2h agoWed 7 Jan 2026 at 8:32pmMarket snapshotASX 200 futures: -0.1% to 8,680 points.Australian dollar: -0.2% to 67.24 US centsWall Street: S&P500 -0.1%, Dow -0.9%, Nasdaq +0.3%Europe: Dax +0.9%, FTSE -0.7%, Eurostoxx 600 -0.1%Spot gold: -0.9% to $US4,457/ounceBrent crude: -0.9% to $US 60.15/barrelIron ore: +2.4% to $US109.00/tonneBitcoin: -2.6% at $US90,825

Prices current at around 7:30am AEDT

8m agoWed 7 Jan 2026 at 11:02pmASX opens up

The Aussie share market has opened in the green, up +0.1% to 8,705 points.

More to come shortly!

10m agoWed 7 Jan 2026 at 11:00pmUS markets trade in “choppy” fashion, according to analysts

It was a mixed day for US trading on Wall Street, as President Trump threatened to do things like ban institutional investors from owning single family homes and ban dividends and buybacks by defence companies.

Senior financial analyst Kyle Rodda says the macroeconomic data also added to the choppiness on Wall Street, with mixed results.

“The latest ADP payroll numbers and JOLTS jobless claims undershot expectations, although the figures lent themselves to further rate cuts from the US Federal Reserve.

“But the ISM Services read was as good as you could hope for given the current macroeconomic backdrop. The headline number showing the sector expanded by more than expected last month as employment jumped back into expansion but the price subindex fell, pointing close to, although not quite, goldilocks conditions in the US.”

20m agoWed 7 Jan 2026 at 10:50pm

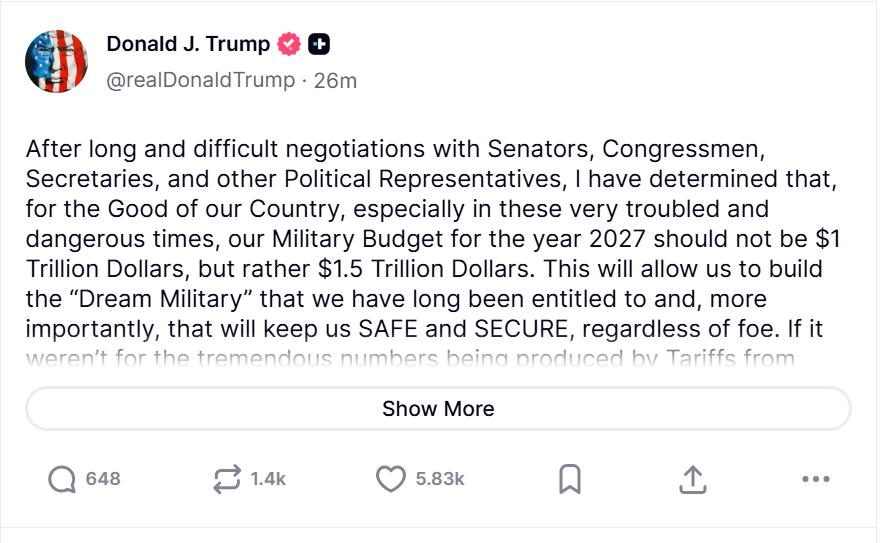

US 2027 budget

US President Donald Trump has posted on his Truth Social account that the military budget for 2027 should be $US1.5 trillion dollars.

“If it weren’t for the tremendous numbers being produced by Tariffs from other Countries, many of which, in the past, have “ripped off” the United States at levels never seen before, I would stay at the $US1 Trillion Dollar number but, because of Tariffs, and the tremendous Income that they bring, amounts being generated, that would have been unthinkable in the past (especially just one year ago during the Sleepy Joe Biden Administration, the Worst President in the History of our Country!), we are able to easily hit the $1.5 Trillion Dollar number while, at the same time, producing an unparalleled Military Force, and having the ability to, at the same time, pay down Debt, and likewise, pay a substantial Dividend to moderate income Patriots within our Country!” President Trump wrote in the post.

