16m agoWed 10 Dec 2025 at 1:36amMarket snapshotASX 200: -0.1% at 8,573 points

Australian dollar: -0.1% at 66.3 US centsWall Street: Dow Jones (-0.4%), S&P 500 (-0.1%), Nasdaq (+0.1%)Europe: DAX (+0.5%), FTSE (flat), Stoxx 600 (-0.1%)Spot gold: +0.8% to $US4,216/ounceOil (Brent crude): +0.1% to $US 62.09/barrelIron ore: -0.1% to $US104.81/tonneBitcoin: -0.1% at $US92,044

Prices current around 12:35pm AEDT

Live updates on the major ASX indices:

10m agoWed 10 Dec 2025 at 1:42am

Here’s what’s happening on local markets today

Hi there,

Local share markets are lower today, ahead of the US interest rate decision tomorrow morning our time.

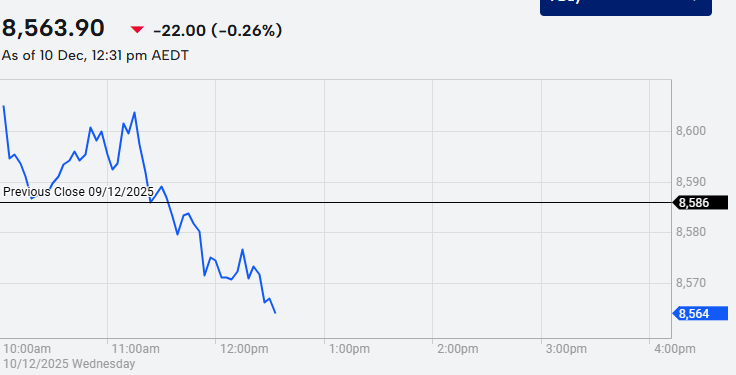

The ASX200 is down 0.2% to 8,565 points as at 12:34pm AEDT. The broader All Ordinaries index is also down 0.2% to 8,854 points.

You can see the downward trend so far today in this graph.

ASX200 (ASX)

ASX200 (ASX)

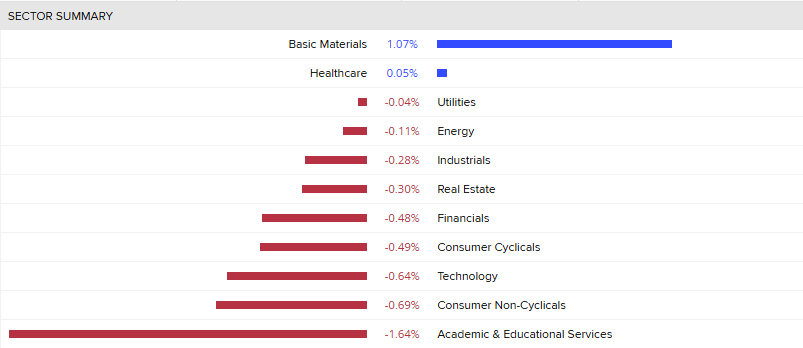

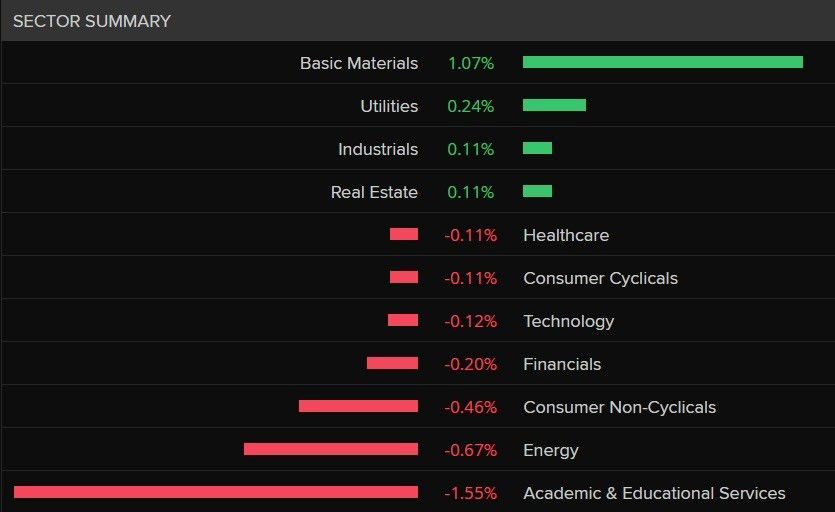

Most sectors are in the red today, with health care and basic materials the best performing so far.

