3h agoWed 24 Dec 2025 at 1:27amMarket snapshotASX 200: -0.4% to 8,763 points

Australian dollar: +0.1% to 67.05 US centsWall Street: Dow Jones (+0.2%), S&P 500 (+0.5%), Nasdaq (+0.6%) Europe: DAX (+0.2%), FTSE (+0.2%), Stoxx 600 (+0.3%)Asia: Nikkei (+0.1%), Shanghai (+0.1%)Spot gold: +0.2% to $US4,495/ounceOil (Brent crude): Flat at $US62.37/barrelIron ore: -0.5% to $US104.20/tonneBitcoin: -0.6% at $US87,168

Prices current around 2:20pm AEDT

Live updates on the major ASX indices:

1h agoWed 24 Dec 2025 at 3:44am

Merry Christmas

Wishing everyone a happy and safe holiday, and see you next Monday (December 29) when the stock market operates again.

Loading1h agoWed 24 Dec 2025 at 3:20amASX closes down

The Australian sharemarket has ended the session lower on Wednesday ahead of a four-day trading shutdown.

The ASX 200 index lost 0.4% or 33 points to 8,763 in a shorter trading day on Christmas Eve. It finished the week 1.6% higher.

All sectors were in the red, except for the mining sector (+0.1%) as copper prices traded at record levels on speculative buying.

Education (-2.8%), healthcare (-1.5%) and industrials (-0.6%) led the losses today.

Heavyweight financials fell 0.4% to ease from a one-month high, dragged by all the big four banks that dropped between 0.2% and 1%.

