Property consultancy Knight Frank has discovered, with data taken from ‘The Co-living Report’, that the total number of operational co-living units has now surpassed the 2,000-unit mark as the sector’s emergence continues at pace.

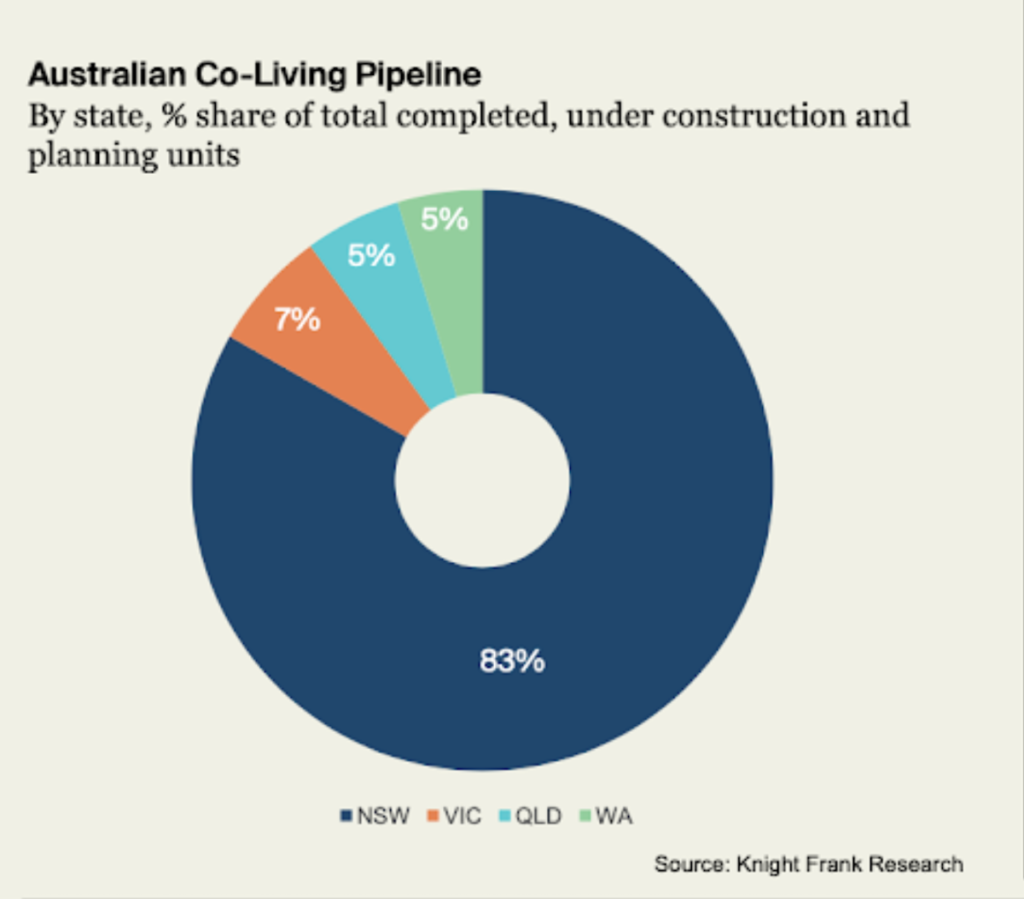

A further 4,159 units are currently under construction or have development approval, whilst 3,647 are in planning or proposed, taking total supply to just over 10,000 units.

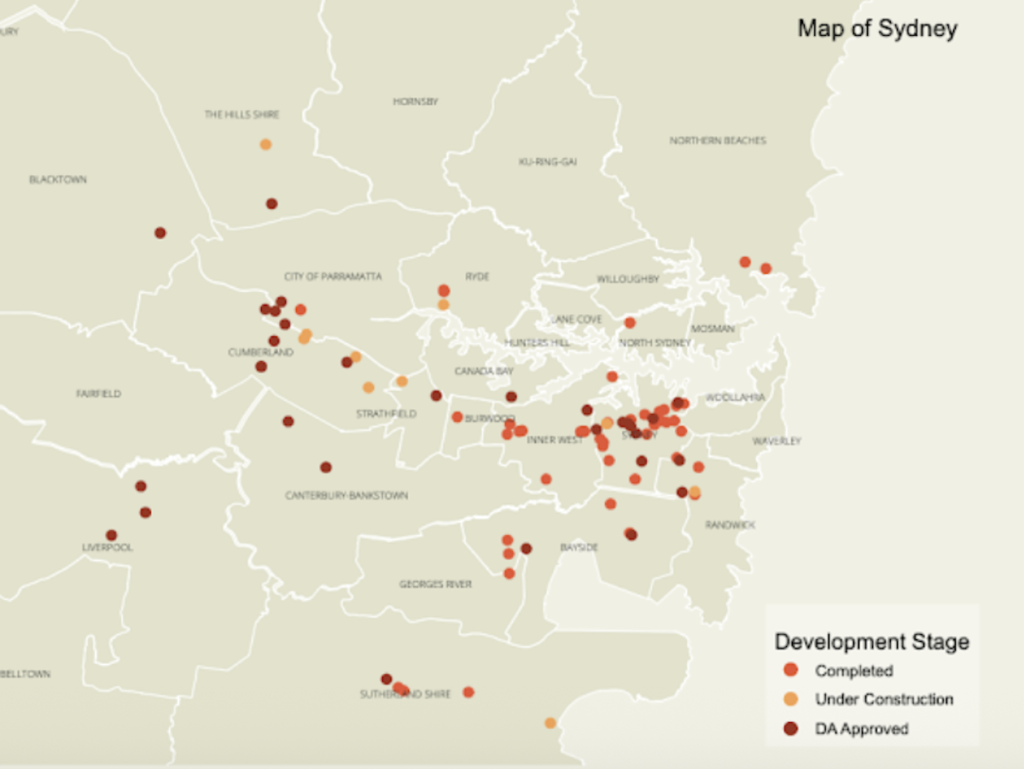

Sydney is the bellwether for the asset class in Australia, accounting for over 90% of completed schemes nationally.