Sector summary (LSEG)

Sector summary (LSEG)

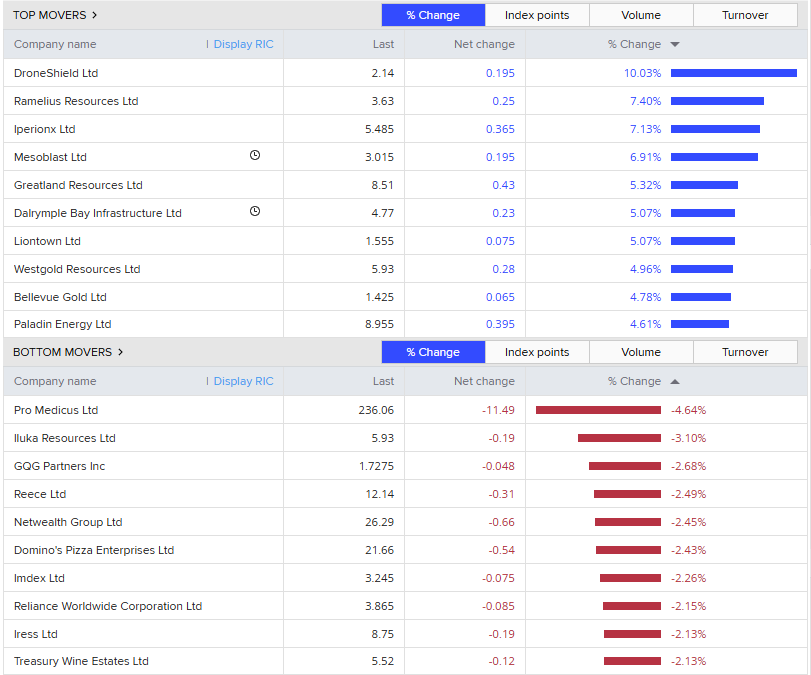

In terms of individual stocks DroneShield is up 10%.

Gold miner Raemlius Resources is up 7% on news it will buy back up to $250 million worth of its shares and increase its minimum dividend.

Top and bottom movers (LSEG)

Top and bottom movers (LSEG)

The bottom movers are Pro Medicus down 4.6% and Iluka Resources down 3%.

45m agoWed 10 Dec 2025 at 1:07am

RBA Chart Pack

1h agoWed 10 Dec 2025 at 12:42am

Google faces EU antitrust investigation over AI Overviews, YouTube

Google is facing an EU antitrust investigation into its use of publishers’ online content and YouTube videos to train its artificial intelligence models.

The European Commission’s second investigation into Google in less than a month underscores growing unease over Big Tech’s dominance in new technologies that could shut out rivals, but could escalate tensions with the United States as EU laws adopted in the last few years have become a sore point in relations with Washington.

The EU competition enforcer said it was concerned that Google may be using publishers’ online content for its AI-generated summaries known as AI Overviews without compensating them adequately and without giving them the option to refuse.

It expressed the same concerns regarding Google’s use of YouTube videos uploaded by its users.

“Google may be abusing its dominant position as a search engine to impose unfair trading conditions on publishers by using their online content to provide its own AI-powered services,” EU antitrust chief Teresa Ribera said on Tuesday.

“A healthy information ecosystem depends on publishers having the resources to produce quality content. We will not allow gatekeepers to dictate those choices,” she added.

Google rejected the complaint by independent publishers in July which triggered the EU investigation.

“This complaint risks stifling innovation in a market that is more competitive than ever,” a Google spokesperson said.

“Europeans deserve to benefit from the latest technologies and we will continue to work closely with the news and creative industries as they transition to the AI era.”

AI Overviews are AI-generated summaries that appear above traditional hyperlinks to relevant webpages and are shown to users in more than 100 countries. It began adding advertisements to AI Overviews last May.

Google’s spam policy is also in the EU crosshairs after an investigation prompted by publishers.