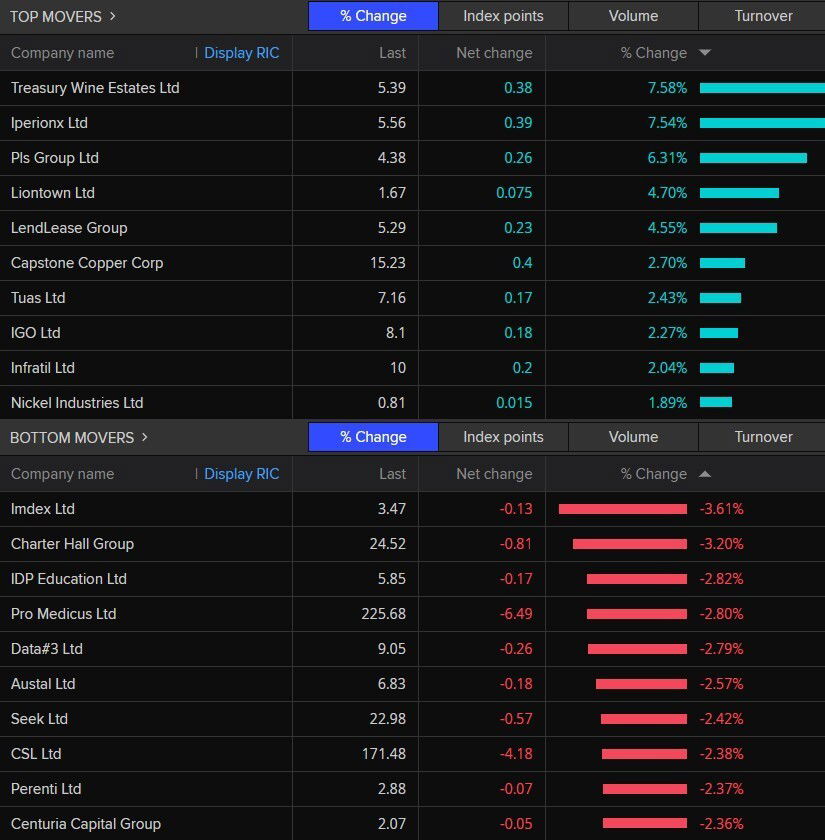

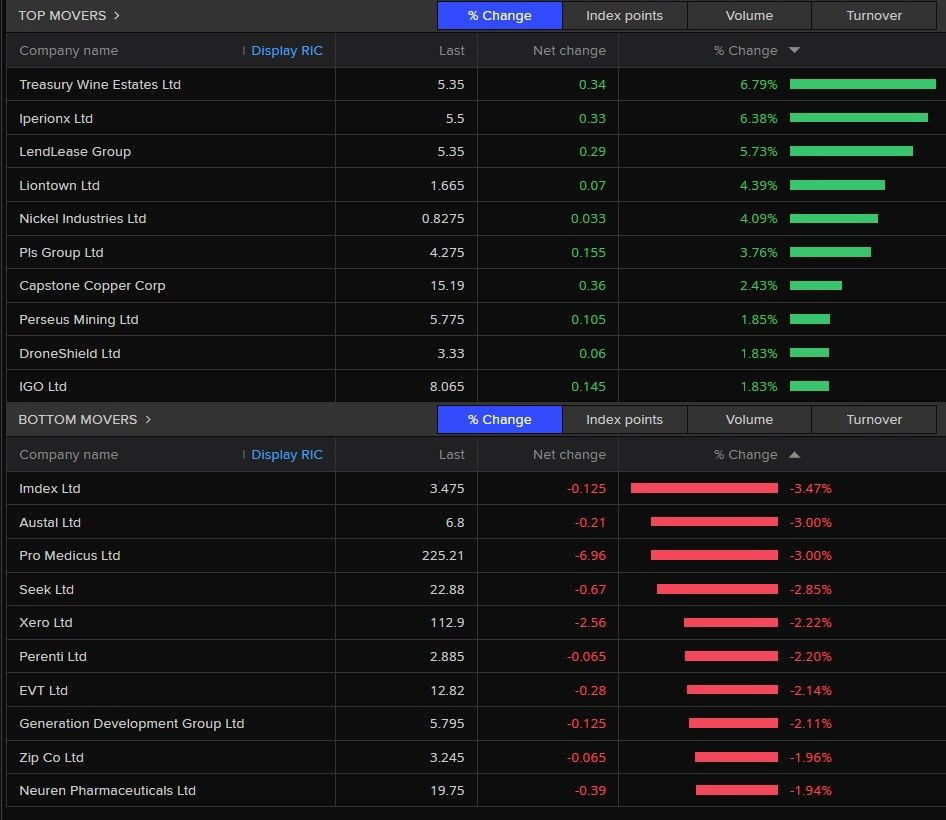

Here were the top and bottom movers of the day.

(LSEG)2h agoWed 24 Dec 2025 at 3:02amUS delays announcement of China chip tariffs until 2027

(LSEG)2h agoWed 24 Dec 2025 at 3:02amUS delays announcement of China chip tariffs until 2027

US President Donald Trump’s administration said it will slap tariffs on Chinese semiconductor imports over Beijing’s “unreasonable” pursuit of chip industry dominance, but would delay the action until June 2027.

The tariff rate will be announced at least 30 days in advance.

“China’s targeting of the semiconductor industry for dominance is unreasonable and burdens or restricts US commerce and thus is actionable,” the US Trade Representative said in its release.

The Chinese Embassy in Washington expressed opposition to any tariffs.

“To politicise, instrumentalize and weaponize trade and tech issues and destabilise the global industrial and supply chains will benefit no one and will eventually backfire,” it said in a statement to Reuters.

“We will take all measures necessary to firmly safeguard our lawful rights and interests,” it added.

The move, which preserves President Trump’s ability to impose the duties, seeks to dial down tensions with Beijing in the face of Chinese export curbs on the rare earth metals that global tech companies rely on and which China controls.

As part of negotiations with China to delay those curbs, Washington pushed back a rule to restrict US tech exports to units of already-blacklisted Chinese companies.

It has also launched a review that could result in the first shipments to China of Nvidia’s second-most powerful AI chips, Reuters reported, despite grave concerns from China hawks in the US who fear the chips could supercharge China’s military.

Former President Joe Biden previously imposed an additional 50% tariff on Chinese semiconductors that started on January 1, 2025.

2h agoWed 24 Dec 2025 at 2:43amASX on track to close lower, DroneShield, LendLease and other stocks jump

There’s less than an hour to go before the shortened Christmas trading day is over, and the Australian share market is on track to finish trading with a 0.5% loss.

Here’s a quick look at some of the companies seeing big moves in their share price (up or down):

DroneShield (+3.1%): secured a $6.2 million contract for an “Asian Pacific military-end customer” for its counter-drone technology.LendLease (5.2%) has won the Sydney Metro Hunter Street West Over Station Development. It’s a project which includes building the metro station and developing a 52-storey commercial tower near Wynyard railway station in the CBD.

