Aflac recently disclosed that a sophisticated cyberattack affected about 22.65 million individuals and has since partnered with CyEx to provide its Medical Shield medical fraud protection service, offering monitoring that extends beyond standard credit checks. This move underscores how cybersecurity and post-breach care are becoming core parts of the value proposition for major supplemental health and life insurers like Aflac. Now we’ll explore how Aflac’s cyber incident response, including Medical Shield support, could influence its longer-term investment narrative.

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Aflac Investment Narrative Recap

Aflac’s investment case rests on belief in its supplemental health and life franchise in Japan and the U.S., and its ability to manage margin pressure from technology spending and soft premium trends. The recent cyberattack and Medical Shield response appear more reputational than financial in impact near term, while the largest immediate risk still lies in ongoing premium and earnings pressure in Japan and currency volatility.

Among recent developments, Aflac’s decision to offer CyEx’s Medical Shield following the breach is especially relevant, because it highlights how technology, data protection and customer care are now tightly linked to its digital transformation efforts. As investors watch for updates on falling Japan premiums and higher expense ratios, the upcoming fourth quarter 2025 results call in early February may help clarify whether rising technology and cyber related costs are being offset by better efficiency and product traction.

Yet beneath Aflac’s reassuring cyber response, investors should still be watching the pressure on Japan premiums and margins…

Read the full narrative on Aflac (it’s free!)

Aflac’s narrative projects $18.5 billion revenue and $3.8 billion earnings by 2028. This requires 5.1% yearly revenue growth and a $1.4 billion earnings increase from $2.4 billion today.

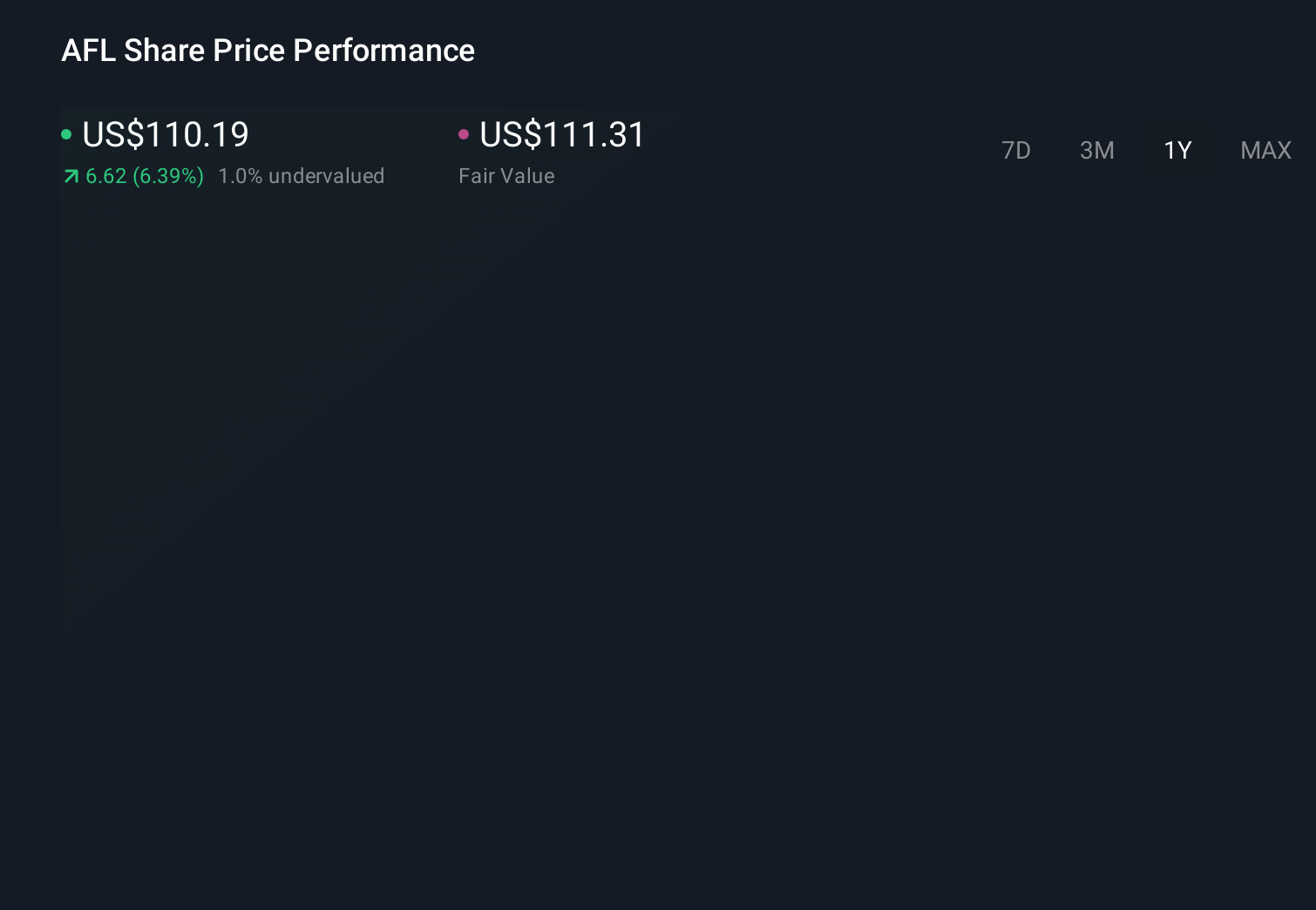

Uncover how Aflac’s forecasts yield a $111.31 fair value, in line with its current price.

Exploring Other Perspectives AFL 1-Year Stock Price Chart

AFL 1-Year Stock Price Chart

Four Simply Wall St Community fair value estimates for Aflac range from US$98.64 to US$168.49, highlighting very different views on upside potential. Set these against the ongoing drag from shrinking Japan premiums and higher technology expenses, and you can see why it pays to compare several independent perspectives before deciding how this stock fits into your portfolio.

Explore 4 other fair value estimates on Aflac – why the stock might be worth as much as 53% more than the current price!

Build Your Own Aflac Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your Aflac research is our analysis highlighting 2 key rewards that could impact your investment decision.Our free Aflac research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Aflac’s overall financial health at a glance.Interested In Other Possibilities?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com