaysia (LIAM), for a copy of the document he signed to keep it on file because “I don’t know what else is written”.

But SY already passed it to an Allianz branch office, which then passed it to the claims department, so she told Ramu to email customer service to request for a copy of the document.

“So now how long do I have to wait? And at the same time, I am paying RM505 monthly premium to your company. Paying that particular amount is high for me. [Is] your company going to reimburse my medical bills or just cut me off? I need an answer within 1 week [because] if cannot reimburse my bills, just [terminate] premiums I have paid. Continue dragging and don’t have any answers, I am sick and tired. Please work it out for me,” Ramu said in a text to SY.

“I cannot be going to customer service every time, if can you get a higher authority to decide. I sudah mau jadi gila.”

Ramu messaged SY again last Friday: “Does my insurance cover my medical expenses? Please answer.”

SY once described Ramu on WhatsApp as, “my friend ramu”. Ramu texted her in September: “You are my friend not only my agent. Please help.”

But SY ghosted her “friend”. Her last message to Ramu was on November 26: “customer can email to customer.service@allianz.com.my.”

Edited by Boo Su-Lyn