On the surface, golf seems a world apart from financial markets. Not to stereotype, but many finance professionals enjoy a game of golf, and it’s not hard to tell why. There are striking parallels that offer invaluable lessons for anyone building lasting wealth.

The recent conclusion of the 153rd Open Championship, the oldest golf tournament in the world, on Jul 20 saw the final grouping consisting of world No 1 Scottie Scheffler against Li Haotong.

It is a rare occurrence to see a Chinese golfer at a major tournament. Scheffler won by an impressive healthy margin, but what was more intriguing was that he went 32 holes bogey-free, demonstrating consistency and dominance under pressure. (For non-golfers, bogey-free means finishing all of those holes at par or better.)

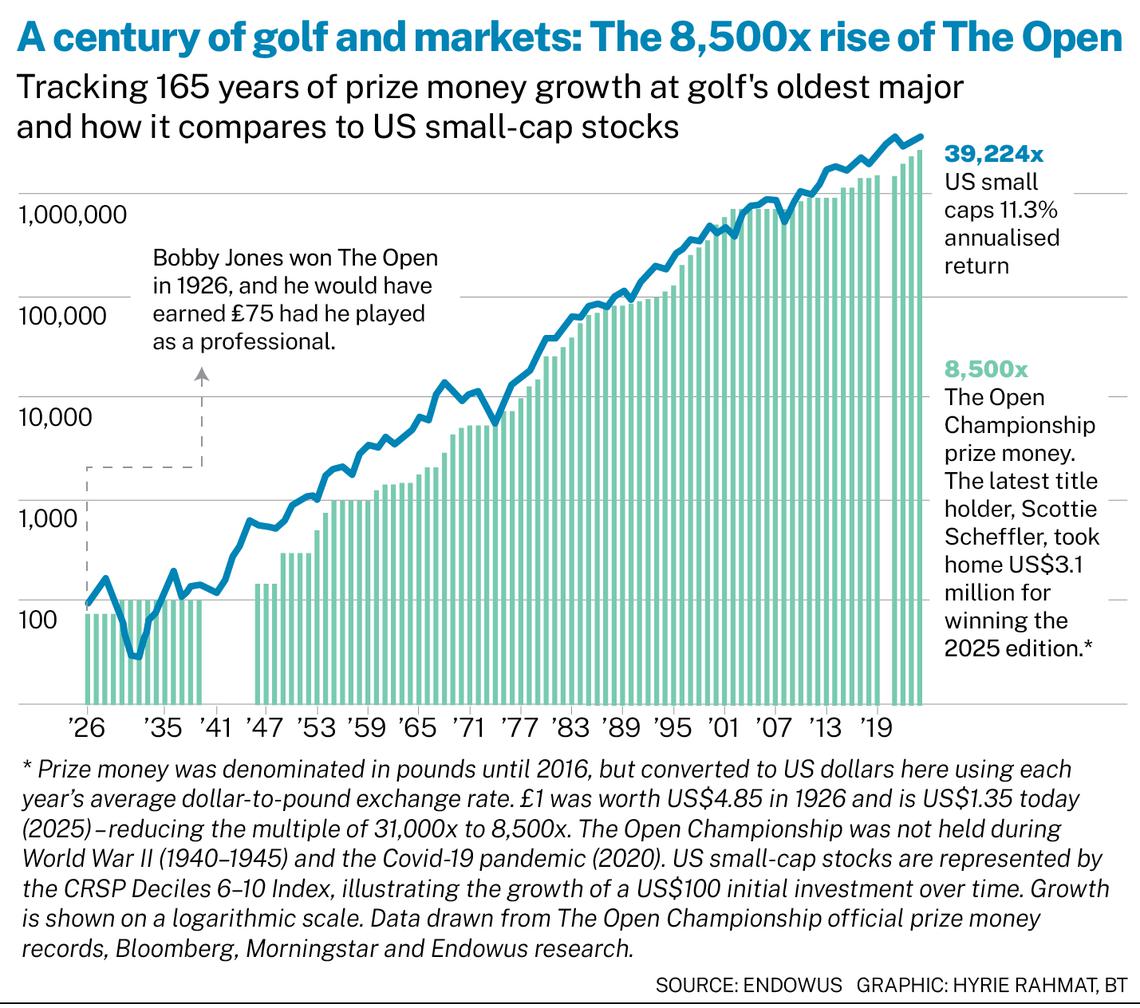

This got me looking into the compounded reward money for the last century. In 1926, the famous Bobby Jones – lawyer by trade, golfer by passion – won for the first time. As a career amateur, he wasn’t entitled to any prize money, so the whopping £75 (US$364) was awarded to the runner-up.

