Electro Optic Systems Holdings Limited (“EOS” or the “Company”) (ASX: EOS) today announces that it has entered into an agreement to acquire the MARSS group business (“MARSS”). MARSS is a Europe-based provider of command and control (“C2”) systems, which are critical for effectively countering drones.

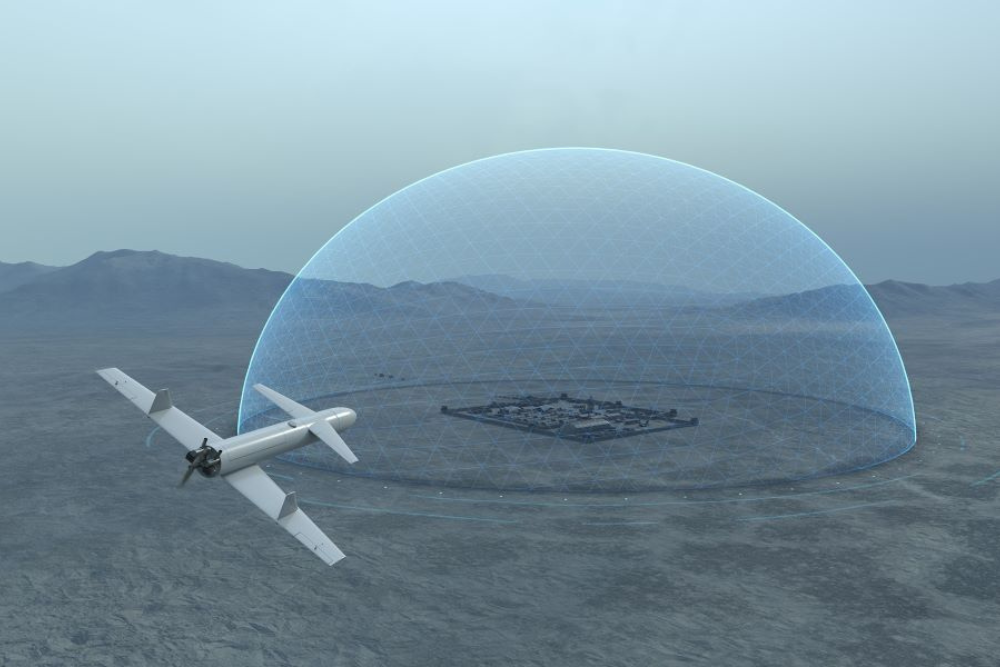

MARSS’ proprietary C2 technology, NiDAR, provides advanced AI-enabled decision making and sensor-effector orchestration to rapidly counter asymmetric drone threats.

By combining its best-in-class effector and sensor capabilities with MARSS’ C2 technology, EOS is transforming from a component supplier to an integrated counter-drone systems provider, with strong software and AI capabilities.

Highlights

Established in 2006, MARSS is a defence and security technology provider focused on developing and marketing sensor-fusion technology and AI-enabled C2 systems primarily for counter-drone use

The acquisition includes MARSS’ NiDAR C2 technology, sensor-fusion and AI software platform and hardware offering, along with associated customer contracts, intellectual property and personnel

Creates an integrated, end-to-end solution for countering drones i.e. Detect → Identify → Decide → Defeat – allowing EOS to act as a true counter-drone system provider and to compete for larger, higher-value programs as a Prime Contractor. This includes the delivery and operation of turn-key solutions for the protection of critical infrastructure in the military, homeland security and civil domain, such as airports or power plants

Expands EOS’ geographic footprint and broadens its end market presence, with scope to leverage MARSS’ defence, homeland security and civil relationships

Significantly strengthens EOS’ in-house AI/software development capability

EOS plans to embed the AI-enabled NiDAR technology into its existing remote weapon system product range. It is envisaged that this will create the ability for the systems to form a mesh-network, providing the client’s vehicle fleet hemispherical coverage against drone attacks – a new feature in today’s market

Transaction structured as an asset acquisition, with consideration consisting of an upfront cash payment and an earnout, being additional contingent consideration tied to new MARSS sales:

Upfront cash payment of US$36m (~A$54m); plus

Potential earnout amount of up to €20m for each €100m (or part thereof) of certain new MARSS third party contract orders (up to €500m) secured prior to the end of the earnout period. The earnout payment is capped at €100m (~A$174m), subject to adjustments and is payable in a combination of cash (capped at €20m) and EOS shares. More details are below (in full ASX announcement).

Acquisition cash consideration, primarily intended to be funded from existing cash reserves (~$107m at 31 Dec 2025), see further details below (in full ASX announcement).

Acquisition anticipated to be broadly neutral for earnings and operating cashflow in 2026.

Completion expected in 2026, subject to customer, regulator and other approvals

Read the full ASX announcement here