The company risks a fine of as much as 10% of its global annual revenue if found guilty of breaching EU antitrust rules.

1h agoWed 10 Dec 2025 at 12:06amDroneShield and gold miners among the best performing stocks of the ASX 200

Now let’s take a look at today’s best and worst performing stocks.

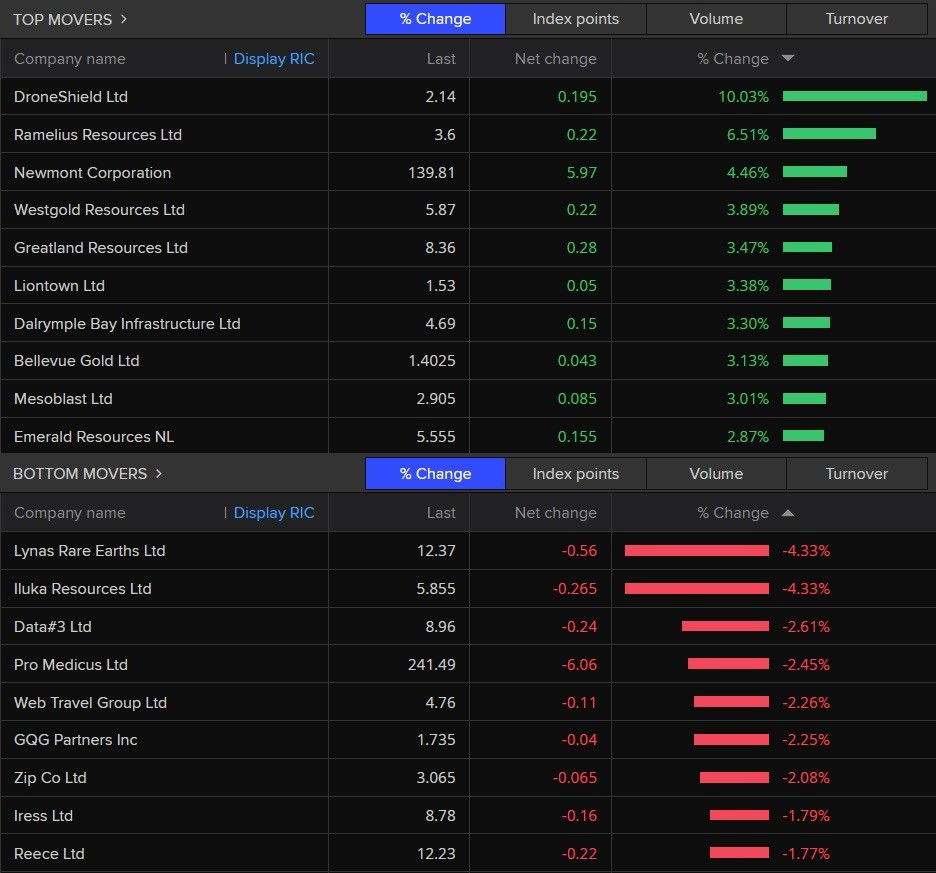

DroneShield shares have surged 10% in a remarkable turnaround.

I say “remarkable” because there’s renewed interest in the stock after a huge sell-off in recent weeks (which saw the company lose three-quarters of its value at its worst point).

There were good reasons for the heavy selling — mainly because it was overvalued (with an extreme ‘price to earnings ratio’ of around 300x at one point).

On top of that, its CEO, chairman and a director sold all their shares in the company (which doesn’t normally signal confidence in the company), and haven’t explained why they did it.

So it looks like a case of ‘buying the dip’.

DroneShield’s share price is still down 36% over the past month.

But it’s still up more than 200% since the year began as a rise in global conflicts has led to improved sales for its anti-drone technology.

Gold mining stocks are also seeing a sharp rise in their share price, including Ramelius Resources, Newmont Corporation and Westgold Resources.

On the flip side, some of today’s worst performing stocks include Lynas Rare Earths, Iluka Resources, Data#3, Prdo Medicus and Web Travel Group.

Several of today’s best performing stocks are gold miners. (Refinitiv)2h agoTue 9 Dec 2025 at 11:44pmASX materials sector keeps Australian share market in positive territory

Several of today’s best performing stocks are gold miners. (Refinitiv)2h agoTue 9 Dec 2025 at 11:44pmASX materials sector keeps Australian share market in positive territory

The Australian share market has been open for more than half an hour, and it’s still looking lacklustre.