Monash IVF (-13.4%): a consortium led by Genesis Capital Investment Management and Soul Patts has withdrawn its bid to purchase the fertility company for 80 cents per share.Seven West Media’s (+4.2%) merger with Southern Cross Media has been approved by the Supreme Court of NSW. The company’s shares will be suspended from the ASX today, and will soon be de-listed.3h agoWed 24 Dec 2025 at 1:45amAussie dollar at a 17-month high against Japanese yen

The Australian dollar is trading at a 14-month high, partly due to the prospect of higher interest rates next year.

Continued gains across commodities also supported the resource-heavy currency with gold and copper hitting records, both of which are major export earners for Australia.

The Aussie dollar is sitting around 67 US cents, having climbed 1.2% in just two sessions.

It’s doing particularly well against Japan’s currency, having jumped to a 17-month high of 104.6 yen (a gain of almost 7% in the past quarter).

The rally has been driven by rising bond yields as markets swung to price in the risk of a 2026 tightening from the Reserve Bank (RBA).

Minutes from the RBA’s last meeting showed the board preparing the ground for a hike should inflation not recede as hoped, highlighting the importance of the December-quarter inflation numbers (which will be published on January 28).

The RBA holds its first meeting of the year on February 3 and markets are pricing in a 28% chance of the cash rate rising by a quarter-point to 3.85%.

– with Reuters

3h agoWed 24 Dec 2025 at 1:25amMajor banks drag ASX down, despite record commodity prices driving miners higher

Losses for the Australian share market have worsened in midday trade.

The ASX 200 index was down 0.6% to 8,745 points.

Now that the market has been open for a couple of hours, let’s take a look at today’s best and worst performing stocks.

The companies seeing the strongest demand for their shares are DroneShield, Treasury Wine Estates, LendLease, lithium stocks Liontown and PLS, along with miners IGO, Perseus Mining and Capstone Copper — thanks to gold and copper prices hitting new record highs.

On the flip side, Austal, Seek, Pro Medicus, Xero and Zip Co are seeing the biggest falls to their share price.

But the biggest drags on the market are the heavyweight financial stocks, with the ‘big four’ banks Commonwealth Bank, Westpac, NAB and ANZ dropping between 0.3% and 0.8%.

The major banks are facing “stretched valuations”, which are among the most expensive compared to banks in developed economies.

It’s a technical way of saying they’re “too pricey” (when you compare their share price with the profits they’re earning).

Record high commodity prices are boosting mining shares. (Refinitiv)4h agoWed 24 Dec 2025 at 12:54amCopper also hits new record high, boosting shares of Rio Tinto and other miners

Record high commodity prices are boosting mining shares. (Refinitiv)4h agoWed 24 Dec 2025 at 12:54amCopper also hits new record high, boosting shares of Rio Tinto and other miners

These record highs just keep on coming!

The price of copper has surged above $US12,000 per tonne.

This has led to shares of mining giant Rio Tinto climbing as high as $148 (a new record), for its seventh consecutive day.

Capstone Copper and IGO shares have jumped by around 2% each.

“Copper is currently commanding investor attention, driven by surging AI data centre demand and the metal’s essential role in the development of electrification infrastructure,” said Betashares investment strategist Tom Wickenden.

“But rewind a few months and the narrative was different.

“Earlier this year, lithium dominated discussions as EV demand fluctuations drove significant price volatility.

“Silver also surged mid-year on expanding industrial and solar applications, while rare earths captured headlines amid supply chain concerns and growing defence technology requirements.”

4h agoWed 24 Dec 2025 at 12:47amAustralia’s gold mining stocks jump to highest levels ever

It’s not just physical gold prices hitting a new record high — but also Australia’s gold mining stocks.

The All Ords Gold sub-index climbed almost 1% to its highest levels ever.

Shares of large gold miners like Evolution Mining and Northern Star Resources gained as much as 1.5% each.

Since the beginning of the year, the gold sub-index has surged by around 129%.

In other words, its value has more than doubled on expectations the gold price will continue rising, along with the profits of those miners.

The All Ords Gold sub-index hit a new record high (Refinitiv)4h agoWed 24 Dec 2025 at 12:32amWhat’s driving gold to record high … after record high?

The All Ords Gold sub-index hit a new record high (Refinitiv)4h agoWed 24 Dec 2025 at 12:32amWhat’s driving gold to record high … after record high?

With geopolitical tensions (particularly Russia-Ukraine, Israel-Gaza and US-Venezuela) continuing to makes investors nervous, safe haven demand is causing gold prices to surge.

Central banks have also been building up their supplies of physical gold bars, which is seen as an attempt to diversify their reserves to be less reliant on the US dollar and US Treasury bonds.

