Key takeaways

Westpac has hiked its fixed home loan rates by up to 0.35 percentage points, the second increase in just over a month, pushing its lowest rate to 5.49%.

It’s part of a broader trend – 12 lenders have lifted fixed rates in the past week, and the number of lenders offering sub-5% fixed loans has fallen sharply from 43 to just 29.

Modelling from Canstar shows that for a $600,000 loan, fixing now could cost borrowers $1,920 more in interest over two years if the RBA cuts rates twice — but save $6,697 if there are two hikes instead. In short, fixing provides certainty, not guaranteed savings.

Fixed loans can shield borrowers from future hikes but come with restrictions — break fees, limited extra repayments, and fewer offset options.

With the pool of competitive fixed loans shrinking, borrowers who are considering fixing should act soon, but only after comparing terms carefully

If you thought interest rate uncertainty was behind us, think again.

Westpac has just lifted its fixed home loan rates for the second time in just over a month, increasing them by as much as 0.35 percentage points.

The move follows the Reserve Bank’s latest hint that another rate hike could be on the cards in 2026, and it’s setting the tone for what could be another year of volatility for borrowers and investors alike.

While this might seem like a small move on paper, it’s part of a much bigger story, one that tells us a lot about where our economy, banks, and housing market are heading next.

The fixed rate tide is rising again

Let’s start with the numbers.

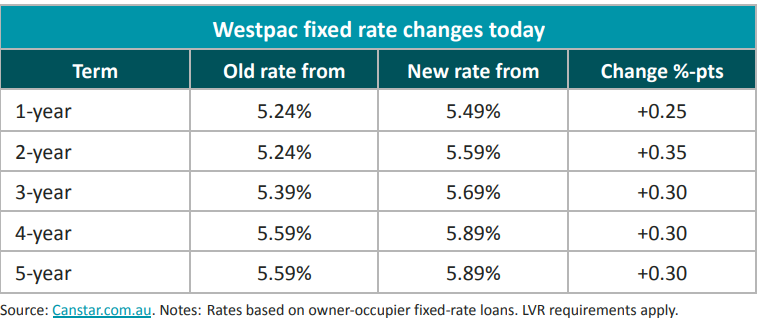

Westpac’s fixed rates have climbed to the following levels:

That means the lowest Westpac fixed rate now sits at 5.49%.

But Westpac isn’t alone.

In the past week, 12 lenders: including St. George, Bank of Melbourne, BankSA, ING, HSBC, Suncorp, and Australian Mutual Bank, have all hiked their fixed rates.

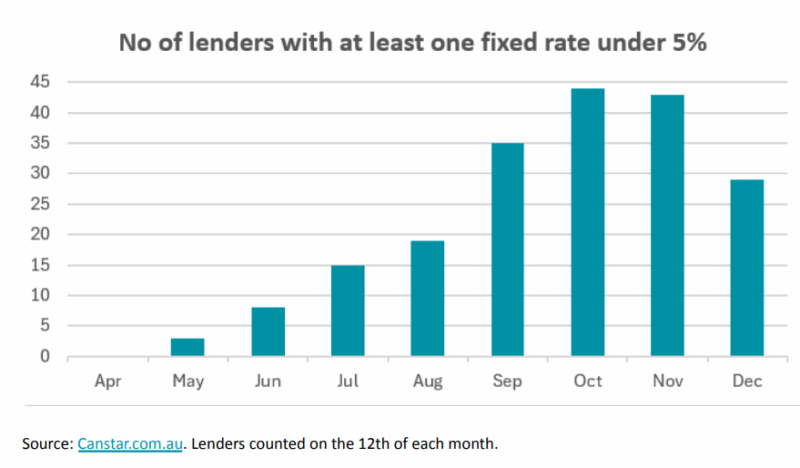

Accroding to Canstar, just a month ago, 43 lenders were offering at least one fixed rate below 5%.

Now, only 29 remain. That’s a rapid contraction in competition, and a clear sign that the broader market is repositioning for higher funding costs.

What’s driving these hikes?

The Reserve Bank hasn’t raised the cash rate since late 2024, but its recent commentary suggests it’s no longer confident inflation is under control.

The latest RBA statement, which hinted that a rate rise may be back on the table in 2026, has triggered a wave of preemptive adjustments across the banking sector.

Canstar reports that even though none of the big four have officially forecast rate hikes, all now concede the risk is growing:

CBA: “The door has been opened for a rate hike as early as February.”

NAB: “February is now a live meeting for a rate hike.”

ANZ: “The risks of an early 2026 rate hike are rising.”

Westpac (the outlier): still expects two rate cuts: one in May and another in August, but admits “the probability of a rate hike has risen.”

This divergence tells you just how uncertain the outlook really is.

While inflation is easing, it’s not falling fast enough for the RBA’s comfort.

And the global picture, with the US Federal Reserve also keeping rates higher for longer, only adds to the pressure.

For banks, the logical response is to protect margins by pricing in the risk of higher wholesale funding costs.

Hence, the rising fixed rates.

The fixed vs variable dilemma: a balancing act

So, what’s the smarter move now: fix or stay variable?