The ASX 200 was up 0.1% to 8,596 points by 10:40am AEDT.

About 105 out of 200 stocks are trading lower (so that’s most of them down).

When you look at it by sectors, consumer staples (-0.4%) and energy (-0.3%) are some of the ones faring the worst.

On the flip side, there are big gains in the materials sector (+1.1%), which means Australia’s mining stocks are keeping the ASX afloat this morning.

Materials is, by far, today’s best performing ASX sector. (Refinitiv)2h agoTue 9 Dec 2025 at 11:26pmDemand for water can’t be an ‘afterthought’ in AI push

Materials is, by far, today’s best performing ASX sector. (Refinitiv)2h agoTue 9 Dec 2025 at 11:26pmDemand for water can’t be an ‘afterthought’ in AI push

Australia has more than 250 data centres and more in the pipeline, with most of them located in Sydney and Melbourne.

The Commonwealth unveiled last week its 37-page National AI Plan which sets out a road map to drive the development and adoption of artificial intelligence by bolstering investment in skills training and data centres that store servers.

One of the country’s leading experts in stormwater treatment says they should ideally be built near waste treatment plants, to avoid using drinking water to run the thirsty facilities.

The United Nations Environment Programme has stressed that data centres “consume large amounts of energy and water, and we know that consumption is only going to grow” around the world.

Australia saw the world second largest investment in data centres last year, behind only the United States, with about $10 billion spent.

For a more in-depth explanation, here’s the latest piece by Ahmed Yussuf:

2h agoTue 9 Dec 2025 at 11:16pm

Market snapshotASX 200: flat at 8,588 points

Australian dollar: +0.3% at 66.4 US centsWall Street: Dow Jones (-0.4%), S&P 500 (-0.1%), Nasdaq (+0.1%)Europe: DAX (+0.5%), FTSE (flat), Stoxx 600 (-0.1%)Spot gold: +0.5% to $US4,208/ounceOil (Brent crude): -0.6% to $US 62.12/barrelIron ore: -0.2% to $US101.90/tonneBitcoin: +2.5% at $US92,609

Prices current around 10:15am AEDT

Live updates on the major ASX indices:

2h agoTue 9 Dec 2025 at 11:13pmASX 200 and All Ords flat in early trade

There’s not a lot of excitement on the Australian share market so far.

The ASX 200 had risen 0.1% to 8,593 points by 10:10am AEDT, while the broader All Ordinaires index was also up 0.1% to 8,882 points.

Essentially, the two main indexes that track local share trading activity are flat.

I’ll have more detail on which stocks are doing well (and poorly) in just a moment!

3h agoTue 9 Dec 2025 at 10:50pmHow a ‘broken’ domestic gas system is contributing to high electricity prices

High electricity prices are a major driver of inflation and a huge burden on businesses.

Underpinning this is a shortage of domestic gas.

That’s because Australia’s east coast gas market is “broken”, according to Josh Runciman, lead analyst for Australian gas at the Institute for Energy Economics and Financial Analysis (IEEFA).

He says the cheap gas reserves that have powered eastern Australia for the past 50 years are effectively gone, and the reserves in offshore Victoria are in decline.

Mr Runciman said the key factor that has led to Australia’s gas shortage problem was the start of the LNG export industry.

He pointed to a decision by Santos to start exporting from the Gladstone LNG facility a decade ago. Since then, Santos has effectively been taking gas out of the domestic market to meet its export contracts.

He also says the company effectively decided to build an LNG export facility that was too large (compared to the reserves they had) and Australians have been paying for it ever since.

You can listen to his full interview with The Business guest-host Ian Verrender here:

Loading…3h agoTue 9 Dec 2025 at 10:31pmSuper funds must dip into scheme to compensate victims of misconduct

The $4.3 trillion superannuation sector will be asked to contribute to a compensation scheme for victims of financial misconduct.

In the wake of the collapses of the First Guardian and Shield managed investment schemes, which have left thousands of investors in limbo, Assistant Treasurer Daniel Mulino has unveiled proposed changes to the bailout scheme known as the Compensation Scheme of Last Resort (CSLR).