This trend is notably different from the Build to Rent sector, where Melbourne has emerged as the dominant force.

Whilst the macro drivers underpinning the demand for co-living are present across the country, New South Wales has benefited from a clear and supportive planning pathway, providing certainty for both investors and developers.

According to Knight Frank, the reverse is true across other states where co-living currently lacks recognition at policy level.

In addition, Sydney’s land market is highly constrained and the efficient nature of the co-living model unlocks sites where lower-density housing options are not feasible.

An established operational base of first-generation assets has also provided proof of concept and cemented Sydney’s competitive advantage when it comes to attracting capital to fund new development.

Despite a more uncertain path to market, co-living is beginning to gain traction in other states as first movers enter the sector.

In total there are approximately 1,110 units in the development pipeline across Victoria, Western Australia and Queensland – this represents progress but is still a relatively small figure that highlights both the nascent stage of the market and the opportunity for growth.

Knight Frank anticipates a further acceleration in the overall pipeline in 2026 as developers respond to growing tenant demand for this product type.

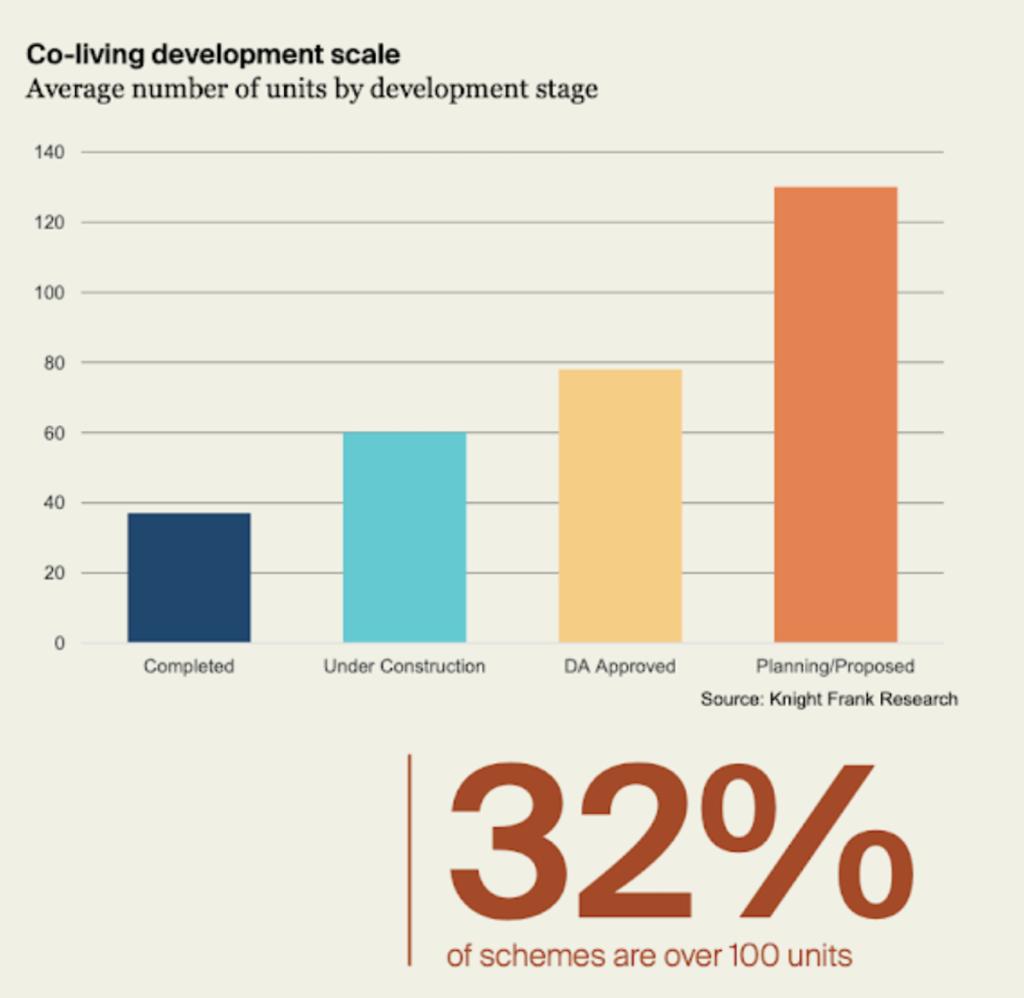

Another trend is that schemes are getting larger. On average, completed schemes have 37 units, rising to 60 units for schemes under construction and to 78 units for those with development approval.

This jumps again to an average size of 130 units for projects either in planning or proposed.

This is a trend Knight Frank has observed in other international markets that are further along in the growth curve; larger investors have entered the market seeking scale, which drives economies of scale for example around operational efficiency and deal size.

This also allows new platforms to aggregate meaningful portfolios more quickly.

First generation assets have been crucial in this regard, laying the foundation for larger developments to come through by providing a host of operational data around rents, occupancy and operating expenses.

The strong performance of stabilised schemes has demonstrated the depth of demand for co-living and provided investors with confidence that larger scale projects will be absorbed by the market quickly.

The success of co-living in Sydney has shown that tenants are happy to compromise on private space in return for location and lifestyle.

Co-living developments are typically situated within densely populated urban areas with good access to existing amenity, transport links and employment.

This has been the case in Sydney where many early schemes have been delivered across supply-constrained inner suburbs.