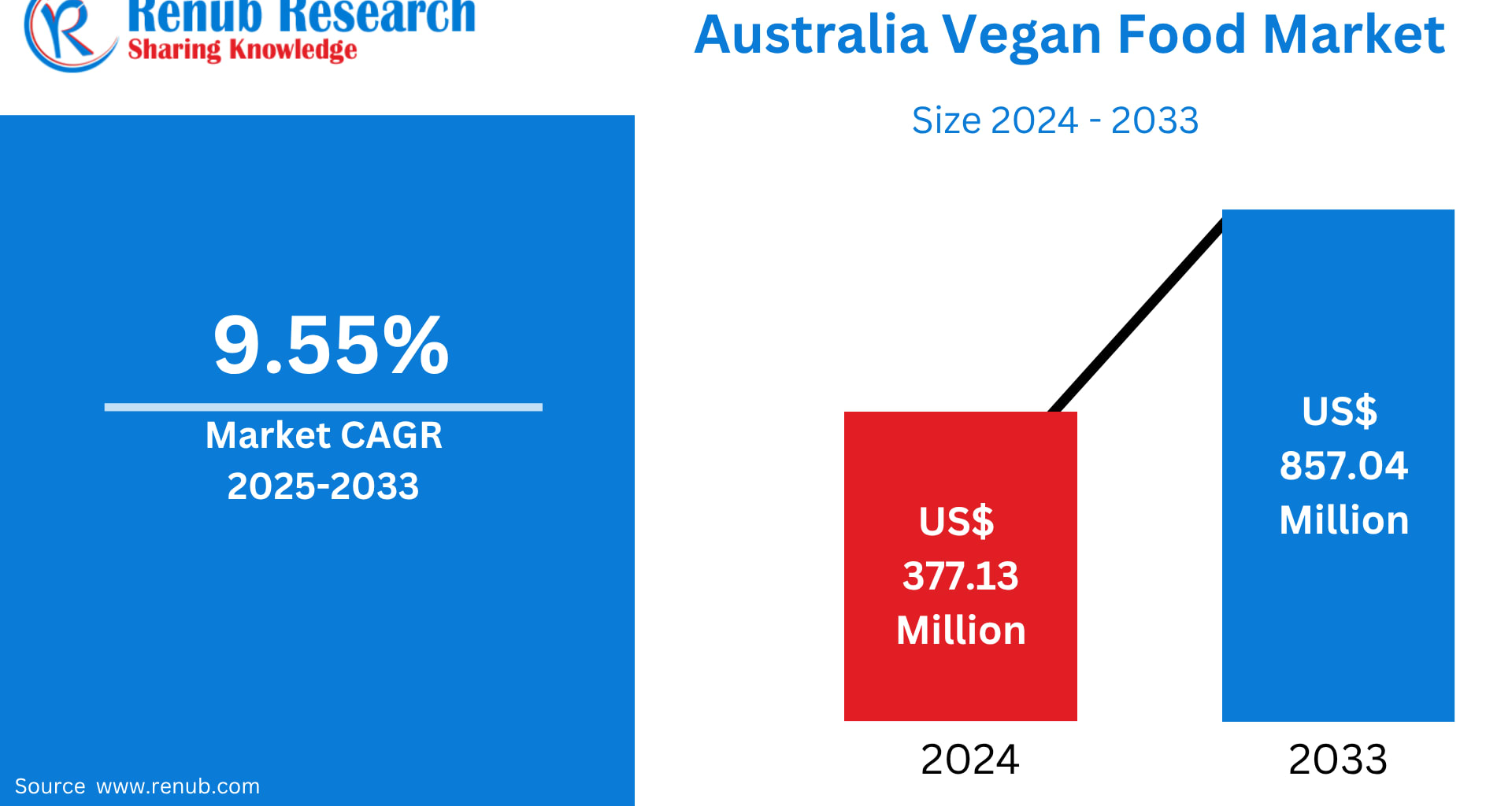

Australia’s vegan food industry is undergoing a powerful transformation as shifting consumer preferences, environmental responsibility, and ethical awareness reshape the nation’s food landscape. According to Renub Research, the Australia Vegan Food Market is expected to grow from US$ 377.13 million in 2024 to US$ 857.04 million by 2033, expanding at a robust CAGR of 9.55% from 2025 to 2033.

Australia Vegan Food Industry Overview

Vegan food focuses entirely on plant-derived ingredients including fruits, vegetables, grains, legumes, nuts, and seeds. These foods are rich in fiber, antioxidants, vitamins, and essential minerals, while typically being lower in saturated fat and cholesterol. Beyond personal health benefits, vegan diets are increasingly associated with reduced environmental impact and cruelty-free food systems.

In Australia, the plant-based movement has expanded well beyond tofu and soy milk. Today’s vegan food portfolio includes advanced meat substitutes, dairy-free cheeses and yogurts, oat and almond milk, plant-based desserts, ready-to-eat meals, and even gourmet offerings in restaurants and cafés. Supermarkets, online retailers, and foodservice providers are all expanding shelf space and menu options to cater to this fast-growing consumer base.

The Australian vegan food market is benefitting from strong retail infrastructure, innovation-driven manufacturers, and an increasingly informed consumer population that views food choices as a reflection of personal values.

Renub Research Market Size and Forecast

Renub Research highlights Australia as one of the most dynamic plant-based food markets in the Asia–Pacific region. Key market figures include:

Market Size 2024: US$ 377.13 million

Expected Market Size 2033: US$ 857.04 million

CAGR (2025–2033): 9.55%

This sustained expansion is supported by rising disposable incomes, product affordability improvements, and a broadening consumer base that includes vegans, vegetarians, flexitarians, and health-conscious omnivores.