It’s been nearly nine months since President Trump’s “Liberation Day” tariffs which sent shockwaves around the world, including Australia.

Businesses have been hit hard as they grapple with escalating tariffs — anywhere between 10% and 50%, depending on the country and sector.

(Truth Social)35m agoWed 7 Jan 2026 at 10:35pmFirst Home Buyer Scheme contributes to faster growth in lower-priced properties

(Truth Social)35m agoWed 7 Jan 2026 at 10:35pmFirst Home Buyer Scheme contributes to faster growth in lower-priced properties

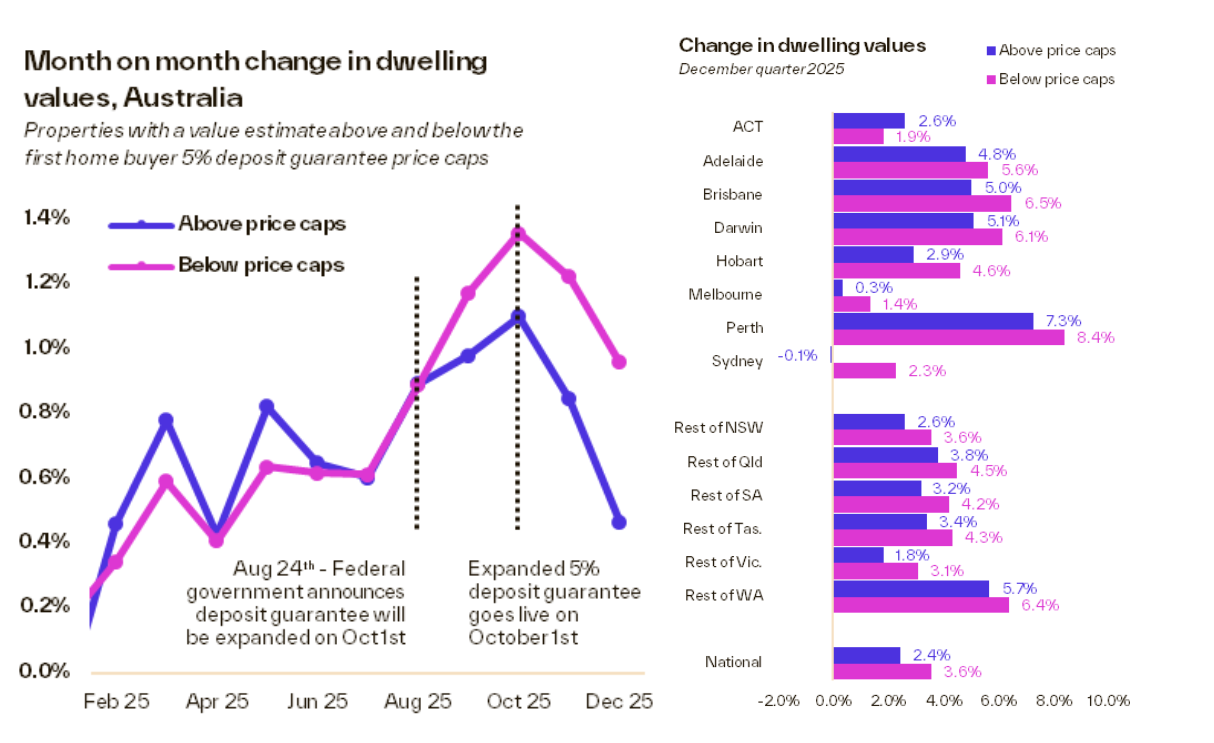

Since September last year, lower-priced homes that fall under the expanded Home Guarantee Scheme price caps have recorded stronger growth than higher-priced homes, according to analysis from Cotality.

Quarterly Growth Trends

Homes under the price cap: +3.6% in the December quarterHomes above the price cap: +2.4% in the same period Change in dwelling values (Cotality)

Change in dwelling values (Cotality)

“The expanded 5% deposit guarantee has sharpened demand at lower price points, with under‑cap markets outperforming across almost nine‑in‑10 regions,” said Tim Lawless, Cotality’s research director.