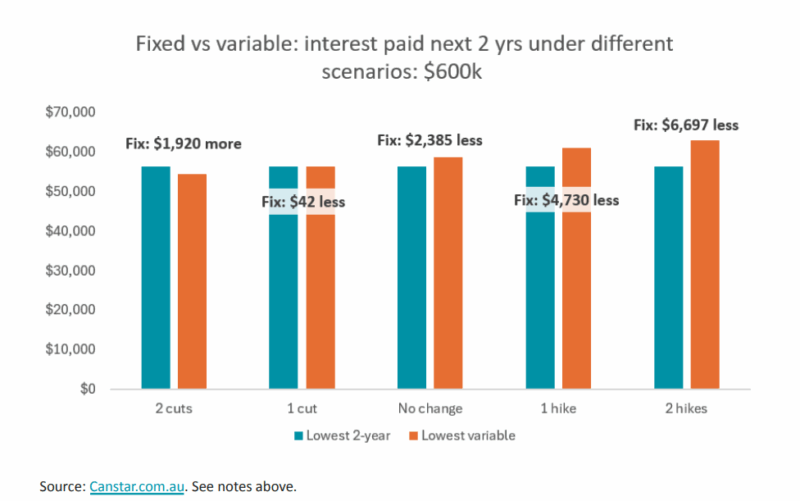

Canstar modelled a simple comparison for a typical $600,000 loan with 25 years remaining.

The results tell an interesting story.

If there are two cash rate cuts next year (as Westpac’s economists predict), borrowers who fix now at the lowest two-year rate would pay around $1,920 more in interest over the next two years than those on a variable rate.

But if there are two rate hikes instead, the fixed borrower would come out ahead by $6,697.

Even a single hike would see the fixed rate outperform by roughly $4,730

Note: Fixing your mortgage rate is a defensive move. You’re paying for certainty, not necessarily savings.

As Canstar’s Data Insight Director Sally Tindall puts it:

“When the RBA signals a rate hike is on the cards, lenders listen and fixed rates move.

This won’t be the last fixed rate hike we see before the year is out.”

What borrowers need to know before fixing

Locking in a fixed rate gives you peace of mind, but it also comes with strings attached.

Before committing, borrowers should weigh:

Break costs: If you refinance or repay early, you could face thousands in exit fees.

Limited flexibility: Fixed loans often cap extra repayments and restrict offset account use.

Timing risk: If the RBA ends up cutting rates instead, you could be stuck paying above-market rates for years.

The good news? There are still 29 lenders with at least one fixed rate under 5%, but the pool is shrinking quickly.

NAB and ANZ currently hold the lowest fixed rates among the majors, but as Canstar notes, they could easily follow Westpac’s lead in coming weeks.

So if you’re planning to fix, now’s the time to do your homework, but don’t sit on your hands.

What this means for property investors

For investors, this latest round of rate hikes is a reminder that we’re entering a new stage of the property cycle: one defined by stability rather than stimulus.

After several years of extraordinary price growth and record-low borrowing costs, markets are normalising.

That’s not necessarily bad news; it just means investors need to be more strategic.

Here’s how to think about it:

Cash flow resilience matters more than ever. Even small increases in rates can eat into returns, so review your portfolio’s serviceability buffer.

Flexibility is key. Many seasoned investors are splitting their loans: part fixed, part variable, to balance stability and agility.

Focus on asset quality. In a higher-rate environment, A-grade properties in blue-chip locations continue to outperform as affordability pressures lock out fringe buyers.

Remember, interest rates are just one lever in a much bigger system.

Population growth, tight rental markets, and undersupply continue to support medium-term property values.

My take

Westpac’s latest move isn’t just about repricing loans; it’s about preparing for uncertainty.

We’re in a phase where banks, borrowers, and investors are all trying to read the tea leaves of an economy that refuses to settle.

Inflation is sticky, the RBA is cautious, and global monetary policy remains tight.

So rather than trying to predict the next rate move, smart investors are doing what they always do: planning for multiple scenarios.

That means reviewing your finance structure, holding liquidity buffers, and not letting short-term rate changes distract you from long-term wealth goals.

Because while rates may move, one thing hasn’t changed: quality assets, in the right locations, bought with a strategic plan, will always outperform over time.

Are you wondering how you should invest in this interesting phase of the property cycle?

If you’re like many property investors, you’re probably wondering what’s the right thing to do at present.

Should you buy, should you sell, or should you just wait?

You can trust the team at Metropole to provide you with direction, guidance, and results.

Whether you’re a beginner or an experienced investor, at times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s exactly what you get from the multi-award-winning team at Metropole.

We help our clients grow, protect and pass on their wealth through a range of services including:

Strategic property advice – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more

Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $4Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney, and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment-grade property. Click here to learn how we can help you.

Property Development – We enable you to become an “armchair developer” and get all the benefits of property development without getting your hands dirty. We take the hassles out of your investment by assisting you with all the expertise you need, from concept to completion, including construction. Click here to see if it’s the right way for you to grow your portfolio.

Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

Property Management – Our stress-free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years, and our properties lease 10 days faster than the market average.

![]()

About Dorian Traill

Dorian is a Senior Wealth Planner at Metropole and helps develop a tailored, individualised wealth plan specifically for the client’s circumstances. Dorian’s career in property and finance started in 1997 as a sales agent in Brisbane before he switched to mortgage broking. He has been advising clients on how to successfully grow their wealth through property for a number of decades.