Meanwhile, the Federal Reserve is expected to cut interest rates further next year, which would generally weaken the US currency.

On top of that, an increasing number of fund managers (including those at investment bank Morgan Stanley) are now recommending investors boost their holdings of gold.

They’ve even gone as as far as recommending an asset allocation of 60% to shares, 20% to bonds and 20% to gold.

Historically, Wall Street gurus recommended investing 60% in shares and 40% to bonds to maximise risk, while managing risk.

So it means fund managers are buying more gold than ever before, and they plan to keep doing so!

And given the price of commodities (like gold) are quoted in US dollars, a weaker greenback makes it cheaper to buy those metals.

That leads to more people buying gold, with the increased demand drive up prices further!

4h agoWed 24 Dec 2025 at 12:14amGold skyrockets above $US4,500 to another record high

Gold has surged above the psychological milestone of $US4,500 for the first time ever.

In the past couple of hours, the precious metal’s spot price rose 0.4% to $US4,509 per troy ounce.

In Australian currency, you’d have to pay $6,725 for just 31 grams of gold!

It’s incredible when you consider an ounce of gold was fetching $US2,657 at the start of the year (or $3,964 in Australian dollars).

So its value has jumped by around 70% in just 12 months!

5h agoWed 24 Dec 2025 at 12:04amWhen Australia could get 6G after Trump launches ‘race’ to next generation of mobile connectivity

Donald Trump says he wants the United States to lead the world in the “6G race” and has given his government one year to find out how to begin making it happen.

The US president has authorised national radio frequencies used by federal agencies to be vacated so private companies can start planning and testing a future rollout of 6G wireless networks.

“The next generation of mobile communications networks (6G) will be foundational to the national security, foreign policy, and economic prosperity of the United States,” Mr Trump said in a statement released on Friday, local time.

There is currently no 6G network connection anywhere in Australia (5G is as fast as it gets).

Some experts believe Australia will not have 6G coverage at least until 2030.

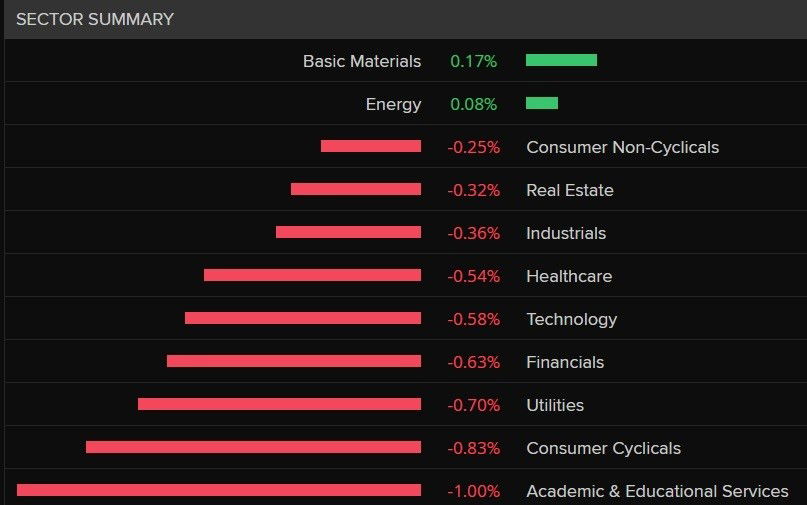

5h agoTue 23 Dec 2025 at 11:32pmConsumer and financial sectors drag ASX lower

Almost every sector on the ASX 200 is trading lower this morning.

The worst performing sectors include consumer discretionary (-0.8%), utilities (-0.7%) and financials (-0.6%).

On the flip side, the only sectors doing well are materials (+0.2%) and energy (+0.1%).

Only two sectors are trading higher on Christmas Eve. (Refinitiv)5h agoTue 23 Dec 2025 at 11:25pmASX falls 0.3 per cent in early trade

Only two sectors are trading higher on Christmas Eve. (Refinitiv)5h agoTue 23 Dec 2025 at 11:25pmASX falls 0.3 per cent in early trade

Australia’s share market is off to a slightly worse-than-expected start.

The ASX 200 is down 0.3% to 8,767 points.

The broader All Ordinaries index is down by a similar percentage to 9,067 points.

I’ll have more details on today’s best and worst performing stocks shortly.