“We’re seeing a clear shift in momentum, with buyers increasingly targeting homes that fall under the new price caps — especially in Sydney, where the value gap is most pronounced.

“This trend was already visible before the scheme’s official start on October 1, suggesting some buyers acted early to secure properties before competition increased.”

Cotality explains three reasons for the stronger growth:

Demand ‘brought forward’: Anticipation of increased competition and price pressure after the scheme’s launch has likely brought forward demand from those who didn’t necessarily need to rely on the deposit guarantee.Serviceability constraints: A trend towards higher home values amid elevated interest rates and serviceability limits may be pushing demand toward lower-priced, more affordable properties.Investor activity: Increased investor presence in the lower price segment, competing with first-home buyers and mainstream demand. Investors comprised 41% of mortgage demand in Q3, and annual investor credit growth is rising at the fastest rate since December 2015.

The stronger growth is consistent across every capital city and regional market, except the ACT.

The largest value growth differential was recorded across Australia’s largest city, Sydney. Homes with a value under the cap rose 2.3%, while those above the cap fell 0.1% during the December quarter.

Across Australia, 78 out of 88 regions analysed showed stronger growth for homes under the cap.

50m agoWed 7 Jan 2026 at 10:20pm

Bluescope rejects “cheap” Stokes takeover bid

The chair of Australia’s biggest steel producer, Bluescope, has come out swinging against a $13.2 billion takeover offer from WA billionaire Kerry Stokes’s SGH and US group Steel Dynamics.

In a statement to the ASX this morning, Bluescope said its board unanimously rejected the offer of $30 cash a share.

Chair Jane McAloon said:

“Let me be clear — this proposal was an attempt to take Bluescope from its shareholders on the cheap.

“It drastically undervalued our world-class assets, our growth momentum, and our future — and the board will not let that happen.

“This is the fourth time we’ve said no, and the answer remained the same — Bluescope is worth considerably more than what was on the table.”

Her remarks echo those of major Bluescope shareholders who this week have — unsurprisingly — said they want more.

But the view clashes with the valuation put on the company by analysts and the market.

The average Bluescope target share price among the 10 analysts with current public estimates is $24.81, according to Bloomberg data.

And this is after several re-rated the stock this week to change their estimate to the offer price.

Of the 10 analysts, only Ramoun Lazar at Jeffries thinks Bluescope is worth more than $30 a share — he’s got an estimate of $37 on the stock.

Bluescope shares closed yesterday at $29.87.

1h agoWed 7 Jan 2026 at 10:05pmAlaska Airlines bets on Boeing with its biggest aircraft deal for global expansion

Alaska Airlines has announced it will purchase 110 new Boeing aircraft, the largest single order in the carrier’s history, as part of an aggressive expansion and fleet modernisation plan.

The Seattle-based carrier has international ambitions, with planned launches to Rome and London. The order signals its confidence in Boeing’s corrective measures, quality enhancements, and future aircraft performance — two years after a door plug missing key bolts blew off one of its new jets at 16,000 feet.

That incident sent shockwaves through the aviation industry, disrupting suppliers, carriers, and passengers. Alaska was forced to ground its fleet of MAX 9 aircraft in the aftermath.

“This is about a doubling down of their commitment to the Boeing Company,” Boeing CEO Kelly Ortberg said at an event marking the deal.

“We don’t take that lightly. We know that you really need us. You’re doubling down, putting your eggs in our basket, and we need to perform.”

The aircraft order includes 105 737 MAX 10 jets and five 787-10 Dreamliners, along with options for 35 additional MAX 10s.

Alaska said the order would help grow its fleet from about 413 aircraft today to more than 475 by 2030 and over 550 by 2035, including 17 long-haul 787s.

Shares of both companies initially rose after the news, but Alaska’s shares closed down 2% while Boeing’s closed 0.75% lower.

“We are creating the fourth global airline in our country to compete against the ‘Big Three,'” Alaska CEO Ben Minicucci said.