The scheme, established after the Hayne Royal Commission, provides up to $150,000 compensation to consumers who faced financial misconduct.

To date it has been funded by levies in financial planners but there have been calls for the levy to be extended to other sectors including super funds.

On Wednesday Mr Mulino said that super funds, as well as financial advisers and credit providers such as banks and fund managers, would now be required to dip in.

He said the special levy for the 2026 financial year is $47.3 million.

Mr Mulino is also considering further changes to fund future shortfalls in the levy, given demand for the scheme is expected to grow in the wake of the First Guardian and Shield collapses.

“The 2026 special levy will be spread widely across subsectors to stabilise the scheme in the immediate term and avoid overwhelming any single part of the industry.,” he told ABC News.

“It is the responsible choice for now, but it does not fix the underlying problems that have driven the CSLR into this position so early in its life.

“Early next year, I will be releasing options paper on post-implementation reform of the CSLR. It outlines the structural and technical levers available to ensure the scheme remains sustainable and operates as intended.

“We are committed to doing this in partnership with industry and consumer advocates.”

3h agoTue 9 Dec 2025 at 10:18pmNo interest rate cuts for foreseeable future, RBA governor Michele Bullock confirms

Michele Bullock was in surprisingly good spirits at yesterday’s Reserve Bank press conference.

I even managed to get a laugh out of her! That was after I (somewhat cheekily) asked the RBA governor:

“What’s the more probable outcome for next year? Interest rates going down or interest rates going up?”

I say “surprisingly” because I was expecting her to get (at least) slightly frustrated by the endless stream of questions from journalists about whether the RBA would lift interest rate next year.

What also surprised me was her very unambiguous response to my question.

Ms Bullock said:

“I don’t think there are interest rate cuts on the horizon for the foreseeable future,” she declared.

“The question is, is it just an extended hold from here or is it the possibility of a rate rise?

“I couldn’t put a probability on those, but I think they’re the two things that the board will be looking closely at coming into the new year.”

I also asked whether the RBA cut rates too many times this year, particularly if the bank ends up having to lift rates in 2026. You can watch her response here:

Loading…3h agoTue 9 Dec 2025 at 9:58pmAEMO slashes forecasts for wind farms as falling costs fuel solar, batteries

The body that runs Australia’s biggest power market has scaled back its plans for high-voltage power lines and wind farms to meet the country’s green energy targets.

Instead, the Australian Energy Market Operator (AEMO) has forecast Australia will need to rely more heavily on big solar farms, batteries and households if it is to get 82 per cent of its electricity from renewable sources by 2030.

The agency has today released the draft version of its latest “integrated system plan”, which it describes as a road map for decarbonising Australia’s electricity system.

Here’s the story by Daniel Mercer:

4h agoTue 9 Dec 2025 at 9:46pm

Alan Kohler on interest rates and housing affordability

In case you need a refresher before the share market opens for trading, I can certainly recommend Alan Kohler’s finance report from last night’s 7pm News bulletin.

Alan talked about the market’s increased expectations of an interest rate hike by the RBA next year and the briefly turbulent reaction on currency markets.

He also looked into a report by KPMG on ‘first home buyer accessibility’, which measures the percentage of homes that first home buyers (on an average wage) can purchase.

You can watch his report here:

Loading…4h agoTue 9 Dec 2025 at 9:35pmWall Street’s lacklustre finish as traders await US interest rate decision

Wall Street has ended its trading session relatively flat ahead of tomorrow’s rates decision from the US Federal Reserve.

Here are the closing figures:

Dow Jones: -0.4% to 47,560 pointsS&P 500: -0.1% to 6,841 pointsNasdaq Composite: +0.1% to 23,576 points

Investors are expecting the Fed to take a hawkish tone even if it cuts interest rates tomorrow morning at 6am AEDT.

Traders are widely expecting a quarter-percentage point rate cut despite inflation still running above the central bank’s 2% target.

Policymakers have sent mixed signals about the outlook with some warning that price pressures could easily reaccelerate, while others have been more concerned about the job market’s health.

Traders are still pricing in a roughly 87% chance of a 0.25 percentage point rate cut, according to CME’s FedWatch Tool.

