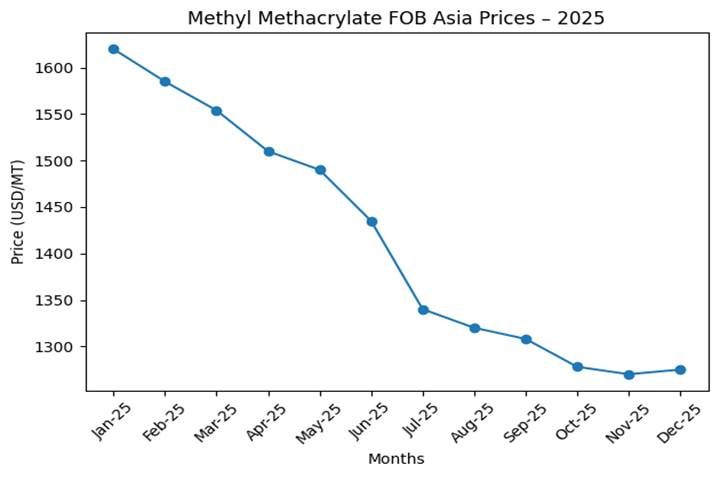

The Asian Methyl Methacrylate (MMA) market experienced a prolonged bearish trend throughout 2025, with prices steadily declining amid weak demand fundamentals, cautious buying behaviour, and persistent macroeconomic and geopolitical uncertainties. Despite intermittent restocking activity, overall market sentiment remained defensive, preventing any sustained price recovery.

MMA prices on a FOB Asia basis showed a consistent downward movement over the year. Prices opened at $1,620 per metric ton in January 2025 and declined almost month-on-month, reflecting soft downstream demand and ample supply availability.

During the first quarter, prices eased from $1,620/MT in January to $1,554/MT by March, driven by muted post-holiday demand and conservative procurement strategies.

In the second quarter, the downtrend continued, with prices falling further to $1,510/MT in April and $1,435/MT by June, as inventories remained comfortable and buyers delayed spot purchases.

The third quarter saw additional pressure, with prices sliding from $1,340/MT in July to $1,308/MT in September, despite lower operating rates among MMA producers.

By the fourth quarter, prices reached their lowest levels of the year, declining to $1,278/MT in October and $1,270/MT in November, before marginally stabilising at $1,275/MT in December 2025.

Overall, MMA prices declined by approximately 21 per cent year-on-year, underscoring the depth and persistence of the market downturn.

Downstream Market Demand

Consumption of MMA across downstream value chains remained notably constrained over the year. Polymethyl Methacrylate (PMMA) producers, which account for a significant share of MMA demand, operated below optimal capacity due to lacklustre order books and cautious production planning. End-use industries such as construction materials, automotive components, architectural signage, and acrylic coatings faced uneven recovery trajectories, limiting incremental MMA requirements. As a result, most processors depended heavily on term contracts while minimising exposure to the spot market.

Buyer Sentiment and Market Drivers

Purchasing behaviour across the Asian MMA market was predominantly conservative in 2025. Buyers focused on short-term coverage, frequently postponing procurement in anticipation of further price declines. Heightened geopolitical tensions, evolving trade regulations, and uncertainty surrounding tariff frameworks amplified risk aversion, discouraging aggressive restocking. This cautious stance persisted even during periods of reduced producer operating rates, preventing any meaningful tightening of supply-demand fundamentals.

Outlook

Looking ahead Q1 2026, MMA prices are expected to remain under pressure in the near term and can be bound under the range of 1320. Any meaningful stabilisation will depend on a gradual recovery in downstream demand, improved market sentiment, and a rebalancing of supply against cautious purchasing behaviour and geopolitical issue impact on upstream or freight etc. Until these conditions materialise, the MMA market is likely to remain range-bound at lower price levels.