– Reuters

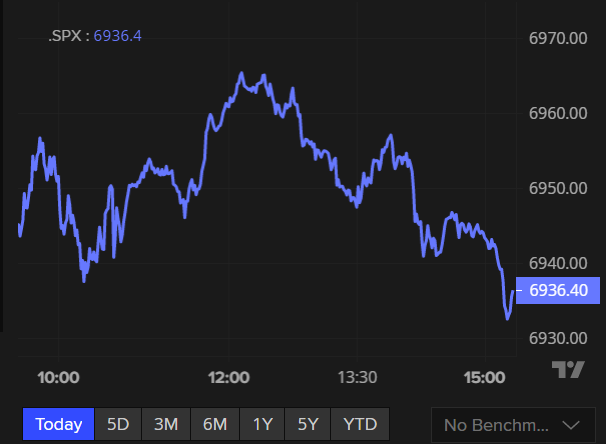

1h agoWed 7 Jan 2026 at 9:45pmWall St closes – summary of the day

As Wall Street closes for the day, the S&P 500 is down -0.4% to 6,921 points.

Here is a table of the day’s movement.

The S&P 500 movement on Wednesday, January 7. (Refinitiv )

The S&P 500 movement on Wednesday, January 7. (Refinitiv )

389 stocks finished in the red, with 114 stocks gaining.

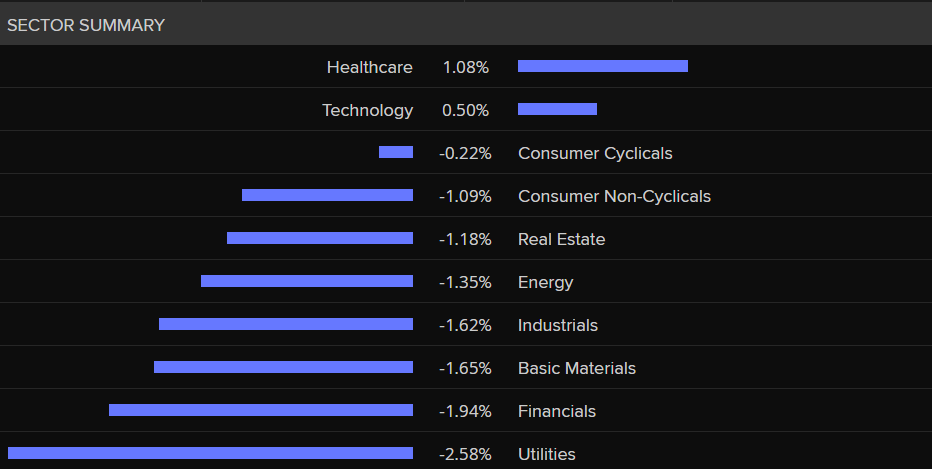

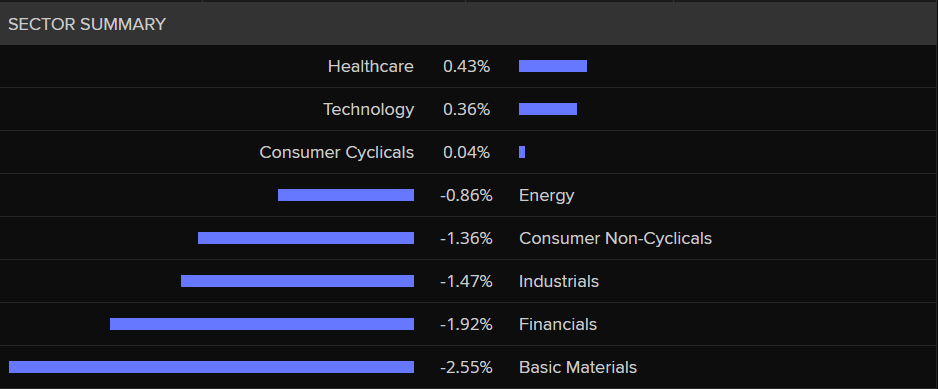

Here is a breakdown of the sectors.

Sector summary for the S&P 500. (Refinitiv)

Sector summary for the S&P 500. (Refinitiv)

As for the Dow Jones Industrial Average, the market has also finished down -0.9% to 48,996 points.