Growth Drivers of the Australia Vegan Food Market

Rising Health Consciousness

Health awareness remains one of the strongest growth drivers in Australia’s vegan food market. Millions of Australians are actively reducing their meat consumption, motivated by concerns over heart disease, obesity, diabetes, and certain cancers. Plant-based diets are increasingly perceived as a preventative health strategy rather than a restrictive lifestyle.

The rise of flexitarianism—where consumers eat mostly plant-based foods while occasionally consuming meat—has significantly expanded the addressable market. Plant-based meat alternatives in Australia have reportedly grown several-fold over the past decade, prompting food manufacturers to invest heavily in nutrient-dense, protein-rich, and minimally processed vegan products.

Environmental Sustainability Awareness

Environmental concerns are reshaping food consumption patterns across Australia. Livestock farming is widely recognized as a major contributor to greenhouse gas emissions, land degradation, and water usage. As awareness grows, consumers are turning toward plant-based foods as a more sustainable alternative.

Younger Australians, in particular, are highly sensitive to climate change issues and often factor environmental impact into purchasing decisions. Vegan food brands that emphasize reduced carbon footprints, eco-friendly packaging, and responsible sourcing are gaining a competitive edge. Even fast-food chains and casual dining outlets are highlighting the environmental benefits of their vegan menu options, further normalizing plant-based eating.

Ethical and Animal Welfare Considerations

Ethical concerns around animal welfare play a crucial role in driving vegan food adoption. High-profile investigations and media coverage exposing animal cruelty within parts of the meat processing industry have significantly influenced public sentiment.

As a result, many Australians are choosing cruelty-free alternatives that align with their moral values. Vegan food offers consumers the reassurance that their dietary choices do not contribute to animal suffering, reinforcing long-term loyalty to plant-based brands.

Product Innovation and Expanding Availability

Innovation is at the heart of Australia’s vegan food market growth. Manufacturers are continuously improving taste, texture, and nutritional profiles to closely mimic animal-based products. Advances in food technology have made plant-based meat and dairy alternatives more appealing to mainstream consumers.

At the same time, availability has expanded rapidly. Vegan products are now widely stocked across supermarkets, hypermarkets, convenience stores, specialty health food shops, and online platforms. Foodservice providers—from cafés to quick-service restaurants—are also expanding vegan offerings, making plant-based eating more accessible than ever.

Challenges in the Australia Vegan Food Market

High Cost of Vegan Products

Despite strong growth, pricing remains a notable challenge. Vegan food products often carry a premium compared to conventional animal-based foods due to higher production costs, specialized ingredients, and smaller-scale manufacturing. Imported raw materials and logistics costs can further inflate prices.

This price gap can discourage price-sensitive consumers, particularly first-time buyers. Addressing this challenge will require increased local production, economies of scale, improved supply chains, and greater competition among manufacturers.

Taste and Texture Perception

Although product quality has improved significantly, taste and texture remain barriers for some consumers. Certain plant-based meat substitutes may still struggle to replicate the sensory experience of traditional meat, leading to hesitation among skeptical consumers.

Continued investment in food science, consumer testing, and flavor innovation will be essential to overcome these perceptions and drive broader adoption.

Recent Developments in the Australia Vegan Food Industry

The Australian vegan food industry has witnessed several notable developments that signal its growing maturity:

November 2024: Harvest B established Australia’s first plant-based meat ingredient production facility in Penrith, New South Wales. This facility aims to supply clean-label, shelf-stable plant proteins, strengthening domestic manufacturing and reducing reliance on imports.

September 2024: Australian brand vEEF launched a range of carbon-neutral plant-based meat products, including beef mince and sausages, through Woolworths. Priced competitively with animal meat and featuring reduced plastic packaging, the range targets affordability, sustainability, and mass-market appeal.

These developments highlight increasing investment confidence and long-term commitment to the plant-based sector.

Australia Vegan Food Market Segmentation

By Product

Dairy Alternatives

Meat Substitutes

Others

By Source

Almond

Soy

Oats

Wheat

Others

By Distribution Channel

Supermarkets and Hypermarkets

Convenience Stores

Specialty Stores

Online Stores

Others

Key Players Analysis

The Australia vegan food market features a mix of global leaders and regional specialists, all competing on innovation, branding, and distribution strength. Major companies profiled in the market include:

Beyond Meat Inc.

Danone S.A.

The Archer Daniels Midland Company

Tofutti Brands Inc.

Vitasoy Australia Products Pty Ltd.

SunOpta

Daiya Foods Inc.

Each company is analyzed across four dimensions: company overview, key personnel, recent developments and strategies, and sales performance. Strategic partnerships, product launches, and sustainability initiatives remain central to competitive positioning.

Final Thoughts

Australia’s vegan food market is no longer a fringe segment—it is a fast-growing pillar of the nation’s food industry. Supported by strong consumer demand, ethical awareness, health consciousness, and sustainability goals, the market is set to more than double in value by 2033.

While challenges such as pricing and taste perceptions persist, ongoing innovation, expanding retail access, and domestic manufacturing investments are steadily addressing these barriers. As plant-based eating continues to align with Australia’s evolving lifestyle values, the vegan food market is poised for long-term, resilient growth—making it one of the most compelling segments in the country’s food and beverage landscape.