6h agoTue 23 Dec 2025 at 11:12pm

Market snapshotASX 200: -0.4% to 8,757 points

Australian dollar: +0.7% to 67 US centsWall Street: Dow Jones (+0.2%), S&P 500 (+0.5%), Nasdaq (+0.6%) Europe: DAX (+0.2%), FTSE (+0.2%), Stoxx 600 (+0.3%)Spot gold: +1.1% to $US4,492/ounceOil (Brent crude): +0.6% to $US62.45/barrelIron ore: -0.5% to $US104.20/tonneBitcoin: -0.5% at $US87,254

Prices current around 10:12am AEDT

6h agoTue 23 Dec 2025 at 11:03pmUS consumers turn pessimistic as inflation, tariffs and interest rates weigh on mood

While America is experiencing stronger-than-expected economic growth, consumers are not feeling so optimistic.

In fact, US consumer confidence deteriorated in December, for a fifth straight month, amid deepening anxiety over jobs and income.

The Conference Board said its consumer confidence index fell 3.8 points to 89.1 points this month.

Economists polled by Reuters had forecast the index at 91 points.

Any number less than 100 points means the number of pessimists outweigh the optimists, and it could be an ominous sign for future consumer spending.

“Consumers’ write-in responses on factors affecting the economy continued to be led by references to prices and inflation, tariffs and trade, and politics,” said Dana Peterson, chief economist at the Conference Board.

“However, December saw increases in mentions of immigration, war, and topics related to personal finances—including interest rates, taxes and income, banks and insurance.”