You can check out the decline throughout the day below:

Dow Jones market movement. (Refinitiv)

Dow Jones market movement. (Refinitiv)

And here is the sector summary:

Dow Jones sector summary. (Refinitiv)

Dow Jones sector summary. (Refinitiv)

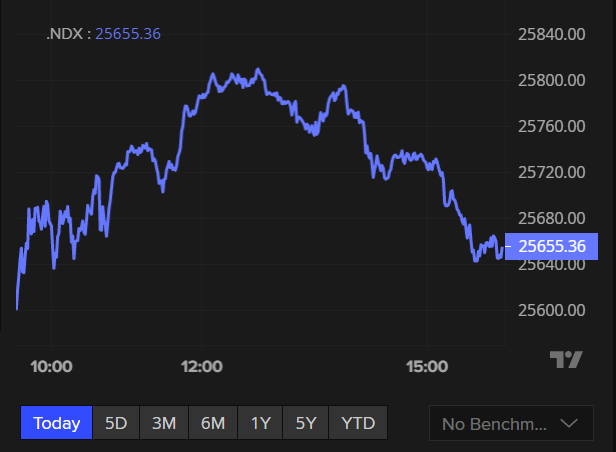

As for Nasdaq, it finished slightly up +0.1% to 25,653 points.

Here is how the market tracked across the day:

Nasqad market movement. (Refinitiv)

Nasqad market movement. (Refinitiv)

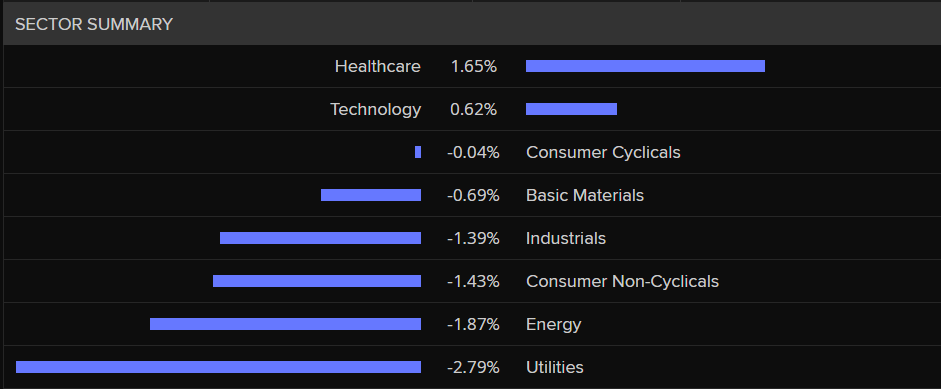

And its sector summary:

Sector summary for Nasdaq. (Refinitiv)1h agoWed 7 Jan 2026 at 9:35pmInterview with RBA deputy governor coming up

Sector summary for Nasdaq. (Refinitiv)1h agoWed 7 Jan 2026 at 9:35pmInterview with RBA deputy governor coming up

Good morning! Popping in to let you know we’ll have an exclusive interview with the RBA’s deputy governor Andrew Hauser coming up later this morning.

Our business editor Michael Janda will be sitting down with the central bank’s 2IC at a very timely moment.

Andrew Hauser was a central banker at the Bank of England and commenced at the RBA in 2024. (Supplied)

Andrew Hauser was a central banker at the Bank of England and commenced at the RBA in 2024. (Supplied)

Prominent economists remain divided on what the RBA will do when its monetary policy board — including Mr Hauser — meets in just under a month’s time.

Yesterday brought fresh inflation data, which showed inflation cooling in November, but remaining well above the mid-point of the RBA’s 2-3% target band — including the trimmed mean, which is a measure of underlying inflation and is closely watched by the central bank to get a sense of where prices are heading.

So, we’ll bring you Mr Hauser’s take on the economy right now in light of yesterday’s data, and of course, where he sees rates heading.

Stick with us!

1h agoWed 7 Jan 2026 at 9:30pm

AI interactions

I published some analysis yesterday about a very strange interaction I had with a lying AI chatbot and the ethical dilemma it posed for my reporting.

