Two major banks are now forecasting the Reserve Bank of Australia will hike rates at its February meeting, in what will be a massive blow to households.

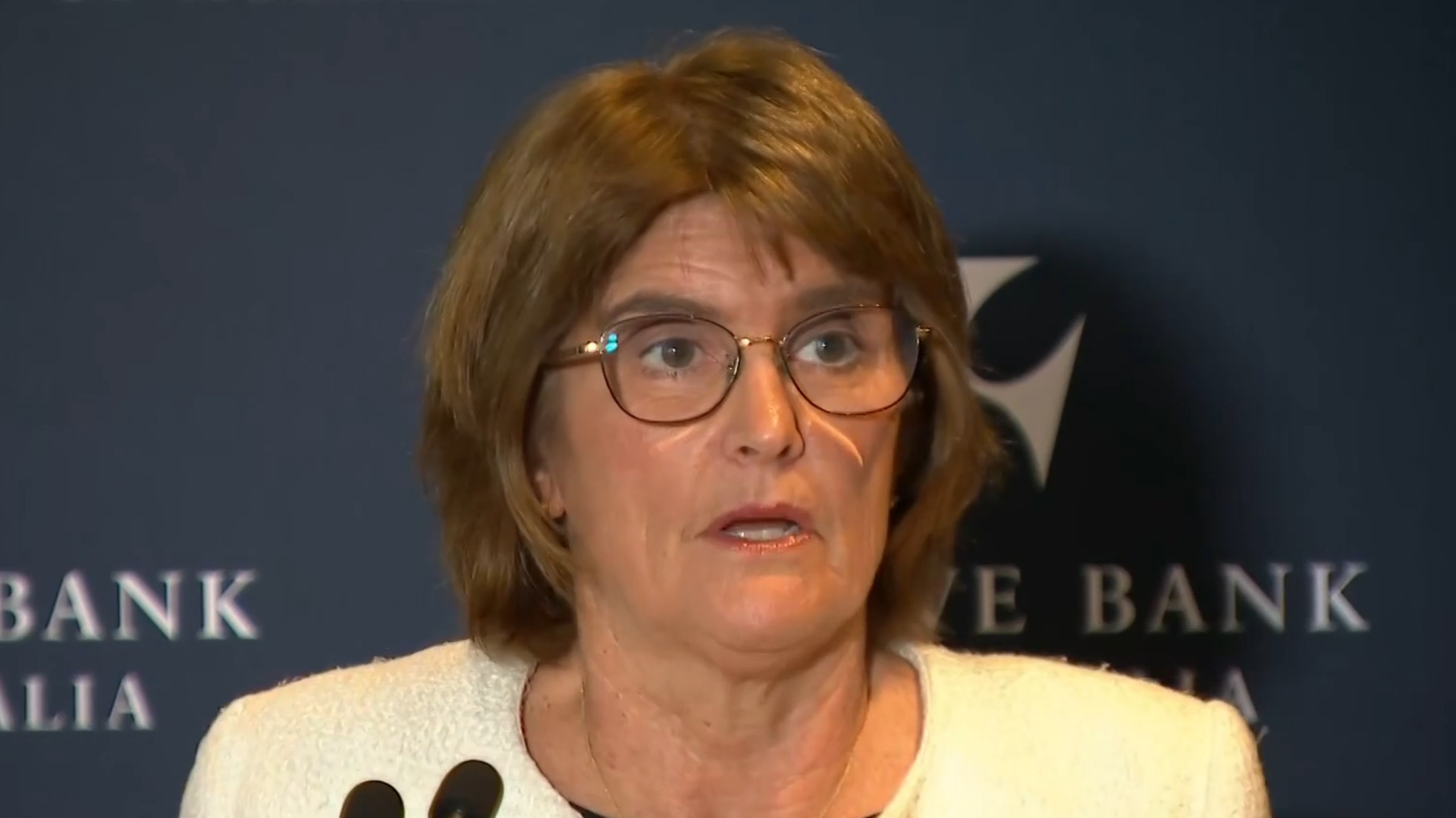

Rate hikes are back on the cards after inflation jumped 3.8 per cent in the 12 months to October, with RBA governor Michele Bullock saying the central bank had ruled out cuts and was considering hikes.

Commonwealth Bank of Australia and NAB have both updated their forecasts and now predict the central bank will lift rates 0.25 per cent during its first meeting of 2026.

NAB is forecasting the RBA will hike rates twice next year, lifting the cash rate to 4.1 per cent by May.

The nation’s largest bank, meanwhile, is only forecasting one rate hike next year and for the RBA to hold the rate at 3.85 per cent until the end of 2026.

ANZ, though, predicts the cash rate will be on hold throughout the year, while Westpac forecasts two cuts, bringing the cash rate down to 3.1 per cent by August.

Canstar.com.au data insights director Sally Tindall said the “blunt warning” from Governor Bullock meant “cash rate cuts are now behind us and what’s in front could well be a rate hike”.

“By the time the RBA meets again in February, it will be armed with more data, including two additional monthly inflation prints and another employment report,” Ms Tindall said in a statement.

“However, if CPI doesn’t start tracking confidently in the right direction, the Board could well be forced to act, particularly if the labour market continues to prove resilient under current interest rate settings.

“While these cash rate forecasts might not unfold exactly as planned, households with a mortgage should prepare for the possibility of hikes, and not just one.”

A household with the average Australian home loan of $600,000 and 25 years remaining could see their minimum monthly repayments rise to $180 if two rate hikes are handed down.

Just one hike could force repayments of up $90 per month.

Money markets are predicting there is a 26 per cent chance of a hike at February’s meeting, while chance of a hold is rated at 74 per cent.

The RBA has cut rates three times since the beginning of the year.

Trimmed mean inflation – the middle 70 per cent of price changes core to the RBA’s decision – fell within the central bank’s 2-3 per cent target band for just two months throughout the past year before lifting again to 3.3 per cent.

Inflation’s rise drove a change of heart for Ms Bullock, who said after the RBA’s latest meeting cuts were effectively off the table.

“We didn’t consider the case for a rate cut at all,” she told reporters.

“We didn’t explicitly consider the case for a rate rise at this meeting, but we did consider, and discuss quite a lot, the circumstances and what might need to happen if it we would decide that interest rates had to rise again at some point next year.”

Unemployment continues to sit near historic lows at 4.3 per cent, giving the RBA further reason to hold on rate cuts.