– with Reuters

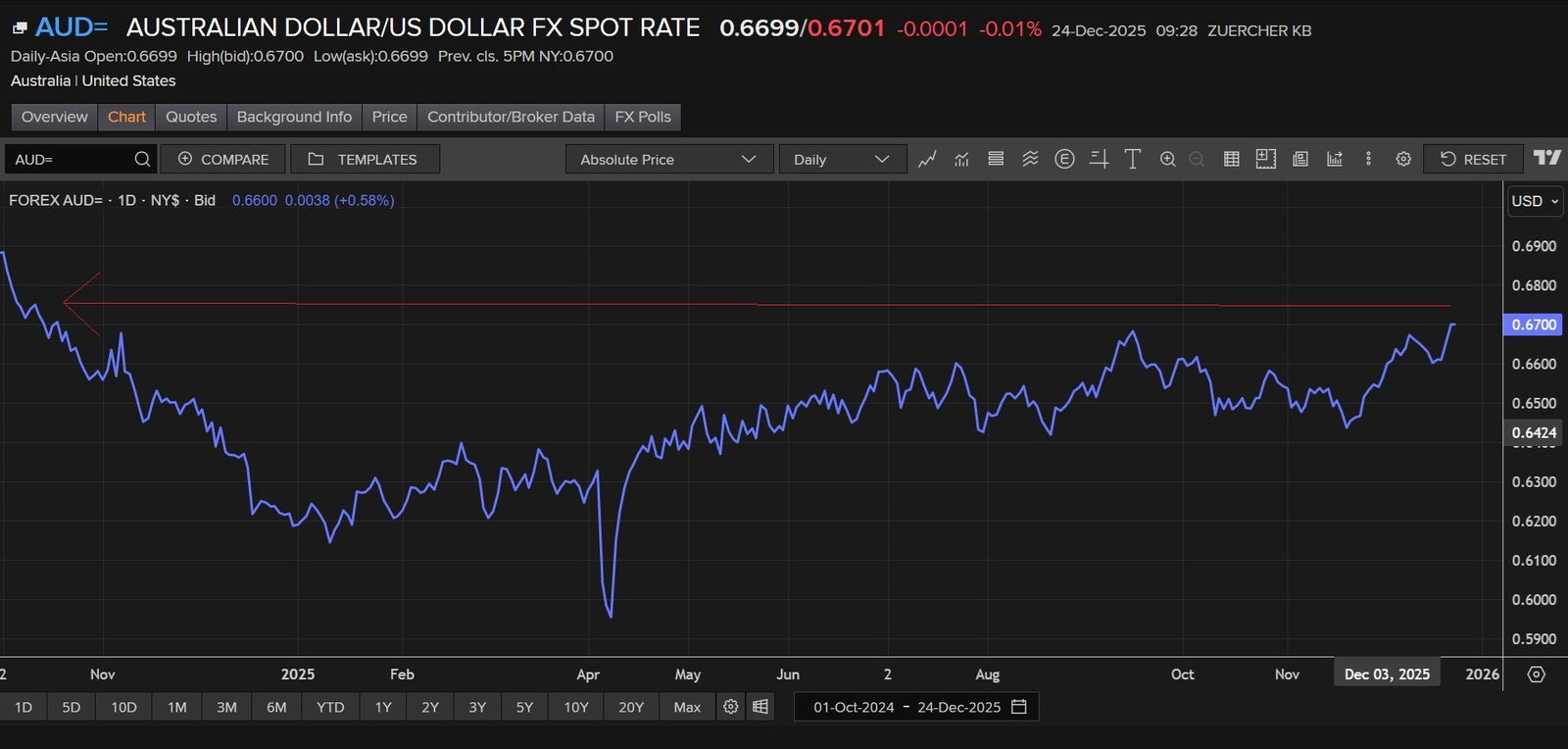

6h agoTue 23 Dec 2025 at 10:46pmStrongest level for Aussie dollar since October 2024 as US dollar weakens

Here’s what the Australian dollar being at a 14-month high looks like.

The last time it traded at 67 US cents was back on October 18, 2024.

So that’s good news if you’re currently travelling in the United States or buying goods from a US shopping website.

The local currency has also jumped 8.3% since the year began.

Conversely, the US dollar index (which tracks the greenback against a basket of major currencies) has dropped more than 10% in the year to date.

It’s largely because of the widening interest rate differentials between the US and Australian currencies.

The Australian dollar’s value has jumped 8.3% in the year to date. (Refinitiv)

The Australian dollar’s value has jumped 8.3% in the year to date. (Refinitiv)

While the Federal Reserve is likely to cut rates next year, Australia’s Reserve Bank is widely expected to announce at least one interest rate hike in 2026.

In general, rate cuts lead to a weaker dollar, while rate hikes boost a currency’s strength.

The US dollar is also being sold off as a result of the “sell America’ trade — as Trump tariff unpredictability, worries about the future independence of the Fed and ballooning US debt (partly used to fund tax cuts which predominantly benefit the wealthy) have led to investors putting their money in less risky places.

6h agoTue 23 Dec 2025 at 10:26pmAussie dollar rises to 14-month high after strong US economic data

The Australian dollar is trading at 67 US cents, after jumping 1% overnight.

That’s the highest level it has been all year.

To be more precise, the local currency hasn’t been this strong since October 2024 (around 14 months ago).

It’s partly because the US dollar weakened overnight as the odds of a Federal Reserve interest rate cut decreased.

That was in response economic figures, showing the US economy growing at a much faster than expected 4.3% in the September quarter.

The data bolstered views that the Fed will hold off on cutting rates at its meeting in late January, with the odds currently at 87%, according to LSEG estimates.

US rate futures now expect the US central bank’s next interest rate cut may occur in June, with two rate reductions priced in for 2026.

– with Reuters

7h agoTue 23 Dec 2025 at 10:02pmConsumer spending drives surprisingly strong US economic growth in September quarter

Wall Street recorded another strong day after the United States released official figures showing the economy growing at its fastest pace in two years.

The figures showed gross domestic product (GDP) increasing at a 4.3% annualised rate in the September quarter, well above the 3.3% estimate of economists polled by Reuters.

America’s economic growth was fuelled by robust consumer spending and a sharp rebound in exports, though momentum appears to have faded amid the rising cost of living and recent government shutdown.

The stronger-than-expected increase in GDP last quarter also reflected continued investment by businesses in equipment and artificial intelligence (AI).

Government spending, mostly on defense, also provided a lift, according to the new data from the US Commerce Department.

While the data was delayed due to the 43-day government shutdown (and many analysts expected the December quarter would show a slower pace of economic growth), markets are now pricing in a smaller chance of a January rate cut from the Federal Reserve, according to CME’s FedWatch Tool.

– with Reuters

7h agoTue 23 Dec 2025 at 9:42pmHouse prices and AI investment boom define economy in 2025

Australians are finishing this year the same way they started it: with rising house prices and inflation pressures on the household budget.

Lower interest rates and migration helped push up Australia’s economic growth (as measured by GDP).

But the GDP per capita number was flat, which means there was no economic growth on a per person basis.

In this report, Alan Kohler also ponders whether the artificial intelligence (AI) investment boom mirrors the Dot Com Bubble.

Loading…

ASX 200: -0.4% to 8,763 points

ASX 200: -0.4% to 8,763 points