Some people then emailed me with their stories of when AI stuffed up, or when the AI function, like in my reporting, wasn’t disclosed.

It made me think maybe this is more common than I realised?

Have you also had a strange experience with AI?

Feel free to email me at miller.adelaide@abc.net.au

And here is the analysis if you’re keen to read:

1h agoWed 7 Jan 2026 at 9:15pmICYMI: inflation pressure easedYesterday, we saw the latest consumer price index (CPI) figures, which rose 3.4% over the year to November 2025.

This figure was down from 3.8% the month earlier, and saw inflation ease more than economists had forecast.

Markets, however, are still expecting a rate hike this year, with a 37% chance of one in February, according to Bloomberg.

We can expect more inflation data at the end of the month, and before the RBA meets at the start of Feb.

For a deeper look, here is a report from business digital lead, Stephanie Chalmers:

2h agoWed 7 Jan 2026 at 9:01pmJ.P. Morgan to take over the Apple credit card

Global financial services firm J.P. Morgan has reached a deal to take over the Apple credit card.

Goldman Sachs is expected to offload roughly $US20 billion of outstanding card balances to J.P. Morgan at more than a $US1 billion discount.

J.P. Morgan will issue Apple credit cards for both new and existing cardholders, and is planning on launching a new Apple savings account.

– Reuters

2h agoWed 7 Jan 2026 at 8:45pm

ICYMI: Wednesday finance with David Chau

After an update on what happened with the markets yesterday in under two minutes?

Here is a great snapshot from my colleague David Chau:

Loading…2h agoWed 7 Jan 2026 at 8:25pmOil and gold

The prices of oil and gas are both trading in the red.

As of 7:15am, Brent Crude is down -0.8% to $US60.22/barrel.

Gold is down -0.9% to $US4,459/ounce.

Geopolitical tensions continue to rise after the US hit Venezuela with strikes and captured its president over the weekend.

The US is after Venezuela’s oil reserves – the largest in the world.

Just overnight, US authorities seized two oil tankers with links to Venezuela.

The Marinera had its registration changed to Russia in recent days and was reportedly being shadowed by a Russian submarine when US forces boarded it.

Another vessel, the Sophia, was seized in the Caribbean as part of a global American blockade of “sanctioned and illicit Venezuelan oil”.

Meanwhile, gold has dropped after strong gains earlier in the week.

2h agoWed 7 Jan 2026 at 8:11pmGood morning

Hello everyone, and happy Thursday!

Welcome to another day on the ABC markets and finance blog.

Adelaide Miller here to take you through market movements this morning.

It appears that the ASX 200 will slip by 0.1% in early trade, with futures indicating a level of 8,672 points.

Meanwhile, Wall Street is up and down.

The S&P 500 is almost flat, down -0.02% to 6,944 points.

The Dow Jones is down -0.7% to 49,129 points.

Nasdaq is up +0.4% to 25,734 points.

The Aussie dollar is trading at 67.26 US cents.

Grab yourself a coffee and see you back here soon!

ASX 200 futures: -0.1% to 8,680 points.Australian dollar: -0.2% to 67.24 US centsWall Street: S&P500 -0.1%, Dow -0.9%, Nasdaq +0.3%Europe: Dax +0.9%, FTSE -0.7%, Eurostoxx 600 -0.1%Spot gold: -0.9% to $US4,457/ounceBrent crude: -0.9% to $US 60.15/barrelIron ore: +2.4% to $US109.00/tonneBitcoin: -2.6% at $US90,825

ASX 200 futures: -0.1% to 8,680 points.Australian dollar: -0.2% to 67.24 US centsWall Street: S&P500 -0.1%, Dow -0.9%, Nasdaq +0.3%Europe: Dax +0.9%, FTSE -0.7%, Eurostoxx 600 -0.1%Spot gold: -0.9% to $US4,457/ounceBrent crude: -0.9% to $US 60.15/barrelIron ore: +2.4% to $US109.00/tonneBitcoin: -2.6% at $US90,825