Fast forward to 2025, Scheffler took home US$3.1 million of the total US$17 million prize money, an increase of 8,500 times from a century prior (taking the US dollar exchange rate in 1926 of £1 to US$4.85). This growth seems mind-blowing and equates to a compounding growth rate of just 9.5 per cent, approximately the return of global stocks in the same period.

Returning to golf with fresh eyes

Returning to golf with fresh eyes

While I played competitively as a junior, I have had the good fortune of returning to the green with my kids reaching the age to start swinging.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Playing as an adult has brought a whole new appreciation for the mental side of the game – the risk-reward trade-offs, the need to make decisions and live with them, the pressure, the choice of equipment and so many other nuances draw parallels to evidence-based investing.

Staying on course by taking appropriate amounts of risk for return

In golf, you are constantly faced with choices. From tee to green, you need to pick the line, shot and trajectory, while taking into account bunkers, water, rough, wind, rain, emotions, your competitor’s actions and the world around you. You could carry that water to try to get on the green in two, or lay up with a higher chance of making par.

Investing presents similar choices. You could take on lots of risk for the chance of making a big short-term return, but you could also catch a bad swing and end up in a ditch.

Astute investors begin by picking the right “shot” for each of their goals. This isn’t about chasing the latest market fad; it’s about crafting a well-thought-out investment strategy and asset allocation that aligns with your unique goals, time horizon and risk tolerance.

Do you need a conservative iron shot to lay up, or can you confidently unleash the driver for a long-term gain and take on the volatility?

Understanding your personal “course conditions” and making strategic choices before you swing is paramount to improving your probability for success, and knowing when to go for it or protect capital.

Working backwards from the goal

Visualisation is important in golf – and not just for the next shot. A good golfer visualises from the green and the hole, and works backwards to the optimal shot they want to play off the tee to put themselves in the best position.

If I want to hit 120 yards into the green on a 350-yard hole, I should try to hit 230 yards off the tee. I don’t have to take out the driver and put myself a more awkward 60 yards from the hole even if I strike it in the middle of the fairway. Scheffler’s performance at the Open clearly showed he consistently made choices off the tee that set himself up for success.

Investing is the same. We start with the life goal, and work backwards to how we allocate our assets today. Liabilities-driven asset allocation has long been the way institutions invest, and now with the power of access, advice, lower costs and technology to implement this method, individuals can do the same.

Like golf gear, every investor needs a set of personalised strategies

Golf is one of the few sports where your gear can become outdated every few months. Golfers have to comb through all the noise, find what suits them and select fourteen golf clubs, each with a distinct purpose.

Similarly, to consciously build investment portfolios, we must assemble an efficient collection of strategies that complement each other. When combined, they must be suitable for our goals, and our ability to tolerate volatility and complexity. Ideally, you can do this in a cost-conscious way and with unbiased advice.

It is probably fair to say most golfers spend more time thinking about and researching how to improve their set of clubs, combing through dozens of websites and consulting multiple experts and friends before making their choice. We can all apply the same discernment to how we grow and manage our hard-earned wealth.

There is no undo button in golf or investing

Golf can also be a uniquely unforgiving sport. In tennis, for example, if you hit a lousy shot, that particular game is far from over. Miss a two-foot putt, that shot is marked on your scorecard forever. Once you’ve hit a shot, you can never get it back.

In investing, the past is gone forever, too. Time lost and hindsight are constant frustrations. The market does not care if you are below your cost. The market does not care if you doubled your money on that stock in the last month, or if you missed out by sitting out for the last year.

You can only focus on your allocations today for your future.

You are playing against yourself

In golf, no one will move your ball. No one is moving the course. You are in total control of implementing your game. A good swing requires consistent practice, focus and discipline, so you can perform when the pressure is on and distractions are everywhere.

Successful investing also demands disciplined execution. This means sticking to your investment plan through market ups and downs, resisting the urge to panic during downturns or chasing fleeting highs. It means regular rebalancing to maintain your asset allocation, to improve the probability of success.

The true mastery in both pursuits comes from controlling your emotions, silencing the inner critic and maintaining a clear, long-term perspective. Patience, resilience and the ability to learn from every shot – good or bad – are the hallmarks of a champion, both on the course and in your financial life.

So, was this more about golf teaching us about investing or investing teaching us about golf? Whichever way you see it, improving your probability of success in managing wealth or playing golf will certainly lead to greater enjoyment in life.

The writer is chief executive officer and co-founder of Endowus