– with Reuters

4h agoTue 9 Dec 2025 at 9:25pmBorrowers bracing for higher mortgage repayments in 2026

If you want a really simple explanation of what’s going on with interest rates, I have just the thing for you!

I filed this story yesterday for The Business on what it would take for the Reserve Bank to start lifting interest rates again.

We spoke with Paul Bloxham, HSBC’s chief economist of Australia and New Zealand, who says:

“Our reading is the economy is already in an upswing. Growth is running a little faster than the economy has and that’s why inflation has picked up recently.

“That’s why we think the next move from the RBA is more likely to be up than down.”

Mr Bloxham also said one of the consequences of a rate hike could be a “slowdown in private sector hiring”.

“That would be one of the mechanisms through which you would be setting [monetary] policy to try and get inflation back to target”.

Loading…4h agoTue 9 Dec 2025 at 9:11pmPenalties push for financial abusers who draw partners into tax and company fraud

Financial and economic abuse is estimated to cost the economy almost $11 billion a year and affects more than 2.4 million Australians, according to research conducted by Deloitte, commissioned by CBA and published by Treasury.

A separate, new national study of coerced business debt – the first in Australia – has revealed its devastating impact on domestic abuse survivors.

The research, led by Jasmine Opdam, senior policy and advocacy officer at Redfern Legal Centre’s financial abuse service, and Monash Business School associate professor Vivien Chen, was done in collaboration with the Economic Abuse Reference Group.

It was based on detailed interviews with frontline professionals and community organisations who regularly assist victims.

Ms Opdam says they described how perpetrators of financial abuse commit fraud by impersonating their partners, signing them up as company directors and putting business and tax debts in their name.

“These coerced business debts rob women of their financial autonomy and often take years and years to recover from, if at all,” Ms Opdam said.

For more, here’s the story by Nassim Khadem:

4h agoTue 9 Dec 2025 at 9:00pmRBA governor’s interest rates comments ‘hawkish’, says AMP economist

Reserve Bank governor Michele Bullock says there’s a lot of uncertainty ahead for the Australian economy, but more interest rate cuts are not on the horizon.

AMP’s deputy chief economist Diana Mousina says the governor’s comments could be described as “hawkish” and “that’s likely to mean that interest rates are either going to be on hold or increased in the next 12 months”.

Ms Mousina says the risks to the economy are titled towards the “downside” next year.

You can watch her full interview with The Business guest-host Ian Verrender here:

Loading…5h agoTue 9 Dec 2025 at 8:49pmInterest rate rises replace cuts on Michele Bullock’s RBA agenda

Our business editor Michael Janda has spent many years trying to read the tea leaves, to divine the thoughts and plans of the Reserve Bank technocrats who determine our interest rates.

He observed that when Michele Bullock released her post-meeting statement yesterday, early views were that the RBA governor and her colleagued had shifted in a “hawkish” direction — where the possibility of rate rises was now on the table, but further rate cuts hadn’t been ruled out.

Not long afterwards, she unequivocally clarified:

“I don’t think there are interest rate cuts on the horizon for the foreseeable future.

“The question is, is it just an extended hold from here, or is it the possibility of a rate rise?”

Not since her predecessor Philip Lowe infamously declared in late 2020 and through 2021 that the board did not expect to raise interest rates until at least 2024 has an RBA governor been quite as explicit in their outlook for rates.

For more, here’s Michael’s latest analysis:

5h agoTue 9 Dec 2025 at 8:43pm

Market snapshotASX futures: +0.2% to 8,610 pointsASX 200 (Tuesday close): -0.5% to 8,586 pointsAustralian dollar: +0.3% at 66.4 US centsWall Street: Dow Jones (-0.2%), S&P 500 (flat), Nasdaq (+0.2%)Europe: DAX (+0.5%), FTSE (flat), Stoxx 600 (-0.1%)Spot gold: +0.6% to $US4,213/ounceOil (Brent crude): -0.8% to $US 62/barrelIron ore: -0.2% to $US101.90/tonneBitcoin: +2.8% at $US93,869

Prices current around 7:40am AEDT

ASX 200: -0.1% at 8,573 points

ASX 200: -0.1% at 8,573 points