Workday Wellness partnership puts Aflac’s benefits tech push in focus

Aflac (AFL) has drawn fresh attention after being named a Workday Wellness partner, integrating its supplemental health products with Workday’s AI-driven benefits platform to help employers fine tune offerings and simplify administration.

See our latest analysis for Aflac.

The Workday Wellness announcement comes as Aflac’s share price sits at US$109.51, with shorter term share price returns relatively muted while the 1 year total shareholder return of about 5% and 5 year total shareholder return of about 165% point to stronger longer run compounding. This suggests investors may be weighing new digital partnerships against a more established track record.

If this benefits tech push has your attention, it can be useful to see how other insurers are positioned too. A starting point is healthcare stocks as a broader set of supplemental and health focused names.

With Aflac trading near its US$110 price target and an intrinsic value estimate that implies a sizeable discount, you are left with the real question: is this a mispriced insurer, or is the market already baking in future growth?

Most Popular Narrative: 1.6% Undervalued

With Aflac’s fair value in the narrative set at about US$111.31 against the recent US$109.51 close, the story centers on steady earnings power, measured growth and how much investors are willing to pay for that profile.

The successful launch of new, customizable cancer insurance (Miraito) in Japan, coupled with strong early sales across all distribution channels including banks and Japan Post, positions Aflac to capture growing demand for supplemental health coverage among aging and younger consumers. This supports topline revenue and premium growth. Increased adoption of digital underwriting, customer-facing Gen AI, and digital human avatar initiatives in both Japan and the U.S. is expected to lower long-term operational costs and improve customer engagement, with the potential to materially expand net margins through enhanced efficiency and better scalability.

Want to see what kind of revenue climb and margin step up are baked into that fair value, and what future P/E the narrative is leaning on? The full storyline lays out a detailed earnings path, explicit profit assumptions, and how a modest valuation shift ties it all together.

Result: Fair Value of $111.31 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, the story can change quickly if Japan premiums stay under pressure, and currency swings or softer investment income unsettle the earnings stability that investors are focusing on.

Find out about the key risks to this Aflac narrative.

Another Angle On Aflac’s Value

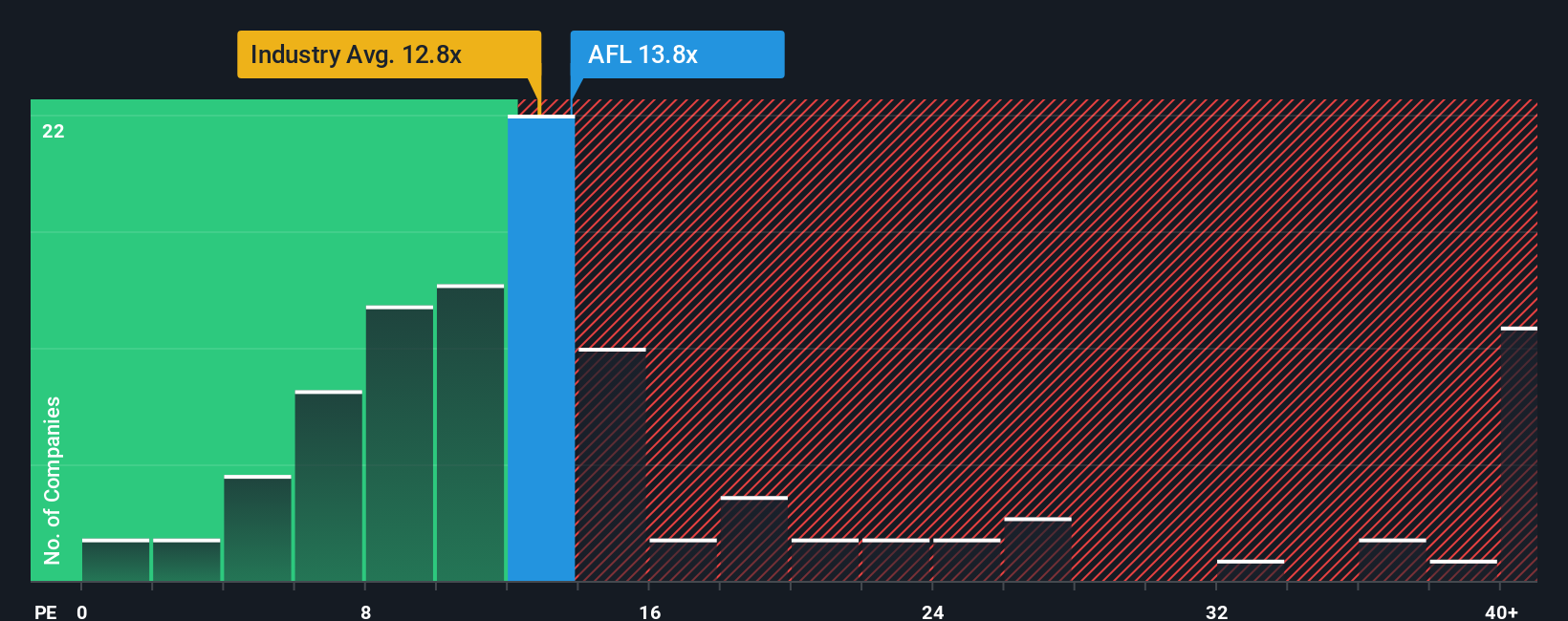

There is a twist when you look at Aflac through its P/E. The shares trade at 13.8x earnings, compared with 12.6x for the US insurance industry and a fair ratio estimate of 13.1x. That points to a small valuation premium. Is that a warning sign, or just the price of perceived quality?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:AFL P/E Ratio as at Jan 2026 Build Your Own Aflac Narrative

NYSE:AFL P/E Ratio as at Jan 2026 Build Your Own Aflac Narrative

If you see the numbers differently or want to test your own assumptions using the same data, you can build a custom Aflac story in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Aflac.

Looking for more investment ideas?

Once you have formed a view on Aflac, do not stop there. Widening your watchlist with fresh ideas can often surface opportunities you did not expect.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com