24/7 Wall St.

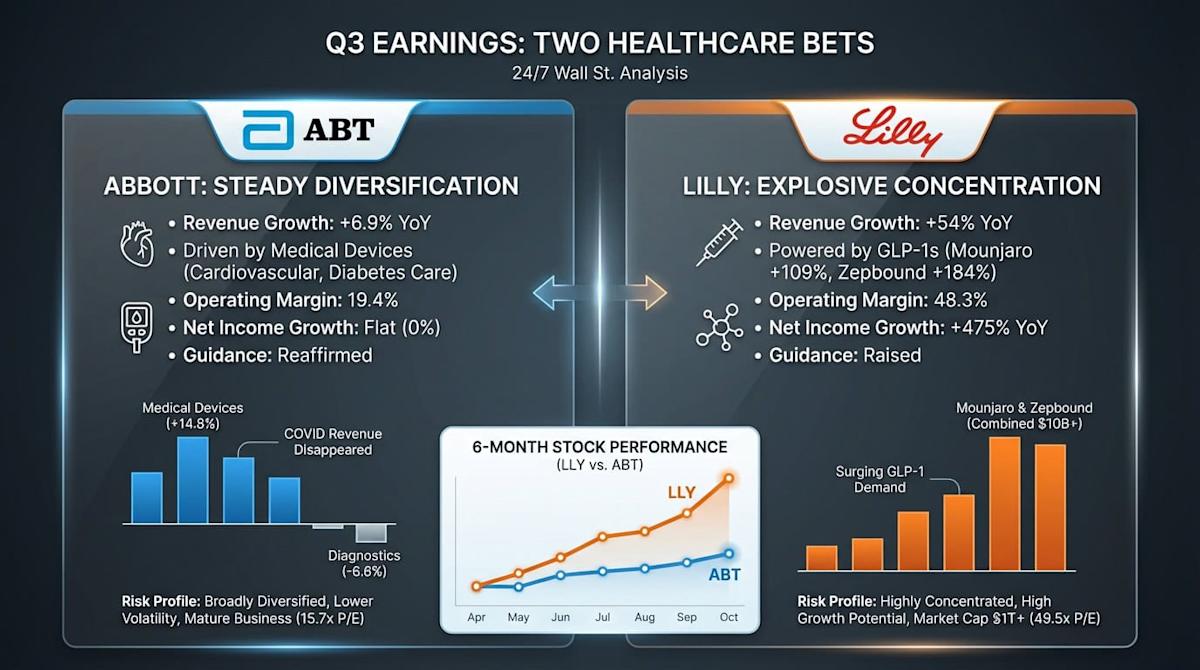

Abbott Laboratories (ABT) grew revenue 6.9% with medical devices up 14.8% to $5.45B. Abbott reaffirmed guidance for 7.5-8.0% organic growth.

Eli Lilly (LLY) posted 54% revenue growth driven by Mounjaro ($6.52B) and Zepbound ($3.57B). Lilly raised guidance to $63.0-63.5B revenue.

Lilly’s operating margin reached 48.3% versus Abbott’s 19.4%. Lilly trades at 49.5x P/E while Abbott trades at 15.71x.

If you’re thinking about retiring or know someone who is, there are three quick questions causing many Americans to realize they can retire earlier than expected. take 5 minutes to learn more here

Abbott Laboratories (NYSE: ABT) and Eli Lilly (NYSE: LLY) just reported Q3 earnings that highlight two fundamentally different healthcare bets. Abbott delivered steady 6.9% revenue growth anchored by medical devices. Lilly posted explosive 54% revenue growth powered by its GLP-1 obesity and diabetes drugs.

Abbott’s medical device segment grew 14.8% to $5.45 billion. The cardiovascular portfolio drove results, with TriClip for tricuspid valve repair gaining Japan approval and Navitor TAVI expanding its CE Mark in Europe. Diabetes Care also contributed meaningfully. Abbott met EPS estimates at $1.30. Diagnostics fell 6.6% as COVID testing revenue disappeared. Operating income rose 13.1% to $2.06 billion, though net income stayed flat year over year.

Lilly’s revenue hit $17.60 billion, beating estimates by 9.5%, with Mounjaro generating $6.52 billion (up 109%) and Zepbound adding $3.57 billion (up 184%). Volume across the incretin portfolio surged 62%. Net income jumped 475% to $5.58 billion. Operating margin reached 48.3%, nearly double Abbott’s. CEO David Ricks highlighted progress on orforglipron, an oral GLP-1 candidate that completed four Phase 3 trials and could enable global obesity submissions by year end. Lilly raised full-year guidance to $63.0-63.5 billion in revenue and $23.00-23.70 in non-GAAP EPS. Abbott reaffirmed its outlook for 7.5-8.0% organic growth excluding COVID testing.

Metric

Abbott

Lilly

Revenue Growth

6.9% YoY

54% YoY

Net Income Growth

Flat (0%)

475% YoY

Operating Margin

19.4%

48.3%

Guidance

Reaffirmed

Raised

Abbott spreads risk across medical devices, diagnostics, nutrition, and branded generics. No single product dominates. The company operates in 160 countries with exposure to cardiovascular, diabetes, and structural heart markets. This structure limits upside but cushions downside.

Lilly has placed an enormous bet on incretin-based therapies. Mounjaro and Zepbound now account for over $10 billion in quarterly revenue combined. The company is expanding manufacturing capacity in Virginia, Texas, and Puerto Rico to meet demand. Return on equity sits at 96.5%. But concentration creates vulnerability. If GLP-1 demand softens or competition intensifies, Lilly’s growth trajectory changes immediately.

For Abbott, the focus shifts to whether cardiovascular device momentum can offset slower diagnostics. TriClip’s Japan launch and Navitor’s European expansion will determine if medical devices can sustain double-digit growth.

For Lilly, supply chain execution is everything. The company must scale production fast enough to capture demand before competitors like Novo Nordisk close the gap. Orforglipron’s regulatory path will signal whether Lilly can extend its GLP-1 dominance into oral formulations. Any manufacturing delays or safety concerns would hit the stock hard given its 49.5x P/E ratio.

Abbott trades at a 15.71 P/E ratio with a 1.88% dividend yield, reflecting a mature business model. Lilly trades at a 49.5x P/E ratio, pricing in continued GLP-1 dominance. Abbott’s diversified revenue model spreads risk across multiple segments, while Lilly’s concentrated bet on incretin therapies creates both higher growth potential and higher concentration risk. Lilly recently hit $1 trillion in market cap, the first pharma company ever to do so, suggesting the market has already priced in substantial future growth. Abbott offers more predictable returns tied to steady device innovation, while Lilly’s trajectory depends on maintaining its incretin market position.

You may think retirement is about picking the best stocks or ETFs, but you’d be wrong. Even great investments can be a liability in retirement. It’s a simple difference between accumulating vs distributing, and it makes all the difference.

The good news? After answering three quick questions many Americans are reworking their portfolios and finding they can retire earlier than expected. If you’re thinking about retiring or know someone who is, take 5 minutes to learn more here.